Key Insights

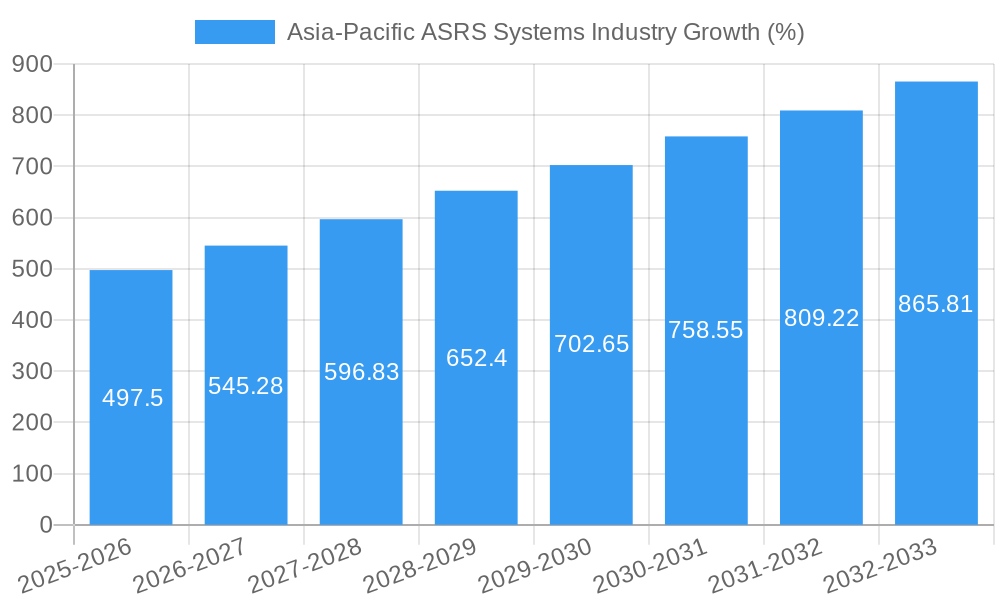

The Asia-Pacific Automated Storage and Retrieval Systems (ASRS) market is experiencing robust growth, driven by the region's expanding e-commerce sector, increasing automation adoption across industries, and a growing need for efficient warehouse management. The market, valued at approximately $XX million in 2025 (assuming a logical value based on the provided CAGR of 9.95% and a reasonable starting point considering similar market reports), is projected to maintain a healthy growth trajectory throughout the forecast period (2025-2033). Key growth drivers include the burgeoning logistics and supply chain industries, particularly in countries like China and India, experiencing rapid urbanization and industrialization. The rising demand for faster order fulfillment and improved inventory management across various end-user industries such as automotive, food and beverage, and retail is further fueling market expansion. Technological advancements in ASRS, including the development of more sophisticated software and robotics integration, are also contributing to the market's upward trend.

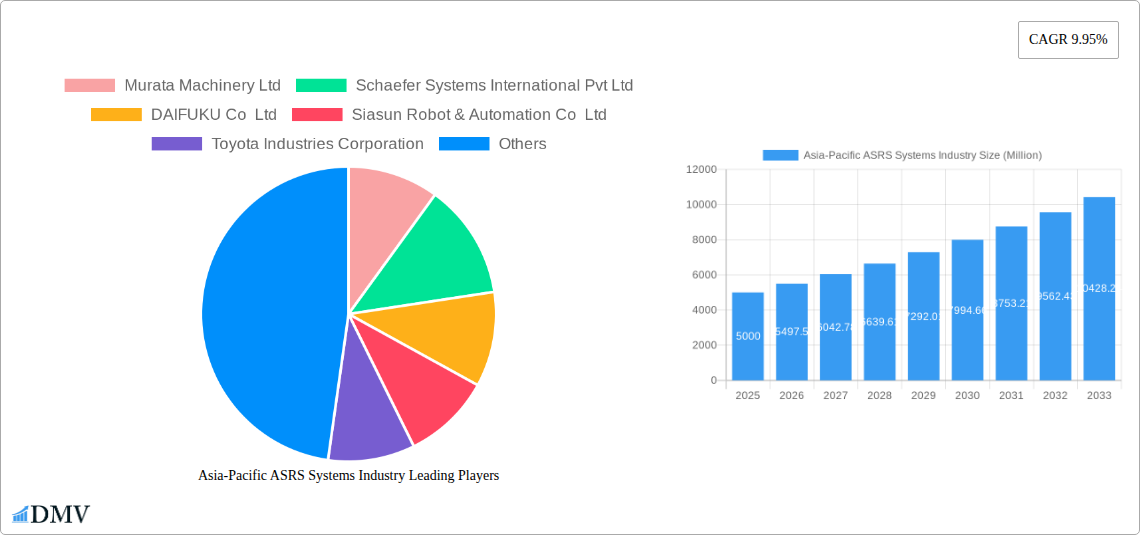

Significant segmental variations exist within the Asia-Pacific ASRS market. Fixed aisle systems currently dominate the product type segment, due to their established presence and suitability for various applications. However, the carousel (both horizontal and vertical) and vertical lift module systems are gaining traction, driven by their space-saving capabilities and enhanced efficiency. China, India, and Japan represent the largest national markets, reflecting their significant manufacturing and logistics capabilities. However, other countries in the region are also witnessing increasing ASRS adoption, indicating a broader regional expansion. While the market faces certain restraints such as high initial investment costs and the need for skilled labor, the long-term benefits of increased efficiency and reduced operational costs outweigh these challenges, ensuring continued market expansion throughout the forecast period. Competition among established players like Murata Machinery, Daifuku, and Toyota Industries, coupled with the emergence of innovative local companies, is further stimulating market growth and technological advancements.

Asia-Pacific ASRS Systems Industry Market Composition & Trends

This comprehensive report provides an in-depth analysis of the Asia-Pacific Automated Storage and Retrieval Systems (ASRS) market, covering the period 2019-2033. The study meticulously examines the market's composition, identifying key trends and drivers shaping its evolution. We delve into the competitive landscape, evaluating market concentration, analyzing innovation catalysts, and assessing the influence of regulatory frameworks and substitute products. The report profiles key end-user industries, including airports, automotive, food and beverage, general manufacturing, post and parcel, and retail, providing a granular understanding of their specific needs and market contributions. Furthermore, the report explores significant mergers and acquisitions (M&A) activities within the sector, analyzing deal values and their impact on market share distribution. The analysis encompasses the major players, including Murata Machinery Ltd, Schaefer Systems International Pvt Ltd, DAIFUKU Co Ltd, Siasun Robot & Automation Co Ltd, Toyota Industries Corporation, System Logistics S p A, Kardex Group, Noblelift Intelligent Equipment Co Ltd, Hanwha Group, and GEEK+ INC, offering insights into their strategic positioning and market influence. The xx% market share held by the top 5 players underscores the industry's consolidation trend. Total M&A deal value in the historical period reached approximately xx Million, indicating robust investment activity.

- Market Concentration: Highly concentrated, with top 5 players holding xx% market share.

- Innovation Catalysts: Advancements in robotics, AI, and IoT driving system sophistication.

- Regulatory Landscape: Government initiatives promoting automation and supply chain efficiency influence market growth.

- Substitute Products: Traditional warehousing methods represent the primary substitute, but ASRS offers significant efficiency gains.

- End-User Profiles: Detailed analysis of industry-specific needs and adoption rates.

- M&A Activities: xx Million in total deal value during the historical period (2019-2024).

Asia-Pacific ASRS Systems Industry Industry Evolution

The Asia-Pacific ASRS systems market has witnessed remarkable growth throughout the historical period (2019-2024), driven by escalating e-commerce, increasing labor costs, and the need for enhanced supply chain efficiency. The market's Compound Annual Growth Rate (CAGR) during this period was xx%, exceeding global averages. Technological advancements, such as the integration of artificial intelligence (AI) and the Internet of Things (IoT) within ASRS systems, have significantly boosted operational efficiency and optimized warehouse management. This has been met with a growing demand for automated solutions across diverse end-user sectors. Furthermore, shifting consumer demands for faster delivery and increased product availability have further fueled the market's expansion. The forecast period (2025-2033) projects continued growth, with a projected CAGR of xx%, reaching a market valuation of xx Million by 2033. Adoption metrics show a significant increase in ASRS installations across key industries, indicating a strong and sustained market trend. The increasing adoption of cloud-based solutions and the rise of Industry 4.0 principles further solidify the trajectory of growth. The market is expected to see further consolidation among key players driving innovation and expanding capabilities.

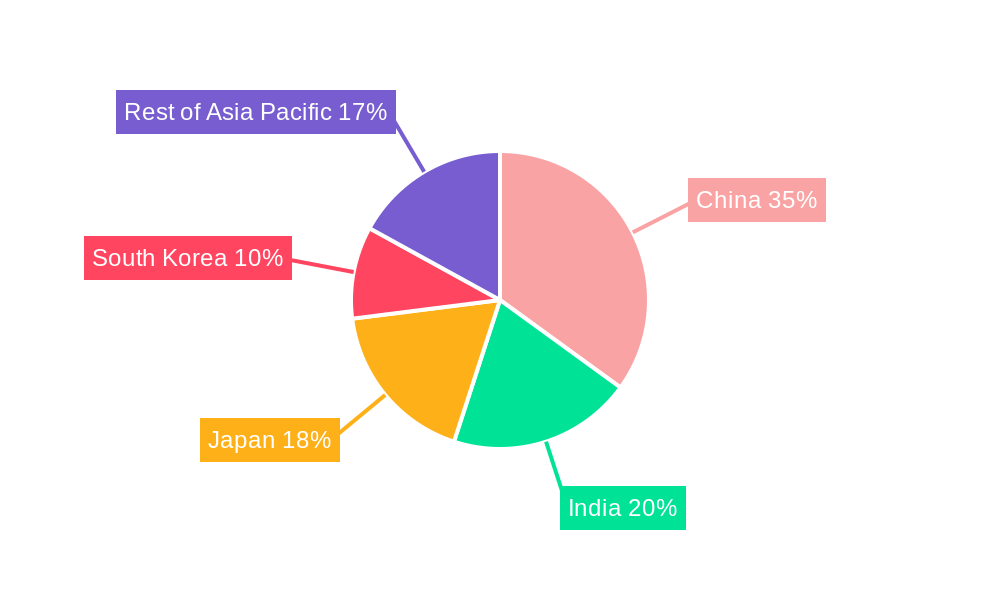

Leading Regions, Countries, or Segments in Asia-Pacific ASRS Systems Industry

The Asia-Pacific ASRS market displays regional and segmental variations in growth dynamics.

By Country:

- China: Dominates the market due to its vast manufacturing sector, burgeoning e-commerce, and government support for automation initiatives. Investment in logistics infrastructure and technological advancements are key drivers.

- Japan: A mature market characterized by high technological advancements and adoption within the automotive and manufacturing sectors.

- India: Shows significant growth potential driven by expanding e-commerce and a focus on improving supply chain infrastructure, but faces challenges related to infrastructure development.

- South Korea: High technology adoption rates and a strong focus on automation across multiple sectors fuel growth.

- Rest of Asia-Pacific: Experiences steady growth, driven by various factors depending on the specific country.

By End-User Industries:

- E-commerce/Retail: The fastest-growing segment due to the explosion of online shopping and the need for efficient order fulfillment.

- Automotive: Significant adoption due to requirements for precise inventory management and efficient production processes.

- Food and Beverage: Strong growth driven by the need for temperature-controlled storage and efficient handling of perishable goods.

- General Manufacturing: A consistently significant segment requiring optimized storage and retrieval for diverse manufacturing operations.

By Product Type:

- Vertical Lift Modules: High adoption due to space-saving capabilities and efficient retrieval mechanisms.

- Carousel Systems: Steady demand driven by their adaptability to various product types and sizes.

- Fixed Aisle Systems: Remain popular due to their high capacity and suitability for large warehouses.

The key drivers for these dominant regions and segments include substantial investments in logistics infrastructure, supportive government regulations fostering automation, and the relentless pursuit of higher efficiency in supply chain management.

Asia-Pacific ASRS Systems Industry Product Innovations

Recent innovations in ASRS systems include the integration of AI-powered robotics for autonomous picking and sorting, improved software for real-time inventory management and predictive maintenance, and the use of IoT sensors for enhanced tracking and monitoring. These innovations increase efficiency, reduce operational costs, and enhance overall warehouse performance. Furthermore, modular designs offer flexible scalability and adaptability to evolving needs. These technological advancements are resulting in improved throughput, reduced error rates, and enhanced worker safety, driving adoption across various industries.

Propelling Factors for Asia-Pacific ASRS Systems Industry Growth

Several factors propel the growth of the Asia-Pacific ASRS industry. Technological advancements like AI and IoT integration are key drivers, enhancing efficiency and optimizing warehouse operations. The booming e-commerce sector necessitates faster order fulfillment, fueling the demand for automated solutions. Government initiatives aimed at improving logistics infrastructure and promoting automation contribute significantly. Furthermore, rising labor costs in many Asian countries make ASRS a cost-effective alternative, improving productivity and reducing operational expenditures.

Obstacles in the Asia-Pacific ASRS Systems Industry Market

Despite significant growth, challenges remain. High initial investment costs and complex implementation processes can deter smaller businesses. Supply chain disruptions can impact the availability of components, leading to project delays. Furthermore, intense competition among established and emerging players creates a dynamic, sometimes volatile market. Regulatory inconsistencies across different regions can also present obstacles for seamless operations. These factors can result in slowed growth or increased operational expenditure impacting profitability.

Future Opportunities in Asia-Pacific ASRS Systems Industry

Future opportunities lie in expanding into less developed markets within the region, focusing on niche applications within specialized industries, and integrating advanced technologies like blockchain for enhanced supply chain transparency. Furthermore, the development of more user-friendly and adaptable ASRS solutions will attract wider adoption among small and medium-sized enterprises. Continued innovation focusing on cost optimization and sustainability will significantly enhance the market's potential and growth.

Major Players in the Asia-Pacific ASRS Systems Industry Ecosystem

- Murata Machinery Ltd

- Schaefer Systems International Pvt Ltd

- DAIFUKU Co Ltd

- Siasun Robot & Automation Co Ltd

- Toyota Industries Corporation

- System Logistics S p A

- Kardex Group

- Noblelift Intelligent Equipment Co Ltd

- Hanwha Group

- GEEK+ INC

Key Developments in Asia-Pacific ASRS Systems Industry Industry

- August 2020: Murata Machinery Ltd. signed a contract with Alpen Co. Ltd. to construct Japan's first 3D robot warehousing system, "ALPHABOT," significantly improving efficiency.

- February 2020: SSI SCHAEFER collaborated with ORCA in the Philippines, establishing the country's first cold chain storage system, expanding ASRS applications into temperature-controlled logistics.

Strategic Asia-Pacific ASRS Systems Industry Market Forecast

The Asia-Pacific ASRS market is poised for sustained growth, driven by ongoing technological advancements, increasing e-commerce penetration, and supportive government policies. The market's expansion into new industries and geographic areas presents significant opportunities for growth. The forecast period indicates strong potential, with a projected market valuation exceeding xx Million by 2033. Continued innovation and strategic partnerships will be key to maximizing market potential and ensuring strong future growth.

Asia-Pacific ASRS Systems Industry Segmentation

-

1. Product Type

- 1.1. Fixed Aisle System

- 1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 1.3. Vertical Lift Module

-

2. End-User Industries

- 2.1. Airports

- 2.2. Automotive

- 2.3. Food and Beverage

- 2.4. General Manufacturing

- 2.5. Post and Parcel

- 2.6. Retail

- 2.7. Other End-user Industries

Asia-Pacific ASRS Systems Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific ASRS Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Aisle System

- 5.1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.1.3. Vertical Lift Module

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Airports

- 5.2.2. Automotive

- 5.2.3. Food and Beverage

- 5.2.4. General Manufacturing

- 5.2.5. Post and Parcel

- 5.2.6. Retail

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Murata Machinery Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Schaefer Systems International Pvt Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 DAIFUKU Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Siasun Robot & Automation Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Toyota Industries Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 System Logistics S p A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kardex Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Noblelift Intelligent Equipment Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hanwha Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 GEEK+ INC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: Asia-Pacific ASRS Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific ASRS Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by End-User Industries 2019 & 2032

- Table 4: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by End-User Industries 2019 & 2032

- Table 15: Asia-Pacific ASRS Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific ASRS Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific ASRS Systems Industry?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Asia-Pacific ASRS Systems Industry?

Key companies in the market include Murata Machinery Ltd, Schaefer Systems International Pvt Ltd, DAIFUKU Co Ltd, Siasun Robot & Automation Co Ltd, Toyota Industries Corporation, System Logistics S p A, Kardex Group, Noblelift Intelligent Equipment Co Ltd , Hanwha Group, GEEK+ INC.

3. What are the main segments of the Asia-Pacific ASRS Systems Industry?

The market segments include Product Type, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce and Concerns over Replacement of Manual Labor.

8. Can you provide examples of recent developments in the market?

August 2020 - Murata Machinery Ltd has signed a contract with Alpen Co. Ltd to construct Japan's first 3D robot warehousing system, "ALPHABOT." ALPHABOT will be introduced at the Alpen Komaki Distribution Center, one of Alpen Group's main distribution centers, to complement its storage capacity and reduce picking, sorting, and packaging operations by approximately 60%. The system is scheduled to go into the process in July 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific ASRS Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific ASRS Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific ASRS Systems Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific ASRS Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence