Key Insights

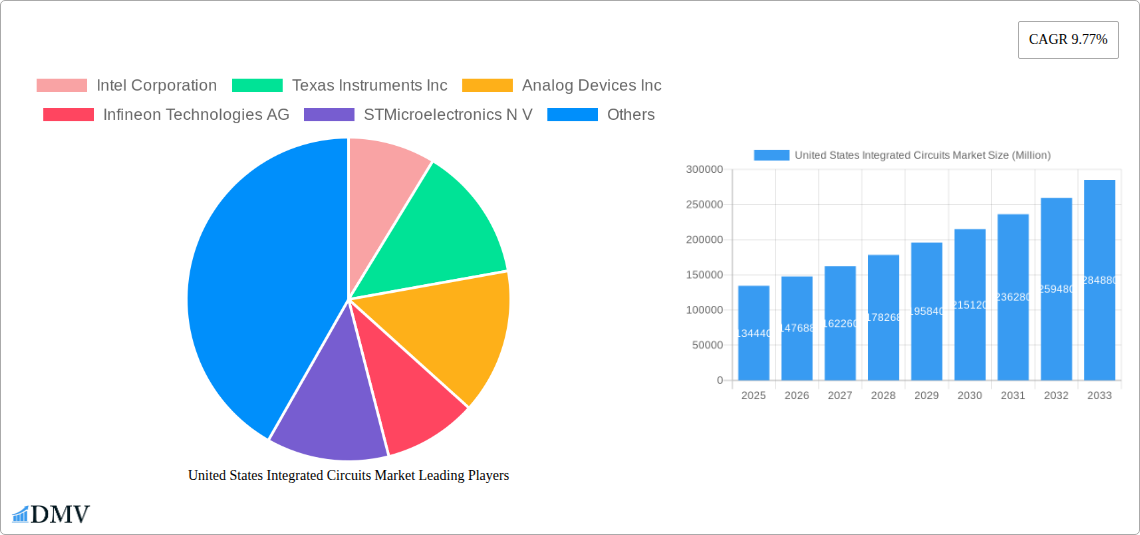

The United States Integrated Circuits (IC) market, valued at $134.44 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-performance computing, particularly in data centers and artificial intelligence (AI), is a significant catalyst. The automotive sector's ongoing shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) further fuels this demand, requiring sophisticated ICs for power management, sensor integration, and autonomous driving functionalities. Furthermore, the proliferation of connected devices in the Internet of Things (IoT) ecosystem contributes to a consistently high volume of IC consumption. The market's strong growth trajectory is also supported by continuous advancements in semiconductor technology, leading to smaller, faster, and more energy-efficient chips. Key players like Intel, Texas Instruments, and Analog Devices are investing heavily in research and development, driving innovation and expanding market capabilities.

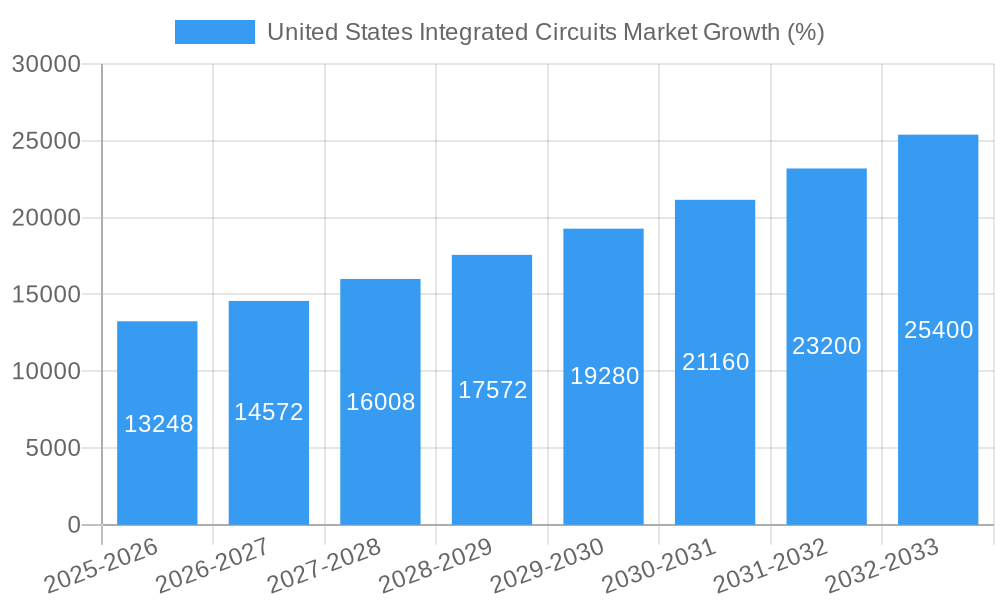

However, the market faces certain constraints. Supply chain disruptions, geopolitical uncertainties, and the cyclical nature of the semiconductor industry pose challenges to consistent growth. The increasing complexity of IC design and manufacturing necessitates significant capital investments, potentially hindering smaller players. Furthermore, the rising cost of raw materials and escalating energy prices impact overall profitability. Despite these challenges, the long-term outlook for the US IC market remains positive, driven by sustained technological advancements and the expanding applications across diverse sectors. The consistent 9.77% Compound Annual Growth Rate (CAGR) suggests a significant market expansion throughout the forecast period (2025-2033), indicating substantial opportunities for established players and emerging companies alike.

United States Integrated Circuits Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the United States Integrated Circuits market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The report encompasses market sizing, segmentation, competitive analysis, technological advancements, and future growth prospects. The total market value in 2025 is estimated at xx Million.

United States Integrated Circuits Market Composition & Trends

This section delves into the intricate structure of the US Integrated Circuits market, analyzing market concentration, innovation drivers, regulatory factors, substitute products, end-user profiles, and merger & acquisition (M&A) activities. We examine the market share distribution amongst key players, revealing the competitive landscape. The report further explores the influence of regulatory frameworks like the CHIPS and Science Act on market dynamics. The impact of substitute technologies and evolving end-user demands are also meticulously assessed. Finally, a detailed analysis of significant M&A activities, including deal values and their implications on market consolidation, is presented.

- Market Concentration: Intel Corporation, Texas Instruments Inc., and Analog Devices Inc. hold a significant portion of the market share, with Intel estimated to hold xx% in 2025.

- Innovation Catalysts: The increasing demand for advanced functionalities in various end-use sectors fuels innovation in IC design and manufacturing.

- Regulatory Landscape: The CHIPS Act significantly influences investments and manufacturing capacity within the US.

- Substitute Products: While few direct substitutes exist, alternative technologies and architectures pose indirect competition.

- End-User Profiles: The major end-users include automotive, consumer electronics, telecommunications, and industrial sectors.

- M&A Activities: The past five years have witnessed xx Million in M&A deals, largely driven by consolidation efforts among smaller players and expansion into new technologies.

United States Integrated Circuits Market Industry Evolution

This section traces the evolution of the US Integrated Circuits market, meticulously charting its growth trajectories, technological advancements, and shifts in consumer demands. We present specific data points like compound annual growth rates (CAGR) and adoption rates for key technologies. The analysis focuses on the historical period (2019-2024), the base year (2025), and the projected forecast period (2025-2033). Key factors influencing market growth, including technological innovations and evolving applications, are explored in detail, contributing to a comprehensive understanding of market dynamics. The projected market size for 2033 is estimated at xx Million. Factors such as the increasing adoption of 5G technology, the rising demand for high-performance computing, and the growth of the Internet of Things (IoT) significantly contribute to the market’s expansion.

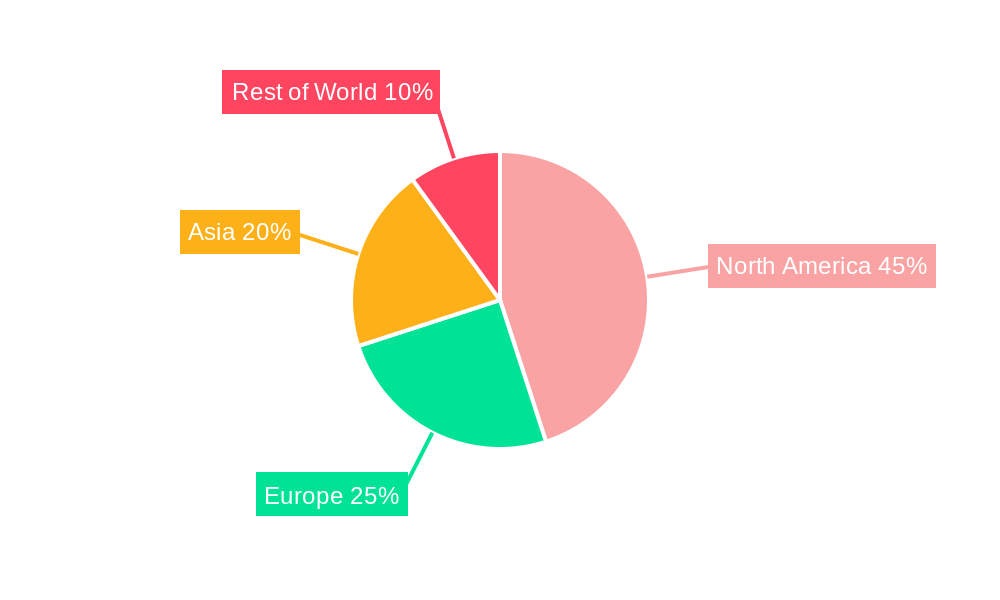

Leading Regions, Countries, or Segments in United States Integrated Circuits Market

This section identifies the dominant regions, countries, or segments within the US Integrated Circuits market. Detailed analysis pinpoints the key factors driving their dominance, with a focus on investment trends, government support, and market access.

Key Drivers:

- Significant government investments: The CHIPS Act's funding is driving substantial investments in domestic semiconductor manufacturing.

- Favorable regulatory environment: Supportive policies promote domestic production and attract foreign investment.

- Strong presence of key players: Major integrated circuit manufacturers have established significant operations in these regions.

Dominance Factors: California, Texas, and Arizona are currently leading regions, driven by the concentration of established players and extensive research and development activities. The automotive segment showcases the strongest growth due to the increasing integration of electronics in vehicles.

United States Integrated Circuits Market Product Innovations

Recent advancements in integrated circuit technology include the development of more energy-efficient designs, higher processing speeds, and increased integration density. Innovations like advanced node processes (e.g., 5nm, 3nm) are driving performance improvements. New memory technologies and specialized ICs for specific applications (e.g., AI accelerators, automotive-grade ICs) are also significantly shaping the market. These innovations enhance product performance, reduce power consumption, and cater to the increasing demand for sophisticated functionalities in various applications.

Propelling Factors for United States Integrated Circuits Market Growth

Several key factors are driving the expansion of the US Integrated Circuits market. Technological advancements, particularly in miniaturization and processing power, fuel demand for more sophisticated devices. Robust economic growth across various end-user sectors, such as automotive, consumer electronics, and telecommunications, creates significant demand. Furthermore, supportive government policies and investments, such as incentives under the CHIPS Act, boost domestic manufacturing and innovation.

Obstacles in the United States Integrated Circuits Market

The US Integrated Circuits market faces challenges such as stringent regulatory compliance requirements, which can increase manufacturing costs and lead times. Supply chain disruptions, particularly related to raw materials and specialized manufacturing equipment, impact production efficiency and market stability. Intense competition from established international players and emerging domestic companies creates pricing pressure and necessitates continuous innovation. These factors collectively impact the overall market growth and profitability.

Future Opportunities in United States Integrated Circuits Market

The US Integrated Circuits market presents significant opportunities. The growing adoption of artificial intelligence (AI) and machine learning (ML) will fuel demand for specialized ICs. The expansion of the Internet of Things (IoT) and the 5G network infrastructure necessitates advanced connectivity solutions. Furthermore, the automotive sector's increasing reliance on electronics offers significant growth potential for automotive-grade ICs. These emerging trends create lucrative opportunities for innovation and expansion in the market.

Major Players in the United States Integrated Circuits Market Ecosystem

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics N V

- NXP Semiconductors N V

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- MediaTek Inc

Key Developments in United States Integrated Circuits Market Industry

- January 2024: At CES 2024, Qualcomm Technologies Inc. and Robert Bosch GmbH launched the automotive industry's first central vehicle computer, a system-on-chip (SoC) integrating infotainment and ADAS functionalities. This signifies a major leap in automotive technology and increased demand for sophisticated SoCs.

- April 2024: Micron Technology Inc. announced the Micron Serial NOR Flash Memory, designed for enhanced performance and reliability in automotive, industrial, and consumer electronics applications. This innovation strengthens Micron's position in the memory market and addresses growing demand for reliable memory solutions.

Strategic United States Integrated Circuits Market Forecast

The US Integrated Circuits market is poised for sustained growth driven by technological advancements, government support, and increasing demand from various sectors. The continued expansion of high-growth sectors such as automotive, data centers, and consumer electronics will fuel market expansion. The strategic adoption of new technologies and innovative manufacturing processes promises to further enhance market potential over the forecast period (2025-2033). The market is expected to witness strong growth, fueled by technological advancements and government initiatives.

United States Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

- 1.4.3. Digital Signal Processors

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

United States Integrated Circuits Market Segmentation By Geography

- 1. United States

United States Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. Logic ICs are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.1.4.3. Digital Signal Processors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics N V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors N V

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MediaTek Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: United States Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: United States Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: United States Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: United States Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: United States Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: United States Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: United States Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: United States Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: United States Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: United States Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Integrated Circuits Market?

The projected CAGR is approximately 9.77%.

2. Which companies are prominent players in the United States Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics N V, NXP Semiconductors N V, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, MediaTek Inc.

3. What are the main segments of the United States Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 134.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Logic ICs are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

April 2024 - Micron Technology Inc. announced the launch of its latest innovation - the Micron Serial NOR Flash Memory. The product is designed to provide enhanced performance and reliability for various applications, from automotive and industrial to consumer electronics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the United States Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence