Key Insights

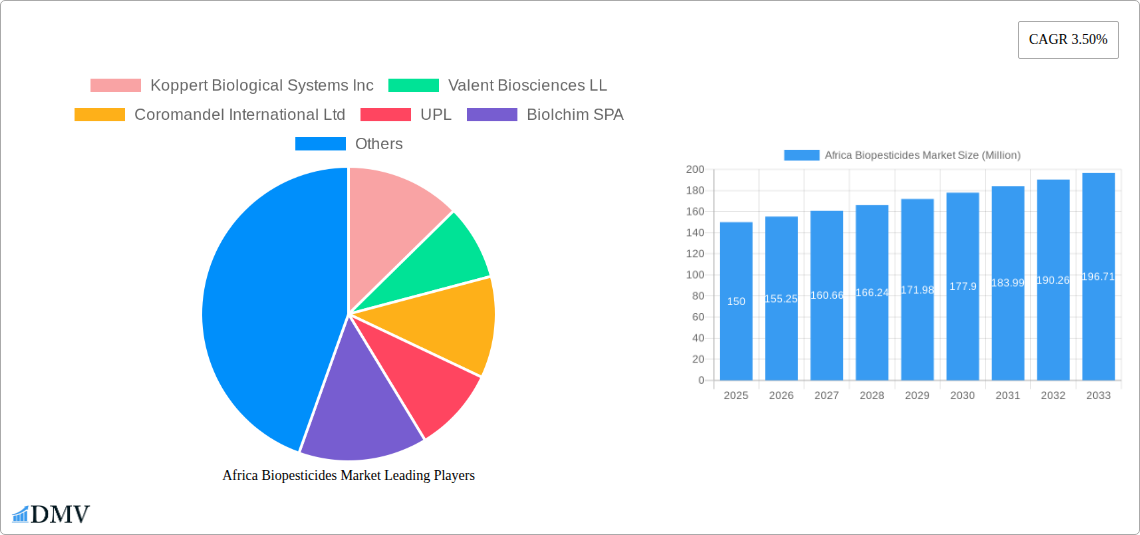

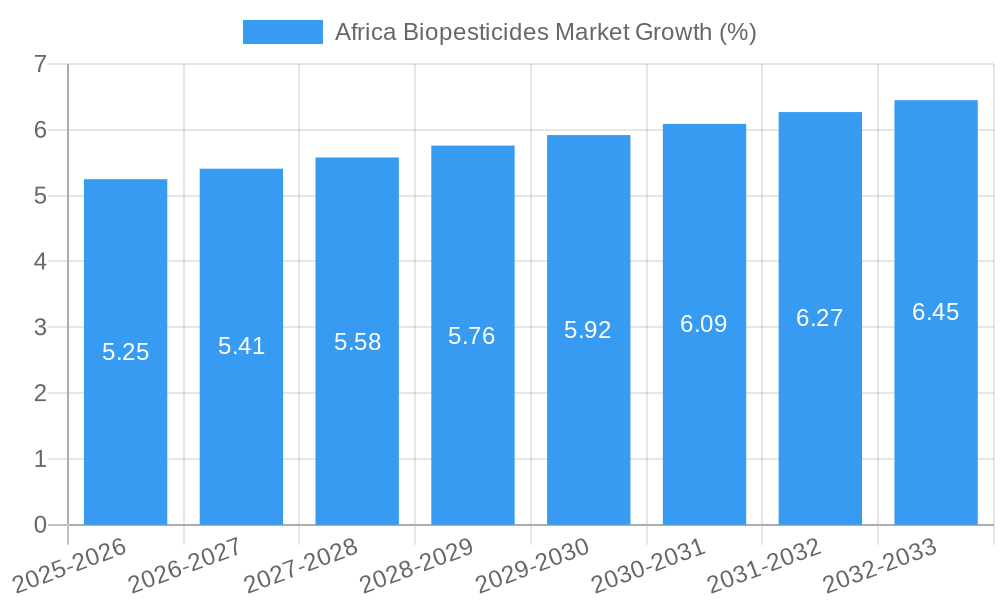

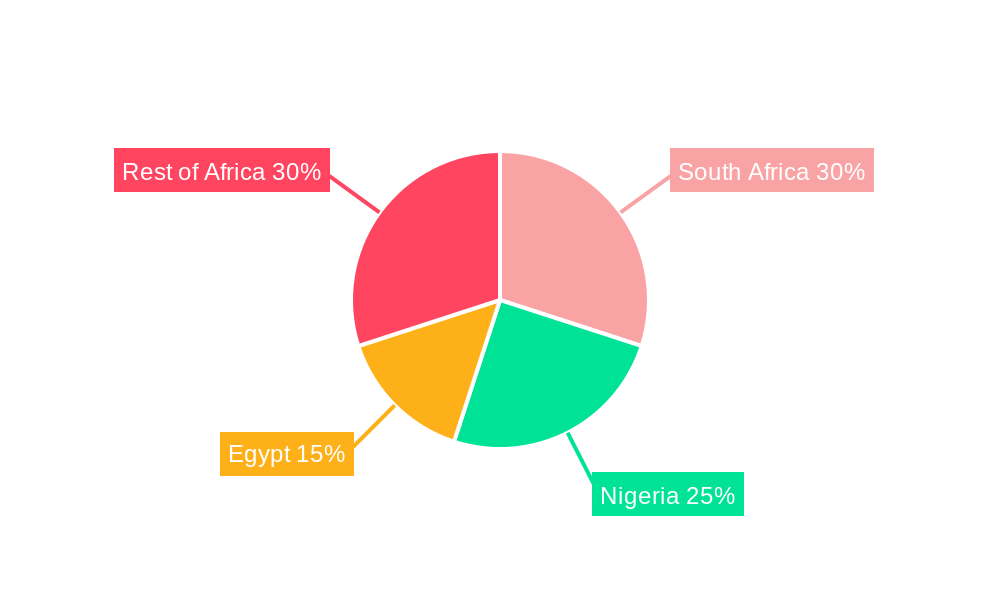

The African biopesticides market, valued at approximately $150 million in 2025, is projected to experience robust growth, driven by increasing awareness of the harmful effects of chemical pesticides, rising demand for organically produced food, and supportive government initiatives promoting sustainable agriculture. A compound annual growth rate (CAGR) of 3.5% from 2025 to 2033 indicates a steady expansion, reaching an estimated $220 million by 2033. This growth is fueled by the expanding agricultural sector in several African nations, particularly in regions like South Africa, Nigeria, and Egypt, which are experiencing increased adoption of biopesticides across various crops, including cash crops, horticultural crops, and row crops. The segments of biofungicides and bioinsecticides are anticipated to contribute significantly to market expansion, driven by the rising prevalence of crop diseases and pest infestations. Key players like Koppert Biological Systems, Valent Biosciences, and UPL are already establishing their presence, contributing to market competition and technological advancements. However, challenges such as limited awareness in certain regions, high initial investment costs, and the need for effective distribution networks remain.

Despite these challenges, the future prospects for the African biopesticides market remain positive. The increasing adoption of sustainable agricultural practices, coupled with growing investments in agricultural research and development, will likely drive further market penetration. Government support through subsidies and awareness campaigns will play a crucial role in accelerating the transition towards biopesticides. Furthermore, the development of innovative biopesticide formulations tailored to specific African crops and pest issues will be vital for ensuring market sustainability and success. The focus on improving the efficiency and efficacy of biopesticides will be key to overcoming current limitations and maximizing their contribution to a healthier and more productive agricultural sector in Africa. The ongoing research and development efforts within this sector will be critical to the market's growth trajectory in the coming years.

Africa Biopesticides Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Africa biopesticides market, offering a detailed examination of market dynamics, key players, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report is crucial for stakeholders seeking to understand the evolving landscape of this dynamic market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Africa Biopesticides Market Composition & Trends

This section delves into the intricacies of the African biopesticides market, examining its competitive landscape, innovation drivers, regulatory environment, and strategic activities. The market exhibits a moderately fragmented structure, with key players such as Koppert Biological Systems Inc, Valent Biosciences LL, Coromandel International Ltd, UPL, Biolchim SPA, IPL Biologicals Limited, Atlántica Agrícola, T Stanes and Company Limited, Andermatt Group AG, and Certis USA LLC vying for market share. Market share distribution is currently estimated at xx% for the top 5 players, with a forecast of xx% by 2033.

- Market Concentration: Moderately fragmented, with increasing consolidation through mergers and acquisitions (M&A).

- Innovation Catalysts: Growing demand for sustainable agriculture, stringent regulations on chemical pesticides, and increasing consumer awareness of environmental concerns.

- Regulatory Landscape: Varying regulations across African countries, creating both challenges and opportunities for market entry. Harmonization efforts are underway, however, streamlining the regulatory approval process.

- Substitute Products: Chemical pesticides remain significant competitors, but biopesticides are gaining traction due to their environmental benefits and growing consumer preference.

- End-User Profiles: Predominantly smallholder farmers, but also includes large-scale commercial farms and horticultural businesses.

- M&A Activities: Significant M&A activity has been observed in the historical period (2019-2024), with total deal values exceeding xx Million. This trend is expected to continue, driving market consolidation.

Africa Biopesticides Market Industry Evolution

The Africa biopesticides market has witnessed substantial growth between 2019 and 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by increasing awareness of the harmful effects of chemical pesticides, the rising demand for organic and sustainably produced food, and supportive government policies promoting biopesticide adoption. Technological advancements, such as the development of novel biopesticides with enhanced efficacy and targeted delivery systems, are further driving market expansion. Consumer demand is shifting towards environmentally friendly and safer alternatives to chemical pesticides, particularly among consumers in urban areas with higher disposable incomes. Adoption metrics indicate a significant increase in the usage of biopesticides in key crops like maize, cotton, and horticultural products, with a xx% rise in adoption from 2019 to 2024. This trend is expected to accelerate in the forecast period (2025-2033), driven by continued technological advancements, supportive government policies, and increased investment in the sector.

Leading Regions, Countries, or Segments in Africa Biopesticides Market

South Africa currently holds the largest market share in the African biopesticides market, driven by its relatively advanced agricultural sector, strong regulatory framework, and high consumer awareness. Egypt and Nigeria are also emerging as significant markets, exhibiting strong growth potential due to expanding agricultural sectors and rising demand for sustainable farming practices.

- Dominant Region: South Africa

- Key Drivers for South Africa's Dominance:

- High level of agricultural mechanization

- Developed infrastructure and distribution networks

- Strong regulatory support for biopesticide adoption

- Relatively high consumer awareness of sustainable agriculture

- Growth Potential in Egypt and Nigeria:

- Large agricultural sectors with significant growth potential

- Growing demand for food security and sustainable farming methods

- Increasing government support for agricultural development, including biopesticide adoption

- Dominant Segments: Bioinsecticides and Biofungicides currently dominate the market, driven by high demand for control of major crop pests and diseases. Horticultural crops, and particularly cash crops, display the highest adoption rate due to their higher economic value and greater susceptibility to pests and diseases.

Form: Bioinsecticides and Biofungicides lead; Bioherbicides show increasing adoption.

Crop Type: Cash Crops (e.g., cotton, coffee, tea) show higher biopesticide adoption than row crops due to higher economic value.

Country: South Africa dominates, followed by Egypt and Nigeria; Rest of Africa segment shows substantial growth potential.

Africa Biopesticides Market Product Innovations

Recent innovations include the development of biopesticides with enhanced efficacy, broader spectrum activity, and improved shelf life. These advancements are driven by the application of nanotechnology, biotechnology, and advanced formulation technologies, resulting in products with greater precision, effectiveness, and reduced environmental impact. Unique selling propositions focus on environmentally friendly characteristics, sustainable agriculture practices, and improved crop yields. Technological advancements are focused on targeted delivery systems, enhancing the efficiency and reducing the environmental footprint of these products.

Propelling Factors for Africa Biopesticides Market Growth

Several factors drive the growth of the African biopesticides market, including:

- Increasing awareness of the harmful effects of chemical pesticides: Consumer demand for safer food and environmentally responsible agriculture is pushing adoption of biopesticides.

- Growing demand for organic and sustainably produced food: The market is benefiting from rising health consciousness and a preference for natural products.

- Stringent regulations on chemical pesticides: Increased regulatory scrutiny on the use of harmful chemicals is boosting the adoption of biopesticides.

- Government support and policies: Various government initiatives and incentives are promoting the use of biopesticides.

- Technological advancements in biopesticide development: Ongoing research and development are resulting in more effective and efficient biopesticides.

Obstacles in the Africa Biopesticides Market

The market faces several challenges:

- High cost of biopesticides: Compared to chemical pesticides, biopesticides can be more expensive, limiting affordability for smallholder farmers.

- Limited availability and access to biopesticides: Distribution networks need improvement to reach remote farming communities.

- Lack of awareness and education among farmers: Many farmers lack the knowledge and training necessary to effectively use biopesticides.

- Regulatory complexities: Varying regulations across different African countries can hinder market entry and expansion.

Future Opportunities in Africa Biopesticides Market

Future opportunities include:

- Expansion into new markets: Untapped potential exists in many African countries with growing agricultural sectors.

- Development of new biopesticide products: Innovations in formulation and delivery systems will further enhance the efficacy and market competitiveness of biopesticides.

- Increased investment in research and development: Continued R&D will lead to improved products and address existing challenges.

- Strengthening partnerships: Collaboration between industry players, government agencies, and research institutions is essential to promote wider adoption.

Major Players in the Africa Biopesticides Market Ecosystem

- Koppert Biological Systems Inc

- Valent Biosciences LL

- Coromandel International Ltd

- UPL

- Biolchim SPA

- IPL Biologicals Limited

- Atlántica Agrícola

- T Stanes and Company Limited

- Andermatt Group AG

- Certis USA LLC

Key Developments in Africa Biopesticides Market Industry

- October 2021: UPL collaborated with Chr. Hansen to develop microbes-based biopesticides, enhancing sustainable pest and disease control options. This collaboration broadened UPL's product portfolio and strengthened its position in the biopesticides market.

- June 2022: Certis Biologicals and Novozymes partnered to develop new technologies for fungal disease control in row crops. This collaboration expands the reach of innovative solutions for a significant agricultural segment.

Strategic Africa Biopesticides Market Forecast

The Africa biopesticides market is poised for significant growth in the coming years, driven by the increasing demand for sustainable agriculture, supportive government policies, and continuous technological innovations. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), exceeding xx Million by 2033. This growth will be driven by increased adoption across various segments and regions, particularly in high-growth countries like Nigeria and Egypt. The rising consumer awareness of environmental issues and a preference for safer agricultural products are significant factors contributing to the market’s optimistic outlook.

Africa Biopesticides Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Biopesticides Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Biopesticides Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Biofungicides is the largest Form

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Biopesticides Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Koppert Biological Systems Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Valent Biosciences LL

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Coromandel International Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 UPL

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Biolchim SPA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 IPL Biologicals Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Atlántica Agrícola

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 T Stanes and Company Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Andermatt Group AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Certis USA LLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Koppert Biological Systems Inc

List of Figures

- Figure 1: Africa Biopesticides Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Biopesticides Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Biopesticides Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Biopesticides Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Africa Biopesticides Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Africa Biopesticides Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Africa Biopesticides Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Africa Biopesticides Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Africa Biopesticides Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Biopesticides Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Africa Biopesticides Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Africa Biopesticides Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Africa Biopesticides Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Africa Biopesticides Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Africa Biopesticides Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Africa Biopesticides Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Nigeria Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Africa Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Egypt Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kenya Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Ethiopia Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Morocco Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Ghana Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Algeria Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Tanzania Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Ivory Coast Africa Biopesticides Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Biopesticides Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Africa Biopesticides Market?

Key companies in the market include Koppert Biological Systems Inc, Valent Biosciences LL, Coromandel International Ltd, UPL, Biolchim SPA, IPL Biologicals Limited, Atlántica Agrícola, T Stanes and Company Limited, Andermatt Group AG, Certis USA LLC.

3. What are the main segments of the Africa Biopesticides Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Biofungicides is the largest Form.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

June 2022: Certis Biologicals and Novozymes, two leading agricultural biotechnology companies, collaborated to develop new technologies for highly effective fungal disease control. This collaboration will provide new solutions to row crop growers.October 2021: UPL agreed to collaborate with Chr. Hansen, a global bioscience company that develops microbes-based biopesticides that help farmers sustainably control plant pests and diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Biopesticides Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Biopesticides Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Biopesticides Market?

To stay informed about further developments, trends, and reports in the Africa Biopesticides Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence