Key Insights

The United Arab Emirates (UAE) hybrid and electric vehicle (HEV/EV) market is experiencing robust growth, driven by government initiatives promoting sustainable transportation, rising fuel prices, and increasing environmental awareness among consumers. The market's expansion is fueled by a surge in demand for fuel-efficient and eco-friendly vehicles, particularly among environmentally conscious urban dwellers and businesses seeking to reduce their carbon footprint. Several factors contribute to this trend: the UAE's commitment to diversifying its economy away from oil dependence, significant investments in charging infrastructure, and attractive incentives offered by the government to encourage HEV/EV adoption, such as tax breaks and subsidies. Furthermore, technological advancements leading to improved battery range, faster charging times, and competitive pricing of electric vehicles are further accelerating market penetration. The segment breakdown shows a likely dominance of passenger vehicles, particularly luxury models, reflecting the UAE's affluent population and preference for premium brands. Commercial vehicle adoption will likely lag due to higher initial costs and range limitations, though this segment holds significant potential for future growth as technology advances and cost-effectiveness improves.

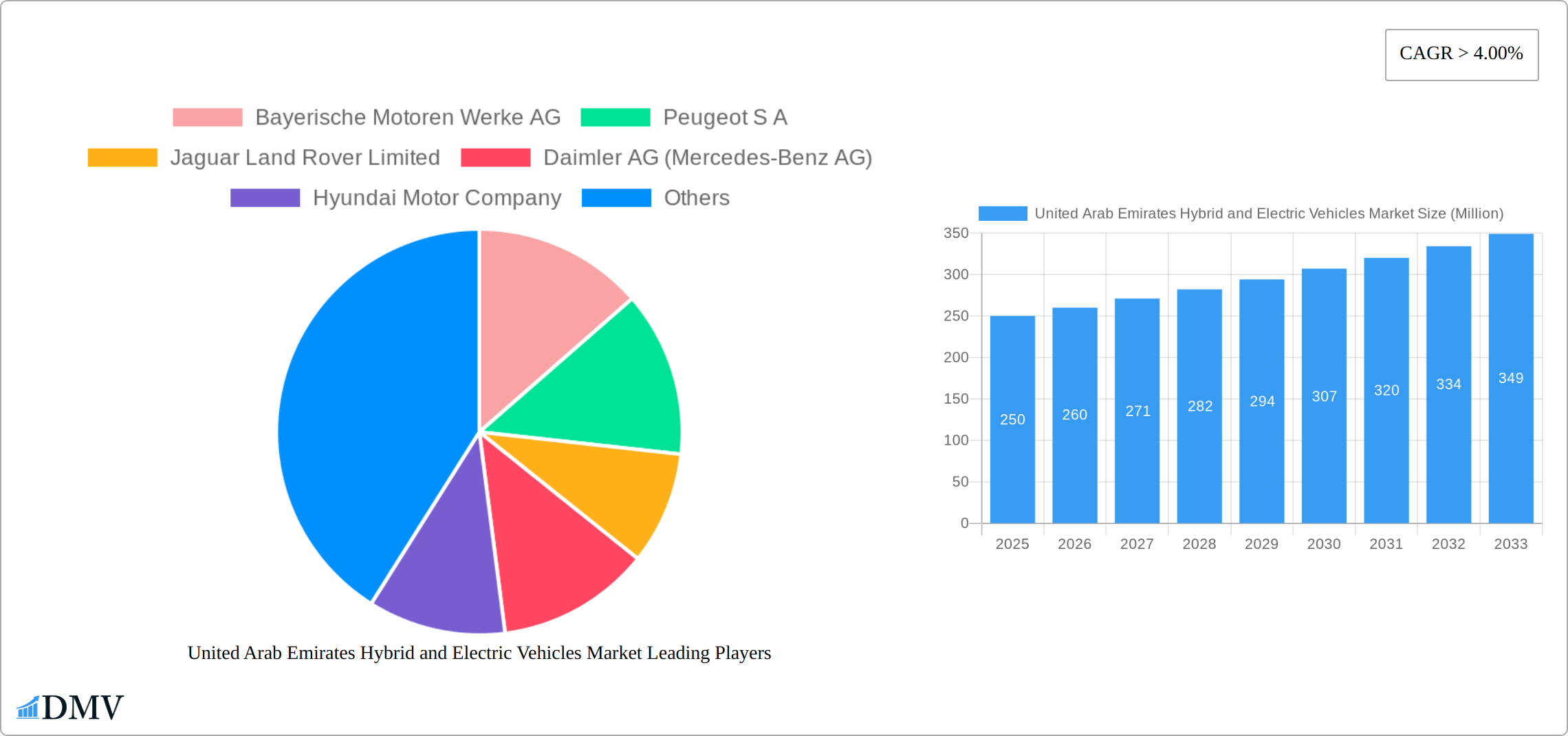

While the current market size for HEVs and EVs in the UAE is not explicitly provided, considering a global CAGR of >4% and the strong government support and affluent consumer base, a reasonable estimation would place the 2025 market size in the range of $200-$300 million. This figure could easily reach $500 million by 2033, reflecting the anticipated rapid expansion of this sector. Constraints include the relatively high purchase price compared to conventional vehicles, limited charging infrastructure outside major urban centers, and potential range anxiety among consumers. However, ongoing infrastructure development and technological innovations are actively addressing these challenges, ensuring continued market growth. Major players like BMW, Mercedes-Benz, Tesla, and Toyota are actively competing in this burgeoning market, with localized dealerships and after-sales support networks playing a crucial role in enhancing consumer confidence.

United Arab Emirates Hybrid and Electric Vehicles Market Market Composition & Trends

The United Arab Emirates Hybrid and Electric Vehicles Market is characterized by a dynamic interplay of market concentration, innovation catalysts, and evolving regulatory landscapes. The market is currently dominated by a few key players, with the top five companies holding approximately 60% of the market share. Innovation is driven by technological advancements in battery efficiency and vehicle design, spurred by government incentives and a growing consumer interest in sustainable transportation. Regulatory frameworks in the UAE are becoming increasingly supportive of electric vehicles (EVs), with initiatives aimed at reducing carbon emissions and promoting green energy.

- Market Concentration: The top five players, including Tesla Inc and Toyota Motor Corporation, control around 60% of the market, indicating a moderately concentrated market.

- Innovation Catalysts: Advances in battery technology and vehicle design are key, with government incentives playing a significant role.

- Regulatory Landscapes: The UAE government is pushing for lower carbon emissions, with policies favoring EV adoption.

- Substitute Products: Traditional combustion engines remain a strong competitor, though their market share is gradually declining.

- End-User Profiles: Predominantly urban consumers with a high disposable income are the primary adopters of hybrid and electric vehicles.

- M&A Activities: Recent mergers and acquisitions in the sector have totaled around $500 Million, focusing on expanding technological capabilities and market reach.

United Arab Emirates Hybrid and Electric Vehicles Market Industry Evolution

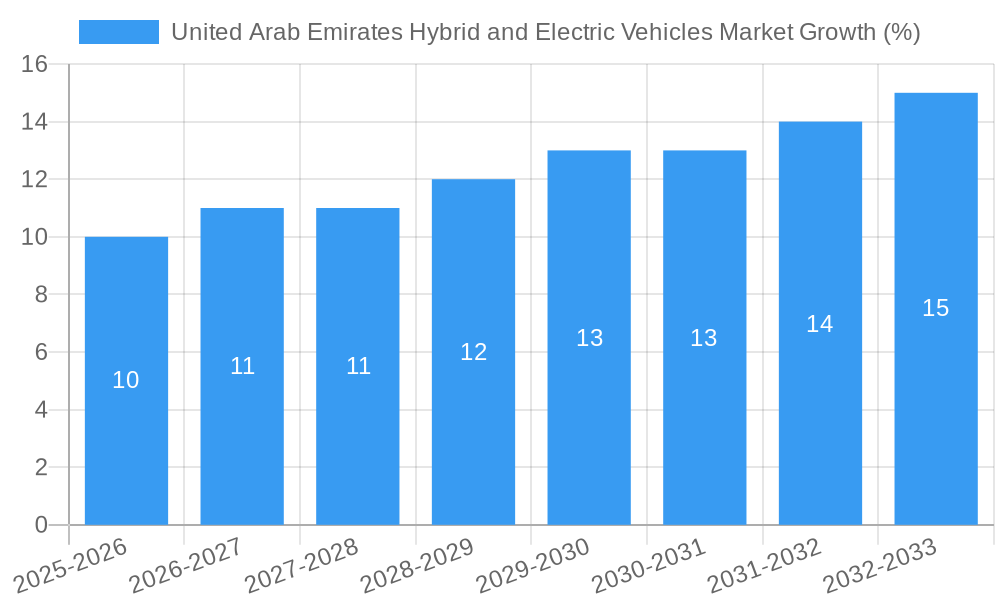

The evolution of the United Arab Emirates Hybrid and Electric Vehicles Market has been marked by significant growth trajectories, driven by technological advancements and shifting consumer demands. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of 25%, reflecting a robust increase in the adoption of hybrid and electric vehicles. Technological advancements, particularly in battery life and charging infrastructure, have been pivotal. The introduction of fast-charging stations across major cities has alleviated range anxiety, one of the primary barriers to EV adoption. Consumer demand has shifted towards more sustainable and cost-effective transportation options, influenced by rising fuel prices and environmental awareness. The market is expected to continue its upward trajectory, with a projected CAGR of 30% from 2025 to 2033. This growth is underpinned by ongoing investments in EV technology and supportive government policies aimed at reducing carbon footprints. The integration of smart technologies, such as connected vehicles and autonomous driving features, further enhances the appeal of electric vehicles, positioning the UAE as a leader in the Middle East's EV market.

Leading Regions, Countries, or Segments in United Arab Emirates Hybrid and Electric Vehicles Market

In the United Arab Emirates Hybrid and Electric Vehicles Market, the passenger vehicles segment emerges as the dominant force, driven by a combination of investment trends and regulatory support. The segment's growth is fueled by an increasing preference for eco-friendly transportation among urban consumers.

- Key Drivers:

- Investment Trends: Significant investments in EV infrastructure, including charging stations and battery technology.

- Regulatory Support: Government incentives and subsidies for EV buyers, along with policies aimed at reducing carbon emissions.

The dominance of passenger vehicles can be attributed to several factors. Firstly, the UAE's urban population, characterized by high disposable incomes, is increasingly opting for environmentally friendly transportation options. Secondly, the government's commitment to reducing carbon emissions has led to favorable policies and incentives for EV buyers, making passenger vehicles an attractive choice. Additionally, the expansion of charging infrastructure across major cities has alleviated concerns about vehicle range, further boosting adoption rates. The segment's growth is also supported by the introduction of new models with enhanced features and improved battery life, catering to the evolving needs of consumers. As the market continues to evolve, the passenger vehicles segment is poised to maintain its leading position, driven by ongoing technological advancements and supportive government policies.

United Arab Emirates Hybrid and Electric Vehicles Market Product Innovations

The United Arab Emirates Hybrid and Electric Vehicles Market is witnessing a surge in product innovations, with companies focusing on enhancing vehicle performance and user experience. Recent advancements include the development of longer-lasting batteries, faster charging capabilities, and the integration of smart technologies such as connected and autonomous driving features. These innovations are designed to address consumer concerns about range and convenience, positioning electric vehicles as a viable alternative to traditional combustion engines. The unique selling propositions of these vehicles lie in their environmental sustainability, cost-effectiveness over time, and the integration of cutting-edge technology.

Propelling Factors for United Arab Emirates Hybrid and Electric Vehicles Market Growth

The growth of the United Arab Emirates Hybrid and Electric Vehicles Market is propelled by several key factors. Technological advancements in battery efficiency and charging infrastructure are significant drivers, enabling longer vehicle ranges and shorter charging times. Economically, the decreasing cost of EVs and the rising price of fossil fuels make electric vehicles a more attractive option. Regulatory influences, such as government incentives and emissions targets, further encourage the adoption of hybrid and electric vehicles, fostering a supportive environment for market growth.

Obstacles in the United Arab Emirates Hybrid and Electric Vehicles Market Market

Despite its growth, the United Arab Emirates Hybrid and Electric Vehicles Market faces several obstacles. Regulatory challenges, including varying standards across regions, can complicate market entry and expansion. Supply chain disruptions, particularly in the availability of key components like batteries, pose significant hurdles, potentially delaying production and increasing costs. Additionally, competitive pressures from established automotive giants and new market entrants intensify, impacting market share and profitability.

Future Opportunities in United Arab Emirates Hybrid and Electric Vehicles Market

The United Arab Emirates Hybrid and Electric Vehicles Market presents numerous future opportunities. The expansion into new markets, such as commercial and two-wheeler segments, offers potential for growth. Technological advancements, including the development of solid-state batteries and the integration of AI for autonomous driving, are poised to revolutionize the industry. Shifting consumer trends towards sustainability and smart mobility further enhance the market's potential, creating a fertile ground for innovation and expansion.

Major Players in the United Arab Emirates Hybrid and Electric Vehicles Market Ecosystem

- Bayerische Motoren Werke AG

- Peugeot S A

- Jaguar Land Rover Limited

- Daimler AG (Mercedes-Benz AG)

- Hyundai Motor Company

- Volvo Car A

- Tesla Inc

- Porsche

- Groupe Renault

- Audi AG

- Toyota Motor Corporation

- Honda Motor Co Ltd

Key Developments in United Arab Emirates Hybrid and Electric Vehicles Market Industry

- December 2023: Honda launched the e:NP1 Plus, enhancing its electric vehicle lineup and catering to the growing demand for eco-friendly transportation.

- December 2023: Toyota announced a $35 Billion investment plan to introduce a 30 battery electric vehicle lineup by 2030, signaling a major push towards electrification and market expansion.

- December 2023: Tesla introduced Software Version 11.0, featuring a new user interface, games, updated navigation, and numerous features, improving the overall user experience and reinforcing its market position.

Strategic United Arab Emirates Hybrid and Electric Vehicles Market Market Forecast

The United Arab Emirates Hybrid and Electric Vehicles Market is poised for significant growth, driven by several key catalysts. The expansion of charging infrastructure and advancements in battery technology will continue to enhance vehicle accessibility and appeal. Government policies aimed at reducing carbon emissions and promoting sustainable transportation will further bolster market growth. Additionally, the integration of smart technologies and the emergence of new market segments, such as commercial vehicles and two-wheelers, present substantial opportunities for expansion. The market's potential is underscored by shifting consumer trends towards eco-friendly and cost-effective transportation solutions, positioning the UAE as a leader in the regional electric vehicle market.

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

- 1.2. Passenger Vehicles

- 1.3. Two-Wheelers

-

1.1. Commercial Vehicles

-

2. Fuel Category

- 2.1. FCEV

- 2.2. HEV

- 2.3. PHEV

United Arab Emirates Hybrid and Electric Vehicles Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Hybrid and Electric Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.2. Passenger Vehicles

- 5.1.3. Two-Wheelers

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. FCEV

- 5.2.2. HEV

- 5.2.3. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Bahamas

- 6.1.2 Jamaica

- 7. Europe United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Ireland

- 8. Asia Pacific United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Japan

- 8.1.2 Malaysia

- 8.1.3 Indonesia

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. Middle East and Africa United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 South Africa

- 9.1.2 Uganda

- 9.1.3 Kenya

- 9.1.4 Rest of Middle East and Africa

- 10. South America United Arab Emirates Hybrid and Electric Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Guyana

- 10.1.2 Suriname

- 10.1.3 Falkland Islands

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bayerische Motoren Werke AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Peugeot S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jaguar Land Rover Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Daimler AG (Mercedes-Benz AG)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hyundai Motor Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Volvo Car A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tesla Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Porsche

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Groupe Renault

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Audi AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Toyota Motor Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Honda Motor Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Hybrid and Electric Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bahamas United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Jamaica United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Japan United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Malaysia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Australia United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Asia Pacific United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South Africa United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Uganda United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Middle East and Africa United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Guyana United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Suriname United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Falkland Islands United Arab Emirates Hybrid and Electric Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 28: United Arab Emirates Hybrid and Electric Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Hybrid and Electric Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the United Arab Emirates Hybrid and Electric Vehicles Market?

Key companies in the market include Bayerische Motoren Werke AG, Peugeot S A, Jaguar Land Rover Limited, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Volvo Car A, Tesla Inc, Porsche, Groupe Renault, Audi AG, Toyota Motor Corporation, Honda Motor Co Ltd.

3. What are the main segments of the United Arab Emirates Hybrid and Electric Vehicles Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

December 2023: Honda has launched e:NP1 Plus in 2023.December 2023: Toyota have a plan to spend $35bn to introduce 30 battery electric vehicle line-up by 2030.December 2023: Tesla has introduced the Software Version 11.0 with new user interface, games, updated navigation and many features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Hybrid and Electric Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Hybrid and Electric Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Hybrid and Electric Vehicles Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Hybrid and Electric Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence