Key Insights

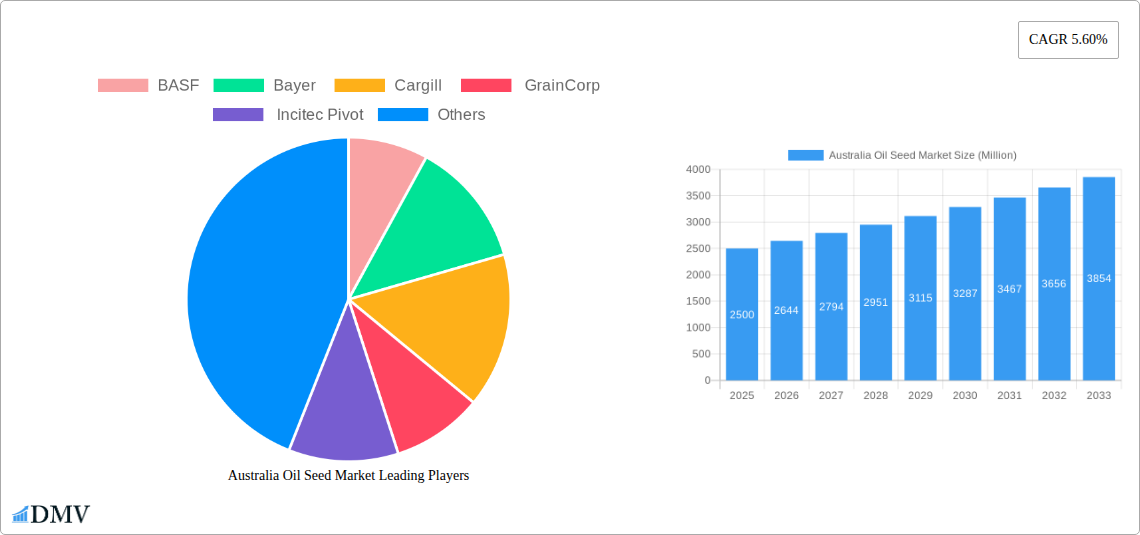

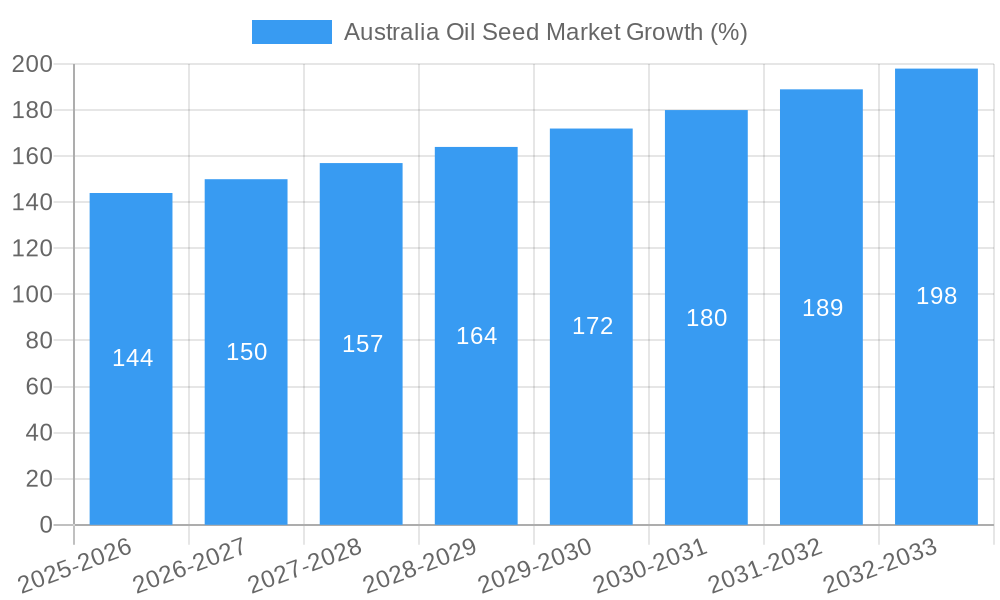

The Australian oilseed market, valued at approximately $2.5 billion AUD in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 5.6% from 2025 to 2033. This expansion is driven by several factors. Rising global demand for vegetable oils, fueled by increasing populations and changing dietary habits, creates a strong export market for Australian producers. Furthermore, the growing biofuel industry is significantly increasing the demand for oilseeds like rapeseed, providing an alternative revenue stream for farmers. Government initiatives promoting sustainable agriculture and investment in research and development further contribute to market growth. However, challenges remain, including fluctuating global commodity prices, climate change impacting crop yields, and increasing input costs like fertilizers and pesticides. Competition from other agricultural commodities for land and resources also presents a constraint. The market is segmented by oilseed type, with rapeseed, cottonseed, soybean, sunflower seed, and safflower seed contributing significantly. Major players, including BASF, Bayer, Cargill, GrainCorp, Incitec Pivot, Nufarm, Richardson International, and Wilmar, are actively involved in the production, processing, and distribution of oilseeds within Australia, influencing pricing and market dynamics.

The forecast for the Australian oilseed market between 2025 and 2033 showcases a positive outlook, although managing price volatility and environmental sustainability will be crucial. Diversification of oilseed production and exploring alternative markets could help mitigate risks associated with global price fluctuations. Continued innovation in agricultural technologies, along with government support for sustainable farming practices, will be instrumental in ensuring long-term growth and competitiveness for the Australian oilseed sector. Understanding consumer preferences and shifting towards higher-value oilseed varieties could also enhance market profitability. The competitive landscape, dominated by both multinational corporations and domestic players, suggests a dynamic market environment where innovation and efficiency are essential for success.

Australia Oil Seed Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Australian oil seed market, offering a detailed examination of market trends, competitive dynamics, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is invaluable for stakeholders including investors, industry players (like BASF, Bayer, Cargill, GrainCorp, Incitec Pivot, Nufarm, Richardson International, and Wilmar), and government agencies seeking to understand and capitalize on opportunities within this dynamic market. The report incorporates rigorous data analysis, market forecasts, and expert insights to deliver a clear picture of the Australian oil seed landscape. The total market value in 2025 is estimated at $XX Million.

Australia Oil Seed Market Composition & Trends

This section delves into the intricate structure of the Australian oil seed market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with the top five players holding an estimated 60% market share in 2025. Key innovation drivers include advancements in crop genetics and precision agriculture technologies, leading to improved yields and oil quality. Regulatory landscapes, including biosecurity and environmental regulations, significantly impact market operations. Substitute products, such as palm oil and other vegetable oils, exert competitive pressure. End-users primarily comprise food processors, biofuel producers, and animal feed manufacturers. M&A activity has been moderate in recent years, with deal values averaging $XX Million per transaction during the historical period (2019-2024).

- Market Share Distribution (2025): Top 5 players - 60%; Others - 40%.

- Average M&A Deal Value (2019-2024): $XX Million

- Key Regulatory Bodies: [List relevant Australian regulatory bodies]

- Major End-Users: Food processing, biofuel production, animal feed.

Australia Oil Seed Market Industry Evolution

The Australian oil seed market has witnessed significant evolution during the historical period (2019-2024). Market growth has been driven by factors including increasing demand for vegetable oils in food and biofuel applications, coupled with advancements in agricultural technologies. The compound annual growth rate (CAGR) for the overall market during 2019-2024 was approximately X%. Technological advancements, such as precision agriculture and improved crop varieties, have enhanced yields and efficiency. A growing consumer preference for healthy and sustainable food products has further stimulated market expansion. Shifting consumer preferences towards plant-based diets are also fueling the market growth, with a projected CAGR of Y% during the forecast period (2025-2033). This trend is particularly evident in the demand for soybean and rapeseed oil.

Leading Regions, Countries, or Segments in Australia Oil Seed Market

The Australian oil seed market demonstrates regional variations in production and consumption patterns. While specific regional data may vary, Western Australia and New South Wales are prominent producers of several oilseeds. Within oilseed types, rapeseed holds a significant market share, driven by its versatile applications and relatively high yields. Soybean also displays strong growth potential, fuelled by increased demand in the food and animal feed sectors. Price trends reveal fluctuations influenced by global market dynamics and weather patterns.

Key Drivers:

- Rapeseed: High yields, versatile applications in food and biofuel.

- Soybean: Growing demand from food and animal feed industries.

- Sunflower Seed: Increased consumer preference for healthy oils.

- Cottonseed: Steady demand in the textile and oil sectors.

- Safflower Seed: Niche market with specific applications in health and cosmetics.

Dominance Factors: The dominance of certain regions or segments is largely attributed to favorable climatic conditions, established agricultural infrastructure, and government support programs promoting oilseed cultivation. Price volatility remains a challenge, impacting profitability for farmers and processors.

Australia Oil Seed Market Product Innovations

Recent innovations in the Australian oil seed market focus on developing high-yielding, disease-resistant, and climate-resilient varieties of oilseeds. Genetic modification and precision breeding techniques are playing a significant role in enhancing oil quality and yield. New applications of oilseed products are emerging, including specialized oils for industrial uses and high-value ingredients for the food industry. These innovations significantly improve the functionality and efficiency of the oilseed market, which ultimately contributes to the market's growth.

Propelling Factors for Australia Oil Seed Market Growth

Several factors are propelling the growth of the Australian oil seed market. Firstly, the increasing global demand for vegetable oils, driven by population growth and changing dietary habits, creates significant opportunities for Australian producers. Secondly, technological advancements in agricultural practices, such as precision farming and improved crop genetics, enhance yields and efficiency. Lastly, government policies and initiatives supporting sustainable agriculture contribute to the expansion of the oil seed industry.

Obstacles in the Australia Oil Seed Market

Challenges facing the Australian oil seed market include climate change variability impacting yields, fluctuating global oilseed prices, and the competitive landscape with international producers. Supply chain disruptions, particularly during periods of extreme weather events, can impact market stability. Furthermore, stringent regulatory requirements related to food safety and environmental sustainability add operational complexities.

Future Opportunities in Australia Oil Seed Market

Future opportunities lie in exploring new applications for oilseed products, such as in bioplastics and other bio-based materials. Further technological innovation, particularly in genetic engineering and precision agriculture, will drive yield improvements and reduce production costs. Expanding into new export markets, especially in Asia and the Pacific region, presents significant growth potential.

Major Players in the Australia Oil Seed Market Ecosystem

Key Developments in Australia Oil Seed Market Industry

- [Date]: [Company Name] launches a new high-yielding rapeseed variety.

- [Date]: [Company Name] announces a significant investment in a new oilseed processing facility.

- [Date]: [Regulatory Body] introduces new regulations concerning sustainable agricultural practices.

- [Date]: Merger between [Company A] and [Company B] creates a larger player in the market. (Add more bullet points as needed)

Strategic Australia Oil Seed Market Forecast

The Australian oil seed market is poised for sustained growth over the forecast period (2025-2033). Driving this growth are increasing global demand for vegetable oils, technological advancements in production, and supportive government policies. While challenges remain, the market's inherent resilience and innovation capacity suggest considerable potential for expansion and profitability. This report provides crucial insights to inform strategic decision-making within this evolving market.

Australia Oil Seed Market Segmentation

-

1. Oilseed Type

-

1.1. Rapeseed

- 1.1.1. Production Analysis

- 1.1.2. Consumption Analysis & Market Size

- 1.1.3. Import Market Analysis (Volume & Value)

- 1.1.4. Export Market Analysis (Volume & Value)

- 1.1.5. Price Trend Analysis

- 1.2. Cotton seed

- 1.3. Soybean

- 1.4. Sunflower Seed

- 1.5. Safflower Seed

-

1.1. Rapeseed

-

2. Oilseed Type

-

2.1. Rapeseed

- 2.1.1. Production Analysis

- 2.1.2. Consumption Analysis & Market Size

- 2.1.3. Import Market Analysis (Volume & Value)

- 2.1.4. Export Market Analysis (Volume & Value)

- 2.1.5. Price Trend Analysis

- 2.2. Cotton seed

- 2.3. Soybean

- 2.4. Sunflower Seed

- 2.5. Safflower Seed

-

2.1. Rapeseed

Australia Oil Seed Market Segmentation By Geography

- 1. Australia

Australia Oil Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Increasing Global Consumption of Canola Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Oil Seed Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Oilseed Type

- 5.1.1. Rapeseed

- 5.1.1.1. Production Analysis

- 5.1.1.2. Consumption Analysis & Market Size

- 5.1.1.3. Import Market Analysis (Volume & Value)

- 5.1.1.4. Export Market Analysis (Volume & Value)

- 5.1.1.5. Price Trend Analysis

- 5.1.2. Cotton seed

- 5.1.3. Soybean

- 5.1.4. Sunflower Seed

- 5.1.5. Safflower Seed

- 5.1.1. Rapeseed

- 5.2. Market Analysis, Insights and Forecast - by Oilseed Type

- 5.2.1. Rapeseed

- 5.2.1.1. Production Analysis

- 5.2.1.2. Consumption Analysis & Market Size

- 5.2.1.3. Import Market Analysis (Volume & Value)

- 5.2.1.4. Export Market Analysis (Volume & Value)

- 5.2.1.5. Price Trend Analysis

- 5.2.2. Cotton seed

- 5.2.3. Soybean

- 5.2.4. Sunflower Seed

- 5.2.5. Safflower Seed

- 5.2.1. Rapeseed

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Oilseed Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GrainCorp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Incitec Pivot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nufarm

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Richardson International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilmar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 BASF

List of Figures

- Figure 1: Australia Oil Seed Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Oil Seed Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Oil Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Oil Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2019 & 2032

- Table 4: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2019 & 2032

- Table 5: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2019 & 2032

- Table 6: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2019 & 2032

- Table 7: Australia Oil Seed Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Oil Seed Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 9: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2019 & 2032

- Table 10: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2019 & 2032

- Table 11: Australia Oil Seed Market Revenue Million Forecast, by Oilseed Type 2019 & 2032

- Table 12: Australia Oil Seed Market Volume Kiloton Forecast, by Oilseed Type 2019 & 2032

- Table 13: Australia Oil Seed Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia Oil Seed Market Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Oil Seed Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Australia Oil Seed Market?

Key companies in the market include BASF, Bayer , Cargill , GrainCorp, Incitec Pivot, Nufarm , Richardson International , Wilmar.

3. What are the main segments of the Australia Oil Seed Market?

The market segments include Oilseed Type, Oilseed Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Increasing Global Consumption of Canola Oil.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Oil Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Oil Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Oil Seed Market?

To stay informed about further developments, trends, and reports in the Australia Oil Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence