Key Insights

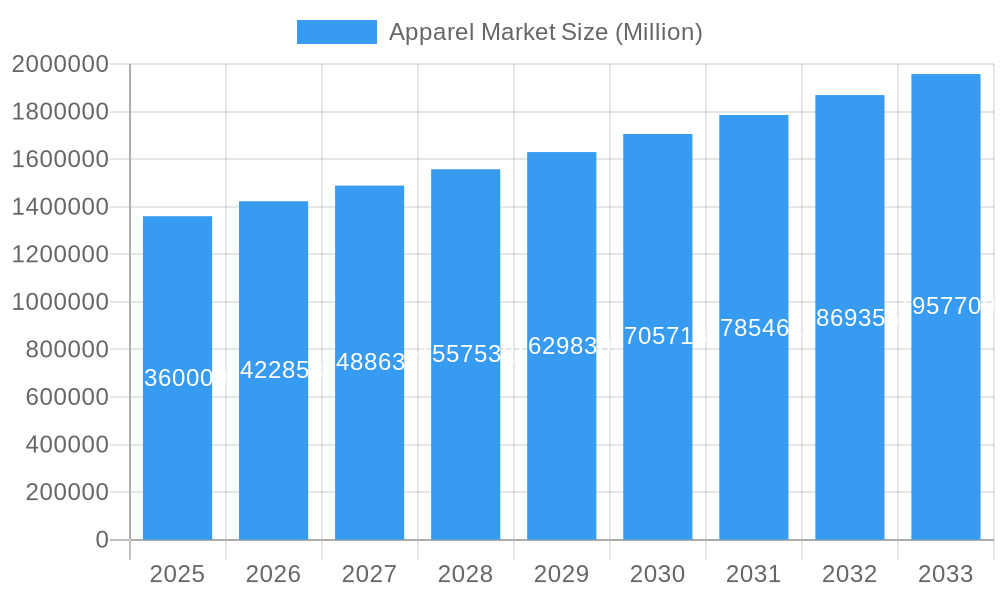

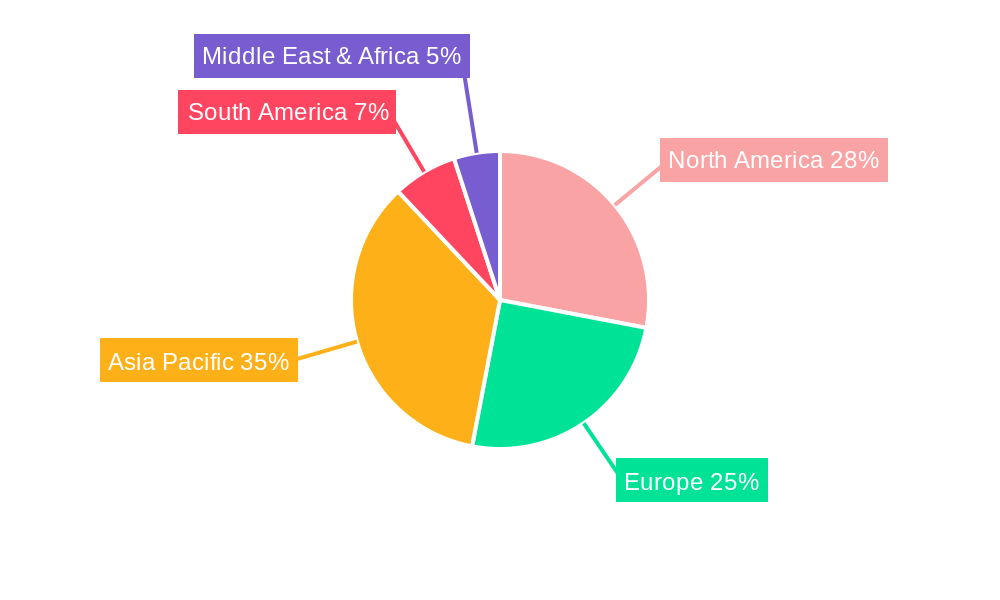

The global apparel market, valued at $1.36 trillion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, particularly in developing economies, fuel increased consumer spending on clothing. Evolving fashion trends and the influence of social media significantly impact purchasing decisions, fostering demand for diverse styles and frequent updates to wardrobes. The market is segmented by end-user (men, women, children) and apparel type (formal wear, casual wear, sportswear, nightwear, other), each exhibiting unique growth trajectories. The dominance of established players like Adidas, Nike, and Inditex is being challenged by fast-fashion brands like Shein, highlighting a shift towards affordability and rapid product turnover. Sustainable and ethical sourcing practices are gaining traction, influencing consumer choices and prompting apparel manufacturers to adopt more environmentally conscious production methods. Regional variations exist, with North America and Europe currently holding significant market share, but the Asia-Pacific region is poised for substantial growth due to its burgeoning middle class and expanding e-commerce infrastructure.

Apparel Market Market Size (In Million)

The projected CAGR of 4.63% suggests consistent market expansion over the forecast period (2025-2033). However, challenges remain. Fluctuations in raw material prices, geopolitical instability, and economic downturns can impact production costs and consumer spending. The increasing emphasis on sustainability presents both opportunities and challenges, requiring companies to invest in eco-friendly materials and manufacturing processes. Competition remains fierce, with brands constantly innovating to attract and retain customers. Understanding consumer preferences, leveraging digital marketing strategies, and adapting to changing supply chain dynamics will be crucial for success in this dynamic market. Further segmentation analysis reveals that the casual wear segment is likely to show the fastest growth due to its versatility and adaptability to various lifestyles. The increasing popularity of athleisure further fuels this segment’s expansion.

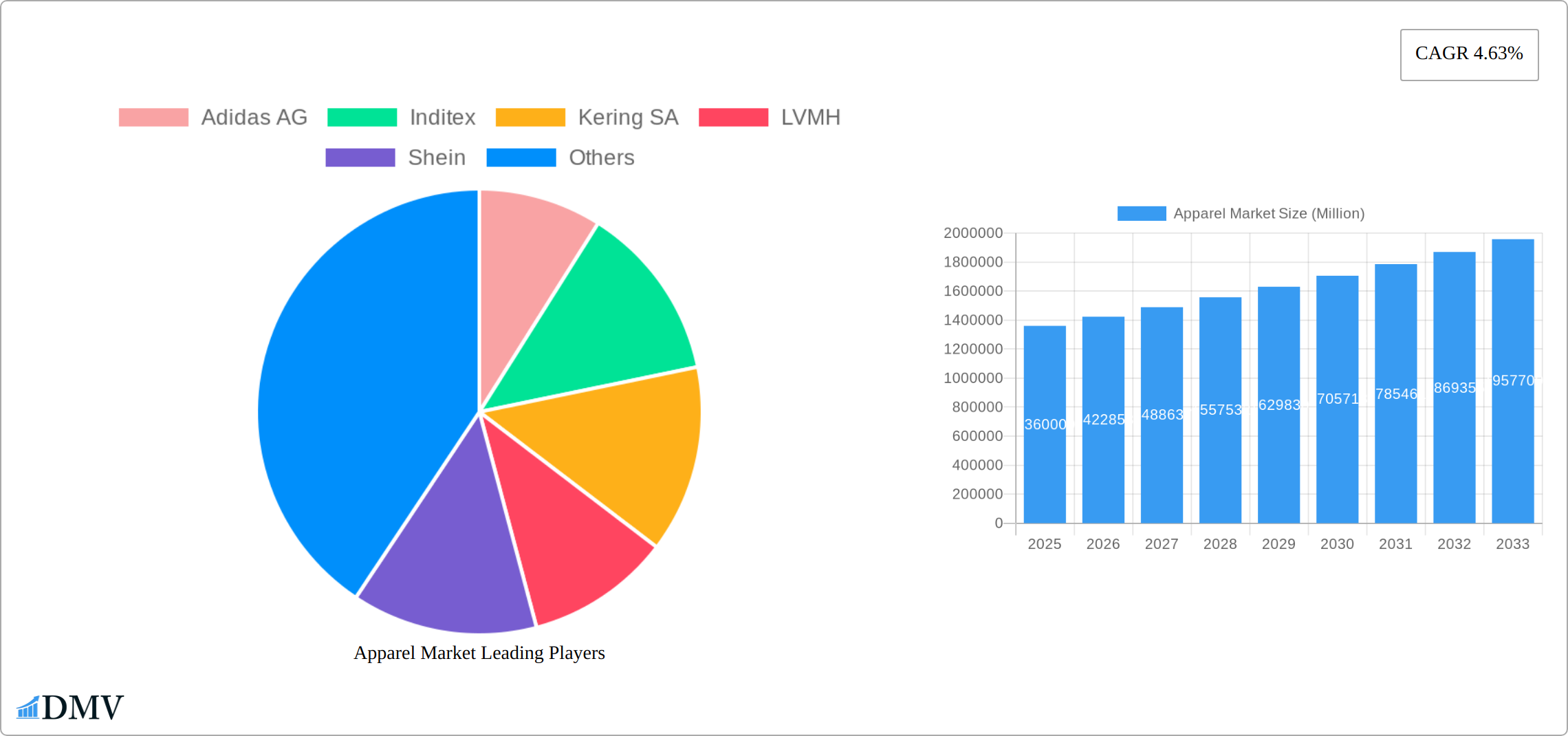

Apparel Market Company Market Share

Apparel Market Market Composition & Trends

The Apparel Market, analyzed from 2019 to 2033, presents a dynamic landscape shaped by interwoven factors: market concentration, innovation, regulatory shifts, substitute products, evolving consumer preferences, and mergers and acquisitions (M&A) activity. Market leadership is highly concentrated, with giants like Adidas AG, Nike Inc., and LVMH holding substantial shares. Illustrative of this concentration, Adidas AG controls approximately 7% of the global apparel market, while Nike Inc. and LVMH hold around 6% and 5%, respectively. This oligopolistic structure significantly influences market dynamics.

Innovation is a key driver, fueled by advancements in fabric technology, sustainable materials, and smart textiles. The regulatory environment varies considerably across regions. Stringent environmental regulations, particularly in Europe (e.g., the EU Green Deal), are pushing the industry towards more sustainable production methods and eco-friendly materials. Simultaneously, the rise of substitute products, including secondhand clothing and apparel rental services, is challenging the traditional retail model and impacting sales of new apparel.

Consumer preferences are shifting towards personalized and sustainable apparel. In 2023, market segmentation revealed men's apparel representing 35% of the market, women's 45%, and children's 20%. This evolving demographic landscape necessitates agile strategies for brands to remain competitive. M&A activity has been robust, with deal values reaching xx Million in the past year, reflecting strategic consolidation and expansion efforts within the industry.

- Market Concentration: Highly concentrated, dominated by a few key players.

- Innovation Catalysts: Technological advancements in fabrics, sustainable materials, and smart textiles.

- Regulatory Landscapes: Globally diverse, with increasing emphasis on sustainability and environmental regulations.

- Substitute Products: The growing popularity of secondhand and rental apparel markets presents a significant competitive challenge.

- End-User Profiles: Consumers increasingly prioritize personalization and environmentally responsible apparel choices.

- M&A Activities: Significant M&A activity, valued at xx Million in the last year, signifies ongoing industry consolidation and strategic growth.

Apparel Market Industry Evolution

The Apparel Market has undergone significant evolution from 2019 to 2033, driven by market growth trajectories, technological advancements, and shifting consumer demands. The market growth rate averaged 4.5% annually from 2019 to 2024, with projections indicating a rise to 5.2% from 2025 to 2033. Technological advancements, particularly in smart textiles and 3D printing, have revolutionized apparel production, allowing for greater customization and efficiency.

Consumer demands have shifted towards sustainability and ethical production, with a notable increase in the adoption of organic and recycled materials. For instance, the adoption rate of sustainable materials in apparel increased by 12% in the last five years. Additionally, the rise of e-commerce has transformed retail dynamics, with online apparel sales growing by 8% annually.

The market has also seen a surge in sportswear, driven by a health-conscious population and the athleisure trend. Sportswear now constitutes 25% of the apparel market, up from 20% in 2019. The integration of technology in apparel, such as wearable tech, is another significant trend, with adoption rates doubling over the past three years.

Overall, the Apparel Market's evolution reflects a blend of technological innovation, consumer-driven sustainability, and shifting retail landscapes, setting the stage for continued growth and transformation.

Leading Regions, Countries, or Segments in Apparel Market

The Apparel Market's leading regions, countries, and segments reveal distinct dominance patterns, with Asia-Pacific emerging as the dominant region due to its large consumer base and manufacturing capabilities. Within Asia-Pacific, China and India stand out, driven by their expansive markets and investment in apparel production.

Asia-Pacific Dominance:

Investment in manufacturing infrastructure.

Growing middle class and increasing disposable income.

Strong government support for textile industries.

China's Market Position:

Largest apparel market globally, with a market size of xx Million in 2023.

Significant investment in smart factories and digitalization.

India's Growth Trajectory:

Rapidly expanding retail sector, projected to reach xx Million by 2033.

Increasing focus on sustainable and ethical apparel production.

Among segments, women's apparel remains the dominant category, driven by a diverse range of products and styles. Women's apparel accounted for 45% of the market in 2023, with casual wear being the most significant type within this segment. Casual wear's popularity is attributed to its versatility and comfort, aligning with current lifestyle trends.

Women's Apparel Dominance:

Broad product range catering to diverse consumer needs.

Significant investment in marketing and brand development.

Casual Wear's Popularity:

Aligns with modern lifestyle and comfort preferences.

High demand across all age groups and demographics.

The dominance of these regions and segments is further reinforced by regulatory support, investment trends, and consumer preferences, positioning them as key areas for future growth and innovation in the Apparel Market.

Apparel Market Product Innovations

Product innovations in the Apparel Market are centered around sustainability, technology integration, and consumer personalization. Recent advancements include the development of smart textiles that incorporate sensors for health monitoring, and eco-friendly fabrics made from recycled materials. Adidas, in collaboration with Better Cotton, introduced a Pride 2023 collection featuring garments crafted partly from recycled materials, showcasing a commitment to sustainability. Additionally, 3D printing technology allows for custom-fit clothing, enhancing the unique selling proposition of personalized apparel. These innovations not only improve product performance but also align with consumer trends towards sustainability and personalization.

Propelling Factors for Apparel Market Growth

Several factors are driving the growth of the Apparel Market. Technological advancements, such as the integration of smart textiles and wearable technology, are enhancing apparel functionality and appealing to tech-savvy consumers. Economically, rising disposable incomes, especially in emerging markets, are fueling increased demand for fashion and apparel. Regulatory pressures, particularly those focused on sustainability, are encouraging companies to adopt eco-friendly practices, thereby attracting environmentally conscious consumers. For example, the European Union's Green Deal is a powerful catalyst, driving innovation and growth in the sustainable apparel segment.

Obstacles in the Apparel Market Market

The Apparel Market faces significant challenges that can hinder growth. Regulatory hurdles, including stringent environmental regulations, increase production costs and complexity throughout the supply chain. Supply chain disruptions, frequently exacerbated by global events (such as pandemics or geopolitical instability), lead to production delays, increased costs, and uncertainty in market dynamics. The intensely competitive landscape, with fast-fashion brands like Shein and H&M aggressively pursuing low prices and margins, puts pressure on profitability and market share for established players. These obstacles collectively pose a considerable threat, potentially reducing annual market growth by up to 2%.

Future Opportunities in Apparel Market

Emerging opportunities in the Apparel Market include the expansion into new markets, particularly in Africa and Latin America, where consumer demand is growing. Technological advancements, such as AI-driven personalization and virtual fitting rooms, offer new avenues for growth. Additionally, the trend towards sustainable and ethical consumption presents opportunities for brands to differentiate themselves. For instance, the rise of circular fashion models, where clothing is recycled or resold, could tap into a market valued at xx Million by 2033.

Major Players in the Apparel Market Ecosystem

Key Developments in Apparel Market Industry

- September 2023: H&M India expanded its presence in Hyderabad, opening its third store in the city, bringing its total to 55 stores across 28 Indian cities. This demonstrates a commitment to growth in the Indian market.

- August 2023: Reliance Retail launched 'Yousta,' a youth-focused fashion brand, with its first store in Hyderabad's Sarath City Mall and online presence on Ajio and JioMart. This targeted strategy aims to capture a significant demographic segment.

- May 2023: Adidas, collaborating with designer Rich Mnisi, released a Pride 2023 apparel collection incorporating sustainable materials. This initiative highlights the increasing importance of inclusivity and sustainability in the apparel industry.

Strategic Apparel Market Market Forecast

The strategic forecast for the Apparel Market from 2025 to 2033 highlights significant growth potential driven by technological advancements, sustainability trends, and expanding consumer bases in emerging markets. The integration of AI and IoT in apparel production will enhance efficiency and personalization, opening new revenue streams. Sustainability will continue to be a major growth catalyst, with brands increasingly adopting circular economy models. The market is expected to grow at a CAGR of 5.2%, reaching a projected value of xx Million by 2033. These factors collectively position the Apparel Market for robust future growth and innovation.

Apparel Market Segmentation

-

1. End User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Type

- 2.1. Formal Wear

- 2.2. Casual Wear

- 2.3. Sportswear

- 2.4. Nightwear

- 2.5. Other Types

Apparel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Apparel Market Regional Market Share

Geographic Coverage of Apparel Market

Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Marketing and Innovative Designs Driving the Market; Growing Demand for Apparel Personalization and Customization

- 3.3. Market Restrains

- 3.3.1. Competition from Local Brands with Affordable Pricing

- 3.4. Market Trends

- 3.4.1. E-Commerce Driving the Apparel Business

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Formal Wear

- 5.2.2. Casual Wear

- 5.2.3. Sportswear

- 5.2.4. Nightwear

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Formal Wear

- 6.2.2. Casual Wear

- 6.2.3. Sportswear

- 6.2.4. Nightwear

- 6.2.5. Other Types

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Formal Wear

- 7.2.2. Casual Wear

- 7.2.3. Sportswear

- 7.2.4. Nightwear

- 7.2.5. Other Types

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Formal Wear

- 8.2.2. Casual Wear

- 8.2.3. Sportswear

- 8.2.4. Nightwear

- 8.2.5. Other Types

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Formal Wear

- 9.2.2. Casual Wear

- 9.2.3. Sportswear

- 9.2.4. Nightwear

- 9.2.5. Other Types

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Apparel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Formal Wear

- 10.2.2. Casual Wear

- 10.2.3. Sportswear

- 10.2.4. Nightwear

- 10.2.5. Other Types

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Saudi Arabia Apparel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Men

- 11.1.2. Women

- 11.1.3. Children

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Formal Wear

- 11.2.2. Casual Wear

- 11.2.3. Sportswear

- 11.2.4. Nightwear

- 11.2.5. Other Types

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Adidas AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Inditex

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kering SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LVMH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Shein

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PVH Corp

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Aditya Birla Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 H&M Hennes & Mauritz Retail Pvt Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Hennes & Mauritz AB

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Puma

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nike Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Reliance Retai

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Adidas AG

List of Figures

- Figure 1: Global Apparel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Apparel Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 5: North America Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 9: North America Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 16: Europe Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 17: Europe Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 19: Europe Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 21: Europe Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 25: Europe Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Asia Pacific Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 29: Asia Pacific Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Asia Pacific Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 33: Asia Pacific Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Asia Pacific Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 40: South America Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 41: South America Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 42: South America Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 43: South America Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 44: South America Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 45: South America Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: South America Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 47: South America Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 49: South America Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 52: Middle East Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 53: Middle East Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 54: Middle East Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 55: Middle East Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Middle East Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 57: Middle East Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Middle East Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Middle East Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Middle East Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Apparel Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Saudi Arabia Apparel Market Revenue (Million), by End User 2025 & 2033

- Figure 64: Saudi Arabia Apparel Market Volume (K Units), by End User 2025 & 2033

- Figure 65: Saudi Arabia Apparel Market Revenue Share (%), by End User 2025 & 2033

- Figure 66: Saudi Arabia Apparel Market Volume Share (%), by End User 2025 & 2033

- Figure 67: Saudi Arabia Apparel Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Saudi Arabia Apparel Market Volume (K Units), by Type 2025 & 2033

- Figure 69: Saudi Arabia Apparel Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Saudi Arabia Apparel Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Saudi Arabia Apparel Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Saudi Arabia Apparel Market Volume (K Units), by Country 2025 & 2033

- Figure 73: Saudi Arabia Apparel Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Saudi Arabia Apparel Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 3: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 5: Global Apparel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Apparel Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 9: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 23: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 25: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 27: Spain Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: United Kingdom Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Germany Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: France Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: Italy Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Russia Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Russia Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 43: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 45: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 47: China Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: China Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Japan Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Japan Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: India Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: India Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Australia Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 58: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 59: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 60: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 61: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 63: Brazil Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Brazil Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: Argentina Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Argentina Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 70: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 71: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 72: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 73: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 75: Global Apparel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 76: Global Apparel Market Volume K Units Forecast, by End User 2020 & 2033

- Table 77: Global Apparel Market Revenue Million Forecast, by Type 2020 & 2033

- Table 78: Global Apparel Market Volume K Units Forecast, by Type 2020 & 2033

- Table 79: Global Apparel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Apparel Market Volume K Units Forecast, by Country 2020 & 2033

- Table 81: South Africa Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: South Africa Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Rest of Middle East Apparel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Rest of Middle East Apparel Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Apparel Market?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Apparel Market?

Key companies in the market include Adidas AG, Inditex, Kering SA, LVMH, Shein, PVH Corp, Aditya Birla Group, H&M Hennes & Mauritz Retail Pvt Ltd, Hennes & Mauritz AB, Puma, Nike Inc, Reliance Retai.

3. What are the main segments of the Apparel Market?

The market segments include End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Marketing and Innovative Designs Driving the Market; Growing Demand for Apparel Personalization and Customization.

6. What are the notable trends driving market growth?

E-Commerce Driving the Apparel Business.

7. Are there any restraints impacting market growth?

Competition from Local Brands with Affordable Pricing.

8. Can you provide examples of recent developments in the market?

September 2023: H&M India revealed its expansion plans in Hyderabad by inaugurating its third store in the city. The company currently boasts 55 stores spread across 28 cities in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Apparel Market?

To stay informed about further developments, trends, and reports in the Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence