Key Insights

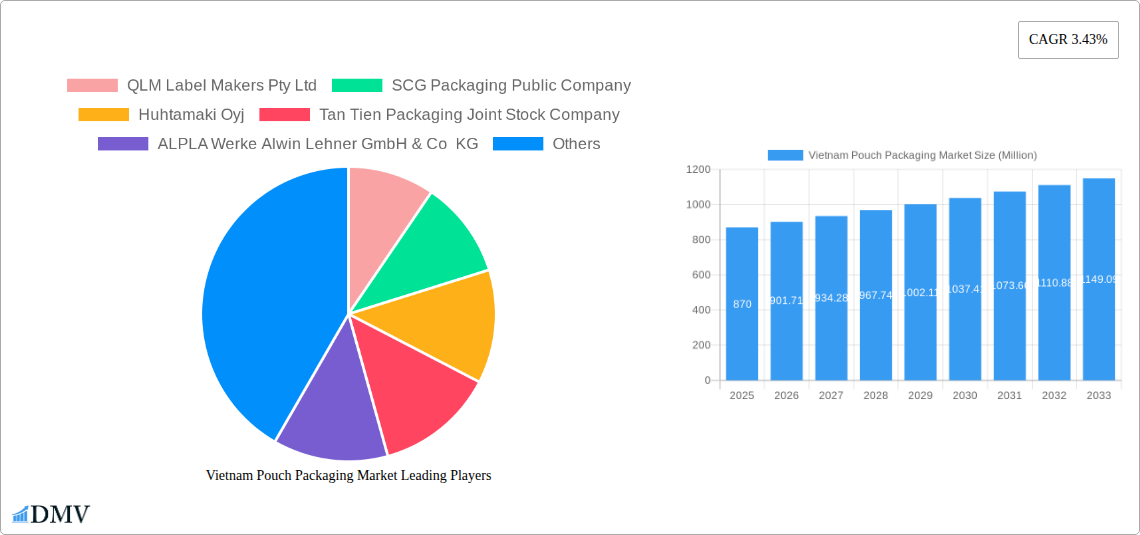

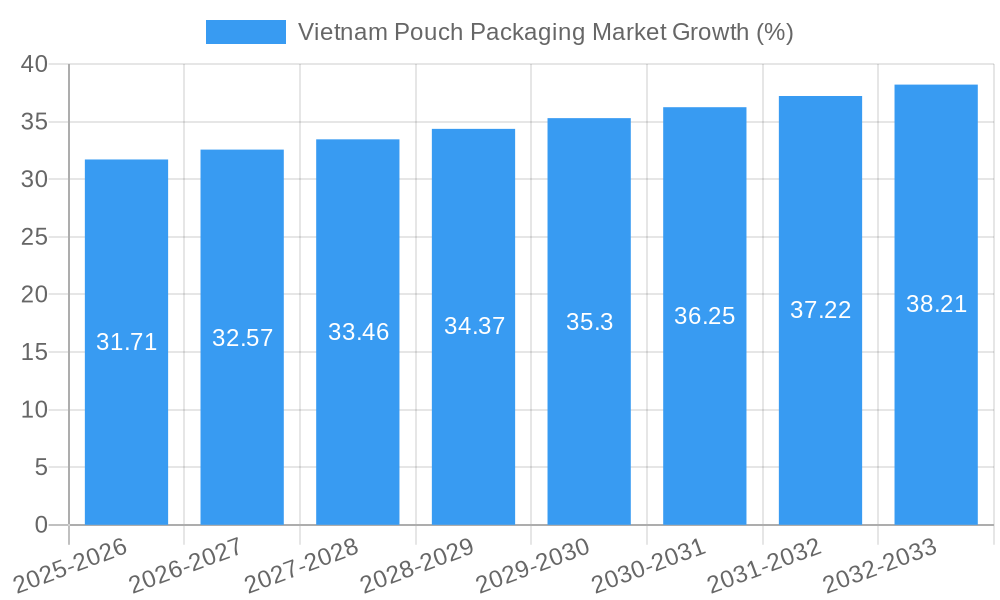

The Vietnam pouch packaging market, valued at $870 million in 2025, is projected to experience robust growth, driven by the rising demand for flexible packaging solutions across various sectors. The country's expanding food and beverage industry, coupled with a growing preference for convenient and shelf-stable products, significantly fuels market expansion. Furthermore, the increasing adoption of e-commerce and online grocery shopping necessitates lightweight, tamper-evident packaging, bolstering the demand for pouches. Key growth drivers include the rising disposable incomes, changing consumer lifestyles, and the government's focus on promoting food processing and export capabilities. While the market faces challenges such as fluctuating raw material prices and stringent regulatory compliance, the overall growth trajectory remains positive. A compound annual growth rate (CAGR) of 3.43% from 2025 to 2033 suggests a steady and continuous expansion, reaching an estimated value exceeding $1.2 billion by 2033. This growth is anticipated to be propelled by innovations in materials, such as sustainable and recyclable options, catering to the rising environmental consciousness. Major players like QLM Label Makers Pty Ltd, SCG Packaging, and Tetra Pak are strategically positioning themselves to capitalize on this upward trend through product diversification and capacity expansion.

The competitive landscape is characterized by a mix of domestic and international players, each vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. The segmentation of the market (though not explicitly provided) is likely categorized by material type (e.g., plastic, foil, paper), application (e.g., food, beverages, personal care), and packaging type (e.g., stand-up pouches, spouted pouches, flat pouches). Further research into specific segment performance would provide a more granular understanding of market dynamics. Despite challenges, the Vietnam pouch packaging market presents significant opportunities for established players and new entrants alike, offering substantial growth potential in the coming years.

Vietnam Pouch Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Vietnam pouch packaging market, offering a detailed overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The market is projected to reach xx Million by 2033.

Vietnam Pouch Packaging Market Composition & Trends

This section delves into the intricate composition of the Vietnam pouch packaging market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution amongst key players, revealing the competitive landscape. Detailed analysis of M&A activity includes deal values and their impact on market consolidation. The report also examines the influence of regulatory changes, the emergence of substitute packaging materials, and evolving consumer preferences on market trends.

- Market Concentration: The market exhibits a [describe concentration level, e.g., moderately concentrated] structure with the top 5 players holding approximately xx% market share in 2024.

- Innovation Catalysts: Growing demand for sustainable and flexible packaging solutions is driving innovation in materials and manufacturing processes.

- Regulatory Landscape: Government regulations regarding food safety and environmental sustainability are influencing packaging material choices.

- Substitute Products: Rigid packaging and other flexible packaging formats represent key substitutes.

- End-User Profiles: The report segments end-users across diverse sectors such as food & beverages, personal care, pharmaceuticals, and industrial goods.

- M&A Activities: The report details significant M&A transactions, analyzing their impact on market dynamics and competitive landscapes, with total deal values estimated at xx Million over the historical period.

Vietnam Pouch Packaging Market Industry Evolution

This section meticulously examines the Vietnam pouch packaging market's growth trajectory, technological breakthroughs, and evolving consumer preferences from 2019 to 2024. We analyze historical growth rates, technological adoption rates, and the influence of consumer trends on market demand. Specific data points, including compound annual growth rates (CAGR), are presented to illustrate market evolution. The analysis covers shifts in consumer preferences towards convenience, sustainability, and premium packaging, highlighting their influence on market dynamics. The impact of technological advancements, such as improved barrier films and advanced printing technologies, on market growth is also examined. The report forecasts market growth for the period 2025-2033, outlining potential scenarios and challenges that could influence future growth trajectories.

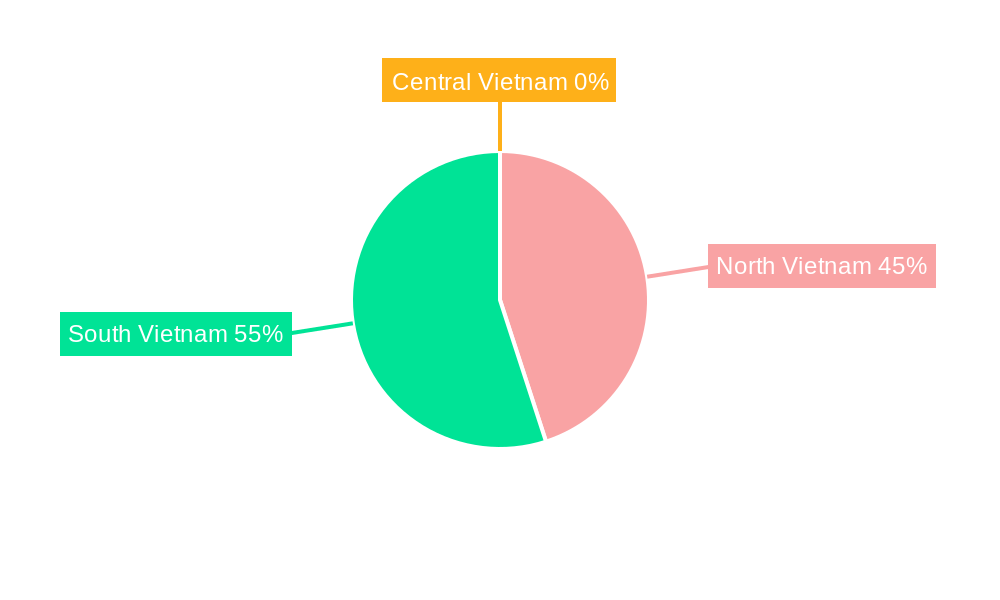

Leading Regions, Countries, or Segments in Vietnam Pouch Packaging Market

This section identifies the leading regions, countries, or segments within the Vietnam pouch packaging market, providing an in-depth analysis of factors driving their dominance. We detail key drivers such as investment trends, regulatory support, and infrastructural developments using bullet points. The analysis explains the factors contributing to the leading position of the dominant segment/region.

- Key Drivers (Example for a dominant region):

- Significant investments in manufacturing facilities.

- Strong government support for the packaging industry.

- High concentration of key players and consumers.

- Favorable regulatory environment.

- Dominance Factors: [In-depth analysis of factors contributing to the dominance of the leading region/segment. Include details such as consumer preferences, manufacturing capabilities, cost-effectiveness and market access].

Vietnam Pouch Packaging Market Product Innovations

This section details recent product innovations, their applications, and performance metrics. We highlight unique selling propositions (USPs) and technological advancements within the pouch packaging industry. Innovations in materials, such as biodegradable and compostable films, and improvements in printing technologies are discussed, along with their impact on market competitiveness and consumer appeal. The section also analyses the adoption rates of these innovations and their contribution to overall market growth.

Propelling Factors for Vietnam Pouch Packaging Market Growth

Several factors contribute to the Vietnam pouch packaging market's growth. These include technological advancements, such as the development of high-barrier films extending product shelf life and the increasing demand for flexible packaging offering cost savings and improved convenience to consumers. Economic factors, including rising disposable incomes and increased consumer spending, also play a significant role. Furthermore, supportive government policies promoting domestic manufacturing and encouraging sustainable packaging practices stimulate market growth.

Obstacles in the Vietnam Pouch Packaging Market

Challenges impacting the Vietnam pouch packaging market include regulatory hurdles related to food safety and environmental standards, imposing compliance costs on manufacturers. Supply chain disruptions, influenced by global events, affect raw material availability and increase production costs. Intense competition amongst domestic and international players increases pricing pressures and necessitates continuous innovation. These factors influence profit margins and restrict overall market expansion. The extent of the impact is quantified using appropriate metrics.

Future Opportunities in Vietnam Pouch Packaging Market

The Vietnam pouch packaging market presents several promising opportunities. Growing demand for sustainable packaging options presents a significant opportunity for manufacturers to develop eco-friendly pouch solutions. Emerging technologies, such as smart packaging incorporating sensors, offer enhanced product traceability and shelf-life management. Expansion into new markets, particularly in rural areas with growing consumption, creates additional growth avenues. Capitalizing on these opportunities requires strategic investments in R&D, sustainable practices, and market expansion strategies.

Major Players in the Vietnam Pouch Packaging Market Ecosystem

- QLM Label Makers Pty Ltd

- SCG Packaging Public Company

- Huhtamaki Oyj

- Tan Tien Packaging Joint Stock Company

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Tetra Pak

- Constantia Flexibles

- St Johns Packaging

Key Developments in Vietnam Pouch Packaging Market Industry

- December 2023: QLM Label Makers Pty Ltd opened a new manufacturing facility in Ho Chi Minh City, boosting flexible packaging production capacity.

- June 2024: Tetra Pak showcased comprehensive packaging solutions at the Vietnam Dairy 2024 event, strengthening its market position.

Strategic Vietnam Pouch Packaging Market Forecast

The Vietnam pouch packaging market is poised for robust growth fueled by rising consumer demand, technological advancements, and supportive government policies. Opportunities in sustainable packaging and innovative product formats will drive market expansion over the forecast period (2025-2033). Continuous innovation and strategic partnerships will be crucial for players to maintain a competitive edge and capitalize on emerging market trends. The market is expected to witness a CAGR of xx% during the forecast period.

Vietnam Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Vietnam Pouch Packaging Market Segmentation By Geography

- 1. Vietnam

Vietnam Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food Processing Industry in the Country; Rising Demand of Pouch Packaging Solutions for End-Use Industries

- 3.3. Market Restrains

- 3.3.1. Growing Food Processing Industry in the Country; Rising Demand of Pouch Packaging Solutions for End-Use Industries

- 3.4. Market Trends

- 3.4.1. The Aseptic Pouch Segment is Expected to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Pouch Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 QLM Label Makers Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SCG Packaging Public Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Huhtamaki Oyj

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tan Tien Packaging Joint Stock Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Pak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Constantia Flexibles

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Johns Packaging8 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 QLM Label Makers Pty Ltd

List of Figures

- Figure 1: Vietnam Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Pouch Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Vietnam Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Vietnam Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 5: Vietnam Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Vietnam Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 7: Vietnam Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Vietnam Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: Vietnam Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Vietnam Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Vietnam Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Vietnam Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: Vietnam Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Vietnam Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: Vietnam Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Vietnam Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: Vietnam Pouch Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Vietnam Pouch Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Pouch Packaging Market?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Vietnam Pouch Packaging Market?

Key companies in the market include QLM Label Makers Pty Ltd, SCG Packaging Public Company, Huhtamaki Oyj, Tan Tien Packaging Joint Stock Company, ALPLA Werke Alwin Lehner GmbH & Co KG, Tetra Pak, Constantia Flexibles, St Johns Packaging8 2 Heat Map Analysi.

3. What are the main segments of the Vietnam Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food Processing Industry in the Country; Rising Demand of Pouch Packaging Solutions for End-Use Industries.

6. What are the notable trends driving market growth?

The Aseptic Pouch Segment is Expected to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

Growing Food Processing Industry in the Country; Rising Demand of Pouch Packaging Solutions for End-Use Industries.

8. Can you provide examples of recent developments in the market?

June 2024: Tetra Pak, a Swedish food packaging company, unveiled a range of comprehensive packaging solutions at the Vietnam Dairy 2024 event. Its showcase of liquid food processing and packaging innovations is poised to bolster Tetra Pak's foothold in the Vietnamese market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Vietnam Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence