Key Insights

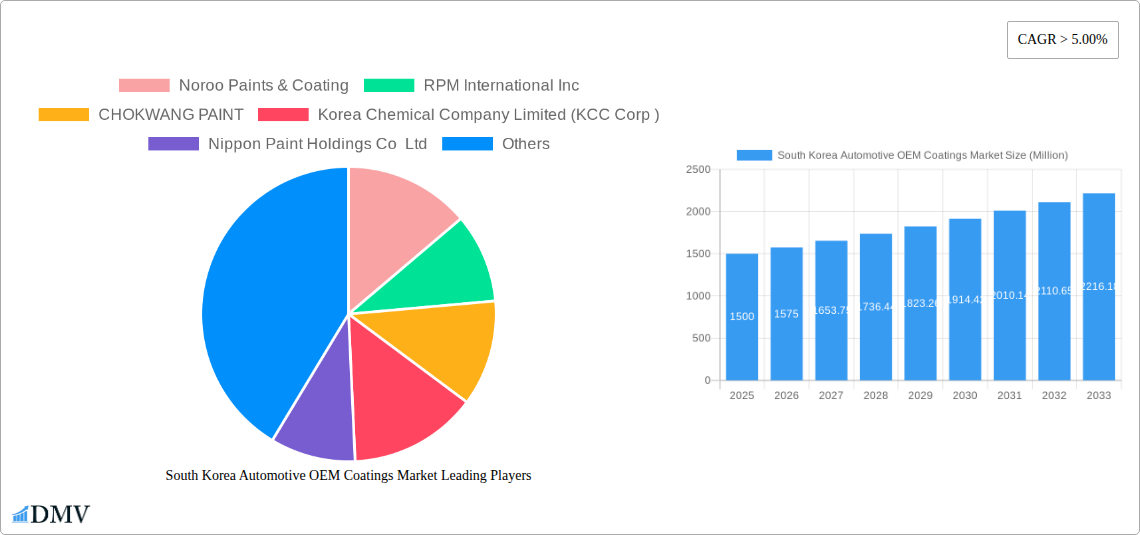

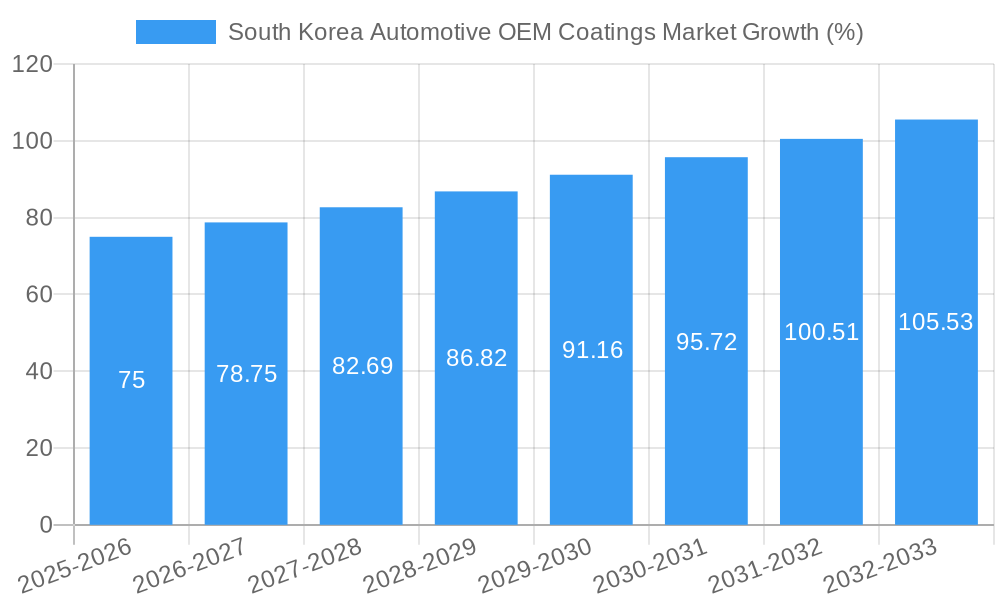

The South Korea automotive OEM coatings market is experiencing robust growth, driven by the country's significant automotive manufacturing sector and increasing demand for high-quality, durable finishes. With a Compound Annual Growth Rate (CAGR) exceeding 5% and a market size in the millions (exact figures unavailable but estimated to be substantial given the context), this sector presents lucrative opportunities for both established players and emerging companies. Key drivers include the rising production of passenger and commercial vehicles, advancements in coating technologies like water-borne and electrocoat solutions, and a growing emphasis on aesthetics and performance in automotive design. The market is segmented by resin type (acrylic, alkyd, epoxy, polyurethane, polyester, and others), layer (e-coat, primer, base coat, clear coat), technology (water-borne, solvent-borne, electrocoat, powder coatings), and application (passenger vehicles, commercial vehicles, and aftermarket coatings). The shift towards environmentally friendly water-borne coatings is a significant trend, aligning with global sustainability initiatives. However, fluctuating raw material prices and stringent environmental regulations pose challenges to market growth. Leading players like Noroo Paints & Coating, RPM International Inc., and KCC Corp. are leveraging technological innovation and strategic partnerships to maintain their competitive edge. The forecast period (2025-2033) indicates continued expansion, fueled by increasing vehicle production and the adoption of advanced coating technologies.

The competitive landscape is characterized by both domestic and international players vying for market share. The dominance of established players reflects their extensive experience, strong distribution networks, and technological capabilities. Nevertheless, smaller, innovative companies are actively participating, especially in niche segments such as specialized coatings for electric vehicles. Future growth will hinge on the successful integration of sustainable practices, technological breakthroughs in coating performance, and the adaptation to changing consumer preferences in vehicle aesthetics and functionality. The South Korean government's initiatives to support the automotive industry also contribute positively to market expansion. A comprehensive understanding of these factors is crucial for stakeholders looking to capitalize on the evolving dynamics of this thriving market.

South Korea Automotive OEM Coatings Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the South Korea automotive OEM coatings market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The market is segmented by resin type (Acrylic, Alkyd, Epoxy, Polyurethane, Polyester, Other Resins), layer (E-Coat, Primer, Base Coat, Clear Coat), technology (Water-Borne, Solvent-Borne, Electrocoat, Powder Coatings), and application (Passenger Vehicles, Commercial Vehicles, ACE). Key players analyzed include Noroo Paints & Coating, RPM International Inc, CHOKWANG PAINT, Korea Chemical Company Limited (KCC Corp), Nippon Paint Holdings Co Ltd, BASF SE, Axalta Coating Systems, Akzo Nobel N V, Samhwa Paint Industrial Co, PPG Industries, Covestro AG, and Kansai Paint Co Ltd. The report projects a market value of XX Million by 2033.

South Korea Automotive OEM Coatings Market Composition & Trends

The South Korean automotive OEM coatings market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Noroo Paints & Coating and KCC Corp are expected to hold the largest shares in 2025, collectively accounting for approximately XX% of the market. However, increasing competition from global players like BASF and Nippon Paint is driving market dynamics. Innovation is largely driven by the demand for eco-friendly water-borne coatings and advancements in high-performance coatings enhancing scratch resistance and durability. Stringent environmental regulations in South Korea are pushing the adoption of sustainable technologies, further shaping market trends. Substitute products, such as powder coatings, are gaining traction due to their cost-effectiveness and environmental benefits. The end-user profile comprises major automotive OEMs and their associated tier-one suppliers. M&A activity remains relatively low but is anticipated to increase as companies seek to expand their market share and technological capabilities. Deal values for recent M&A activities in this sector averaged approximately XX Million.

- Market Concentration: Moderately concentrated, with top players holding XX% market share in 2025.

- Innovation Catalysts: Demand for eco-friendly coatings, high-performance characteristics, and cost reduction.

- Regulatory Landscape: Stringent environmental regulations promoting sustainable solutions.

- Substitute Products: Powder coatings gaining traction.

- End-User Profile: Major automotive OEMs and their suppliers.

- M&A Activity: Low but projected to increase, with average deal values at XX Million.

South Korea Automotive OEM Coatings Market Industry Evolution

The South Korean automotive OEM coatings market has witnessed substantial growth over the past five years, driven by a combination of factors. The automotive industry's expansion, particularly in the electric vehicle (EV) sector, has created significant demand for specialized coatings. Technological advancements, such as the increased adoption of water-borne coatings, have significantly improved environmental performance and reduced volatile organic compound (VOC) emissions, aligning with stricter environmental regulations. Consumer demand for high-quality, durable finishes continues to fuel innovation in coating technology, pushing manufacturers to develop coatings with enhanced scratch resistance, UV protection, and color stability. The market experienced a compound annual growth rate (CAGR) of approximately XX% from 2019 to 2024, and this growth is projected to continue, though at a slightly moderated pace, during the forecast period. The adoption rate of water-borne coatings has increased by XX% since 2019, reflecting the industry’s commitment to sustainability. The increasing prevalence of EVs also drives the need for coatings that can withstand the specific requirements of electric vehicle batteries and components, driving growth in specialized segments.

Leading Regions, Countries, or Segments in South Korea Automotive OEM Coatings Market

The South Korean automotive OEM coatings market is largely concentrated within the country itself, with Seoul and Gyeonggi-do regions housing the majority of automotive manufacturing facilities and related industries. This regional concentration is mainly due to the high density of automotive OEMs and their supply chains within these areas.

Key Drivers:

- High Concentration of Automotive OEMs: A large number of automotive manufacturers are based in South Korea, creating high demand for coatings.

- Government Support for the Automotive Industry: Government initiatives promoting domestic manufacturing and technological advancement in the automotive sector provide indirect support for the coatings industry.

- Strong Export Market: South Korea's automotive industry has a significant export market, contributing to the demand for high-quality coatings that meet international standards.

Dominance Factors:

The dominance of the domestic market is primarily fueled by the robust automotive manufacturing sector in South Korea. This sector's strength translates to increased demand for high-quality coatings. The concentration of automotive production facilities within specific regions further contributes to regional dominance. Significant investments in research and development by coating manufacturers to meet the specific needs of the Korean automotive industry contribute to market leadership.

Segment Analysis:

Among segments, the polyurethane resin segment shows the largest market share, attributed to its superior performance and durability in automotive applications. Within the layer segment, base coat holds the highest market share, reflecting the increasing demand for aesthetically pleasing and high-quality vehicle finishes. Water-borne technology is the fastest-growing segment, propelled by environmental concerns and regulatory pressure. Finally, passenger vehicles constitute the largest application segment, owing to the relatively higher volume of passenger car production in the country compared to commercial vehicles.

South Korea Automotive OEM Coatings Market Product Innovations

Recent product innovations in the South Korean automotive OEM coatings market focus on enhancing sustainability, performance, and aesthetics. Manufacturers are introducing advanced water-borne coatings with improved durability and reduced VOC emissions, meeting stringent environmental regulations. High-performance coatings with enhanced scratch and UV resistance are gaining prominence, satisfying growing consumer demands for longer-lasting vehicle finishes. Innovative color technologies provide wider color palettes and enhanced metallic or pearlescent effects, boosting vehicle aesthetics. The development of specialized coatings for electric vehicle components reflects the rapidly expanding EV market.

Propelling Factors for South Korea Automotive OEM Coatings Market Growth

Several factors are driving growth in the South Korean automotive OEM coatings market. Firstly, the expansion of the domestic automotive industry, with a particular focus on electric vehicles, is creating substantial demand for specialized coatings. Secondly, stringent environmental regulations are encouraging the adoption of eco-friendly water-borne coatings, boosting the market's growth. Thirdly, increasing consumer preference for high-quality, durable finishes is pushing innovation in coating technology. Finally, government support for the automotive industry provides indirect but significant impetus to the coatings sector.

Obstacles in the South Korea Automotive OEM Coatings Market

Challenges facing the market include volatile raw material prices impacting production costs, potential supply chain disruptions impacting timely delivery, and increasing competition from both domestic and international players. Stringent environmental regulations, while driving innovation, also add to compliance costs. Economic downturns can significantly reduce demand from automotive manufacturers. These factors can collectively impact profitability and constrain market expansion.

Future Opportunities in South Korea Automotive OEM Coatings Market

Future opportunities lie in the expansion of the electric vehicle market, creating demand for specialized coatings that can protect EV batteries and other components. Advances in coating technology, including self-healing coatings and coatings with embedded sensors, offer significant potential. Exploring new market segments, such as the automotive aftermarket, can further expand market reach. Lastly, focusing on sustainable and eco-friendly coating solutions will remain crucial for long-term success.

Major Players in the South Korea Automotive OEM Coatings Market Ecosystem

- Noroo Paints & Coating

- RPM International Inc

- CHOKWANG PAINT

- Korea Chemical Company Limited (KCC Corp)

- Nippon Paint Holdings Co Ltd

- BASF SE

- Axalta Coating Systems

- Akzo Nobel N V

- Samhwa Paint Industrial Co

- PPG Industries

- Covestro AG

- Kansai Paint Co Ltd

Key Developments in South Korea Automotive OEM Coatings Market Industry

- 2024 Q4: KCC Corp announced the launch of a new water-borne coating with enhanced scratch resistance.

- 2023 Q3: Noroo Paints & Coating partnered with a leading chemical supplier to develop sustainable coating solutions.

- 2022 Q2: BASF SE invested in a new manufacturing facility in South Korea to expand its production capacity.

- 2021 Q1: Axalta Coating Systems acquired a smaller domestic coating company, bolstering its market share. (Note: Specific dates and details may need verification)

Strategic South Korea Automotive OEM Coatings Market Forecast

The South Korea automotive OEM coatings market is poised for continued growth, driven by the expansion of the automotive industry, particularly electric vehicles, and the increasing demand for high-performance, eco-friendly coatings. Opportunities lie in technological innovation, such as the development of specialized coatings for EV components, and meeting the growing demand for sustainable solutions. The market’s overall growth trajectory is expected to be positive, albeit potentially affected by economic fluctuations and global supply chain dynamics. The forecast predicts a steady increase in market size and value over the next decade, with the potential for significant growth in niche segments like coatings for EV batteries and autonomous driving systems.

South Korea Automotive OEM Coatings Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Epoxy

- 1.4. Polyurethane

- 1.5. Polyester

- 1.6. Other Resins

-

2. Layer

- 2.1. E-Coat

- 2.2. Pirmer

- 2.3. Base Coat

- 2.4. Clear Coat

-

3. Technology

- 3.1. Water-Borne

- 3.2. Solvent-Borne

- 3.3. Electrocoat

- 3.4. Powder Coatings

-

4. Application

- 4.1. Passenger Vehicles

- 4.2. Commercial Vehicles

- 4.3. ACE

South Korea Automotive OEM Coatings Market Segmentation By Geography

- 1. South Korea

South Korea Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the demand for Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies

- 3.4. Market Trends

- 3.4.1. Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Epoxy

- 5.1.4. Polyurethane

- 5.1.5. Polyester

- 5.1.6. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by Layer

- 5.2.1. E-Coat

- 5.2.2. Pirmer

- 5.2.3. Base Coat

- 5.2.4. Clear Coat

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Water-Borne

- 5.3.2. Solvent-Borne

- 5.3.3. Electrocoat

- 5.3.4. Powder Coatings

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Passenger Vehicles

- 5.4.2. Commercial Vehicles

- 5.4.3. ACE

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Noroo Paints & Coating

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPM International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CHOKWANG PAINT

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korea Chemical Company Limited (KCC Corp )

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BASF SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Axalta Coating Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Akzo Nobel N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samhwa Paint Industrial Co*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PPG Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Covestro AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Paint Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Noroo Paints & Coating

List of Figures

- Figure 1: South Korea Automotive OEM Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Automotive OEM Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2019 & 2032

- Table 3: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 4: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2019 & 2032

- Table 5: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 6: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2019 & 2032

- Table 7: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2019 & 2032

- Table 9: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2019 & 2032

- Table 11: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Region 2019 & 2032

- Table 13: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2019 & 2032

- Table 15: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 16: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Resin 2019 & 2032

- Table 17: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Layer 2019 & 2032

- Table 18: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Layer 2019 & 2032

- Table 19: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Technology 2019 & 2032

- Table 21: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Application 2019 & 2032

- Table 23: South Korea Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: South Korea Automotive OEM Coatings Market Volume Kilo Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Automotive OEM Coatings Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the South Korea Automotive OEM Coatings Market?

Key companies in the market include Noroo Paints & Coating, RPM International Inc, CHOKWANG PAINT, Korea Chemical Company Limited (KCC Corp ), Nippon Paint Holdings Co Ltd, BASF SE, Axalta Coating Systems, Akzo Nobel N V, Samhwa Paint Industrial Co*List Not Exhaustive, PPG Industries, Covestro AG, Kansai Paint Co Ltd.

3. What are the main segments of the South Korea Automotive OEM Coatings Market?

The market segments include Resin, Layer, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the demand for Electric Vehicles.

6. What are the notable trends driving market growth?

Passenger Cars Are Expected To Drive The Automotive OEM Coatings Market.

7. Are there any restraints impacting market growth?

Decreasing in the production of Automotive vehicles; Increasing costs of Raw material used in automotive coatings; Stringent VOC Regulations Set By The Governing Bodies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kilo Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the South Korea Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence