Key Insights

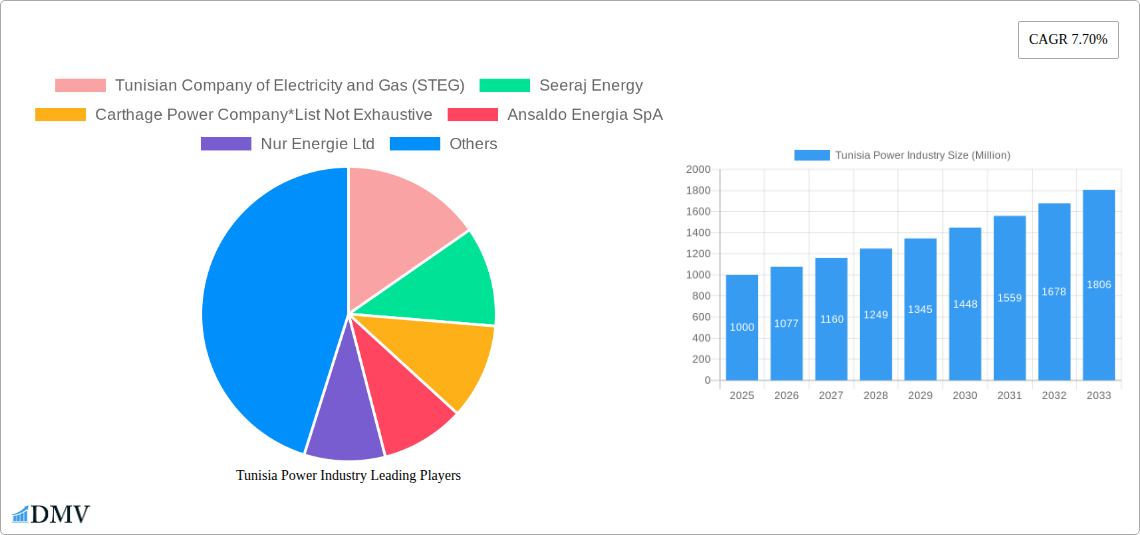

The Tunisian power industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.70% from 2025 to 2033. This expansion is driven by several key factors. Increasing energy demand fueled by population growth and economic development necessitates significant investments in power generation and distribution infrastructure. The Tunisian government's commitment to diversifying the energy mix, incorporating renewable sources like solar PV, is another crucial driver. Furthermore, the ongoing modernization of the national grid and improvements in energy efficiency are contributing to market expansion. However, challenges remain. Limited access to financing for renewable energy projects and potential regulatory hurdles could hinder growth. The reliance on fossil fuels for a significant portion of electricity generation also presents environmental concerns and price volatility risks. The market is segmented by technology, with solar PV, diesel gensets, natural gas gensets, microgrids, and other technologies competing for market share. Key players include STEG, Seeraj Energy, Carthage Power Company, Ansaldo Energia SpA, Nur Energie Ltd, and General Electric Company, although the market also features numerous smaller, local operators. Competition is intensifying, particularly within the renewable energy segment as international investors increasingly explore opportunities in Tunisia. The forecast period (2025-2033) will likely see a shift towards cleaner energy sources, driven by both governmental policies and increasing environmental awareness.

The success of the Tunisian power industry’s growth trajectory will heavily depend on the successful implementation of government initiatives supporting renewable energy adoption, along with attracting further foreign direct investment. The effectiveness of grid modernization efforts, coupled with managing the challenges of financing and regulatory frameworks, will determine the pace of this expansion. Overcoming these challenges will unlock the full potential of the Tunisian power market, leading to a more sustainable and reliable energy supply for the nation.

Tunisia Power Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Tunisian power industry, covering market trends, technological advancements, key players, and future growth prospects. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report encompasses a market size valuation of xx Million for 2025, projecting xx% CAGR during the forecast period, reaching xx Million by 2033. This in-depth analysis uses data from the historical period (2019-2024) to provide accurate forecasts and valuable insights.

Tunisia Power Industry Market Composition & Trends

The Tunisian power industry is characterized by a mix of state-owned entities and private players, leading to a moderately concentrated market. STEG, the Tunisian Company of Electricity and Gas, holds a significant market share, though the emergence of private companies like Seeraj Energy and Carthage Power Company is increasing competition. Innovation is driven by government initiatives promoting renewable energy adoption, particularly solar PV, while regulatory changes continuously shape the landscape. Substitute products are limited, primarily encompassing other energy sources like natural gas and diesel. The primary end-users are residential, commercial, and industrial sectors, with varying consumption patterns. M&A activity has been observed, with deal values ranging from xx Million to xx Million in recent years, primarily focusing on renewable energy projects.

- Market Share Distribution: STEG holds approximately xx% market share, with other players sharing the remaining xx%.

- M&A Deal Values (2019-2024): Averaging xx Million per deal.

- Innovation Catalysts: Government support for renewable energy, increasing energy demand.

- Regulatory Landscape: A mix of government regulation and private sector participation.

Tunisia Power Industry Industry Evolution

The Tunisian power industry has witnessed significant evolution driven by several factors. Market growth is influenced by increasing energy demand due to population growth and economic development. The adoption of renewable energy technologies, particularly solar PV, has accelerated due to government incentives and decreasing technology costs. This shift is visible in the increasing number of solar PV projects, exceeding previous projections. Growth in the forecast period (2025-2033) is expected to be primarily driven by further investment in renewables and upgrades to existing infrastructure. Consumer demand is also changing, with a growing preference for cleaner and more sustainable energy sources. This is reflected in the increasing consumer adoption of solar panels for residential purposes, although the uptake of more efficient energy-saving appliances remains limited at the residential level. The overall market exhibits an estimated growth rate of xx% annually from 2025.

Leading Regions, Countries, or Segments in Tunisia Power Industry

Within Tunisia's power sector, Solar PV technology is emerging as the leading segment. This growth is largely driven by abundant sunshine, government support through various subsidy programs, and declining costs of solar PV panels. Natural Gas Gensets maintain a significant share due to their established role in the national energy mix, but their expansion is expected to be gradual as the country transitions to renewables.

- Key Drivers for Solar PV Dominance:

- Favorable solar irradiance

- Government incentives and subsidies

- Decreasing technology costs

- International investments in renewable energy projects.

- Other Technologies: While Diesel Gensets and Microgrids play a supporting role, particularly in remote areas, their growth is constrained by the overall shift to cleaner energy sources and higher operational costs. The "Other Technologies" segment will include a small but growing share for wind energy.

Tunisia Power Industry Product Innovations

Recent innovations include advanced solar PV technologies with increased efficiency and durability, along with smart grid solutions to optimize energy distribution and consumption. These improvements aim to enhance energy security, reduce reliance on fossil fuels, and contribute to Tunisia's sustainability goals. Unique selling propositions focus on cost reduction, efficiency improvements, and integration with smart grid infrastructure.

Propelling Factors for Tunisia Power Industry Growth

Several factors are driving growth in the Tunisian power industry. Technological advancements in renewable energy are reducing costs and improving efficiency. Economic factors such as increasing industrialization and population growth contribute to higher energy demands. Moreover, supportive government policies, including incentives for renewable energy adoption and energy efficiency programs, further propel growth.

Obstacles in the Tunisia Power Industry Market

The Tunisian power industry faces several obstacles. Regulatory hurdles, including bureaucratic processes and permitting delays, can hinder project implementation. Supply chain disruptions, particularly in the procurement of essential equipment and materials, can impact project timelines and costs. Moreover, competition from established players and the need for significant investment in grid infrastructure pose challenges.

Future Opportunities in Tunisia Power Industry

Future opportunities include expansion of renewable energy capacity, especially solar and wind power. Smart grid technologies offer significant potential for improving energy efficiency and reliability. Further investment in storage solutions, particularly batteries, is necessary to address the intermittency of renewable energy sources. Finally, exploring opportunities in green hydrogen production presents a promising avenue for future growth.

Major Players in the Tunisia Power Industry Ecosystem

- Tunisian Company of Electricity and Gas (STEG)

- Seeraj Energy

- Carthage Power Company

- Ansaldo Energia SpA

- Nur Energie Ltd

- General Electric Company

Key Developments in Tunisia Power Industry Industry

- July 2020: STEG partnered with Qair for a 200kV floating photovoltaic solar farm pilot project on Lake Tunis.

- September 2020: Akuo Energy, HBG Holding, and Nour Energy signed a PPA with STEG for a 10 MWp solar plant in Gabès.

- May 2021: Nur Energie secured a contract to build a 10 MW solar PV park in Gabès Sudes.

Strategic Tunisia Power Industry Market Forecast

The Tunisian power industry is poised for significant growth, driven by increasing energy demand, government support for renewable energy, and technological advancements. The market's future potential lies in expanding renewable energy capacity, implementing smart grid technologies, and exploring new energy storage solutions. This will contribute to a more sustainable and reliable energy system for Tunisia.

Tunisia Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Tunisia Power Industry Segmentation By Geography

- 1. Tunisia

Tunisia Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries

- 3.3. Market Restrains

- 3.3.1. 4.; The Technology's Exorbitant Costs and Environmental Impacts

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tunisia Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Tunisia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seeraj Energy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carthage Power Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ansaldo Energia SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nur Energie Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Tunisian Company of Electricity and Gas (STEG)

List of Figures

- Figure 1: Tunisia Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Tunisia Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Tunisia Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Tunisia Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Tunisia Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Tunisia Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Tunisia Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Tunisia Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Tunisia Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Tunisia Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Tunisia Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Tunisia Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Tunisia Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Tunisia Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Tunisia Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Tunisia Power Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tunisia Power Industry?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the Tunisia Power Industry?

Key companies in the market include Tunisian Company of Electricity and Gas (STEG), Seeraj Energy, Carthage Power Company*List Not Exhaustive, Ansaldo Energia SpA, Nur Energie Ltd, General Electric Company.

3. What are the main segments of the Tunisia Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Energy Transition Toward Renewables4.; The Rollout of New Technologies in Many Developed Countries.

6. What are the notable trends driving market growth?

Conventional Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Technology's Exorbitant Costs and Environmental Impacts.

8. Can you provide examples of recent developments in the market?

In July 2020, the Société Tunisienne de l'Electricité et du Gaz (STEG) signed a partnership agreement with Qair to carry out a 200kV pilot project for a floating photovoltaic solar farm on the lake of Tunis and a study of the floating solar potential in Tunisia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tunisia Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tunisia Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tunisia Power Industry?

To stay informed about further developments, trends, and reports in the Tunisia Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence