Key Insights

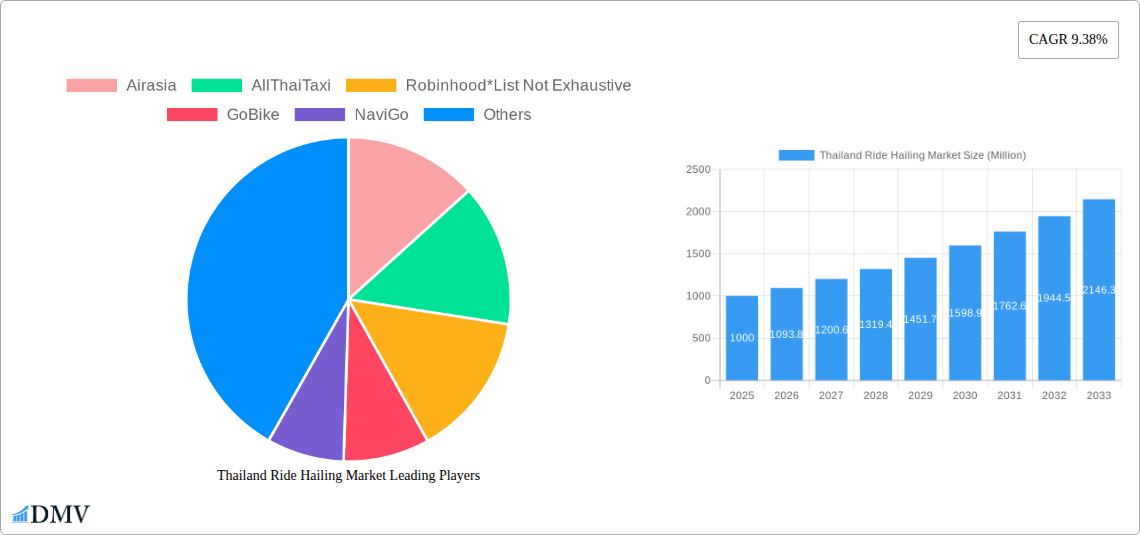

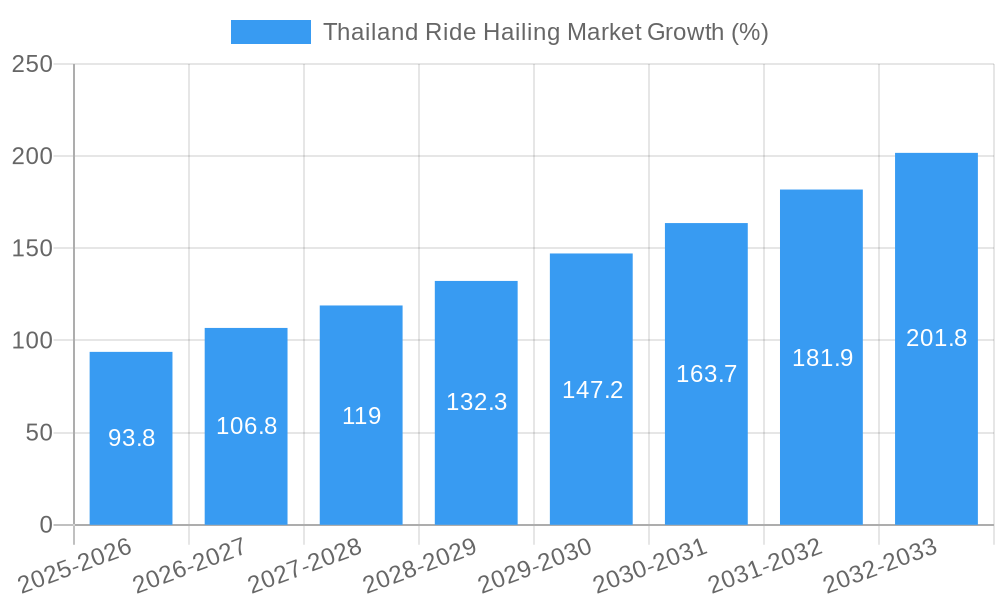

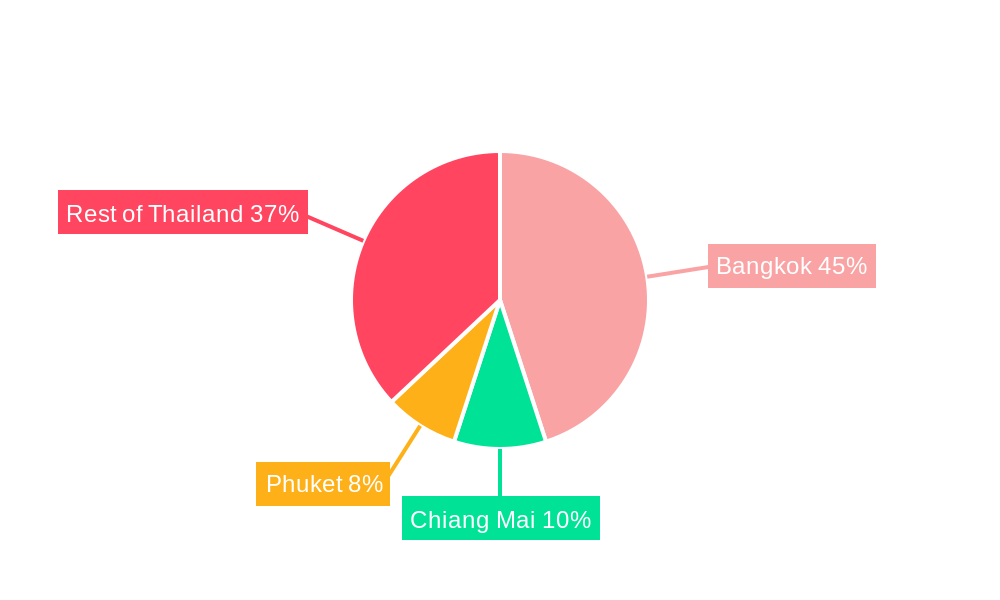

The Thailand ride-hailing market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 9.38% from 2025 to 2033. This expansion is fueled by several key factors. Increasing urbanization and a burgeoning middle class are driving demand for convenient and affordable transportation alternatives. Smartphone penetration and readily available internet access have significantly boosted the adoption of online booking platforms, contributing to the market's rapid growth. Furthermore, the expansion of tourism in Thailand further fuels the demand for ride-hailing services, particularly in major cities like Bangkok, Chiang Mai, and Phuket. The market is segmented by vehicle type (two-wheelers, passenger cars), booking type (online, offline), and end-use (personal, commercial), offering diverse service options to cater to varied consumer needs. Competition is fierce amongst established players like Grab Holdings Inc., Bolt, and local operators such as Airasia and AllThaiTaxi, each vying for market share through innovative features and competitive pricing strategies. However, regulatory challenges and infrastructure limitations pose potential restraints on market expansion. Future growth will likely be influenced by advancements in technology, such as autonomous vehicles, and government initiatives promoting sustainable transportation.

The dominance of online booking reflects the preference for ease and efficiency among Thai consumers. The passenger car segment is expected to remain the largest share of the market due to factors such as safety and comfort. However, the two-wheeler segment, particularly motorbike taxis, will maintain a significant presence due to their affordability and suitability for navigating congested city streets. The commercial segment is likely to grow considerably driven by business needs for efficient logistics and employee transportation. Going forward, the market's success will depend on addressing infrastructure gaps, developing sustainable practices, and fostering a regulatory environment that supports innovation and fair competition. The integration of technological advancements and efficient customer service will be crucial for companies to maintain a competitive edge in this rapidly evolving market.

Thailand Ride Hailing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Thailand ride-hailing market, encompassing historical data (2019-2024), the base year (2025), and a comprehensive forecast (2025-2033). It offers invaluable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth opportunities within this rapidly evolving sector. The report utilizes data-driven analysis to identify key players, lucrative segments, and potential challenges, providing a crucial foundation for strategic decision-making. The total market value in 2025 is estimated at XXX Million, with projections reaching XXX Million by 2033.

Thailand Ride Hailing Market Composition & Trends

This section dissects the competitive landscape of the Thailand ride-hailing market, examining market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. We analyze market share distribution amongst key players like Grab Holdings Inc, Bolt, GoBike, NaviGo, AllThaiTaxi, and Airasia, revealing the degree of market concentration. The report explores the impact of regulatory changes on market growth and the influence of technological innovations, such as the integration of AI and GPS technology, on the user experience and service efficiency. Analysis of substitute transportation options, including public transport and personal vehicles, helps determine the market's resilience and long-term growth potential.

- Market Share Distribution (2025): Grab Holdings Inc. (XX%), Bolt (XX%), GoBike (XX%), Others (XX%). (Note: Exact figures are dependent on final data analysis.)

- M&A Activity (2019-2024): A total of XX M&A deals valued at approximately XXX Million were recorded during this period, with details of each significant transaction included in the full report.

- End-User Segmentation: Detailed breakdown of personal vs. commercial usage, highlighting growth trends within each segment.

- Innovation Catalysts: Analysis of technological advancements driving market evolution.

- Regulatory Landscape: A comprehensive overview of the legal and regulatory environment influencing the market.

Thailand Ride Hailing Market Industry Evolution

This section details the evolution of the Thailand ride-hailing market from 2019 to 2033, focusing on market growth trajectories, technological advancements, and evolving consumer preferences. We present historical growth rates and project future growth based on macroeconomic indicators, technological developments, and evolving consumer habits. We examine the adoption rate of online booking platforms compared to traditional offline methods and discuss the role of technological advancements in enhancing convenience, safety, and overall user satisfaction. The impact of increasing smartphone penetration and internet accessibility on market growth is also investigated. The influence of external factors such as fluctuating fuel prices and economic cycles is also considered. The report includes detailed data on the growth rate of the two-wheeler and passenger car segments.

The expected Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at XX%.

Leading Regions, Countries, or Segments in Thailand Ride Hailing Market

This section identifies the dominant segments within the Thailand ride-hailing market, analyzing factors driving their success. We investigate the leading regions in terms of market size and growth potential across different segments (Vehicle Type: Two-Wheeler, Passenger Car; Booking Type: Online, Offline; End-Use: Personal, Commercial).

Key Drivers:

- Bangkok and Metropolitan Areas: High population density, increasing urbanization, and high disposable incomes contribute to significant demand for ride-hailing services.

- Online Booking: Convenience, transparency, and ease of payment make online booking the dominant method.

- Passenger Cars: This segment is larger due to the greater carrying capacity and suitability for longer distances and larger groups.

- Personal Use: This segment constitutes a larger portion of the market due to higher demand from commuters, tourists, and individual users.

Dominance Factors:

[Detailed paragraph analysis explaining the factors contributing to the dominance of the identified leading regions, countries, or segments, including investment trends, government regulations, and infrastructural development.]

Thailand Ride Hailing Market Product Innovations

The Thailand ride-hailing market is witnessing continuous product innovation, focusing on enhancing user experience and service efficiency. New features like in-app payment systems, real-time tracking, fare estimations, and safety features are becoming increasingly common. The integration of artificial intelligence (AI) and machine learning (ML) algorithms helps optimize routes, predict demand, and improve pricing models. The emergence of ride-sharing options and electric vehicle integration adds to the range of services. These innovations cater to evolving consumer preferences for convenience, safety, and sustainability.

Propelling Factors for Thailand Ride Hailing Market Growth

Several factors are driving the growth of the Thailand ride-hailing market. Increasing urbanization leads to higher demand for convenient and efficient transportation solutions. The rising adoption of smartphones and internet access fuels the growth of online booking platforms, leading to greater convenience and accessibility. Favorable government regulations supporting the growth of the technology sector further boost the market. Finally, technological advancements, particularly in navigation and payment systems, enhance user experience.

Obstacles in the Thailand Ride-Hailing Market

Challenges facing the Thailand ride-hailing market include stringent regulatory frameworks, which can impose restrictions on operations and increase compliance costs. The high dependence on fuel prices can significantly impact profitability, and intense competition amongst existing and emerging players keeps margins tight. Supply chain disruptions relating to vehicle maintenance and repair can impact service availability.

Future Opportunities in Thailand Ride Hailing Market

Future opportunities lie in expanding into underserved areas, developing specialized services (e.g., delivery, tourism), and incorporating green technologies such as electric vehicles. The integration of ride-hailing services with other platforms creates opportunities for synergy and expanded service offerings. The growing demand for efficient and environmentally friendly transport options creates space for expansion.

Major Players in the Thailand Ride Hailing Market Ecosystem

- Airasia

- AllThaiTaxi

- Robinhood

- GoBike

- NaviGo

- Bolt

- Grab Holdings Inc

Key Developments in Thailand Ride Hailing Market Industry

- June 2022: Google and Robinhood announced the joint development of a Super App for Thailand, incorporating ride-hailing services.

- June 2022: AirAsia launched its ride-hailing service in Thailand.

Strategic Thailand Ride Hailing Market Forecast

The Thailand ride-hailing market is poised for substantial growth, driven by technological advancements, increasing smartphone penetration, and favorable regulatory policies. The market's expansion into less-served areas and the integration of innovative services will continue to fuel growth in the coming years. The projected growth rate of XX% CAGR from 2025 to 2033 reflects this positive outlook.

Thailand Ride Hailing Market Segmentation

-

1. Vehicle Type

- 1.1. Two-Wheeler

- 1.2. Passenger Car

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. End-Use

- 3.1. Personal

- 3.2. Commercial

Thailand Ride Hailing Market Segmentation By Geography

- 1. Thailand

Thailand Ride Hailing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry is Expected to Boost the Boat Rental Service Market

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Governmental Policies May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Online Booking to Gain Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Ride Hailing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-Wheeler

- 5.1.2. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End-Use

- 5.3.1. Personal

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Airasia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AllThaiTaxi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robinhood*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GoBike

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NaviGo

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolt

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grab Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Airasia

List of Figures

- Figure 1: Thailand Ride Hailing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Ride Hailing Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Ride Hailing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Ride Hailing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Thailand Ride Hailing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 4: Thailand Ride Hailing Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 5: Thailand Ride Hailing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Ride Hailing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Thailand Ride Hailing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Thailand Ride Hailing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 9: Thailand Ride Hailing Market Revenue Million Forecast, by End-Use 2019 & 2032

- Table 10: Thailand Ride Hailing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Ride Hailing Market?

The projected CAGR is approximately 9.38%.

2. Which companies are prominent players in the Thailand Ride Hailing Market?

Key companies in the market include Airasia, AllThaiTaxi, Robinhood*List Not Exhaustive, GoBike, NaviGo, Bolt, Grab Holdings Inc.

3. What are the main segments of the Thailand Ride Hailing Market?

The market segments include Vehicle Type, Booking Type, End-Use.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry is Expected to Boost the Boat Rental Service Market.

6. What are the notable trends driving market growth?

Online Booking to Gain Traction.

7. Are there any restraints impacting market growth?

Environmental Regulations and Governmental Policies May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

June 2022- Google and Robinhood announced the joint development of a Super App for Thailand customers. The app will offer several services under one platform, including food delivery, ride-hailing, payments, travel booking, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Ride Hailing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Ride Hailing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Ride Hailing Market?

To stay informed about further developments, trends, and reports in the Thailand Ride Hailing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence