Key Insights

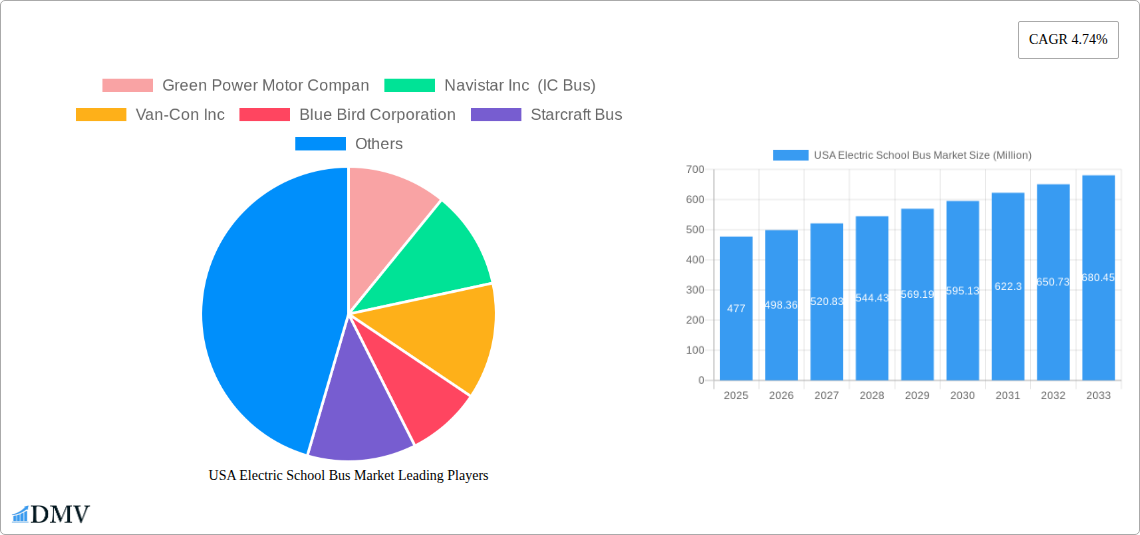

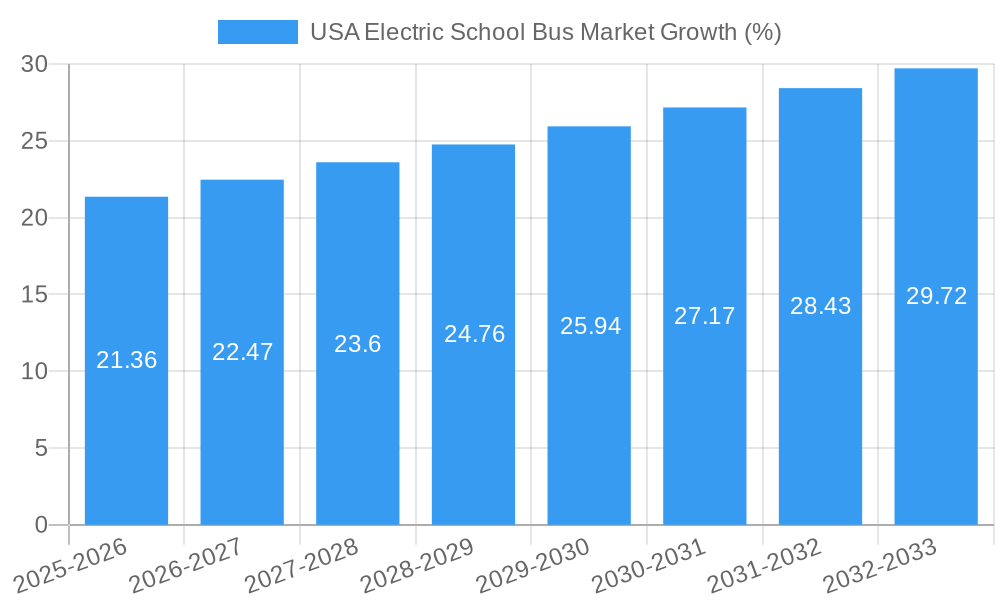

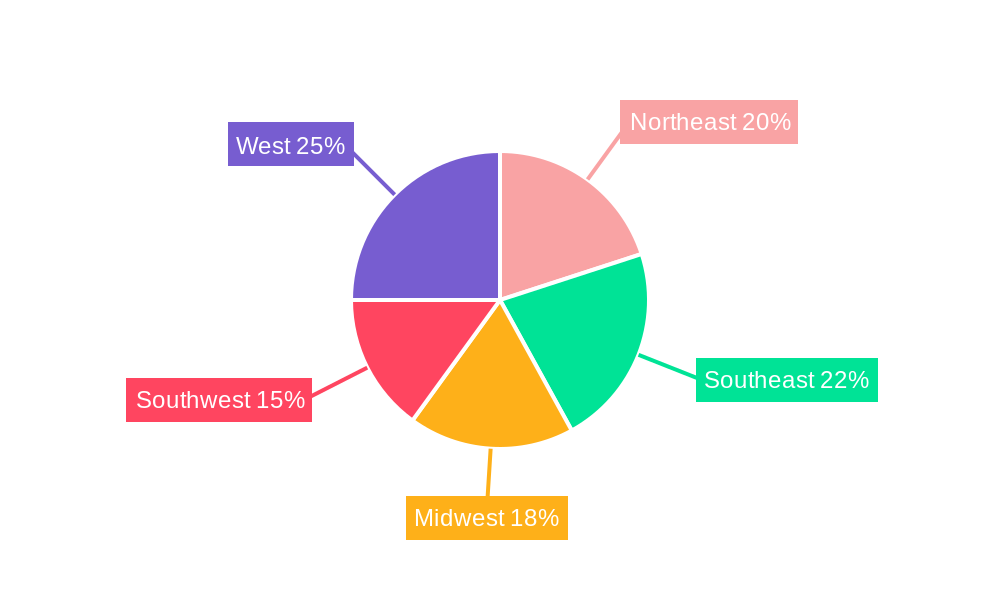

The US electric school bus market is experiencing robust growth, projected to reach a significant size by 2033. Driven by stringent emission regulations, increasing environmental concerns, and government incentives promoting sustainable transportation, the market is witnessing a rapid shift towards electric vehicles. The transition is fueled by advancements in battery technology, leading to improved range, longer lifespans, and reduced charging times. Key players like Green Power Motor Company, Navistar Inc (IC Bus), and Lion Electric Company are at the forefront of innovation, constantly enhancing vehicle designs and functionalities to meet evolving market demands. Segment-wise, the electric powertrain type is experiencing the highest growth, surpassing the traditional internal combustion engine (ICE) segment. Different design types (A, B, C, and D) cater to diverse school district needs, creating various opportunities within the market. Geographic distribution shows strong demand across all US regions, with potentially higher growth rates in states with ambitious clean energy targets and robust infrastructure for charging stations. The market's expansion is, however, tempered by factors such as the high initial investment cost of electric buses and the need for widespread development of charging infrastructure to support widespread adoption.

Despite these challenges, the long-term outlook for the US electric school bus market remains highly positive. Continued technological advancements, supportive government policies, and increasing awareness of the environmental and health benefits associated with electric vehicles are expected to drive substantial growth throughout the forecast period (2025-2033). The market will likely see further consolidation among manufacturers as companies compete to offer increasingly efficient and cost-effective solutions. The focus will shift toward optimizing the entire ecosystem, including battery management, charging infrastructure, and lifecycle cost analysis, to ensure the long-term viability and widespread adoption of electric school buses across the nation. Further research into battery technology and advancements in charging infrastructure will be crucial for sustained market growth.

USA Electric School Bus Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning USA Electric School Bus Market, offering crucial data and trends for stakeholders from 2019 to 2033. The study meticulously examines market dynamics, technological advancements, and key players shaping this rapidly evolving sector, ultimately providing a robust forecast for future growth. With a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for informed decision-making. The total market value in 2025 is estimated at xx Million.

USA Electric School Bus Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities within the USA Electric School Bus Market. The report examines market share distribution amongst key players like Green Power Motor Company, Navistar Inc (IC Bus), Van-Con Inc, Blue Bird Corporation, Starcraft Bus, Trans Tech, Lion Electric Company, Collins Bus Corporation, and Daimler AG (Thomas Built Buses).

- Market Concentration: The market exhibits a [insert level of concentration e.g., moderately concentrated] structure, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Government incentives, stringent emission regulations, and advancements in battery technology are key drivers of innovation.

- Regulatory Landscape: Federal and state-level regulations promoting zero-emission vehicles are significantly impacting market growth.

- Substitute Products: While limited, alternative transportation solutions like ride-sharing services pose indirect competition.

- End-User Profiles: School districts, private transportation companies, and government agencies comprise the primary end-users.

- M&A Activities: The report analyzes recent M&A deals, providing insights into deal values and their impact on market consolidation. For example, the xx Million deal between [mention any relevant M&A deal if available] showcases the growing interest in the sector. Total M&A deal value from 2019-2024 is estimated at xx Million.

USA Electric School Bus Market Industry Evolution

This section provides a detailed analysis of the USA Electric School Bus Market's growth trajectory, technological advancements, and evolving consumer preferences from 2019 to 2033. We analyze market growth rates, adoption metrics, and technological shifts influencing the transition from traditional diesel buses to electric models. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing environmental concerns and government support for electric vehicle adoption. Specific data points on growth rates and adoption metrics will be provided within the complete report. The increasing demand for enhanced safety features and improved fuel efficiency is also driving market expansion.

Leading Regions, Countries, or Segments in USA Electric School Bus Market

This section identifies the leading regions, countries, and market segments within the USA Electric School Bus Market based on Power Train Type (IC Engine, Hybrid, Electric) and Design Type (Type A, Type B, Type C, Type D).

- Dominant Segment: The electric powertrain segment is expected to dominate the market during the forecast period, owing to supportive government policies and increasing environmental awareness. The Type D segment is projected to hold the largest market share due to its higher passenger capacity and suitability for long routes.

Key Drivers:

- California: Strong state-level regulations and significant investments in electric vehicle infrastructure are driving rapid adoption in California.

- Investment Trends: Significant funding from government grants, private equity, and venture capital is fueling the growth of the electric school bus market.

- Regulatory Support: Federal and state-level incentives, including tax credits and rebates, are incentivizing the adoption of electric school buses.

Dominance Factors: California's proactive approach to emission reduction, coupled with substantial financial incentives, makes it the leading region. The Type D segment's dominance stems from its capacity and suitability for longer routes, making it the preferred choice for many school districts.

USA Electric School Bus Market Product Innovations

The market showcases continuous product innovations, focusing on extended range, improved battery technology, enhanced safety features (like C-V2X integration as demonstrated by Audi and IC Bus), and reduced charging times. Manufacturers are also emphasizing features that improve the overall passenger experience. These innovations are driving the adoption of electric school buses by offering superior performance and operational efficiency compared to traditional diesel buses.

Propelling Factors for USA Electric School Bus Market Growth

Several factors are propelling the growth of the USA Electric School Bus Market. These include:

- Stringent Emission Regulations: Governments are increasingly implementing stringent emission standards, making electric buses a more attractive alternative.

- Technological Advancements: Improvements in battery technology, charging infrastructure, and overall vehicle performance are driving adoption.

- Government Incentives: Federal and state-level subsidies and tax credits are significantly reducing the upfront cost of electric school buses.

Obstacles in the USA Electric School Bus Market

Despite significant growth potential, several challenges hinder market expansion:

- High Upfront Costs: The initial investment in electric school buses remains relatively high compared to diesel buses, representing a barrier for some school districts.

- Limited Charging Infrastructure: The lack of widespread charging infrastructure in some areas poses logistical challenges for widespread adoption.

- Range Anxiety: Concerns about the range of electric buses, particularly for longer routes, remain a barrier for some potential adopters.

Future Opportunities in USA Electric School Bus Market

Emerging opportunities for market expansion include:

- Expansion into Rural Areas: Focusing on developing charging infrastructure and addressing range anxiety can facilitate growth in rural areas.

- Technological Advancements: Further innovations in battery technology, charging infrastructure, and vehicle design will unlock new opportunities.

- Subscription Models: Innovative financing models, such as subscription services, can make electric buses more accessible to school districts.

Major Players in the USA Electric School Bus Market Ecosystem

- Green Power Motor Company

- Navistar Inc (IC Bus)

- Van-Con Inc

- Blue Bird Corporation

- Starcraft Bus

- Trans Tech

- Lion Electric Company

- Collins Bus Corporation

- Daimler AG (Thomas Built Buses)

Key Developments in USA Electric School Bus Market Industry

- September 2023: Audi of America and IC Bus Navistar demonstrated the life-saving potential of C-V2X technology in school bus safety.

- March 2023: First Student partnered with Bechtel to accelerate its electrification efforts, focusing on charging infrastructure development.

- March 2022: Highland Electric Fleets and Thomas Built Buses expanded their partnership to reduce costs and accelerate electric school bus adoption, including cost parity with diesel until 2025.

- March 2022: Modesto City Schools placed a significant order of 30 Blue Bird All-American Type D electric school buses, showcasing the growing demand.

Strategic USA Electric School Bus Market Forecast

The USA Electric School Bus Market is poised for substantial growth over the next decade, driven by strong government support, technological advancements, and increasing environmental awareness. The focus on improving battery technology, expanding charging infrastructure, and introducing innovative financing models will further accelerate market expansion. The market is expected to witness significant expansion, particularly in regions with proactive environmental policies and substantial investments in electric vehicle infrastructure. The long-term outlook is positive, with considerable potential for growth and market share gains for key players.

USA Electric School Bus Market Segmentation

-

1. Power Train Type

- 1.1. IC Engine

- 1.2. Hybrid and Electric

-

2. Design Type

- 2.1. Type A

- 2.2. Type B

- 2.3. Type C

- 2.4. Type D

USA Electric School Bus Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Electric School Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Potential Shift Toward Adoption of Electric Buses to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Electric Charging Infrastructure May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Potential Shift Toward Adoption of Electric Buses to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Train Type

- 5.1.1. IC Engine

- 5.1.2. Hybrid and Electric

- 5.2. Market Analysis, Insights and Forecast - by Design Type

- 5.2.1. Type A

- 5.2.2. Type B

- 5.2.3. Type C

- 5.2.4. Type D

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Power Train Type

- 6. North America USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Power Train Type

- 6.1.1. IC Engine

- 6.1.2. Hybrid and Electric

- 6.2. Market Analysis, Insights and Forecast - by Design Type

- 6.2.1. Type A

- 6.2.2. Type B

- 6.2.3. Type C

- 6.2.4. Type D

- 6.1. Market Analysis, Insights and Forecast - by Power Train Type

- 7. South America USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Power Train Type

- 7.1.1. IC Engine

- 7.1.2. Hybrid and Electric

- 7.2. Market Analysis, Insights and Forecast - by Design Type

- 7.2.1. Type A

- 7.2.2. Type B

- 7.2.3. Type C

- 7.2.4. Type D

- 7.1. Market Analysis, Insights and Forecast - by Power Train Type

- 8. Europe USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Power Train Type

- 8.1.1. IC Engine

- 8.1.2. Hybrid and Electric

- 8.2. Market Analysis, Insights and Forecast - by Design Type

- 8.2.1. Type A

- 8.2.2. Type B

- 8.2.3. Type C

- 8.2.4. Type D

- 8.1. Market Analysis, Insights and Forecast - by Power Train Type

- 9. Middle East & Africa USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Power Train Type

- 9.1.1. IC Engine

- 9.1.2. Hybrid and Electric

- 9.2. Market Analysis, Insights and Forecast - by Design Type

- 9.2.1. Type A

- 9.2.2. Type B

- 9.2.3. Type C

- 9.2.4. Type D

- 9.1. Market Analysis, Insights and Forecast - by Power Train Type

- 10. Asia Pacific USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Power Train Type

- 10.1.1. IC Engine

- 10.1.2. Hybrid and Electric

- 10.2. Market Analysis, Insights and Forecast - by Design Type

- 10.2.1. Type A

- 10.2.2. Type B

- 10.2.3. Type C

- 10.2.4. Type D

- 10.1. Market Analysis, Insights and Forecast - by Power Train Type

- 11. Northeast USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 15. West USA Electric School Bus Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Green Power Motor Compan

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Navistar Inc (IC Bus)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Van-Con Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Blue Bird Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Starcraft Bus

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Trans Tech

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Lion Electric Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Collins Bus Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Daimler AG (Thomas Built Buses)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Green Power Motor Compan

List of Figures

- Figure 1: Global USA Electric School Bus Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America USA Electric School Bus Market Revenue (Million), by Power Train Type 2024 & 2032

- Figure 5: North America USA Electric School Bus Market Revenue Share (%), by Power Train Type 2024 & 2032

- Figure 6: North America USA Electric School Bus Market Revenue (Million), by Design Type 2024 & 2032

- Figure 7: North America USA Electric School Bus Market Revenue Share (%), by Design Type 2024 & 2032

- Figure 8: North America USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America USA Electric School Bus Market Revenue (Million), by Power Train Type 2024 & 2032

- Figure 11: South America USA Electric School Bus Market Revenue Share (%), by Power Train Type 2024 & 2032

- Figure 12: South America USA Electric School Bus Market Revenue (Million), by Design Type 2024 & 2032

- Figure 13: South America USA Electric School Bus Market Revenue Share (%), by Design Type 2024 & 2032

- Figure 14: South America USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe USA Electric School Bus Market Revenue (Million), by Power Train Type 2024 & 2032

- Figure 17: Europe USA Electric School Bus Market Revenue Share (%), by Power Train Type 2024 & 2032

- Figure 18: Europe USA Electric School Bus Market Revenue (Million), by Design Type 2024 & 2032

- Figure 19: Europe USA Electric School Bus Market Revenue Share (%), by Design Type 2024 & 2032

- Figure 20: Europe USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa USA Electric School Bus Market Revenue (Million), by Power Train Type 2024 & 2032

- Figure 23: Middle East & Africa USA Electric School Bus Market Revenue Share (%), by Power Train Type 2024 & 2032

- Figure 24: Middle East & Africa USA Electric School Bus Market Revenue (Million), by Design Type 2024 & 2032

- Figure 25: Middle East & Africa USA Electric School Bus Market Revenue Share (%), by Design Type 2024 & 2032

- Figure 26: Middle East & Africa USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific USA Electric School Bus Market Revenue (Million), by Power Train Type 2024 & 2032

- Figure 29: Asia Pacific USA Electric School Bus Market Revenue Share (%), by Power Train Type 2024 & 2032

- Figure 30: Asia Pacific USA Electric School Bus Market Revenue (Million), by Design Type 2024 & 2032

- Figure 31: Asia Pacific USA Electric School Bus Market Revenue Share (%), by Design Type 2024 & 2032

- Figure 32: Asia Pacific USA Electric School Bus Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific USA Electric School Bus Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global USA Electric School Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 3: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 4: Global USA Electric School Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 12: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 13: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 18: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 19: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 24: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 25: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 36: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 37: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global USA Electric School Bus Market Revenue Million Forecast, by Power Train Type 2019 & 2032

- Table 45: Global USA Electric School Bus Market Revenue Million Forecast, by Design Type 2019 & 2032

- Table 46: Global USA Electric School Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific USA Electric School Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Electric School Bus Market?

The projected CAGR is approximately 4.74%.

2. Which companies are prominent players in the USA Electric School Bus Market?

Key companies in the market include Green Power Motor Compan, Navistar Inc (IC Bus), Van-Con Inc, Blue Bird Corporation, Starcraft Bus, Trans Tech, Lion Electric Company, Collins Bus Corporation, Daimler AG (Thomas Built Buses).

3. What are the main segments of the USA Electric School Bus Market?

The market segments include Power Train Type, Design Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Potential Shift Toward Adoption of Electric Buses to Drive the Market.

6. What are the notable trends driving market growth?

Potential Shift Toward Adoption of Electric Buses to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Electric Charging Infrastructure May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

September 2023: Audi of America and IC Bus Navistar school buses illustrated the role of direct connection via Cellular Vehicle to Everything (C-V2X). Technology may play a role in providing potentially life-saving safety technologies for the 26 million students who ride school buses in the United States. The driver receives a direct message alert in the cockpit of the Audi vehicle using C-V2X direct communications technology. It will provide early notification of an approaching school bus stop situation even when the school bus is not visible to the driver.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Electric School Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Electric School Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Electric School Bus Market?

To stay informed about further developments, trends, and reports in the USA Electric School Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence