Key Insights

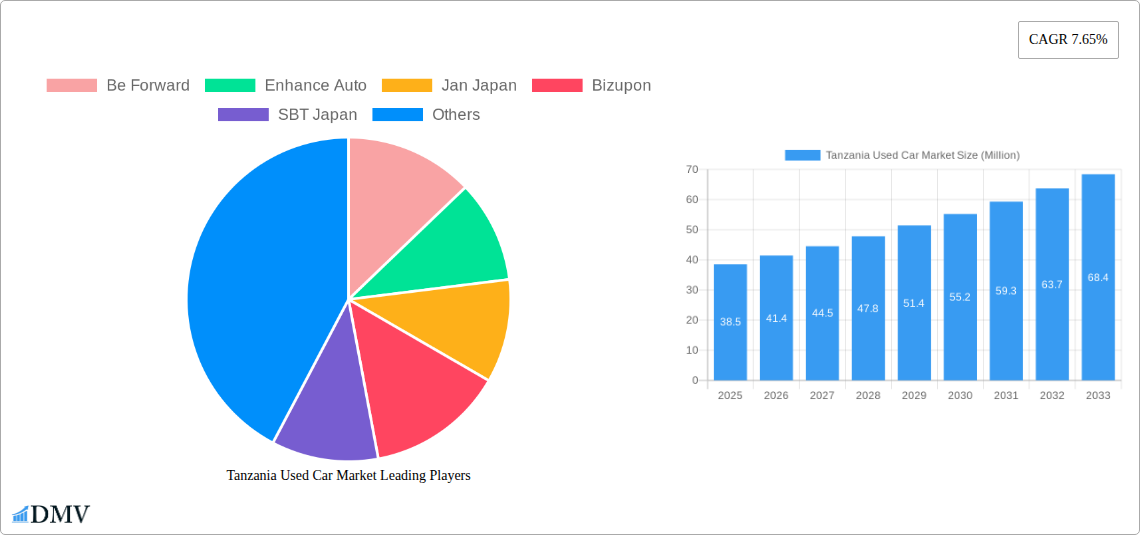

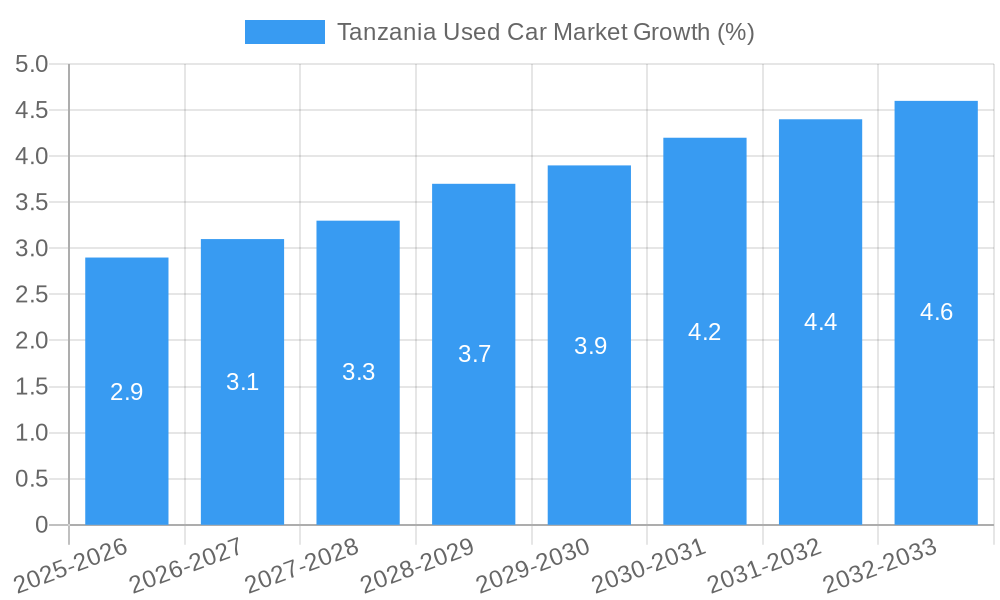

The Tanzania used car market, valued at $38.5 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.65% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes within Tanzania are increasing affordability, driving demand for personal vehicles. The relatively underdeveloped public transportation system in many areas further boosts the necessity of personal car ownership. Furthermore, the availability of diverse vehicle types—hatchbacks, sedans, SUVs/MPVs—through both organized and unorganized sales channels (online and offline) caters to a wide range of consumer needs and budgets. The market also shows a shift towards fuel efficiency, with growing interest in petrol and diesel vehicles alongside a nascent but expanding market for electric vehicles and alternative fuel types like LPG and CNG. This reflects a broader global trend toward environmentally conscious choices and potential government incentives promoting cleaner energy vehicles in the future. Competition among established players like Be Forward, Enhance Auto, and Jan Japan, alongside numerous local vendors, ensures a dynamic market landscape.

However, challenges persist. The unorganized sector, while a significant part of the market, often lacks transparency and standardized quality checks. This can lead to issues with vehicle reliability and consumer trust. Infrastructure limitations, particularly in rural areas, may hinder the expansion of online sales channels and the growth of electric vehicle adoption. Fluctuations in global used car prices and import regulations also present potential market volatility. To maximize growth opportunities, increased regulatory oversight of the unorganized sector and government investments in charging infrastructure for electric vehicles will be crucial. Furthermore, promoting financial solutions like car loans can enhance affordability and drive sales further. Addressing these challenges strategically can propel the Tanzania used car market to significant expansion in the coming years.

Tanzania Used Car Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Tanzania used car market, encompassing historical data (2019-2024), current market estimations (2025), and future projections (2025-2033). The study unveils market dynamics, competitive landscapes, and growth opportunities within this burgeoning sector. Key players like Be Forward, Enhance Auto, and SBT Japan are profiled, alongside an examination of market segments by vehicle type, vendor type, fuel type, and sales channel. Discover the impact of significant industry developments and unlock the potential of this dynamic market. The report is invaluable for investors, industry participants, and anyone seeking to understand the complexities and future of Tanzania's used car market. The market is estimated to be worth xx Million in 2025.

Tanzania Used Car Market Market Composition & Trends

This section delves into the current state of the Tanzania used car market, examining market concentration, innovation, regulations, substitute products, end-user profiles, and merger and acquisition (M&A) activity. The report leverages extensive data analysis to paint a comprehensive picture of the market landscape.

Market Concentration & Share Distribution:

- The market is characterized by a mix of organized and unorganized players. Organized players such as Be Forward, Jiji, and CarTanzania hold a significant market share (estimated at xx%), while unorganized players account for the remaining xx%. Precise market share for individual players remains unavailable, and further research is required to get this data.

Innovation Catalysts:

- The increasing adoption of online sales channels (e.g., Jiji, CarTanzania) and the integration of technology in vehicle inspection and valuation drive innovation. The entry of new players with innovative business models continues to shape the market.

Regulatory Landscape:

- Government regulations regarding vehicle imports, taxation, and environmental standards significantly impact market dynamics. The report analyzes the current regulatory landscape and its potential future implications.

Substitute Products:

- Public transportation and the availability of new vehicles act as substitute products. The report analyzes the competitive pressure and market substitution in different segments.

End-User Profiles:

- The target audience comprises private individuals, businesses, and rental companies, each having unique needs and purchasing behaviors. The report provides insights into the profile and purchasing habits of the typical used car buyer in Tanzania.

M&A Activities:

- While precise deal values remain unavailable for recent M&A activities in the Tanzanian used car market, the report notes an increase in consolidation among online platforms and the potential for future acquisitions. This consolidation has been estimated at xx Million.

Tanzania Used Car Market Industry Evolution

This section examines the historical and projected growth trajectories of the Tanzania used car market, technological advancements, and evolving consumer preferences, providing a deep dive into the market's evolution.

The Tanzanian used car market has witnessed substantial growth over the past few years, driven by increasing vehicle demand, rising disposable incomes, and the growing popularity of online marketplaces. From 2019 to 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, reaching an estimated value of xx Million in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), with the market value reaching xx Million by 2033. Several technological advancements have influenced this growth. The rise of online platforms has revolutionized how used cars are bought and sold, offering greater transparency and convenience. The adoption of mobile technology for online transactions and vehicle inspections has further enhanced the user experience. Moreover, changing consumer preferences play a significant role in market dynamics. The increasing demand for fuel-efficient vehicles (especially petrol and diesel) and a growing preference for SUVs and MPVs are influencing market trends. These trends are expected to drive future growth, although the availability of electric vehicles remains limited.

Leading Regions, Countries, or Segments in Tanzania Used Car Market

This section identifies the dominant regions, countries, or segments within the Tanzania used car market, examining key factors driving their dominance.

By Vehicle Type:

SUVs/MPVs: This segment holds the largest market share due to increased demand from families and businesses, leading to higher sales volume. This is driven by their perceived utility and adaptability to Tanzanian road conditions.

Sedans: This segment experiences moderate growth due to its affordability and relatively low maintenance costs.

Hatchbacks: This segment maintains a stable but relatively smaller market share compared to SUVs/MPVs and Sedans.

By Vendor Type:

Organized: Organized vendors benefit from established brand reputation, wider reach through online platforms and better after-sales service. This segment holds a larger market share because of established infrastructure and a broader customer base.

Unorganized: Unorganized vendors operate with lower overhead costs and often offer lower prices, attracting price-sensitive buyers. This segment faces increased scrutiny regarding vehicle quality and trustworthiness.

By Fuel Type:

Petrol: Petrol-powered vehicles constitute the largest segment due to established infrastructure and affordability.

Diesel: Diesel vehicles hold a notable market share due to their fuel efficiency and lower running costs, making them attractive to businesses and individuals.

Electric: The electric vehicle segment is still nascent, with limited adoption due to high initial costs, range anxiety, and a lack of charging infrastructure.

Other Fuel Types (LPG, CNG, etc.): This segment remains marginal in the overall market.

By Sales Channel:

Online: Online sales channels show significant growth and are projected to dominate the market further owing to their convenience, wider reach, and enhanced transparency compared to offline channels.

Offline: Offline channels retain some market share among consumers who prefer direct interaction with sellers before purchase.

Tanzania Used Car Market Product Innovations

The Tanzania used car market has witnessed a gradual incorporation of technological advancements and product innovations, including the introduction of online marketplaces for improved transparency and ease of purchase. Digital vehicle history reports enhance consumer trust and confidence. Innovative financing options and extended warranties are also being introduced by key players to cater to different customer segments. The expansion of online sales channels allows for larger customer reach, ultimately driving market growth.

Propelling Factors for Tanzania Used Car Market Growth

Several factors drive the growth of the Tanzania used car market. Rising disposable incomes are making vehicle ownership more accessible, boosting demand. Urbanization and population growth also contribute. Government initiatives focused on infrastructure development improve road networks, facilitating vehicle use.

Obstacles in the Tanzania Used Car Market Market

Challenges remain within the market. Stricter import regulations increase costs and create supply chain bottlenecks. The lack of readily available, reliable financing options limits affordability for many. Competition among online and offline players also intensifies price wars, impacting profitability.

Future Opportunities in Tanzania Used Car Market

Future opportunities lie in expanding into less-penetrated rural markets. The increasing adoption of online sales channels presents further growth potential. Government support for sustainable and efficient transportation could spur the uptake of electric or hybrid vehicles. Investment in efficient and accessible financing options is also crucial for further market expansion.

Major Players in the Tanzania Used Car Market Ecosystem

- Be Forward

- Enhance Auto

- Jan Japan

- Bizupon

- SBT Japan

- Jiji

- CarTanzania

- SBI Motor Japan

- Car Junction Tanzania

- UsedCars.co.tz

- Garipesa

- Autorod

Key Developments in Tanzania Used Car Market Industry

- June 2021: SBT Japan expands into the C2C segment.

- November 2022: Dar es Salaam port sees a 316% increase in vehicle imports from Zimbabwe (2016-2022), reaching an estimated 15,000 vehicles annually.

Strategic Tanzania Used Car Market Market Forecast

The Tanzania used car market is poised for continued growth, driven by increasing affordability, improved infrastructure, and the expansion of online sales channels. The market's evolution towards greater transparency and better consumer protection through technological advancements creates a robust and promising future, particularly in the online sales segment. The long-term forecast anticipates steady growth, potentially exceeding xx Million in annual market value by 2033.

Tanzania Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Tanzania Used Car Market Segmentation By Geography

- 1. Tanzania

Tanzania Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Fuel Prices to Hinder the Demand for Used Cars

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tanzania Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Tanzania

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Be Forward

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enhance Auto

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jan Japan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bizupon

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SBT Japan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jiji

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CarTanzania

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SBI Motor Japa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Car Junction Tanzania

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 UsedCars co tz

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Garipesa

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Autorod

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Be Forward

List of Figures

- Figure 1: Tanzania Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Tanzania Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Tanzania Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Tanzania Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Tanzania Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Tanzania Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Tanzania Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 6: Tanzania Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Tanzania Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Tanzania Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 9: Tanzania Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 10: Tanzania Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 11: Tanzania Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 12: Tanzania Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tanzania Used Car Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Tanzania Used Car Market?

Key companies in the market include Be Forward, Enhance Auto, Jan Japan, Bizupon, SBT Japan, Jiji, CarTanzania, SBI Motor Japa, Car Junction Tanzania, UsedCars co tz, Garipesa, Autorod.

3. What are the main segments of the Tanzania Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Increasing Fuel Prices to Hinder the Demand for Used Cars.

8. Can you provide examples of recent developments in the market?

November 2022: The Dar Es Salaam port in Tanzania witnessed a remarkable annual increase of 316% in the importation of both new and used vehicles by Zimbabweans in 2022, compared to the figures recorded in 2016. As of November 2022, it was estimated that approximately 15,000 vehicles were being imported annually by Zimbabweans through this port, a significant surge from the mere 3,600 vehicles in 2016. This substantial shift in preference towards Dar Es Salaam port for shipments by Zimbabwe's used car dealers can be attributed to challenges in the South African ports' logistical operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tanzania Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tanzania Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tanzania Used Car Market?

To stay informed about further developments, trends, and reports in the Tanzania Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence