Key Insights

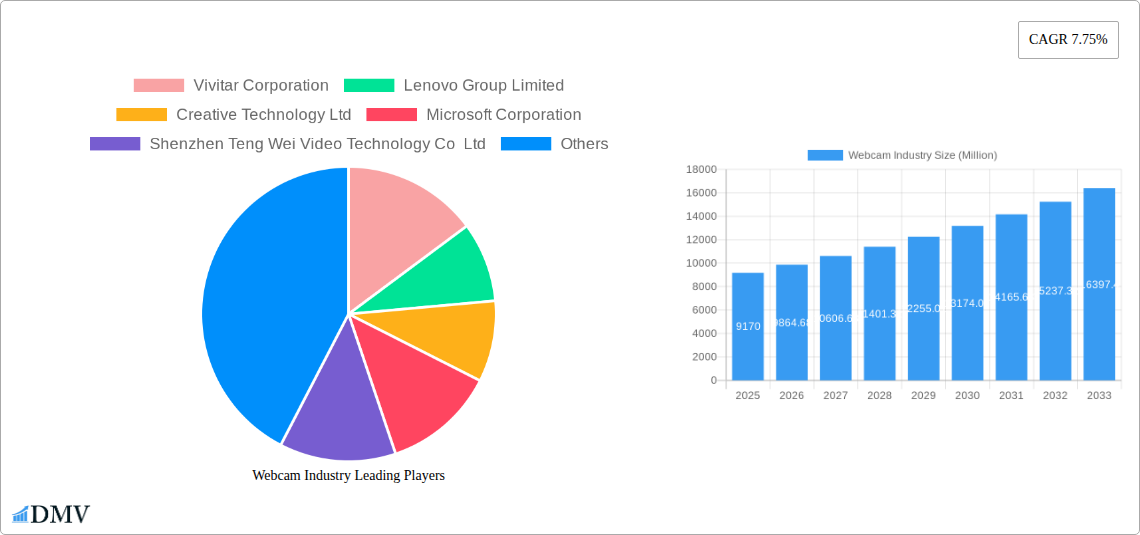

The global webcam market, valued at $9.17 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of remote work and online education, fueled by technological advancements and the lingering effects of the pandemic, significantly boosts demand for high-quality webcams. Furthermore, the rising popularity of video conferencing and live streaming platforms, coupled with the integration of advanced features like high-resolution imaging, improved low-light performance, and AI-powered functionalities (e.g., auto-framing, background blur), are propelling market expansion. The market is segmented by webcam type, with external webcams holding a larger market share due to their versatility and superior features compared to embedded webcams. Leading players like Logitech, Microsoft, and Razer are continuously innovating, introducing new models with enhanced functionalities and competitive pricing strategies to maintain their market positions. This competitive landscape fosters innovation and drives overall market growth.

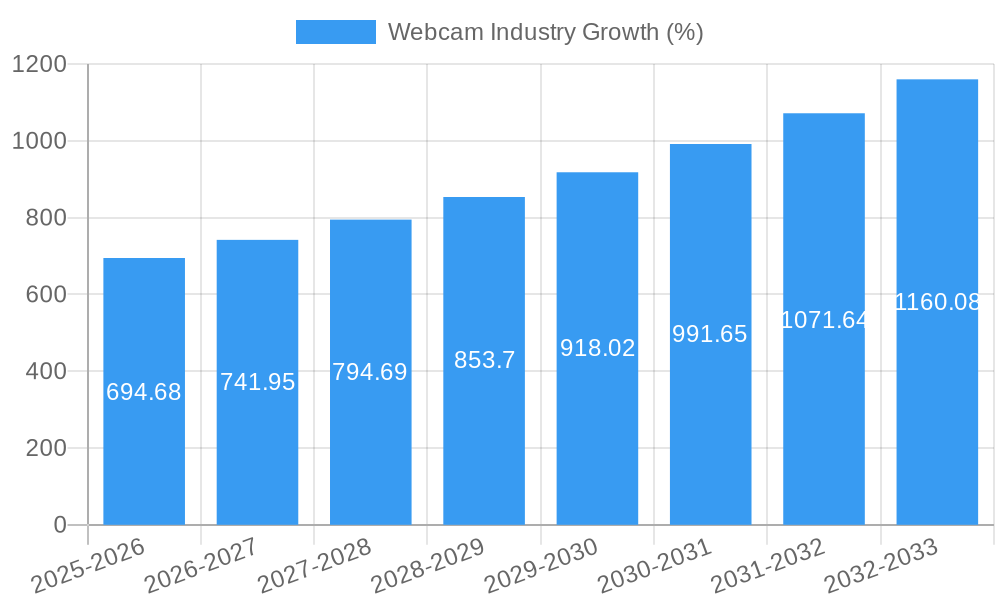

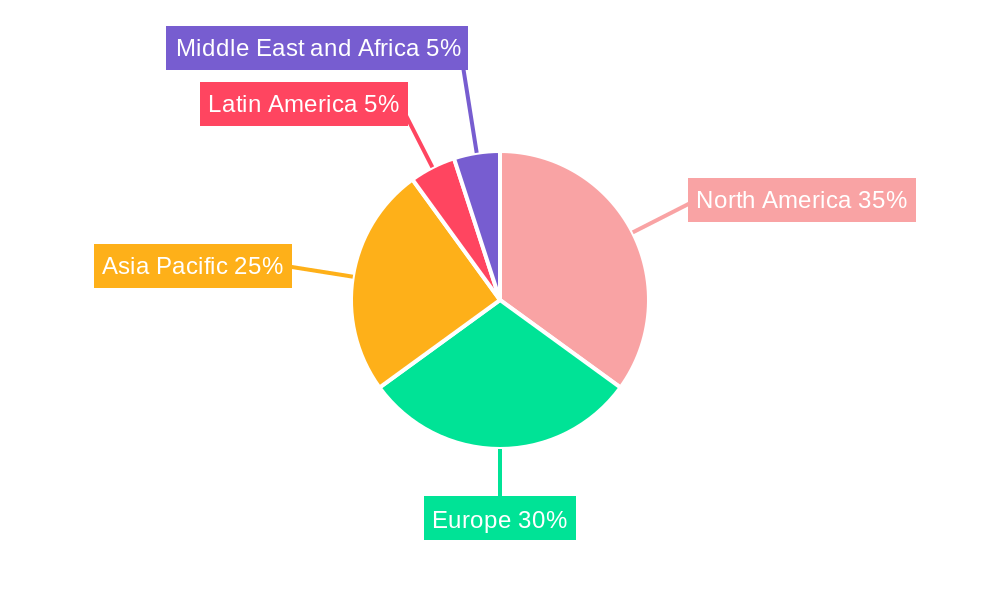

Growth is expected to continue at a Compound Annual Growth Rate (CAGR) of 7.75% from 2025 to 2033. While geographic data is not fully detailed, North America and Europe are likely to dominate the market initially due to higher per capita income and greater tech adoption. However, the Asia-Pacific region is poised for substantial growth due to increasing internet penetration and a burgeoning middle class. Potential restraints include economic downturns which could impact consumer spending on discretionary electronics and the increasing integration of high-quality cameras into laptops and other devices which could potentially reduce demand for standalone webcams. Nevertheless, the long-term outlook for the webcam market remains positive, driven by ongoing digital transformation and the enduring need for seamless visual communication across various sectors.

Webcam Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global webcam industry, projecting a market value exceeding $XX Million by 2033. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report offers invaluable insights for stakeholders, investors, and industry professionals seeking to navigate this dynamic market.

Webcam Industry Market Composition & Trends

The global webcam market, valued at $XX Million in 2024, is characterized by a moderately concentrated landscape with key players such as Logitech, Microsoft, and Razer holding significant market share. However, the emergence of several smaller, innovative companies suggests a potential shift towards increased competition. Innovation is primarily driven by advancements in image sensors, lens technology, and software features like AI-powered background blurring and auto-framing. Regulatory landscapes vary across regions, impacting data privacy and security standards for webcam usage. Substitute products like built-in laptop cameras are a constant competitive pressure, while the rise of virtual reality and augmented reality applications presents both opportunities and challenges. The end-user profile is diverse, encompassing individual consumers, businesses (for video conferencing and remote work), and educational institutions. Mergers and acquisitions (M&A) activity has been moderate, with deal values fluctuating between $XX Million and $XX Million in recent years.

- Market Share Distribution (2024): Logitech (XX%), Microsoft (XX%), Razer (XX%), Others (XX%)

- Significant M&A Activity (2019-2024): [List key M&A deals with values if available, otherwise use "XX Million" as a placeholder for values].

Webcam Industry Industry Evolution

The webcam market has experienced significant growth since 2019, fueled by the increasing adoption of remote work and online learning. The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) of XX%, driven by strong demand for high-quality video conferencing solutions. The market is expected to maintain a robust growth trajectory during the forecast period (2025-2033), with a projected CAGR of XX%. This growth is primarily attributed to technological advancements, including improvements in image resolution, low-light performance, and the integration of advanced features like AI-powered enhancements. Consumer demand has shifted towards webcams with higher resolutions, better low-light capabilities, and versatile mounting options. Furthermore, the growing prevalence of live streaming and online gaming is further stimulating market growth. The adoption of 4K and higher resolution webcams is steadily increasing, reaching XX% penetration in 2024 and projected to reach XX% by 2033.

Leading Regions, Countries, or Segments in Webcam Industry

North America currently dominates the global webcam market, driven by high technological adoption rates and strong demand from businesses and individuals. This dominance is fuelled by significant investments in technological infrastructure and supportive regulatory frameworks.

- Key Drivers for North America's Dominance:

- High disposable income and consumer spending on technology.

- Strong presence of major webcam manufacturers and distributors.

- Robust adoption of remote work and online learning practices.

- Favorable regulatory environment for technology adoption.

The external webcam segment holds a larger market share compared to embedded webcams, attributed to greater versatility and superior image quality. This segment is expected to maintain strong growth driven by the expanding market for professional video conferencing, live streaming, and gaming.

- Key Drivers for External Webcam Segment Dominance:

- Superior image quality and features compared to embedded webcams.

- Greater flexibility in terms of placement and usage.

- Growing demand from professionals for high-quality video conferencing solutions.

- Increasing popularity of live streaming and online gaming.

Webcam Industry Product Innovations

Recent product innovations focus on enhanced image quality, improved low-light performance, and the integration of AI-powered features like auto-framing and background blurring. Features like ultra-wide field-of-view lenses, advanced noise reduction, and high dynamic range (HDR) are becoming increasingly common. The introduction of webcams with integrated microphones and privacy shutters is also gaining popularity. These innovations cater to the growing demand for seamless and high-quality video communication experiences across various applications, including video conferencing, streaming, and gaming.

Propelling Factors for Webcam Industry Growth

The webcam market's growth is propelled by several key factors. Technological advancements, like improved sensors and AI capabilities, are significantly enhancing webcam performance. The rise of remote work and online education is driving increased demand for high-quality video communication tools. Government initiatives promoting digital infrastructure and the expansion of high-speed internet access in many regions are further bolstering market growth.

Obstacles in the Webcam Industry Market

The webcam market faces challenges, including intense competition from established players and the emergence of new entrants. Supply chain disruptions, particularly concerning semiconductor components, can affect production and pricing. Stringent data privacy regulations and concerns regarding cybersecurity also present significant hurdles.

Future Opportunities in Webcam Industry

Future opportunities lie in the development of webcams with advanced features like 8K resolution, enhanced AI capabilities, and seamless integration with virtual and augmented reality platforms. Expansion into emerging markets with growing internet penetration presents significant potential for growth. The increasing demand for high-quality video content creation also presents exciting prospects for webcam manufacturers.

Major Players in the Webcam Industry Ecosystem

- Vivitar Corporation

- Lenovo Group Limited

- Creative Technology Ltd

- Microsoft Corporation

- Shenzhen Teng Wei Video Technology Co Ltd

- KYE Systems Corp (Genius)

- Logitech International S A

- Razer Inc

- A4Tech Co Ltd

- Ausdom Global

Key Developments in Webcam Industry Industry

- June 2023: BenQ launched the Ideacam S1 Pro and S1 Plus webcams, featuring an 8MP Sony CMOS sensor, 3264x2448p resolution, and a 15X macro lens. This signifies a push towards professional-grade video conferencing solutions.

- April 2023: Microsoft announced the discontinuation of its own-branded webcams, focusing instead on Surface-branded accessories. This signals a strategic shift towards its Surface ecosystem and potential impact on market share.

Strategic Webcam Industry Market Forecast

The webcam industry is poised for sustained growth, driven by technological advancements, increasing demand for remote work solutions, and expansion into new markets. The projected CAGR of XX% underscores the significant market potential and attractive investment opportunities in this dynamic sector. Innovation in areas such as AI integration and high-resolution capabilities will be key to success in the coming years.

Webcam Industry Segmentation

-

1. Webcam Type

- 1.1. External Webcam

- 1.2. Embedded Webcam

Webcam Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Webcam Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Penetration of Teleconferencing and Virtual Meetings; Steep Decline in Average Selling Price of Webcams

- 3.3. Market Restrains

- 3.3.1. Poor Internet Penetration in Developing Countries; Increasing Cases of Webcam Hacking (Privacy Concerns)

- 3.4. Market Trends

- 3.4.1. External Webcam Expected to Gain Considerable Significance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Webcam Type

- 5.1.1. External Webcam

- 5.1.2. Embedded Webcam

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Webcam Type

- 6. North America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Webcam Type

- 6.1.1. External Webcam

- 6.1.2. Embedded Webcam

- 6.1. Market Analysis, Insights and Forecast - by Webcam Type

- 7. Europe Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Webcam Type

- 7.1.1. External Webcam

- 7.1.2. Embedded Webcam

- 7.1. Market Analysis, Insights and Forecast - by Webcam Type

- 8. Asia Pacific Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Webcam Type

- 8.1.1. External Webcam

- 8.1.2. Embedded Webcam

- 8.1. Market Analysis, Insights and Forecast - by Webcam Type

- 9. Latin America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Webcam Type

- 9.1.1. External Webcam

- 9.1.2. Embedded Webcam

- 9.1. Market Analysis, Insights and Forecast - by Webcam Type

- 10. Middle East and Africa Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Webcam Type

- 10.1.1. External Webcam

- 10.1.2. Embedded Webcam

- 10.1. Market Analysis, Insights and Forecast - by Webcam Type

- 11. North America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Webcam Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Vivitar Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lenovo Group Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Creative Technology Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Microsoft Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Shenzhen Teng Wei Video Technology Co Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 KYE Systems Corp (Genius)*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Logitech International S A

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Razer Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 A4Tech Co Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ausdom Global

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Vivitar Corporation

List of Figures

- Figure 1: Global Webcam Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 13: North America Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 14: North America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 17: Europe Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 18: Europe Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 21: Asia Pacific Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 22: Asia Pacific Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 25: Latin America Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 26: Latin America Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Webcam Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Webcam Industry Revenue (Million), by Webcam Type 2024 & 2032

- Figure 29: Middle East and Africa Webcam Industry Revenue Share (%), by Webcam Type 2024 & 2032

- Figure 30: Middle East and Africa Webcam Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Webcam Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Webcam Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 3: Global Webcam Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Germany Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 22: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 26: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 32: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: China Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: India Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Webcam Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 38: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Global Webcam Industry Revenue Million Forecast, by Webcam Type 2019 & 2032

- Table 40: Global Webcam Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Webcam Industry?

The projected CAGR is approximately 7.75%.

2. Which companies are prominent players in the Webcam Industry?

Key companies in the market include Vivitar Corporation, Lenovo Group Limited, Creative Technology Ltd, Microsoft Corporation, Shenzhen Teng Wei Video Technology Co Ltd, KYE Systems Corp (Genius)*List Not Exhaustive, Logitech International S A, Razer Inc, A4Tech Co Ltd, Ausdom Global.

3. What are the main segments of the Webcam Industry?

The market segments include Webcam Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Penetration of Teleconferencing and Virtual Meetings; Steep Decline in Average Selling Price of Webcams.

6. What are the notable trends driving market growth?

External Webcam Expected to Gain Considerable Significance.

7. Are there any restraints impacting market growth?

Poor Internet Penetration in Developing Countries; Increasing Cases of Webcam Hacking (Privacy Concerns).

8. Can you provide examples of recent developments in the market?

June 2023: BenQ introduced two new webcams for professionals seeking high-quality video conferencing solutions: the Ideacam S1 Pro and Ideacam S1 Plus. These cameras include numerous shooting modes and an 8MP Sony CMOS sensor. The Ideacam S1 series boasts a resolution of up to 3264x2448 p and a 15X macro lens that can zoom in on any surface or material to provide detailed photos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Webcam Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Webcam Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Webcam Industry?

To stay informed about further developments, trends, and reports in the Webcam Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence