Key Insights

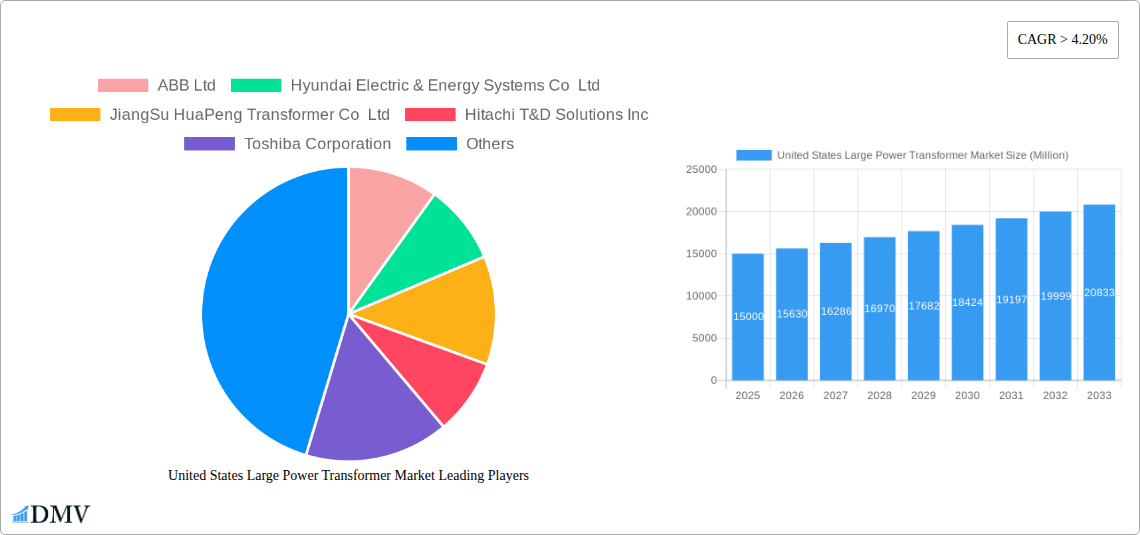

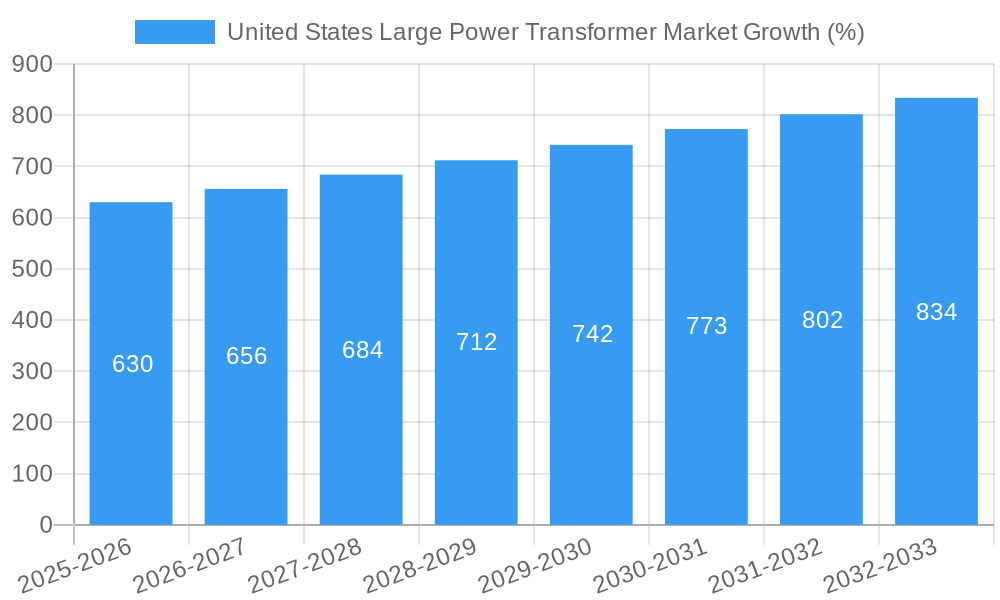

The United States large power transformer market is experiencing robust growth, driven by increasing investments in renewable energy infrastructure, grid modernization initiatives, and the expansion of industrial sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 4.20% from 2019 to 2024 suggests a significant upward trajectory. This expansion is fueled by the rising demand for reliable power transmission and distribution across various sectors, including power generation (driven by both fossil fuel and renewable sources), and industrial applications. The single-phase and three-phase transformer segments, both crucial for power transmission and generation, are expected to witness substantial growth, with three-phase transformers likely holding a larger market share due to their higher capacity and suitability for large-scale projects. Key players such as ABB, Siemens, and GE are actively investing in research and development to enhance transformer efficiency, lifespan, and grid integration capabilities. However, challenges such as the high initial cost of transformers and the fluctuating prices of raw materials like copper and steel could potentially restrain market growth to some degree.

Looking ahead to 2033, the US large power transformer market is poised for continued expansion, albeit potentially at a slightly moderated pace. Factors such as government regulations promoting energy efficiency and the transition to smart grids are expected to bolster market growth. Furthermore, the increasing adoption of advanced technologies like condition-based monitoring systems and digital twins for transformers will further improve operational efficiency and reduce downtime, creating additional market opportunities. Regional variations in growth may arise depending on investment patterns in renewable energy projects and infrastructure development across different states. Continued innovation in transformer design, focusing on higher power capacity, improved cooling systems, and reduced environmental impact, is crucial for sustaining the growth trajectory in the coming years.

United States Large Power Transformer Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the United States large power transformer market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with 2025 as the base year, this study offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this crucial sector. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

United States Large Power Transformer Market Composition & Trends

This section delves into the competitive landscape of the US large power transformer market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. The analysis includes a detailed examination of M&A activities, providing insights into deal values and their impact on market share distribution.

Market Concentration: The US large power transformer market exhibits a moderately concentrated structure, with the top five players commanding approximately xx% of the market share in 2024. This is attributed to significant entry barriers, including high capital investment requirements and specialized technical expertise.

Innovation Catalysts: Ongoing advancements in materials science, digital technologies, and smart grid initiatives are fueling innovation within the sector. This includes the development of more efficient, reliable, and environmentally friendly transformers.

Regulatory Landscape: Stringent environmental regulations and grid modernization mandates are driving the adoption of advanced transformer technologies, creating both challenges and opportunities for market players.

Substitute Products: While there are limited direct substitutes for large power transformers, advancements in HVDC technology and alternative energy solutions are indirectly impacting market demand.

End-User Profiles: The primary end-users include power utilities, independent power producers (IPPs), and industrial consumers, each exhibiting distinct purchasing patterns and priorities.

M&A Activities: Significant M&A activity has been observed in recent years, with notable transactions, such as the USD 645 Million acquisition of SPX Transformer Solutions by GE-Prolec Transformers Inc. in October 2021, significantly reshaping the market landscape. These deals often aim to enhance technological capabilities, expand market reach, and consolidate market share. The average M&A deal value in the period 2019-2024 was approximately xx Million.

United States Large Power Transformer Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the US large power transformer market, focusing on technological advancements and evolving consumer demands. The analysis encompasses detailed data points regarding growth rates and adoption metrics. The market experienced a period of moderate growth from 2019-2024, driven largely by investments in grid infrastructure upgrades. The forecast period (2025-2033) anticipates accelerated growth, fueled by increased renewable energy integration, modernization of aging infrastructure, and the growing adoption of smart grid technologies. This growth will be further influenced by the increasing demand for reliable and efficient power transmission and distribution systems across various sectors including manufacturing, commercial, and residential. Technological advancements like the development of flexible transformers are expected to significantly impact the market growth, leading to enhanced grid stability and efficiency. Shifting consumer demands towards environmentally friendly and cost-effective solutions will also play a key role, demanding the development of energy-efficient transformers with lower lifecycle costs.

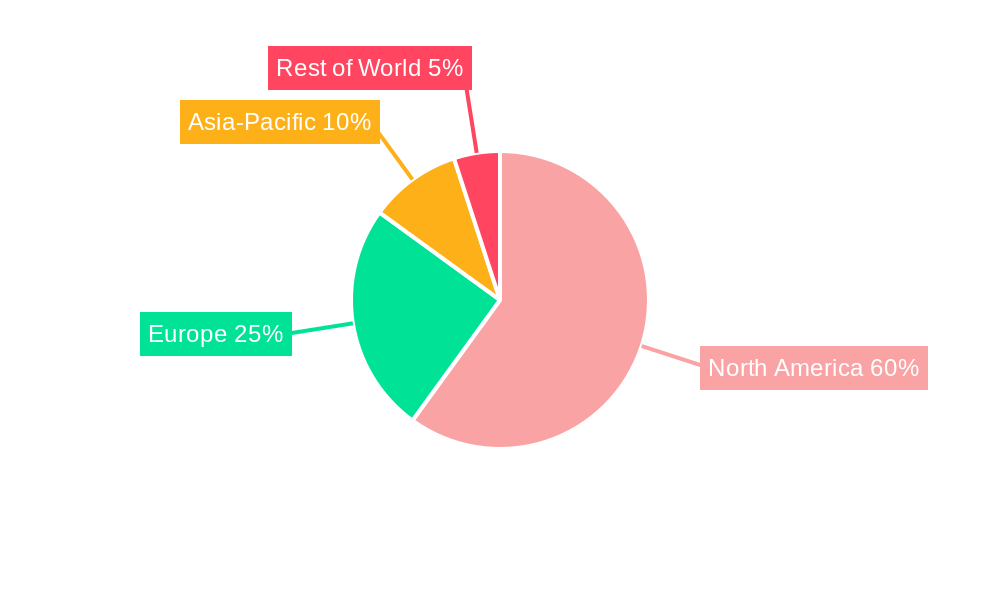

Leading Regions, Countries, or Segments in United States Large Power Transformer Market

This section identifies the leading regions, countries, and segments within the US large power transformer market. The analysis encompasses detailed investigation into factors contributing to their dominance.

Type: Three-phase transformers dominate the market due to their widespread use in power transmission and distribution networks. Single-phase transformers hold a smaller market share, primarily used in specific applications.

Application: The power transmission segment constitutes the largest portion of the market, driven by the need for efficient and reliable long-distance power delivery. The power generation segment is also experiencing significant growth, owing to expansion in power generation capacities. Other applications comprise a smaller yet growing market share, encompassing industrial and specialized uses.

Key Drivers:

Power Transmission Segment: Significant investments in grid modernization and expansion projects are the primary driver for growth in this segment. Increased demand for reliable and efficient power transmission across long distances is also a key factor.

Power Generation Segment: The increasing adoption of renewable energy sources, along with the expansion of traditional power generation facilities, are contributing to the growth of this segment.

Three-Phase Transformers: Their superior performance and suitability for high-power applications are the main reasons for their dominance in the market.

The dominance of these segments and applications is largely driven by increasing power demands, government initiatives promoting grid modernization, and investments in renewable energy infrastructure.

United States Large Power Transformer Market Product Innovations

Recent innovations in the large power transformer market include the development of flexible transformers, demonstrating advancements in grid management and efficiency. These transformers offer enhanced controllability and adaptability, significantly improving grid stability and optimizing power flow. The introduction of these advanced technologies offers unique selling propositions focused on improved efficiency, reduced losses, and enhanced grid resilience. The use of advanced materials and sophisticated control systems further contributes to improved performance metrics, including increased lifespan, higher power ratings, and lower environmental impact. The field validation of the 165kV, 60/80/100 MVA flexible transformer in Mississippi marks a significant milestone in this area.

Propelling Factors for United States Large Power Transformer Market Growth

Several factors contribute to the growth of the US large power transformer market. Technological advancements, such as the development of smart grid technologies and energy-efficient transformers, are driving adoption. Economic factors, including rising energy demand and infrastructure investments, also play a significant role. Furthermore, supportive government regulations aimed at grid modernization and renewable energy integration are fostering market expansion. The increasing adoption of renewable energy and the need to modernize aging grid infrastructure are primary drivers of the market's growth.

Obstacles in the United States Large Power Transformer Market

Several factors hinder the growth of the US large power transformer market. Regulatory complexities and lengthy approval processes can delay project implementation. Supply chain disruptions and raw material price fluctuations can significantly impact production costs and timelines. Furthermore, intense competition from both domestic and international players creates pricing pressures and necessitates continuous innovation to maintain market share. These factors collectively pose challenges to market expansion and profitability.

Future Opportunities in United States Large Power Transformer Market

Future opportunities lie in the growing demand for smart grid technologies, the increasing adoption of renewable energy sources, and the modernization of existing power grids. Expansion into new geographical markets and exploration of novel applications for large power transformers present further potential for growth. Furthermore, the development and commercialization of next-generation transformer technologies with enhanced efficiency, reliability, and sustainability characteristics will offer significant market opportunities.

Major Players in the United States Large Power Transformer Market Ecosystem

- ABB Ltd

- Hyundai Electric & Energy Systems Co Ltd

- Jiangsu HuaPeng Transformer Co Ltd

- Hitachi T&D Solutions Inc

- Toshiba Corporation

- Weg SA

- Mitsubishi Electric Corporation

- Siemens Energy AG

- General Electric Company

- TBEA Co Ltd

Key Developments in United States Large Power Transformer Market Industry

October 2021: GE Research, Prolec GE, and Cooperative Energy collaborated to install the world's first flexible large power transformer (165kV, 60/80/100 MVA) in Columbia, Mississippi. This development, funded by the US Department of Energy, signifies a significant advancement in grid management technology.

October 2021: GE-Prolec Transformers Inc. acquired SPX Transformer Solutions for USD 645 Million, expanding its market share and product portfolio in the large power transformer sector.

Strategic United States Large Power Transformer Market Forecast

The US large power transformer market is poised for significant growth, driven by increasing energy demand, renewable energy integration, and grid modernization initiatives. Future opportunities lie in advanced technologies like flexible transformers, smart grid integration, and the development of more efficient and sustainable solutions. The market's robust growth trajectory presents significant potential for both established players and new entrants, making it an attractive sector for investment and innovation.

United States Large Power Transformer Market Segmentation

-

1. Type

- 1.1. Single-phase Transformer

- 1.2. Three-phase Transformer

-

2. Application

- 2.1. Power Transmission

- 2.2. Power Generation

- 2.3. Other Applications

United States Large Power Transformer Market Segmentation By Geography

- 1. United States

United States Large Power Transformer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities

- 3.3. Market Restrains

- 3.3.1. 4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment

- 3.4. Market Trends

- 3.4.1. Power Generation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Large Power Transformer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-phase Transformer

- 5.1.2. Three-phase Transformer

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Transmission

- 5.2.2. Power Generation

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States of America United States Large Power Transformer Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada United States Large Power Transformer Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of North America United States Large Power Transformer Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 ABB Ltd

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Hyundai Electric & Energy Systems Co Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 JiangSu HuaPeng Transformer Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Hitachi T&D Solutions Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Toshiba Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Weg SA*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Mitsubishi Electric Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Energy AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 General Electric Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 TBEA Co Ltd

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 ABB Ltd

List of Figures

- Figure 1: United States Large Power Transformer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Large Power Transformer Market Share (%) by Company 2024

List of Tables

- Table 1: United States Large Power Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Large Power Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: United States Large Power Transformer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Large Power Transformer Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: United States Large Power Transformer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: United States Large Power Transformer Market Volume K Units Forecast, by Application 2019 & 2032

- Table 7: United States Large Power Transformer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Large Power Transformer Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: United States Large Power Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Large Power Transformer Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: United States of America United States Large Power Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States of America United States Large Power Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: Canada United States Large Power Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada United States Large Power Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Rest of North America United States Large Power Transformer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of North America United States Large Power Transformer Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: United States Large Power Transformer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: United States Large Power Transformer Market Volume K Units Forecast, by Type 2019 & 2032

- Table 19: United States Large Power Transformer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: United States Large Power Transformer Market Volume K Units Forecast, by Application 2019 & 2032

- Table 21: United States Large Power Transformer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Large Power Transformer Market Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Large Power Transformer Market?

The projected CAGR is approximately > 4.20%.

2. Which companies are prominent players in the United States Large Power Transformer Market?

Key companies in the market include ABB Ltd, Hyundai Electric & Energy Systems Co Ltd, JiangSu HuaPeng Transformer Co Ltd, Hitachi T&D Solutions Inc, Toshiba Corporation, Weg SA*List Not Exhaustive, Mitsubishi Electric Corporation, Siemens Energy AG, General Electric Company, TBEA Co Ltd.

3. What are the main segments of the United States Large Power Transformer Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities.

6. What are the notable trends driving market growth?

Power Generation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment.

8. Can you provide examples of recent developments in the market?

In October 2021, A collaboration between GE Research and Prolec GE with Cooperative Energy led to the development and installation of the world's first flexible large power transformer at the utility's major substation in Columbia, Mississippi. The transformer, rated at 165kV, 60/80/100 MVA, and developed as part of an ongoing project funded by the US Department of Energy's (DOE's) Office of Electricity, has begun field validation for six months to assess its performance and understand how this new technology could transform grid management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Large Power Transformer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Large Power Transformer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Large Power Transformer Market?

To stay informed about further developments, trends, and reports in the United States Large Power Transformer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence