Key Insights

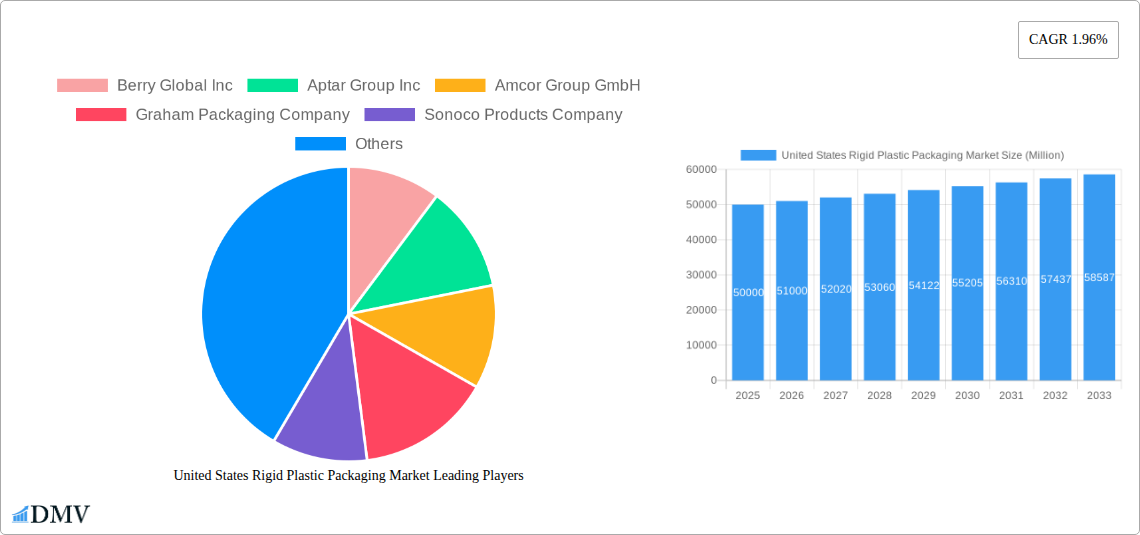

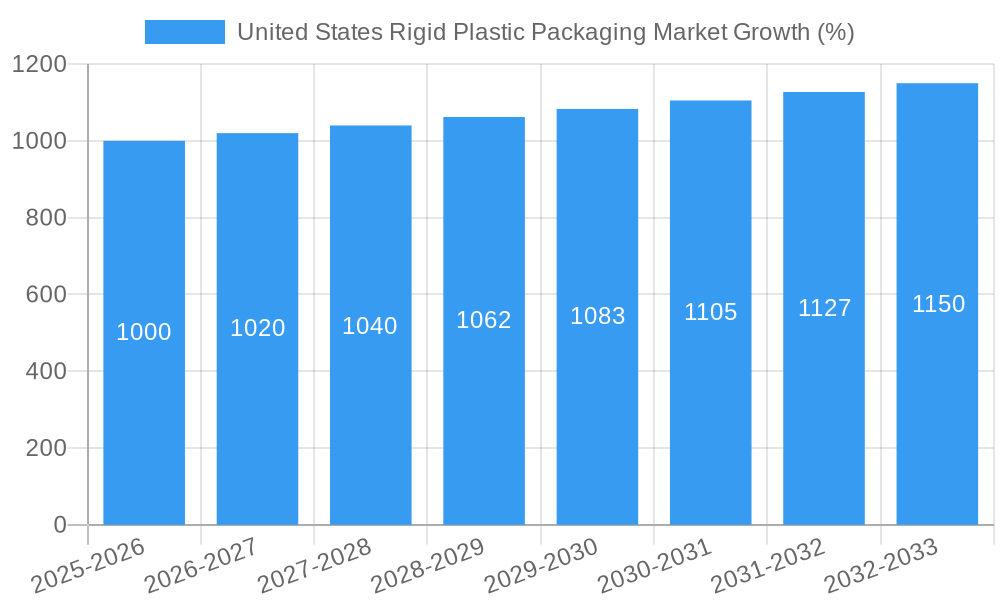

The United States rigid plastic packaging market is a substantial and steadily growing sector. While the provided CAGR of 1.96% suggests moderate growth, industry knowledge suggests this figure could be higher considering the increasing demand for lightweight, durable, and cost-effective packaging solutions across various sectors like food and beverages, pharmaceuticals, and consumer goods. This growth is driven by factors such as the rising popularity of ready-to-eat meals and single-serve products, the escalating demand for convenient packaging formats, and advancements in plastic packaging technology leading to enhanced barrier properties and recyclability. Furthermore, the increasing e-commerce penetration necessitates robust and protective packaging, further fueling market expansion. However, growing environmental concerns related to plastic waste and increasing regulatory pressure to reduce plastic pollution present significant challenges. The market is segmented by packaging type (bottles, containers, films, etc.), application (food, beverages, personal care, etc.), and material type (PET, HDPE, PP, etc.). Key players in the market, including Berry Global Inc, Amcor, and Silgan Holdings, are adopting sustainable packaging solutions and investing in recycling infrastructure to mitigate environmental concerns and maintain market competitiveness. This strategic shift towards sustainable practices represents a crucial aspect of the market's future trajectory.

The competitive landscape is characterized by a mix of established multinational corporations and smaller, specialized players. Established players benefit from extensive distribution networks and strong brand recognition, while emerging players often focus on niche applications or innovative packaging solutions. The market's future growth will depend on balancing the demand for convenient and cost-effective plastic packaging with the urgent need for sustainable solutions. Companies are actively pursuing advancements in biodegradable and compostable plastics, exploring lightweighting techniques to reduce material usage, and investing in improved recycling technologies. This focus on sustainability will be critical in shaping the trajectory of the U.S. rigid plastic packaging market in the coming years. Accurate market sizing requires additional data points, but a reasonable estimation based on publicly available information would place the 2025 market size in the billions of dollars.

United States Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States rigid plastic packaging market, encompassing market size, trends, competitive landscape, and future projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This comprehensive resource is essential for stakeholders seeking to understand the dynamics of this crucial sector and make informed strategic decisions. The market is expected to reach xx Million by 2033.

United States Rigid Plastic Packaging Market Composition & Trends

This section delves into the intricate structure of the US rigid plastic packaging market, examining its concentration levels, key innovation drivers, regulatory landscape, the prevalence of substitute products, end-user profiles, and recent merger and acquisition (M&A) activities. We analyze market share distribution across key players, providing a clear picture of the competitive intensity. The report also quantifies the financial impact of significant M&A deals, shedding light on strategic shifts within the industry.

- Market Concentration: The market exhibits a [High/Medium/Low] level of concentration, with the top five players accounting for approximately xx% of the total market share in 2024.

- Innovation Catalysts: Growing demand for sustainable and lightweight packaging solutions is a primary driver of innovation. Advancements in materials science, such as the use of recycled PET (rPET) and bio-based plastics, are reshaping the industry.

- Regulatory Landscape: Stringent environmental regulations concerning plastic waste are influencing packaging design and material selection, promoting the adoption of eco-friendly alternatives.

- Substitute Products: The market faces competition from alternative packaging materials like paperboard, glass, and metal, each with their own strengths and weaknesses.

- End-User Profiles: The report profiles key end-use sectors including food & beverages, consumer goods, healthcare, and industrial products, analyzing their specific packaging needs.

- M&A Activities: The report documents significant M&A activities, including deal values and strategic implications, highlighting the ongoing consolidation within the market. For example, in 2024, the value of M&A deals in the rigid plastic packaging sector totaled approximately xx Million.

United States Rigid Plastic Packaging Market Industry Evolution

This section offers a comprehensive analysis of the US rigid plastic packaging market's evolution. It traces the market's growth trajectory, highlighting technological advancements, shifts in consumer preferences, and the emergence of new market trends. Specific growth rates and adoption metrics are provided to illuminate the market's dynamism. The impact of sustainability initiatives on market growth will be extensively examined. This analysis will also incorporate insights into emerging technologies, including advanced recycling and material innovations to support more circular economy approaches to rigid plastic packaging.

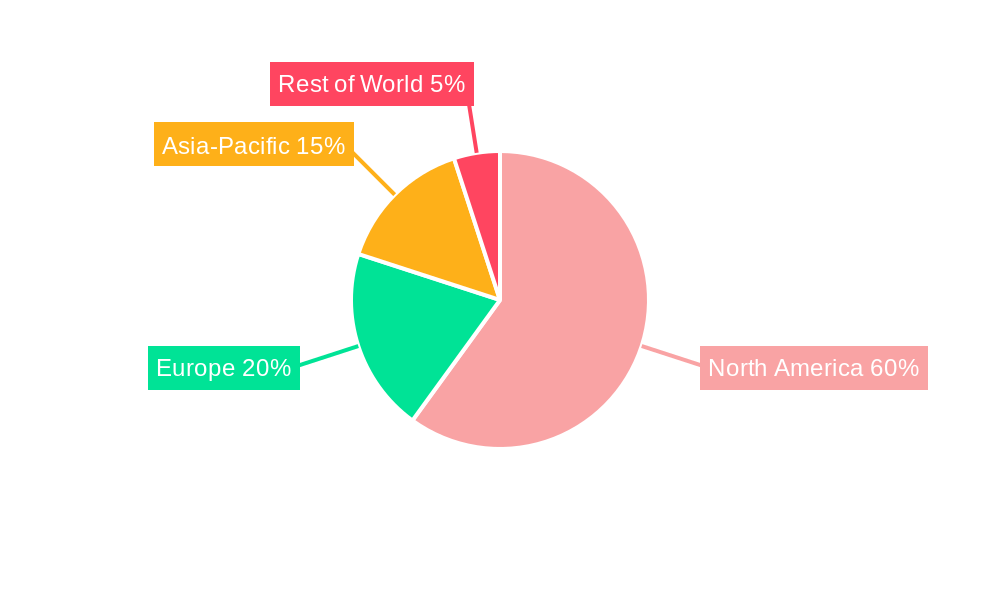

Leading Regions, Countries, or Segments in United States Rigid Plastic Packaging Market

This section pinpoints the dominant regions, countries, or segments within the US rigid plastic packaging market. The analysis leverages both quantitative and qualitative data to establish dominance factors. We identify key drivers of growth in these leading segments and delve into a detailed analysis of their sustained dominance.

- Key Drivers in Leading Regions/Segments:

- Increased investment in manufacturing facilities and infrastructure.

- Favorable government regulations and incentives supporting sustainable packaging.

- Robust economic growth and rising consumer spending.

- High demand from specific end-use industries (e.g., food and beverage).

- In-depth Analysis of Dominance Factors: [Detailed paragraph explaining factors contributing to the dominance of the leading region/country/segment. This could include factors such as established manufacturing capabilities, proximity to key markets, access to raw materials, and a skilled workforce].

United States Rigid Plastic Packaging Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics of rigid plastic packaging. We analyze unique selling propositions (USPs) and technological advancements that are driving market growth. Examples of such innovations may include lighter weight packaging, improved barrier properties, and enhanced recyclability.

Propelling Factors for United States Rigid Plastic Packaging Market Growth

Several factors are propelling growth in the US rigid plastic packaging market. Key among these are technological advancements driving efficiency and sustainability, favorable economic conditions stimulating consumer demand, and supportive regulatory frameworks encouraging eco-conscious packaging solutions. Examples include the increasing adoption of automation in manufacturing and the development of innovative materials like rPET.

Obstacles in the United States Rigid Plastic Packaging Market

The US rigid plastic packaging market faces several challenges. Stringent environmental regulations can increase production costs. Supply chain disruptions, especially those linked to raw material availability, impact manufacturing capabilities. Intense competition from established and emerging players also pressures profit margins. For example, fluctuations in resin prices, a key raw material, have impacted production costs by an estimated xx% in recent years.

Future Opportunities in United States Rigid Plastic Packaging Market

The US rigid plastic packaging market presents promising future opportunities. Emerging markets within the healthcare and consumer goods sectors offer potential expansion. The growing demand for sustainable and recyclable packaging creates opportunities for businesses committed to environmental responsibility. Advancements in barrier technologies and active packaging further enhance market potential.

Major Players in the United States Rigid Plastic Packaging Market Ecosystem

- Berry Global Inc

- Aptar Group Inc

- Amcor Group GmbH

- Graham Packaging Company

- Sonoco Products Company

- Altium Packaging

- Silgan Holdings Inc

- Reliable Caps LLC

- Pretium Packaging

- Axium Packaging Inc

Key Developments in United States Rigid Plastic Packaging Market Industry

- October 2023: Chlorophyll Water's adoption of 100% rPET bottles and Clean Label Project Certification signifies a growing consumer preference for sustainable packaging and transparency.

- August 2024: Origin Materials' partnership with Reed City Group for mass-producing PET caps and closures marks a significant step toward commercially viable sustainable packaging solutions. This collaboration highlights the industry's shift towards sustainable and eco-friendly materials.

Strategic United States Rigid Plastic Packaging Market Forecast

The US rigid plastic packaging market is poised for continued growth, driven by technological innovation, increasing demand from key end-use sectors, and a strong focus on sustainability. The market's trajectory is expected to remain positive, with significant potential for expansion in the coming years, particularly within the segments focusing on sustainable and innovative packaging solutions. The increasing consumer awareness of environmental issues and stringent governmental regulations will further shape the market's growth trajectory, promoting the adoption of eco-friendly packaging alternatives.

United States Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics and Personal Care

- 3.5. Industri

- 3.6. Building and Construction

- 3.7. Automotive

- 3.8. Other En

United States Rigid Plastic Packaging Market Segmentation By Geography

- 1. United States

United States Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics and Personal Care

- 5.3.5. Industri

- 5.3.6. Building and Construction

- 5.3.7. Automotive

- 5.3.8. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aptar Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Graham Packaging Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Altium Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Reliable Caps LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: United States Rigid Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Rigid Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: United States Rigid Plastic Packaging Market Revenue Million Forecast, by End-use Industry 2019 & 2032

- Table 5: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 8: United States Rigid Plastic Packaging Market Revenue Million Forecast, by End-use Industry 2019 & 2032

- Table 9: United States Rigid Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Rigid Plastic Packaging Market?

The projected CAGR is approximately 1.96%.

2. Which companies are prominent players in the United States Rigid Plastic Packaging Market?

Key companies in the market include Berry Global Inc, Aptar Group Inc, Amcor Group GmbH, Graham Packaging Company, Sonoco Products Company, Altium Packaging, Silgan Holdings Inc, Reliable Caps LLC, Pretium Packaging, Axium Packaging Inc 7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the United States Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Food And Beverage Sector Drives Demand For Rigid Plastic Packaging Products.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

August 2024: Origin Materials, a tech firm dedicated to facilitating the global shift toward sustainable materials, has teamed up with Reed City Group, a comprehensive injection mold builder and molder, hydraulic press manufacturer, and provider of automation solutions. Together, they aim to mass-produce PET caps and closures in North America. At Reed City Group's facilities in Michigan, the duo is set to run commercial manufacturing lines for Origin's PET caps and closures. These lines are set to utilize advanced high-speed equipment and automation to transform both virgin and recycled PET into caps. Notably, Origin's caps are set to be the first commercially viable PET closures to penetrate the mass market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the United States Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence