Key Insights

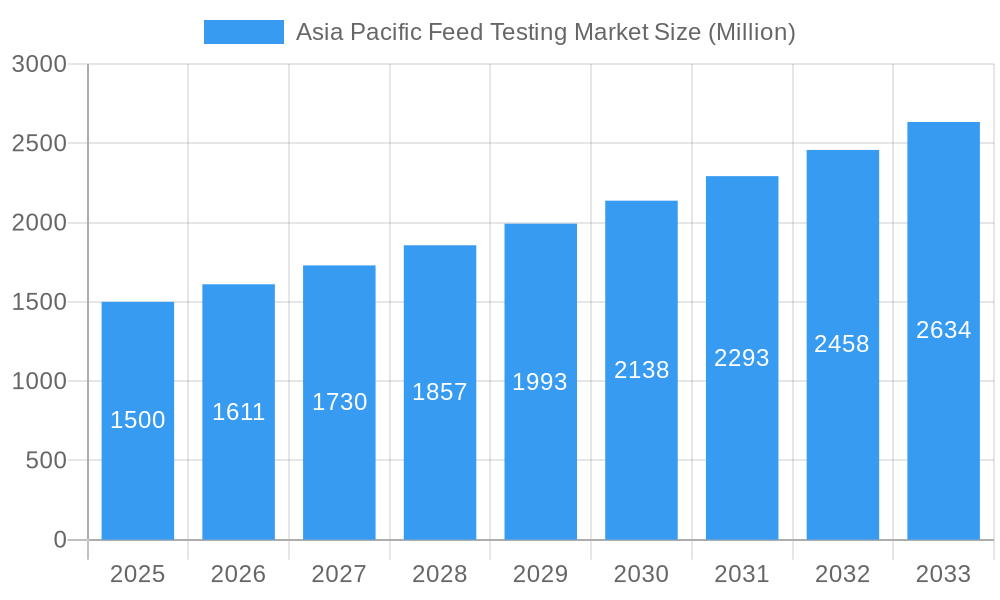

The Asia Pacific feed testing market is experiencing robust growth, driven by increasing consumer demand for safe and high-quality animal products, stringent government regulations on feed safety, and the rising prevalence of feed-borne diseases. The market's Compound Annual Growth Rate (CAGR) of 7.40% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several factors. Firstly, the expansion of the aquaculture and poultry industries in the region is creating a higher demand for feed testing services to ensure product quality and prevent outbreaks. Secondly, growing awareness of food safety among consumers is pushing manufacturers to invest heavily in feed testing to maintain brand reputation and avoid potential recalls. Furthermore, governments in the Asia-Pacific region are implementing stricter regulations regarding feed safety and quality, further stimulating market growth. The increasing adoption of advanced testing technologies, such as PCR and ELISA, is also contributing to market expansion, enabling faster and more accurate results. Segment-wise, pathogen testing and mycotoxin testing are expected to witness substantial growth, driven by concerns about animal health and potential contamination risks. Within the feed types, ruminant and poultry feed segments are expected to dominate due to their larger production volumes in the region. Key players like SGS SA, Eurofins Scientific, and Intertek Group PLC are strategically expanding their service offerings and geographic reach to capitalize on the growing market opportunities.

Asia Pacific Feed Testing Market Market Size (In Billion)

The market's future growth will depend on several factors. Continued economic growth in several Asia-Pacific countries will drive increased demand for animal products and thus, feed testing services. However, challenges remain, including the high cost of advanced testing technologies and the need for skilled technicians to operate these technologies. Nevertheless, the overall outlook remains positive, with the market poised for continued expansion throughout the forecast period (2025-2033). The consistent investment in research and development of newer and more efficient testing methods will likely propel the market towards a more sustainable and advanced future. Competition among existing players and the emergence of new entrants are also anticipated to shape the market landscape. The continuous implementation of stringent regulations and the increasing focus on food safety and animal health will further drive demand for sophisticated and reliable feed testing services. Expansion into underdeveloped regions within Asia-Pacific also presents significant growth potential.

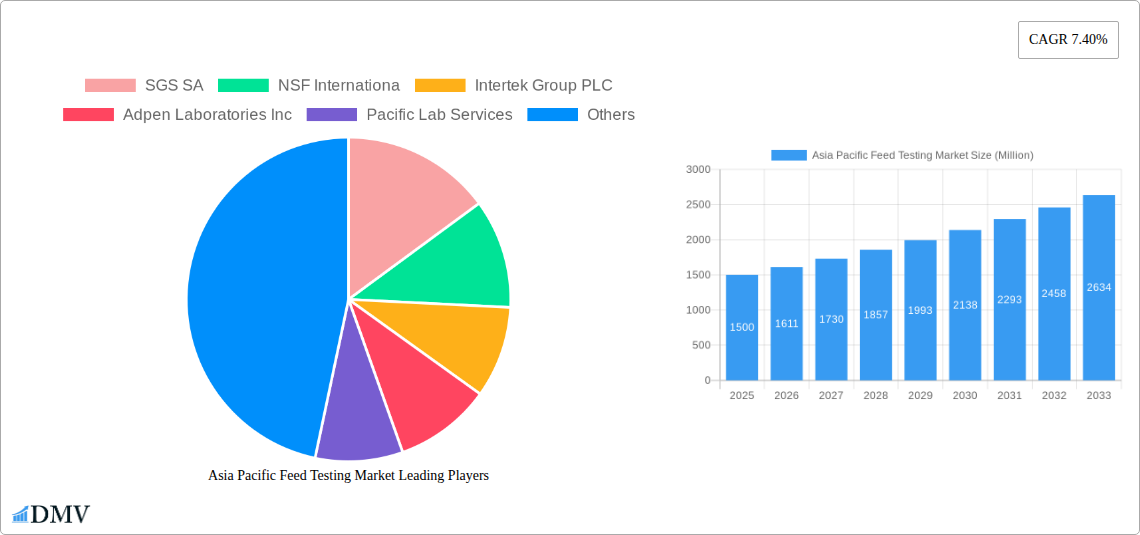

Asia Pacific Feed Testing Market Company Market Share

Asia Pacific Feed Testing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific Feed Testing market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Valued at xx Million in 2025, the market is poised for significant growth, reaching xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The study covers the historical period (2019-2024), with 2025 serving as the base year and estimated year. This comprehensive analysis incorporates meticulous market segmentation by Type (Pathogen Testing, Pesticide Residue Analysis, Nutritional Labeling Analysis, Fats and Oils Analysis, Mycotoxin Testing, Other Types) and Feed Type (Ruminant Feed, Poultry Feed, Swine Feed, Aquaculture Feed, Other Feed Type), providing a granular understanding of market dynamics. Key players such as SGS SA, NSF International, Intertek Group PLC, Adpen Laboratories Inc, Pacific Lab Services, Bruker Biosciences Corporation, Genetic ID NA Inc, Eurofins Scientific, and Invisible Sentinel Inc are profiled, highlighting their contributions to market evolution.

Asia Pacific Feed Testing Market Market Composition & Trends

The Asia Pacific feed testing market exhibits a moderately consolidated structure, with a few major players holding significant market share. The top five companies account for approximately xx% of the market in 2025. However, the market is witnessing increased competition from smaller, specialized testing laboratories. Innovation is driven by advancements in analytical techniques, particularly in areas like genomics and proteomics, which allow for faster, more accurate, and cost-effective testing. Stringent regulatory frameworks concerning food safety and animal health are shaping market practices, pushing for improved testing standards and accreditation. The market experiences limited substitution, with most tests offering specialized analyses. End-users primarily comprise feed manufacturers, government regulatory agencies, and research institutions. M&A activity has been moderate in recent years, with deal values averaging xx Million per transaction.

- Market Share Distribution (2025): SGS SA (xx%), NSF International (xx%), Intertek Group PLC (xx%), Others (xx%).

- Average M&A Deal Value (2019-2024): xx Million

- Key M&A Activities: [Insert brief details of significant M&A activities, including company names and transaction values if available.]

Asia Pacific Feed Testing Market Industry Evolution

The Asia Pacific feed testing market is undergoing a dynamic transformation, characterized by sustained and accelerated growth. This expansion is intricately linked to a confluence of escalating consumer consciousness regarding food safety and animal well-being, which directly fuels the demand for sophisticated feed testing solutions. Simultaneously, a more rigorous regulatory landscape across numerous Asia Pacific nations is mandating comprehensive testing protocols throughout the entire feed production and distribution value chain. The relentless pace of technological innovation is a significant enabler, with the advent of rapid diagnostic kits, enhanced automation, and cutting-edge analytical methodologies such as Liquid Chromatography-Mass Spectrometry/Mass Spectrometry (LC-MS/MS) and Polymerase Chain Reaction (PCR) dramatically boosting testing efficiency, accuracy, and the ability to detect a wider spectrum of contaminants. Furthermore, a palpable shift in consumer preferences towards feed produced organically and through sustainable agricultural practices is emerging as a powerful catalyst, carving out new market niches and driving demand for specialized testing services that validate these claims.

Historically, the market demonstrated a Compound Annual Growth Rate (CAGR) of approximately [Insert specific CAGR]% during the period of 2019-2024. This growth was predominantly propelled by a surging demand originating from the poultry and swine feed sectors. The integration of advanced testing technologies, including PCR and Enzyme-Linked Immunosorbent Assay (ELISA), witnessed a substantial uptick, with adoption rates increasing by roughly [Insert specific percentage]% between 2019 and 2024. The burgeoning aquaculture industry across the Asia Pacific region is also playing a pivotal role in market expansion, underscoring the need for tailored feed testing solutions. Projections indicate a robust CAGR of approximately [Insert specific CAGR]% for the forecast period spanning 2025-2033, a trajectory anticipated to be sustained by the ongoing enforcement of stringent regulations and strategic investments in state-of-the-art testing infrastructure.

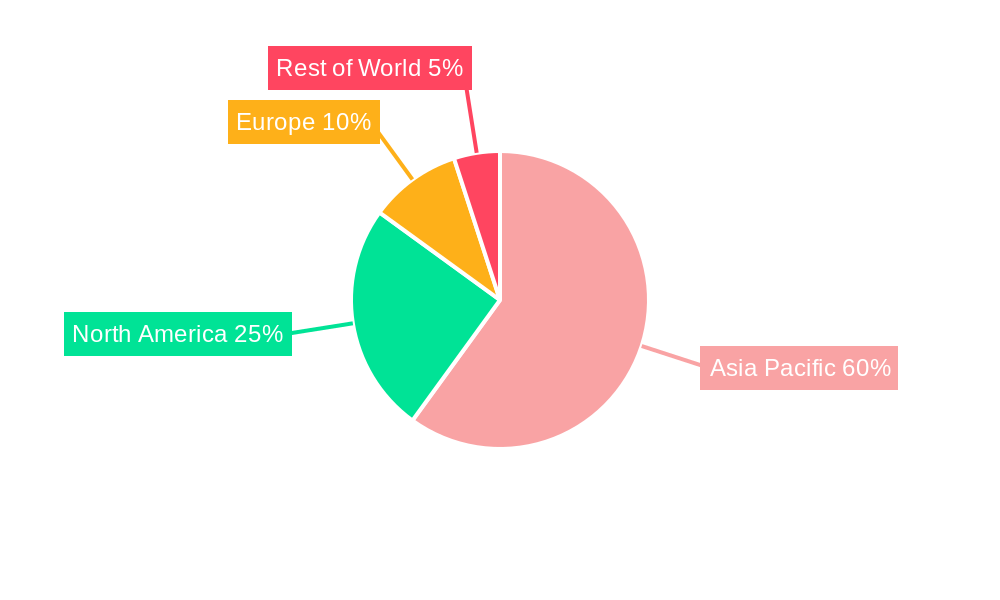

Leading Regions, Countries, or Segments in Asia Pacific Feed Testing Market

China and India dominate the Asia Pacific feed testing market, accounting for a combined xx% of market share in 2025. This dominance stems from factors including the large livestock populations, substantial feed production, and increasing regulatory scrutiny. Within the testing segments, pathogen testing and mycotoxin testing are the largest segments.

Key Drivers:

- China & India: High livestock population, stringent regulatory frameworks, growing feed production capacity, significant investments in food safety infrastructure.

- Pathogen Testing: Growing awareness of foodborne illnesses and stringent government regulations.

- Mycotoxin Testing: Increasing prevalence of mycotoxins in feed and associated health risks to animals.

Dominance Factors: China's vast livestock industry and its government's significant investment in food safety infrastructure contribute to its market leadership. India's rapidly growing poultry and dairy sectors fuel demand for feed testing.

Asia Pacific Feed Testing Market Product Innovations

Recent innovations include rapid diagnostic tests for pathogens, advanced analytical techniques for pesticide residue analysis offering quicker turnaround times and higher accuracy, and automated systems for high-throughput testing. These innovations enhance the efficiency and accuracy of testing processes, leading to better quality control and reduced operational costs. Unique selling propositions include faster turnaround times, higher sensitivity and specificity, and reduced cost per test.

Propelling Factors for Asia Pacific Feed Testing Market Growth

The trajectory of the Asia Pacific feed testing market is powerfully influenced by a multifaceted array of drivers. Paramount among these are the increasingly stringent governmental regulations enacted to safeguard food safety and bolster animal health standards. This regulatory push, coupled with a burgeoning demand for premium-quality animal feed that guarantees optimal nutrition and minimizes health risks, forms a cornerstone of market expansion. The rapid technological advancements in testing methodologies, ranging from highly sensitive molecular diagnostics to sophisticated spectroscopic techniques, are not only improving accuracy but also enabling faster turnaround times, a critical factor in a fast-paced industry. The robust economic growth experienced by many Asian economies has significantly uplifted the livestock and aquaculture industries, consequently escalating the need for both feed production and its associated testing services. In parallel, a heightened consumer awareness regarding the safety and integrity of the food supply chain is creating a powerful demand for transparency and accountability in feed production, compelling stakeholders to invest more in rigorous testing and quality assurance.

Obstacles in the Asia Pacific Feed Testing Market Market

Challenges include the high cost of advanced testing technologies, limited skilled workforce in certain regions, and the potential for supply chain disruptions impacting reagent availability. Competition from smaller, local testing laboratories can also put pressure on margins for larger players. Regulatory inconsistencies across different countries in the region present operational complexities for multi-national companies.

Future Opportunities in Asia Pacific Feed Testing Market

The horizon for the Asia Pacific feed testing market is replete with promising opportunities. A significant area for growth lies in the expansion of specialized testing services tailored to the unique demands of the rapidly expanding aquaculture industry, which requires precise monitoring of feed composition and contaminant levels to ensure fish health and food safety. The development and commercialization of novel diagnostic tests capable of detecting emerging and re-emerging pathogens in feed ingredients and finished products represent another critical avenue for innovation and market penetration. The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) for sophisticated data analysis and predictive modeling of feed quality and safety trends holds immense potential to revolutionize testing strategies. Furthermore, the burgeoning global and regional emphasis on organic and sustainably produced feed is creating substantial new market segments, demanding specialized testing protocols to verify claims related to sourcing, production methods, and the absence of harmful substances. The increasing demand for fortified and functional feeds also presents opportunities for testing services that can validate the efficacy and stability of added nutrients and bioactive compounds.

Major Players in the Asia Pacific Feed Testing Market Ecosystem

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Pacific Lab Services

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Eurofins Scientific

- Invisible Sentinel Inc

- ALS Limited

- Bureau Veritas SA

- iD vision systems

- FOSS A/S

Key Developments in Asia Pacific Feed Testing Market Industry

- June 2024: SGS SA launched a pioneering rapid diagnostic test kit for early detection of avian influenza strains, enhancing biosecurity measures in poultry farming.

- October 2023: NSF International strategically expanded its footprint in Southeast Asia by acquiring a prominent feed testing laboratory based in Vietnam, bolstering its regional service capabilities.

- April 2023: Eurofins Scientific introduced a new suite of advanced analytical services for mycotoxin detection in animal feed, addressing growing concerns over feed contamination in humid climates.

- January 2023: Intertek Group PLC announced a significant investment in upgrading its molecular diagnostics capabilities in its Asia Pacific laboratories, enabling faster and more comprehensive pathogen screening in feed.

- November 2022: FOSS A/S unveiled an innovative automated solution for real-time analysis of key nutritional components in feed, promising enhanced quality control and reduced processing time for feed manufacturers.

- [Add more bullet points with specific dates and impactful developments if available.]

Strategic Asia Pacific Feed Testing Market Market Forecast

The Asia Pacific feed testing market is poised for continued growth, driven by increasing demand from the livestock sector, stringent regulatory frameworks, and technological innovation. Opportunities lie in expanding testing services to emerging markets and adopting advanced technologies to improve efficiency and accuracy. This robust growth trajectory is expected to continue through 2033.

Asia Pacific Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Feed Testing Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Feed Testing Market Regional Market Share

Geographic Coverage of Asia Pacific Feed Testing Market

Asia Pacific Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Over Quality Feed

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pacific Lab Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bruker Biosciences Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genetic ID NA Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: Asia Pacific Feed Testing Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Asia Pacific Feed Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia Pacific Feed Testing Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: China Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: China Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Japan Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: South Korea Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: India Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: India Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Australia Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Australia Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: New Zealand Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: New Zealand Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Indonesia Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Indonesia Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Malaysia Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Malaysia Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Singapore Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Singapore Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Thailand Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Thailand Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Vietnam Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Vietnam Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: Philippines Asia Pacific Feed Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Philippines Asia Pacific Feed Testing Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Feed Testing Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Asia Pacific Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Pacific Lab Services, Bruker Biosciences Corporation, Genetic ID NA Inc, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the Asia Pacific Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Over Quality Feed.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Feed Testing Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence