Key Insights

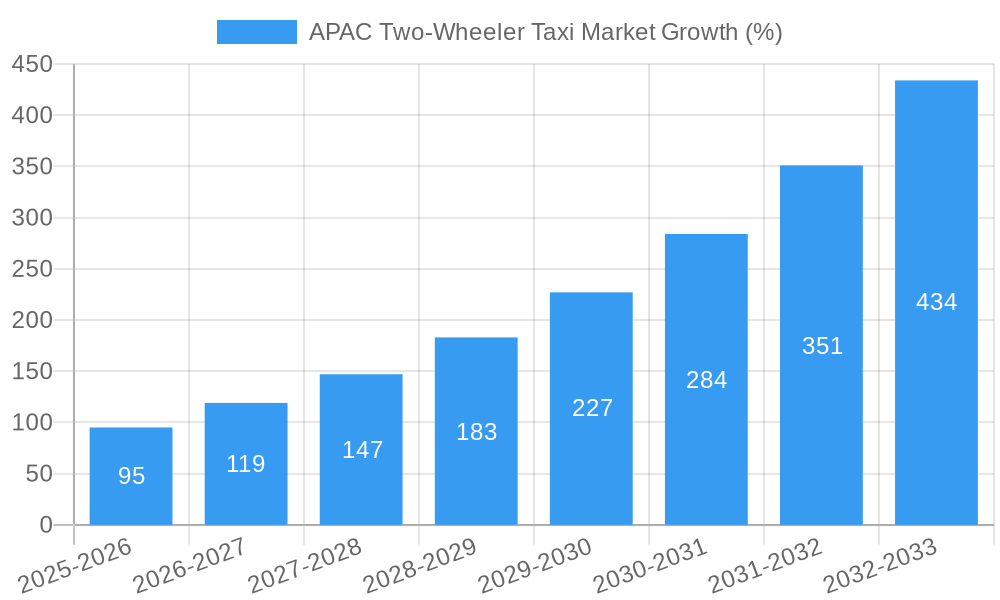

The Asia-Pacific (APAC) two-wheeler taxi market is experiencing robust growth, projected to reach a market size of $0.39 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 24.50% from 2025 to 2033. This surge is driven primarily by increasing urbanization, rising traffic congestion in major APAC cities, and the affordability and convenience offered by two-wheeler taxis compared to traditional four-wheeler options. The "pay-as-you-go" model dominates the service type segment, attracting a large customer base seeking flexible and cost-effective transportation solutions. However, subscription-based services are emerging as a significant growth area, offering value-added benefits and attracting a loyal customer base. Market penetration is particularly high in densely populated countries like India, China, and Vietnam, where two-wheelers provide a crucial last-mile connectivity solution. Factors like improved technological integration (GPS tracking, digital payment options), increasing smartphone penetration, and the expansion of ride-hailing platforms are further bolstering market expansion. While regulatory challenges related to safety and licensing remain, the overall market outlook is incredibly positive, fueled by a growing young population embracing on-demand transportation and a push for sustainable mobility options within these often congested urban environments.

The market segmentation reveals that motorcycles and scooters contribute significantly to the two-wheeler taxi market, with motorcycles potentially holding a larger market share due to their wider availability and affordability. While specific regional data for China, India, Japan, Thailand, and Vietnam are unavailable, a logical deduction based on population density, technological adoption rates, and existing ride-hailing infrastructure suggests that India and Vietnam might be experiencing the fastest growth rates within the APAC region. The competitive landscape is dynamic, with both established players like Uber and Ola and regional startups vying for market dominance. The increasing competition is likely to spur innovation in service offerings, pricing strategies, and technological advancements, ultimately benefitting consumers and furthering market growth. This rapid expansion presents significant opportunities for both investors and businesses looking to capitalize on the growing demand for efficient and affordable two-wheeler taxi services across the diverse APAC region.

APAC Two-Wheeler Taxi Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific (APAC) two-wheeler taxi market, encompassing market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The study offers crucial insights for stakeholders, investors, and industry players seeking to navigate this dynamic and rapidly evolving sector. With a base year of 2025 and an estimated year of 2025, this report forecasts market trends until 2033, utilizing data from the historical period of 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

APAC Two-Wheeler Taxi Market Composition & Trends

This section delves into the intricate composition of the APAC two-wheeler taxi market, examining key trends shaping its trajectory. We analyze market concentration, revealing the share held by major players like Uber Technologies Inc, ANI Technologies Pvt Ltd (OLA), GrabTaxi Holdings Pte Ltd, GOJEK Ltd, and others. The report further explores the influence of innovation catalysts such as technological advancements in electric vehicles and ride-hailing apps, alongside regulatory landscapes impacting operations across various APAC nations. We analyze the impact of substitute products, examining the competitive pressures from other transportation modes, and detailing end-user profiles – identifying key demographics utilizing two-wheeler taxi services. Finally, we meticulously examine mergers and acquisitions (M&A) activity within the sector, providing insights into deal values and their impact on market dynamics. For example, the market share distribution in 2025 is estimated as follows: Uber - xx%, Ola - xx%, Grab - xx%, others - xx%. M&A activity in the period 2019-2024 totalled approximately xx Million.

APAC Two-Wheeler Taxi Market Industry Evolution

This section meticulously traces the evolutionary path of the APAC two-wheeler taxi market, highlighting significant growth trajectories. We analyze data showing a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and project a CAGR of xx% from 2025 to 2033. This growth is propelled by several factors including the increasing adoption of smartphone technology, rising urbanization, and growing preference for convenient and affordable transportation options. Furthermore, we explore technological advancements, such as the introduction of electric two-wheelers and the integration of advanced GPS tracking and payment systems, significantly impacting market dynamics. The shift in consumer demands, a move towards greater convenience, safety, and sustainability, also influences the market. We also examine the impact of evolving government regulations and initiatives on market expansion.

Leading Regions, Countries, or Segments in APAC Two-Wheeler Taxi Market

This section pinpoints the leading regions, countries, and market segments within the APAC two-wheeler taxi market. We identify the dominant segment and provide a detailed examination of the factors driving their success.

By Vehicle Type:

- Motorcycle: The motorcycle segment leads due to its affordability and adaptability to varied terrains. Investment in motorcycle taxi fleets is high in developing nations.

- Scooter: Scooter taxis are gaining popularity in urban areas due to ease of maneuverability and increased rider comfort. Government initiatives promoting eco-friendly scooters are further fueling growth.

By Service Type:

- Pay as You Go: This remains the dominant service type due to its flexibility and accessibility.

- Subscription-Based: Subscription models are gaining traction, offering cost savings and added convenience to frequent users. This segment is expected to experience significant growth in the forecast period.

The dominance of specific regions is largely influenced by factors including population density, economic development, and government regulations. For example, India and Southeast Asia are key contributors due to their large populations and burgeoning middle class.

APAC Two-Wheeler Taxi Market Product Innovations

Significant innovations are transforming the two-wheeler taxi landscape. Electric two-wheelers are gaining prominence, driven by environmental concerns and government incentives. Features like improved battery technology, enhanced range, and faster charging times are key selling points. Integrated ride-hailing apps with advanced features like real-time tracking, cashless payments, and rider safety measures are becoming standard. The integration of IoT (Internet of Things) sensors for improved fleet management and enhanced data analytics further contributes to market growth.

Propelling Factors for APAC Two-Wheeler Taxi Market Growth

Several factors contribute to the growth of the APAC two-wheeler taxi market. Technological advancements like electric vehicle adoption and improved ride-hailing apps enhance efficiency and convenience. Economic growth in several APAC nations increases disposable income, leading to higher demand. Supportive government policies and initiatives promoting sustainable transportation further accelerate market expansion. For instance, the increasing investment in smart city infrastructure and the development of dedicated motorcycle taxi lanes in several urban areas contribute to this growth.

Obstacles in the APAC Two-Wheeler Taxi Market

The APAC two-wheeler taxi market faces several challenges. Regulatory hurdles regarding licensing, safety standards, and insurance create operational complexities. Supply chain disruptions, especially concerning the sourcing of electric vehicle components, affect market expansion. Intense competition from established players and the emergence of new entrants create pricing pressures. These factors combined reduce profitability margins and hinder market growth to varying degrees, impacting the overall market size.

Future Opportunities in APAC Two-Wheeler Taxi Market

The APAC two-wheeler taxi market presents several future opportunities. Expansion into untapped markets within the region presents significant potential. The adoption of advanced technologies like autonomous driving and AI-powered route optimization will enhance efficiency and safety. Emerging consumer trends toward sustainable transportation, coupled with increasing government support for electric vehicles, present a large growth opportunity. Focus on market penetration in rural and less-connected areas also offers considerable untapped potential.

Major Players in the APAC Two-Wheeler Taxi Market Ecosystem

- Madhatters Voyage Pvt Ltd

- Roppen Transportation (Rapido)

- Uber Technologies Inc

- Moped

- GOJEK Ltd

- GrabTaxi Holdings Pte Ltd

- ANI Technologies Pvt Ltd (OLA)

Key Developments in APAC Two-Wheeler Taxi Market Industry

- May 2022: The Thai government and UNEP launched a pilot project for electric motorcycle taxis using 50 TAILG electric motorcycles, demonstrating sustainable mobility.

- May 2022: EGAT, Stallions, and TAILG partnered to introduce electric motorcycle taxis in Thailand, promoting eco-friendly transportation.

Strategic APAC Two-Wheeler Taxi Market Forecast

The APAC two-wheeler taxi market is poised for robust growth, driven by technological advancements, supportive government policies, and evolving consumer preferences. The increasing adoption of electric vehicles and the expansion of ride-hailing services will significantly shape market dynamics in the coming years. The market’s potential is substantial, with continued expansion expected across various segments and geographic locations. This presents significant opportunities for investors and industry players to capitalize on this rapidly evolving sector.

APAC Two-Wheeler Taxi Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter

-

2. Service Type

- 2.1. Pay as You Go

- 2.2. Subscription-Based

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Thailand

- 3.5. Vietnam

- 3.6. Rest of Asia-Pacific

APAC Two-Wheeler Taxi Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Thailand

- 5. Vietnam

- 6. Rest of Asia Pacific

APAC Two-Wheeler Taxi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone User and Internet Penetration Across the Region

- 3.3. Market Restrains

- 3.3.1. Increase in Traffic Problems

- 3.4. Market Trends

- 3.4.1. Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Pay as You Go

- 5.2.2. Subscription-Based

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Thailand

- 5.3.5. Vietnam

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Thailand

- 5.4.5. Vietnam

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Motorcycle

- 6.1.2. Scooter

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Pay as You Go

- 6.2.2. Subscription-Based

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Thailand

- 6.3.5. Vietnam

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Motorcycle

- 7.1.2. Scooter

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Pay as You Go

- 7.2.2. Subscription-Based

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Thailand

- 7.3.5. Vietnam

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Japan APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Motorcycle

- 8.1.2. Scooter

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Pay as You Go

- 8.2.2. Subscription-Based

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Thailand

- 8.3.5. Vietnam

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Thailand APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Motorcycle

- 9.1.2. Scooter

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Pay as You Go

- 9.2.2. Subscription-Based

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Thailand

- 9.3.5. Vietnam

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Vietnam APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Motorcycle

- 10.1.2. Scooter

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Pay as You Go

- 10.2.2. Subscription-Based

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Thailand

- 10.3.5. Vietnam

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Rest of Asia Pacific APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.1.1. Motorcycle

- 11.1.2. Scooter

- 11.2. Market Analysis, Insights and Forecast - by Service Type

- 11.2.1. Pay as You Go

- 11.2.2. Subscription-Based

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Thailand

- 11.3.5. Vietnam

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 12. China APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. India APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Japan APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Thailand APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Vietnam APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Rest of Asia Pacific APAC Two-Wheeler Taxi Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Madhatters Voyage Pvt Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Roppen Transportation(Rapido)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Uber Technologies Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Moped

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 GOJEK Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 GrabTaxi Holdings Pte Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 ANI Technologies Pvt Ltd (OLA)

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.1 Madhatters Voyage Pvt Ltd

List of Figures

- Figure 1: Global APAC Two-Wheeler Taxi Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 3: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: India APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 5: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: China APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: China APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 17: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 18: China APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 19: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 20: China APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 21: China APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: India APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: India APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 25: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 26: India APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 27: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 28: India APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 29: India APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 33: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 34: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 35: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Japan APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Japan APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 41: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 42: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 43: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Thailand APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Thailand APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 47: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 48: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 49: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 50: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 51: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 52: Vietnam APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Vietnam APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 55: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 56: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Service Type 2024 & 2032

- Figure 57: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Service Type 2024 & 2032

- Figure 58: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Geography 2024 & 2032

- Figure 59: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Geography 2024 & 2032

- Figure 60: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Rest of Asia Pacific APAC Two-Wheeler Taxi Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: APAC Two-Wheeler Taxi Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 19: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 23: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 24: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 31: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 32: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 35: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 36: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 39: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 40: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global APAC Two-Wheeler Taxi Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Two-Wheeler Taxi Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the APAC Two-Wheeler Taxi Market?

Key companies in the market include Madhatters Voyage Pvt Ltd, Roppen Transportation(Rapido), Uber Technologies Inc, Moped, GOJEK Ltd, GrabTaxi Holdings Pte Ltd, ANI Technologies Pvt Ltd (OLA).

3. What are the main segments of the APAC Two-Wheeler Taxi Market?

The market segments include Vehicle Type, Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone User and Internet Penetration Across the Region.

6. What are the notable trends driving market growth?

Increase in Smartphone and Internet Penetration Across the Region will Stimulate Pay as You Go Segment.

7. Are there any restraints impacting market growth?

Increase in Traffic Problems.

8. Can you provide examples of recent developments in the market?

May 2022: A significant milestone was achieved as the Thai government and the United Nations Environment Program (UNEP) jointly initiated a pilot project for electric motorcycle taxis in Thailand. In a remarkable collaboration, approximately fifty electric motorcycles generously donated by the Chinese company TAILG will be utilized as green motorcycle taxis, serving as both a research project and a demonstration of sustainable mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Two-Wheeler Taxi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Two-Wheeler Taxi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Two-Wheeler Taxi Market?

To stay informed about further developments, trends, and reports in the APAC Two-Wheeler Taxi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence