Key Insights

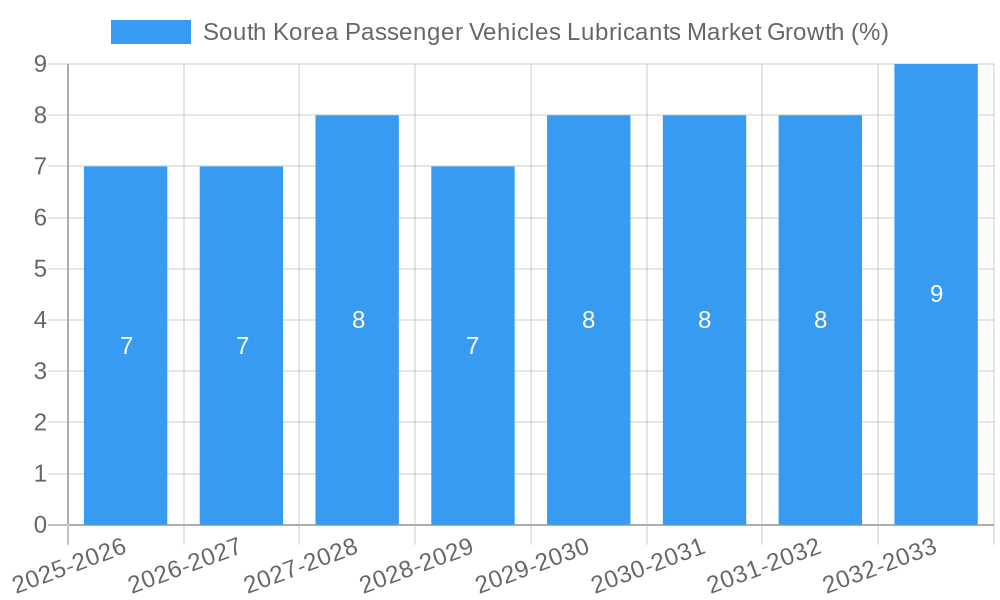

The South Korea passenger vehicle lubricants market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. This growth is fueled by a rising number of passenger vehicles on the road, increasing demand for higher-quality lubricants to meet stringent emission standards, and a growing preference for synthetic lubricants offering enhanced performance and engine protection. Key market drivers include the expansion of the automotive industry, government regulations promoting fuel efficiency, and increasing consumer awareness of the importance of regular lubricant changes for vehicle longevity. The market is segmented by product type, encompassing engine oils, greases, hydraulic fluids, and transmission & gear oils, with engine oils holding the largest market share due to their frequent replacement needs. Leading players like ExxonMobil, GS Caltex, and SK Lubricants are actively competing through product innovation, brand building, and strategic partnerships to cater to the evolving needs of the South Korean passenger vehicle market.

However, market growth faces certain restraints. Fluctuations in crude oil prices directly impact lubricant pricing, affecting consumer demand. Furthermore, the increasing adoption of electric vehicles (EVs) presents a long-term challenge, albeit a gradual one, as the demand for conventional lubricants is expected to decline. Despite this, the market is expected to witness strong growth in specialized lubricants for hybrid vehicles, creating new opportunities for lubricant manufacturers. Technological advancements leading to the development of energy-efficient lubricants are also shaping market trends, with a growing preference for eco-friendly and sustainable options. The South Korean market's robust automotive sector, coupled with a focus on technological advancement, will contribute to sustained growth of the passenger vehicle lubricants market throughout the forecast period.

South Korea Passenger Vehicles Lubricants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the South Korea passenger vehicles lubricants market, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and lucrative investment opportunities. Spanning the period from 2019 to 2033, with 2025 as the base year, this comprehensive study meticulously examines market size, growth drivers, challenges, and future prospects. The market is expected to reach xx Million by 2033.

South Korea Passenger Vehicles Lubricants Market Market Composition & Trends

The South Korea passenger vehicles lubricants market exhibits a moderately concentrated landscape, with key players like ExxonMobil Corporation, GS Caltex, and SK Lubricants Co Ltd holding significant market share. However, the market is also witnessing increased competition from both domestic and international players. Innovation is a key driver, with companies focusing on developing lubricants tailored to the specific needs of modern engines, including those with advanced technologies like hybrid and electric vehicles. The regulatory environment, including emission standards and environmental regulations, significantly influences product development and market trends. Substitute products, while limited, pose a degree of competition. The end-user profile is largely comprised of automobile manufacturers, workshops, and individual consumers. M&A activity within the sector has been relatively low in recent years, with deal values averaging xx Million per transaction over the historical period (2019-2024).

- Market Share Distribution (2024): ExxonMobil (15%), GS Caltex (12%), SK Lubricants (10%), Others (63%).

- Average M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Stringent emission norms, demand for fuel efficiency, and the rise of electric vehicles.

- Regulatory Landscape: Focus on environmental protection and product safety standards.

South Korea Passenger Vehicles Lubricants Market Industry Evolution

The South Korean passenger vehicles lubricants market has experienced a steady growth trajectory over the historical period (2019-2024), driven by a growing automotive sector and increasing vehicle ownership. The market is witnessing substantial technological advancements, with a shift towards higher-performance, energy-efficient lubricants. Consumer demand is also evolving, with a growing preference for environmentally friendly and longer-lasting products. The annual growth rate (CAGR) during the historical period was approximately xx%, and is projected to remain healthy at xx% during the forecast period (2025-2033), driven by factors such as increasing vehicle production and the growing adoption of advanced engine technologies. Technological advancements, such as the introduction of synthetic and semi-synthetic lubricants, are significantly improving product performance and extending the lifespan of engines. Moreover, the increasing demand for specialized lubricants for electric vehicles is creating new growth opportunities.

Leading Regions, Countries, or Segments in South Korea Passenger Vehicles Lubricants Market

The Engine Oils segment dominates the South Korea passenger vehicles lubricants market, accounting for approximately xx% of the total market value in 2024. This dominance is primarily attributed to the high demand for engine oils from the vast number of passenger vehicles on the road.

- Key Drivers for Engine Oil Segment Dominance:

- High vehicle ownership and usage rates.

- Regular oil change requirements for optimal engine performance.

- Continuous innovation in engine oil formulations to meet evolving engine technologies.

- Stringent government regulations promoting higher-quality engine oils.

- In-depth Analysis: The continuous advancement in engine technology, coupled with increased consumer awareness of the importance of regular oil changes for optimum engine performance, has fuelled the dominance of the engine oil segment. The stringent emission standards implemented by the South Korean government have also pushed for the adoption of higher-quality engine oils which further strengthens the segment's leadership position.

South Korea Passenger Vehicles Lubricants Market Product Innovations

Recent innovations include the development of lubricants specifically formulated for hybrid and electric vehicles (EVs), focusing on thermal stability and extended lifespan. Manufacturers are increasingly incorporating advanced additive technologies to enhance fuel efficiency, reduce emissions, and improve engine protection. The unique selling propositions of these new products often include superior performance characteristics, such as reduced friction and enhanced wear protection, contributing to longer engine lifespan and improved fuel economy. These advancements underscore the market's commitment to sustainability and technological progress.

Propelling Factors for South Korea Passenger Vehicles Lubricants Market Growth

The South Korea passenger vehicles lubricants market is experiencing robust growth propelled by a number of factors. The burgeoning automotive industry, with consistently high vehicle production and sales, directly fuels demand for lubricants. Economic growth and rising disposable incomes are also contributing to increased vehicle ownership, further boosting market demand. Additionally, stringent government regulations on emission standards incentivize the adoption of high-performance, eco-friendly lubricants.

Obstacles in the South Korea Passenger Vehicles Lubricants Market Market

Challenges for the market include volatile crude oil prices, which impact raw material costs and pricing strategies. Supply chain disruptions, especially those associated with global events, can lead to temporary shortages and price fluctuations. Intense competition among numerous domestic and international players necessitates continuous innovation and differentiation strategies to maintain market share.

Future Opportunities in South Korea Passenger Vehicles Lubricants Market

Future opportunities lie in the expanding EV market, requiring specialized lubricants. The development of sustainable and biodegradable lubricants presents a significant avenue for growth, aligning with environmental concerns. Furthermore, increasing focus on preventative maintenance and extended drain intervals is creating demand for higher-performance, longer-lasting lubricants.

Major Players in the South Korea Passenger Vehicles Lubricants Market Ecosystem

- ExxonMobil Corporation

- MICHANG OIL IND CO LTD

- GS Caltex

- BP PLC (Castrol)

- Motul

- Royal Dutch Shell Plc

- Hyundai Oilbank

- AMSOIL Inc

- SK Lubricants Co Lt

- S-Oil Corporation

Key Developments in South Korea Passenger Vehicles Lubricants Market Industry

- August 2021: GS Caltex's lubricant brand, Kixx, introduced a new line of engine oils, Kixx G1 SP, to meet the latest API requirements and provide modern-day engines with the latest technology.

- August 2021: Renault Samsung Motors launched Castrol synthetic engine oil designed specifically for Renault engines, sold at a discount at 439 Renault Samsung Motors after-sales service (AS) locations nationwide.

- November 2021: S-OIL introduced SEVEN electric vehicle lubricants in South Korea, signifying a strategic move into the growing EV market.

Strategic South Korea Passenger Vehicles Lubricants Market Market Forecast

The South Korea passenger vehicles lubricants market is poised for continued growth, driven by the sustained expansion of the automotive sector, increasing vehicle ownership, and the growing adoption of advanced engine technologies. The market's focus on innovation and the emergence of new product categories, such as EV lubricants, will further contribute to its expansion. The market is expected to witness significant growth driven by the increasing demand for high-performance and eco-friendly lubricants.

South Korea Passenger Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

South Korea Passenger Vehicles Lubricants Market Segmentation By Geography

- 1. South Korea

South Korea Passenger Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants

- 3.3. Market Restrains

- 3.3.1. Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Passenger Vehicles Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MICHANG OIL IND CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GS Caltex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BP PLC (Castrol)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Motul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Oilbank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AMSOIL Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SK Lubricants Co Lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 S-Oil Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: South Korea Passenger Vehicles Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Passenger Vehicles Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2019 & 2032

- Table 5: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Region 2019 & 2032

- Table 7: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Country 2019 & 2032

- Table 9: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Product Type 2019 & 2032

- Table 11: South Korea Passenger Vehicles Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Korea Passenger Vehicles Lubricants Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Passenger Vehicles Lubricants Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the South Korea Passenger Vehicles Lubricants Market?

Key companies in the market include ExxonMobil Corporation, MICHANG OIL IND CO LTD, GS Caltex, BP PLC (Castrol), Motul, Royal Dutch Shell Plc, Hyundai Oilbank, AMSOIL Inc, SK Lubricants Co Lt, S-Oil Corporation.

3. What are the main segments of the South Korea Passenger Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automotive Production and Sales; Increasing Adoption of High-performance Lubricants.

6. What are the notable trends driving market growth?

Largest Segment By Product Type : <span style="font-family: 'regular_bold';color:#0e7db3;">Engine Oils</span>.

7. Are there any restraints impacting market growth?

Extended Drain Intervals; Modest Impact of Electric Vehicles (EVs) in the Future.

8. Can you provide examples of recent developments in the market?

November 2021: S-OIL introduced SEVEN electric vehicle lubricants in South Korea.August 2021: Renault Samsung Motors launched Castrol synthetic engine oil designed specifically for Renault engines, to be sold at a discount at 439 Renault Samsung Motors after-sales service (AS) locations across the country.August 2021: GS Caltex's lubricant brand, Kixx, introduced a new line of engine oils, Kixx G1 SP, to meet the latest API requirements and provide modern-day engines with the latest technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Passenger Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Passenger Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Passenger Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the South Korea Passenger Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence