Key Insights

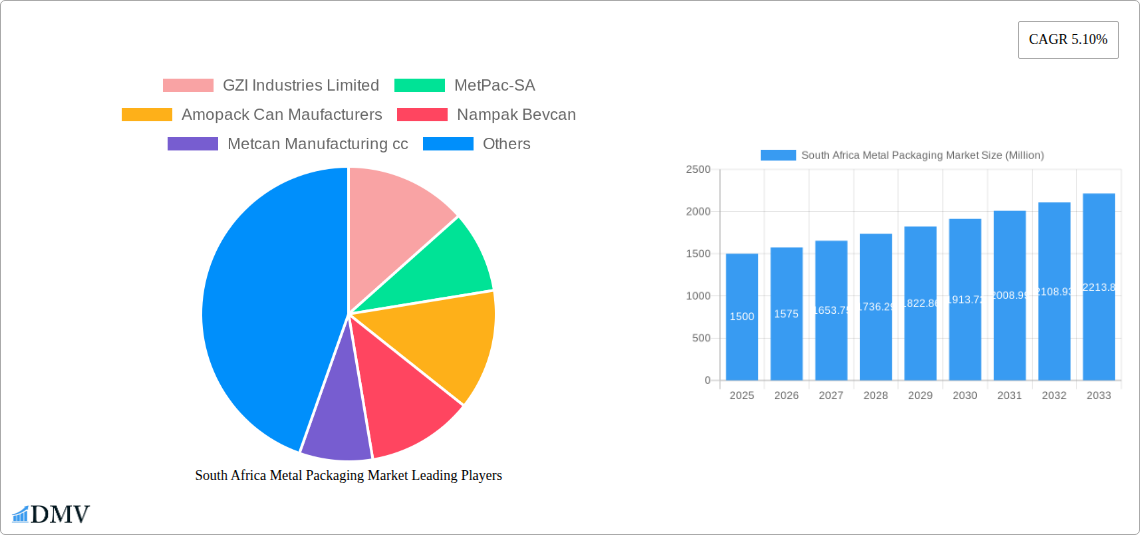

The South African metal packaging market, while part of a larger GCC and African landscape, exhibits unique growth characteristics. Driven by increasing demand from the food and beverage sector, particularly for canned goods and beverages, the market is projected to experience steady expansion. A CAGR of 5.10% (as observed for the broader region) suggests a healthy growth trajectory, albeit potentially influenced by factors specific to South Africa. The prevalence of established players like Hulamin Limited and Nampak Bevcan indicates a competitive but consolidated market structure. However, smaller players and new entrants might find opportunities in niche segments or by focusing on sustainable and innovative packaging solutions. Growth is likely to be further fueled by rising disposable incomes and changing consumer preferences, particularly a shift towards convenient and shelf-stable food products. The pharmaceutical and medical sectors also present significant opportunities, with a growing demand for secure and tamper-evident metal packaging. Challenges might include fluctuations in raw material prices (primarily metal), environmental regulations promoting sustainable packaging alternatives, and competition from other packaging materials like plastic and paper. The market's future will be shaped by successful adaptations to these challenges, investments in advanced manufacturing technologies, and the adoption of environmentally friendly practices.

The South African metal packaging market's segmentation offers insights into its diverse nature. The "Bags and Pouches" segment, though possibly smaller than "Films and Wraps," will likely benefit from growth in the food and personal care sectors. The dominance of established players suggests a relatively mature market, yet innovation in material types (exploring lighter-weight metals or metal alloys) and product design will remain critical for continued growth. Geographic concentration within South Africa itself will influence regional variations in market size and growth, with urban centers likely exhibiting higher demand than rural areas. Government policies regarding waste management and recycling will also significantly impact the market's trajectory, potentially incentivizing the adoption of recyclable and sustainable metal packaging solutions and influencing overall market size estimations. A deeper analysis of specific sub-segments (e.g., aluminum vs. steel cans) within the food and beverage industry would provide a more granular understanding of market dynamics.

South Africa Metal Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the South Africa metal packaging market, offering a detailed overview of its current state, future trends, and growth potential from 2019 to 2033. The study meticulously examines market dynamics, competitive landscapes, and key industry developments, equipping stakeholders with actionable intelligence for informed decision-making. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for businesses seeking to navigate and capitalize on opportunities within this dynamic sector. The market value is estimated to reach xx Million by 2025.

South Africa Metal Packaging Market Composition & Trends

This section delves into the intricate structure of the South Africa metal packaging market, offering a granular view of its composition and prevailing trends. We analyze market concentration, identifying key players and their respective market shares. The report further explores innovation drivers, including technological advancements and evolving consumer preferences. The regulatory landscape and its impact on market participants are meticulously examined, along with a detailed analysis of substitute products and their competitive threat. The study also includes an assessment of end-user profiles across various sectors and a review of significant M&A activities, including deal values and their implications for the market.

- Market Share Distribution: Nampak Bevcan holds a significant market share, estimated at xx%, followed by GZI Industries Limited with approximately xx%. Other players like MetPac-SA, Amopack Can Manufacturers, and Hulamin Limited collectively account for xx%.

- M&A Activity: The report details significant mergers and acquisitions within the South Africa metal packaging market during the historical period (2019-2024), including deal values where available. For example, xx Million deal between [Company A] and [Company B] (if applicable).

- Innovation Catalysts: Growing demand for sustainable packaging solutions drives innovation towards recyclable and lightweight metal packaging.

- Regulatory Landscape: The report analyzes the influence of relevant South African regulations on the metal packaging industry, including environmental standards and labeling requirements.

- Substitute Products: The competitive threat from alternative packaging materials such as plastic and paper is assessed in detail.

South Africa Metal Packaging Market Industry Evolution

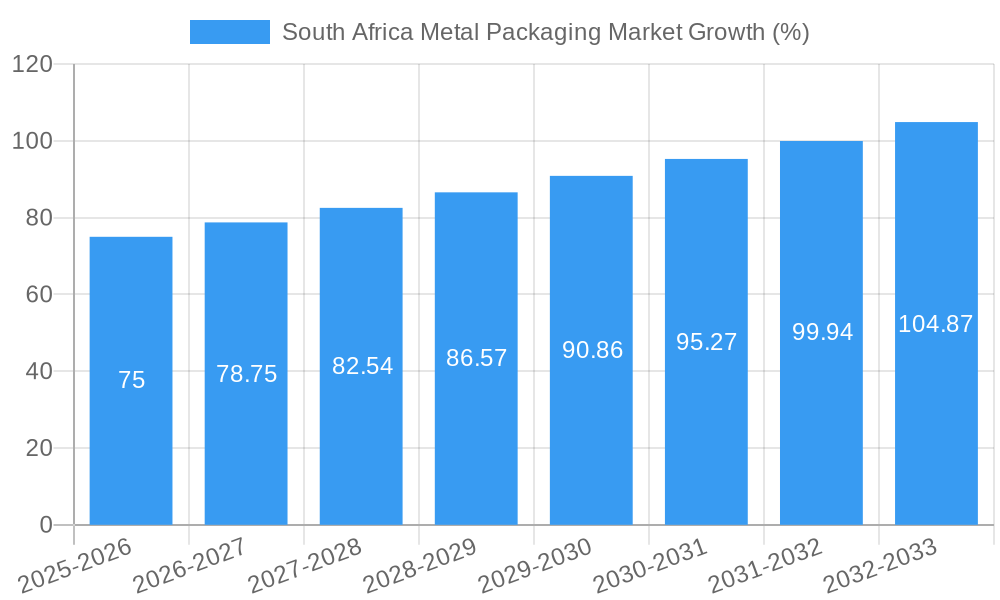

This section provides a detailed chronological analysis of the South Africa metal packaging market's evolution, encompassing market growth trajectories, technological advancements, and shifting consumer demands throughout the study period (2019-2033). We present specific data points like compound annual growth rates (CAGR) and adoption metrics for key technologies. Factors influencing market growth, including economic shifts, changing consumption patterns, and technological disruptions, are analyzed in detail. The impact of these factors on market size and segmentation is also assessed. Growth is expected to be driven by the increasing demand for canned food and beverages, and the growing adoption of sustainable packaging practices. The market is anticipated to witness a CAGR of xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in South Africa Metal Packaging Market

This section identifies and analyzes the dominant regions, countries, and segments within the South Africa metal packaging market. The analysis encompasses different segments:

- By Material Type: Metal packaging dominates this market segment, driven by its durability, recyclability, and suitability for various applications.

- By Product Type: Cans constitute a significant portion of the market, followed by other metal containers and closures.

- By End-user Industry: The food and beverage industry is the primary driver of demand, with significant contribution from the pharmaceutical and medical sectors.

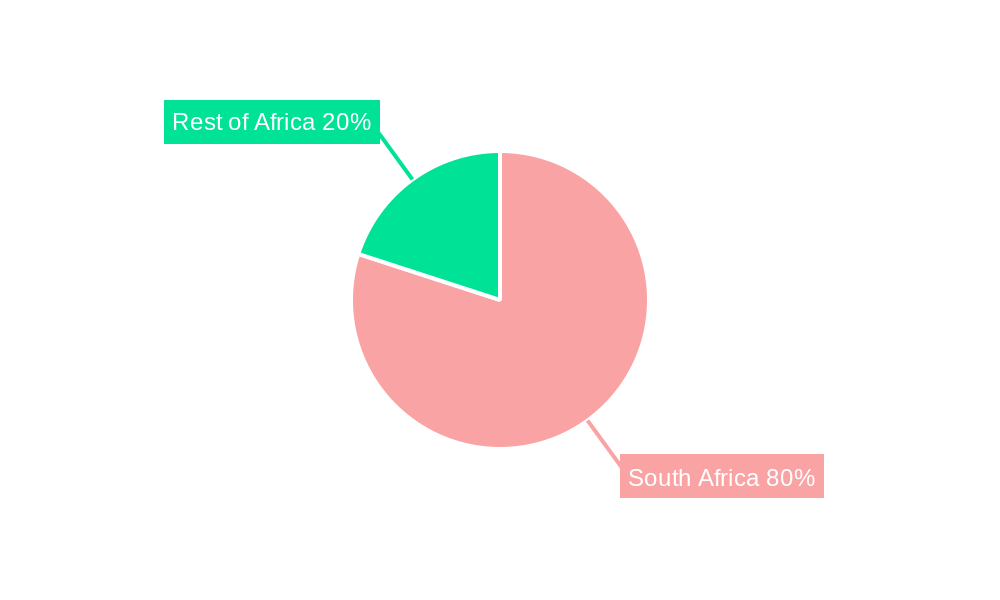

- By Country: The domestic South African market constitutes the largest segment.

Key Drivers:

- Investment Trends: Increased investment in advanced manufacturing technologies and sustainable packaging solutions.

- Regulatory Support: Government policies promoting sustainable packaging and recycling initiatives.

The dominance of these segments is explained through detailed analysis of factors driving growth, such as consumer preferences, industrial demand, and regulatory frameworks.

South Africa Metal Packaging Market Product Innovations

Recent innovations in South Africa's metal packaging sector focus on enhancing sustainability and functionality. This includes the development of lightweight, recyclable cans, improved coatings for extended shelf life, and innovative designs for enhanced product presentation. These innovations target specific end-user needs, focusing on improved functionality, convenience, and environmental responsibility. The use of advanced printing techniques for enhanced branding is another notable trend.

Propelling Factors for South Africa Metal Packaging Market Growth

Several factors are driving the growth of the South Africa metal packaging market. Strong economic growth in South Africa fuels increased consumer spending on packaged goods. Technological advancements in packaging materials and manufacturing processes lead to improved efficiency and sustainability. Furthermore, favorable government regulations promoting recycling and sustainable packaging practices contribute significantly to market expansion.

Obstacles in the South Africa Metal Packaging Market

The South Africa metal packaging market faces challenges such as fluctuating raw material prices, particularly for metal, which impacts production costs. Supply chain disruptions, potentially due to geopolitical events or logistical issues, can cause delays and affect production output. Intense competition from other packaging materials like plastics and paper also presents a significant challenge. These factors can influence market growth and profitability.

Future Opportunities in South Africa Metal Packaging Market

The South Africa metal packaging market presents significant future opportunities. Growing demand for convenient and sustainable packaging will drive growth across diverse sectors. The rising popularity of e-commerce further enhances market potential, as metal packaging provides excellent protection for online delivery of various goods. Innovations in packaging materials and designs will open new avenues for customization and value addition.

Major Players in the South Africa Metal Packaging Market Ecosystem

- GZI Industries Limited

- MetPac-SA

- Amopack Can Manufacturers

- Nampak Bevcan

- Metcan Manufacturing cc

- Hulamin Limited

- Ardgh Group S.A.

- Can-It

Key Developments in South Africa Metal Packaging Market Industry

- December 2022: Increased sales of canned fish (Lucky Star brand) by Oceana, driven by strong consumer demand, resulted in an 11% sales increase to SAR 8.44 Billion (USD 480 Million) and a 4% increase in operating profit to SAR 1.25 Billion (USD 71 Million).

- November 2022: South African canned fruit sales increased due to bumper shipments, capitalizing on a poor harvest in Greece.

Strategic South Africa Metal Packaging Market Forecast

The South Africa metal packaging market is poised for sustained growth driven by increasing demand from various sectors, advancements in sustainable packaging solutions, and favorable economic conditions. Strong growth is anticipated throughout the forecast period, with significant opportunities arising from emerging consumer trends and technological innovations. The market’s continued expansion hinges on addressing current challenges, including mitigating the impact of fluctuating raw material prices and strengthening supply chain resilience.

South Africa Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Metal Packaging Market Segmentation By Geography

- 1. South Africa

South Africa Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Food and Baverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Metal Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 GZI Industries Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 MetPac-SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Amopack Can Maufacturers

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nampak Bevcan

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Metcan Manufacturing cc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hulamin Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ardgh Group S

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Can It

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 GZI Industries Limited

List of Figures

- Figure 1: South Africa Metal Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Metal Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Metal Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Metal Packaging Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: South Africa Metal Packaging Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: South Africa Metal Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: South Africa Metal Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: South Africa Metal Packaging Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: South Africa Metal Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Metal Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa South Africa Metal Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: South Africa Metal Packaging Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: South Africa Metal Packaging Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: South Africa Metal Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: South Africa Metal Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: South Africa Metal Packaging Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: South Africa Metal Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Metal Packaging Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the South Africa Metal Packaging Market?

Key companies in the market include GZI Industries Limited, MetPac-SA, Amopack Can Maufacturers, Nampak Bevcan, Metcan Manufacturing cc, Hulamin Limited, Ardgh Group S, Can It.

3. What are the main segments of the South Africa Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Growing Food and Baverage Industry.

7. Are there any restraints impacting market growth?

Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Sales at Oceana, which owns the canned fish brand Lucky Star, have increased in South Africa. The strong demand for canned fish enabled a lift of Oceana's sales by double digits in the second part of the year. Sales for the global fishing company rose 11% to SAR 8.44 billion (USD 480 million), with operating profit rising 4% to SAR 1.25 billion (USD 71.0 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Metal Packaging Market?

To stay informed about further developments, trends, and reports in the South Africa Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence