Key Insights

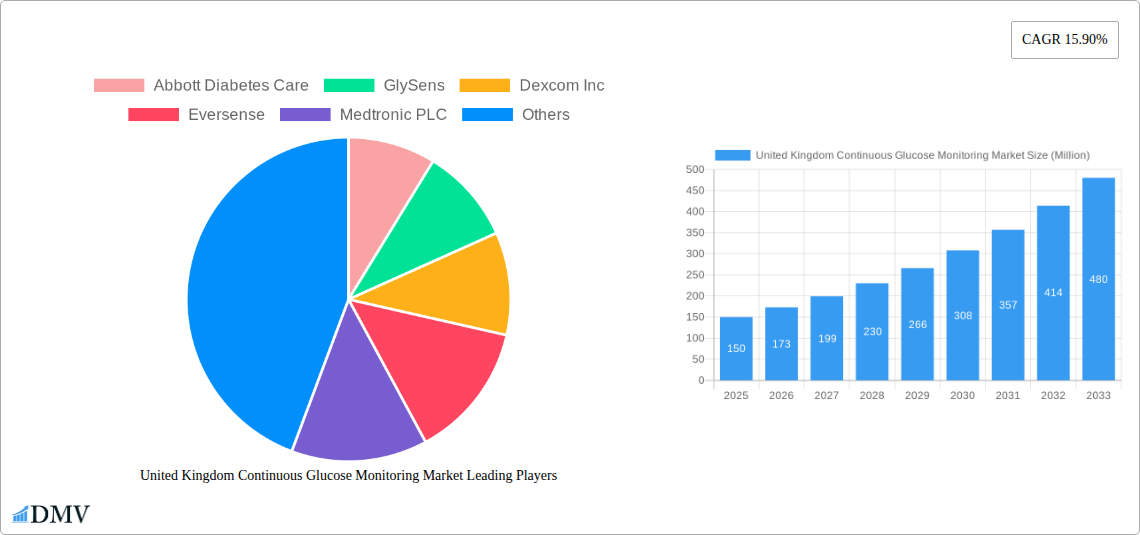

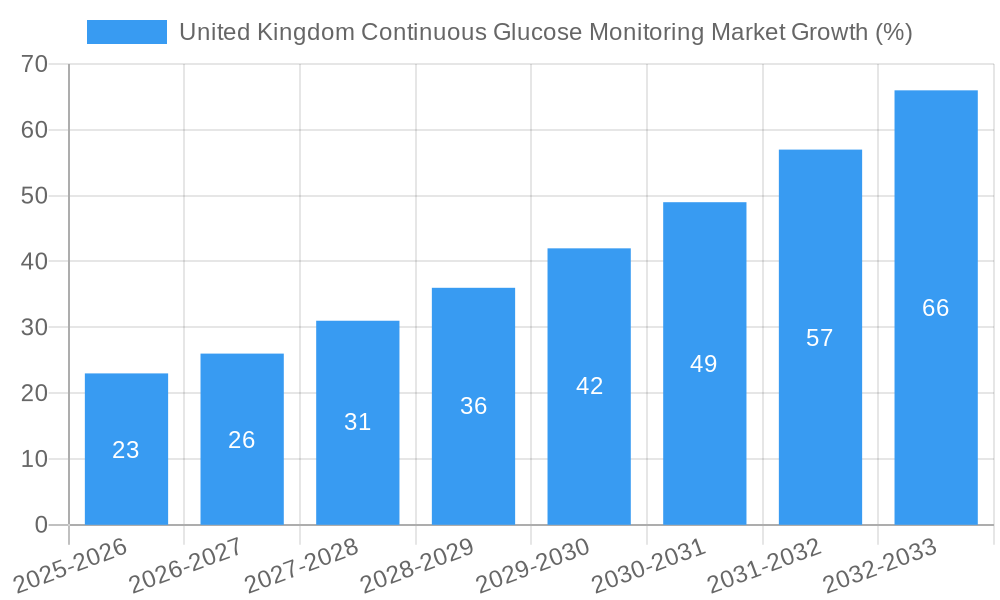

The United Kingdom Continuous Glucose Monitoring (CGM) market is experiencing robust growth, driven by increasing prevalence of diabetes, technological advancements in CGM devices, and rising patient preference for less invasive and more convenient blood glucose monitoring. The market, while currently smaller than some global counterparts like the US market indicated by the provided CAGR of 15.90% and a value unit of millions (exact figures for the UK market are needed for precision), shows significant potential for expansion throughout the forecast period (2025-2033). Key drivers include improved accuracy and reliability of CGM systems, the integration of smart technologies for data management and remote patient monitoring, and increasing reimbursement coverage by healthcare providers. Furthermore, the market's segmentation into sensors and durables reflects ongoing innovation in both disposable and reusable components, influencing the market's overall growth trajectory. Leading players such as Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC are actively involved in product development and market penetration, contributing to the competitive landscape. However, factors like high initial costs of CGM systems and potential limitations related to accuracy in certain patient populations pose challenges to the market's growth.

The projected CAGR of 15.90% suggests a substantial increase in market value over the forecast period. While specific UK market size data is missing, a reasonable estimation can be made based on global market trends and the UK's healthcare spending patterns. Considering the advanced healthcare infrastructure and high prevalence of diabetes in the UK, the market is expected to witness significant expansion, potentially exceeding hundreds of millions of pounds within the forecast period. Further market segmentation analysis, considering factors such as age demographics and type of diabetes, would provide a more nuanced understanding of the market’s future trajectory. The competitive landscape remains dynamic, with ongoing innovation and strategic partnerships influencing market share distribution among key players. Future growth will likely be influenced by regulatory approvals for new technologies, advancements in data analytics capabilities, and wider integration with existing diabetes management systems.

United Kingdom Continuous Glucose Monitoring (CGM) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Kingdom Continuous Glucose Monitoring (CGM) market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, technological advancements, and key players shaping this dynamic sector. The UK CGM market is projected to reach xx Million by 2033, exhibiting significant growth potential.

United Kingdom Continuous Glucose Monitoring Market Market Composition & Trends

The UK CGM market is characterized by a moderate level of concentration, with key players like Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC holding significant market share. However, the presence of smaller innovative companies and the potential for new entrants suggests a dynamic competitive landscape. Market share distribution in 2025 is estimated as follows: Abbott Diabetes Care (xx%), Dexcom Inc. (xx%), Medtronic PLC (xx%), Ascensia Diabetes Care (xx%), Other Companies (xx%). Innovation is a key catalyst, driven by advancements in sensor technology, data analytics, and integration with insulin delivery systems. The regulatory landscape, primarily governed by the MHRA (Medicines and Healthcare products Regulatory Agency), plays a crucial role in market access and product approvals. Substitute products, such as traditional blood glucose meters, continue to exist, but CGM systems' superior convenience and data-driven insights are driving market shift. The primary end-users are individuals with diabetes (Type 1 and Type 2), healthcare professionals, and hospitals. Mergers and acquisitions (M&A) activity in the sector has been moderate, with deal values averaging around xx Million in recent years.

- Market Concentration: Moderately concentrated, with key players holding significant share.

- Innovation Catalysts: Advancements in sensor technology, data analytics, and integration with insulin pumps.

- Regulatory Landscape: Primarily governed by the MHRA, impacting market access and product approvals.

- Substitute Products: Traditional blood glucose meters, facing increased competition from CGM systems.

- End-User Profiles: Individuals with diabetes, healthcare professionals, and hospitals.

- M&A Activity: Moderate activity with deal values averaging xx Million.

United Kingdom Continuous Glucose Monitoring Market Industry Evolution

The UK CGM market has witnessed substantial growth throughout the historical period (2019-2024), driven by increasing diabetes prevalence, rising awareness of CGM benefits, and technological improvements leading to smaller, more accurate, and user-friendly devices. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, such as the introduction of sensor technology requiring fewer calibration finger-prick tests and improved data integration capabilities, have significantly contributed to market expansion. Changing consumer demands, emphasizing convenience, improved accuracy, and seamless data integration, are also key factors. The forecast period (2025-2033) anticipates continued growth, propelled by the expansion of CGM reimbursement policies, increasing adoption among younger diabetic populations, and the emergence of integrated solutions that link CGM data with insulin delivery. Adoption rates are expected to increase from xx% in 2025 to xx% by 2033. The market is expected to exhibit a CAGR of xx% during the forecast period, reaching a value of xx Million by 2033.

Leading Regions, Countries, or Segments in United Kingdom Continuous Glucose Monitoring Market

The UK CGM market demonstrates strong and relatively even growth across its regions, reflecting the widespread prevalence of diabetes across the country. However, urban centers tend to exhibit higher adoption rates due to increased accessibility to healthcare resources and higher awareness campaigns. Within the component segments, Sensors are currently the dominant segment, driving a larger portion of the market value due to their recurrent nature compared to Durables.

Key Drivers for Segment Dominance:

- Sensors: High demand due to their consumable nature and technological advancements enabling improved accuracy and comfort.

- Durables: While holding a smaller market share than sensors, steady growth is driven by technological improvements offering user-friendly interfaces and data-management features.

Dominance Factors:

- High Prevalence of Diabetes: The substantial number of people living with diabetes significantly contributes to the high demand for CGM systems.

- Improved Healthcare Infrastructure: Advances in the UK’s healthcare system, combined with proactive health initiatives, support broader CGM access and utilization.

- Positive Clinical Outcomes: Numerous studies demonstrating CGM's ability to reduce HbA1c levels and improve patient quality of life are key to increasing acceptance.

- Reimbursement Policies: Growing coverage by insurance and healthcare providers further accelerates market growth.

United Kingdom Continuous Glucose Monitoring Market Product Innovations

Recent innovations in the UK CGM market focus on smaller, less invasive sensors, improved accuracy and reliability, longer sensor lifespan, and seamless integration with mobile apps and insulin pumps. Systems like Dexcom G7 represent significant advancements in terms of ease of use and shorter warmup time. The integration of advanced algorithms and AI capabilities is also on the rise, enabling predictive analytics and personalized diabetes management solutions. This enhances the value proposition of CGM, moving beyond simple glucose monitoring to proactive management and improved health outcomes.

Propelling Factors for United Kingdom Continuous Glucose Monitoring Market Growth

Technological advancements leading to smaller, more user-friendly devices with improved accuracy are a primary growth driver. Economic factors such as increasing insurance coverage and government initiatives aimed at improving diabetes management are also significant. Favorable regulatory policies that streamline the approval process for new CGM systems facilitate market expansion. For example, the MHRA's efforts in expediting the review of innovative medical technologies is beneficial.

Obstacles in the United Kingdom Continuous Glucose Monitoring Market Market

Regulatory hurdles related to pricing and reimbursement policies can restrict market access and growth. Supply chain disruptions, particularly concerning the availability of sensor components, could also impact market supply. Strong competition among established players and emerging companies creates intense pressure on pricing and necessitates continuous innovation to maintain market share. These factors could collectively reduce the overall market growth rate by an estimated xx% over the forecast period.

Future Opportunities in United Kingdom Continuous Glucose Monitoring Market

Expanding CGM utilization into new patient segments (e.g., pregnant women with diabetes) offers significant growth potential. Technological advancements like the development of non-invasive CGM sensors and improved data analytics capabilities for personalized medicine are key opportunities. Furthermore, integrating CGM systems with other health technologies, such as wearable fitness trackers, and leveraging telehealth platforms to deliver remote monitoring services can further increase market expansion.

Major Players in the United Kingdom Continuous Glucose Monitoring Market Ecosystem

- Abbott Diabetes Care

- GlySens

- Dexcom Inc

- Eversense

- Medtronic PLC

- Other Company Share Analyse

- Ascensia Diabetes Care

Key Developments in United Kingdom Continuous Glucose Monitoring Market Industry

- October 2022: Abbott announced a study in The New England Journal of Medicine showing Abbott's FreeStyle Libre 2 significantly reduced HbA1c levels in adults with Type 1 diabetes compared to self-monitoring of blood glucose, leading to improved quality of life.

- April 2022: Dexcom launched the G7 in the UK, featuring faster sensor warmup, eliminating finger-prick calibration and scanning needs. This launch significantly increased market accessibility and convenience, impacting sales figures.

Strategic United Kingdom Continuous Glucose Monitoring Market Market Forecast

The UK CGM market is poised for substantial growth driven by technological innovation, favorable regulatory environments, and rising diabetes prevalence. The expansion of reimbursement policies and increasing patient awareness will further accelerate market adoption. The market's future is bright, with ongoing innovation promising even more accurate, convenient, and user-friendly CGM systems that seamlessly integrate into daily life, leading to improved diabetes management and overall health outcomes. This is expected to result in a continued CAGR of xx% for the next several years.

United Kingdom Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

United Kingdom Continuous Glucose Monitoring Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Growing Diabetes Population in the United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Abbott Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GlySens

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dexcom Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eversense

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Other Company Share Analyse

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ascensia Diabetes Care

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Abbott Diabetes Care

List of Figures

- Figure 1: United Kingdom Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Continuous Glucose Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 10: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 11: United Kingdom Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Continuous Glucose Monitoring Market?

The projected CAGR is approximately 15.90%.

2. Which companies are prominent players in the United Kingdom Continuous Glucose Monitoring Market?

Key companies in the market include Abbott Diabetes Care, GlySens, Dexcom Inc, Eversense, Medtronic PLC, Other Company Share Analyse, Ascensia Diabetes Care.

3. What are the main segments of the United Kingdom Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Growing Diabetes Population in the United Kingdom.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2022: Abbott announced that a new study published in The New England Journal of Medicine demonstrated that for adults with Type-1 diabetes and suboptimal glycemic control, Abbott's FreeStyle Libre 2 glucose monitoring system provided significant reductions in glycated hemoglobin (HbA1c) compared to self-monitoring of blood glucose, which were sustained for the study duration of 24 weeks. The FreeStyle Libre 2 system was also linked to improvements in participant-reported quality of life outcomes, including overall satisfaction and reduced burden associated with glucose monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the United Kingdom Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence