Key Insights

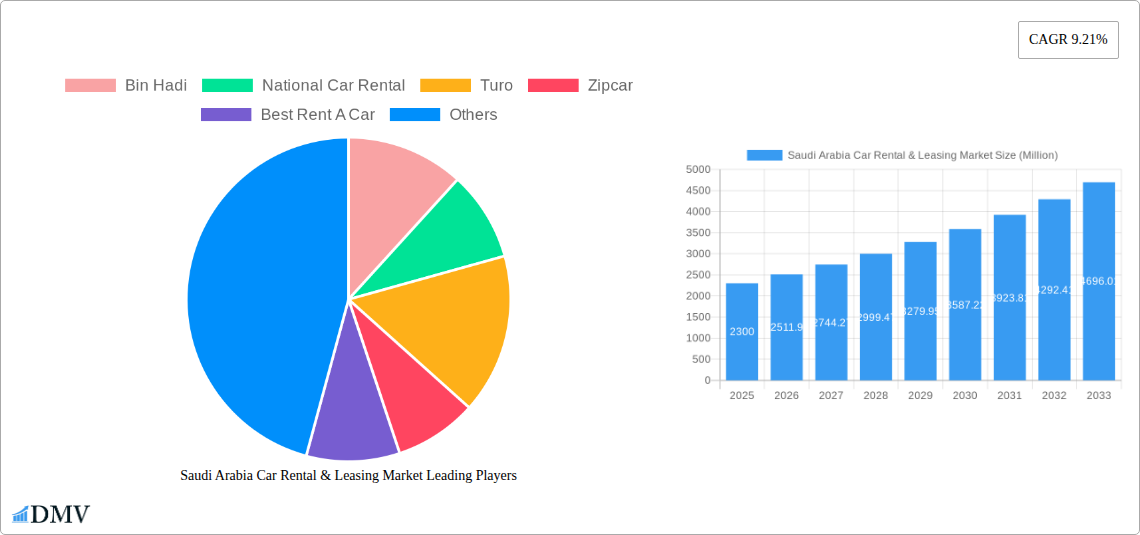

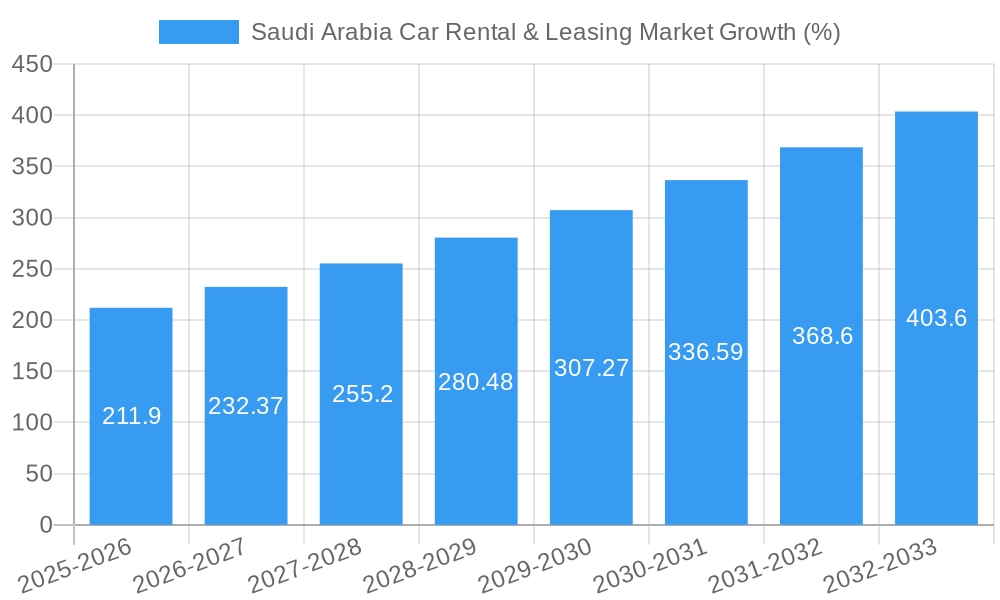

The Saudi Arabian car rental and leasing market is experiencing robust growth, projected to reach a market size of $2.30 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 9.21% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning tourism sector, coupled with increasing disposable incomes and a young, rapidly growing population, significantly boosts demand for rental vehicles. Furthermore, the government's Vision 2030 initiative, focused on diversifying the economy and promoting tourism, is creating a favorable environment for the car rental industry. The increasing preference for short-term rentals, driven by convenience and flexibility, contributes to market dynamism. Technological advancements, such as online booking platforms and mobile applications, are streamlining the rental process and enhancing customer experience, further accelerating market growth. The market segmentation, encompassing diverse vehicle types (economy to luxury, hatchbacks to SUVs), rental durations (short-term and long-term), and booking methods (online and offline), caters to a wide range of consumer needs. Competition among established players like Hertz, Avis, and local firms like Bin Hadi and Theeb Rent A Car is intense, pushing innovation and service improvement.

However, the market also faces certain challenges. Fluctuations in oil prices, as a primary driver of the Saudi Arabian economy, can impact consumer spending and, subsequently, the demand for rental vehicles. Government regulations and licensing requirements can pose operational hurdles for companies. The rising costs of vehicle maintenance and insurance can affect profitability. Furthermore, the market's dependence on tourism necessitates effective management of seasonal fluctuations in demand. Despite these constraints, the overall outlook for the Saudi Arabian car rental and leasing market remains positive, with continued growth predicted throughout the forecast period. The strategic adaptation of companies to market trends and technological advancements will be crucial to sustain competitiveness and capitalize on future opportunities.

Saudi Arabia Car Rental & Leasing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia car rental and leasing market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand this dynamic market. From market sizing and segmentation to key players and future trends, this report equips you with the knowledge necessary to make informed business decisions. The Saudi Arabia car rental and leasing market is experiencing significant growth, driven by factors such as increasing tourism, infrastructure development, and a burgeoning young population. This report delves deep into these trends and their implications for the industry's future.

Saudi Arabia Car Rental & Leasing Market Market Composition & Trends

The Saudi Arabia car rental and leasing market exhibits a moderately concentrated structure, with several large players alongside numerous smaller operators. Market share distribution varies significantly across segments, with larger firms dominating the long-term leasing and premium vehicle categories. Innovation is driven by technological advancements in online booking platforms, fleet management systems, and the adoption of electric vehicles. The regulatory landscape, while evolving, generally supports market growth. Substitute products, such as ride-hailing services, are presenting competition, particularly in the short-term rental segment. The end-user profile is diverse, encompassing individual consumers, businesses, and government entities. Mergers and acquisitions (M&A) activity is moderate, with deals primarily focused on expanding fleet size and geographical reach. The total M&A deal value for the period 2019-2024 is estimated at xx Million USD.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Catalysts: Technological advancements in booking, fleet management, and EV adoption.

- Regulatory Landscape: Supportive of market growth, with ongoing evolution.

- Substitute Products: Ride-hailing services pose a competitive challenge.

- End-User Profile: Diverse, including individuals, businesses, and government.

- M&A Activity: Moderate, focused on expansion and market share.

Saudi Arabia Car Rental & Leasing Market Industry Evolution

The Saudi Arabia car rental and leasing market has shown consistent growth from 2019 to 2024, with an average annual growth rate (AAGR) of xx%. This positive trajectory is expected to continue throughout the forecast period (2025-2033), driven by several factors. The increasing adoption of online booking platforms and mobile applications has significantly enhanced customer convenience and streamlined the rental process. Technological advancements in vehicle telematics and fleet management solutions have optimized operational efficiency and improved cost management for rental companies. Consumer preferences are shifting towards premium and luxury vehicles, particularly among younger demographics and high-net-worth individuals. The expansion of the tourism sector and investments in infrastructure projects further contribute to the growth of the market, leading to a significant increase in demand for car rentals and leases. The introduction of electric and hybrid vehicles is also gaining traction, albeit slowly, within the rental market, spurred by government initiatives promoting sustainable transportation. The market is witnessing increased competition, with both established players and new entrants vying for market share, leading to increased innovation and competitive pricing. The overall trend points towards a continued expansion of the market, although the rate of growth might fluctuate year on year depending on economic conditions and government policies.

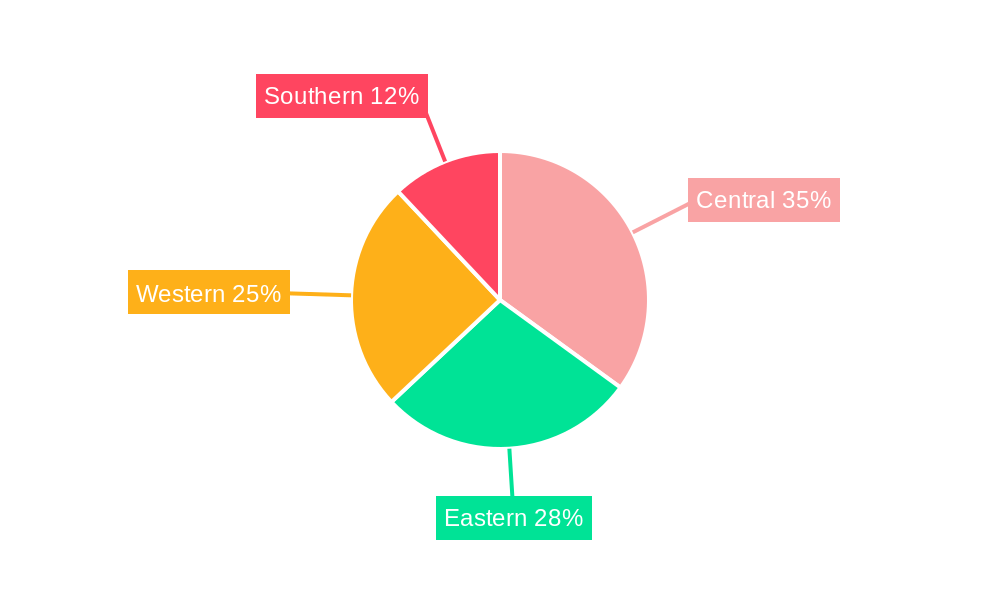

Leading Regions, Countries, or Segments in Saudi Arabia Car Rental & Leasing Market

The Saudi Arabia car rental and leasing market is geographically diverse, with significant activity across major urban centers. However, Riyadh and Jeddah consistently dominate as the leading regions due to higher population density, significant business activity, and a thriving tourism sector.

- Duration: Long-term leasing accounts for a larger market share compared to short-term leasing, driven by corporate demand and government contracts.

- Vehicle Type: The premium/luxury segment experiences high demand due to increasing disposable incomes and a preference for upscale vehicles.

- Body Type: SUVs and Multi-Utility Vehicles (MUVs) show strong growth fueled by family needs and the popularity of spacious vehicles.

- Booking Type: Online bookings are rapidly gaining traction, with a steady increase in adoption.

Key Drivers:

- High Population Density in Urban Centers: Driving demand for rentals in major cities like Riyadh and Jeddah.

- Strong Corporate Demand: Fuels the growth of the long-term leasing market segment.

- Tourism Sector Growth: Drives demand for short-term rentals, particularly in major tourist destinations.

- Government Initiatives: Supporting infrastructure development and sustainable transportation further influences market dynamics.

Saudi Arabia Car Rental & Leasing Market Product Innovations

Recent innovations in the Saudi Arabia car rental and leasing market include the integration of advanced telematics systems for enhanced fleet management, the expansion of online booking platforms with user-friendly interfaces, and the introduction of subscription-based leasing models offering flexible rental terms. These innovations are focused on improving customer experience, optimizing operational efficiency, and enhancing revenue streams. Furthermore, the gradual introduction of electric vehicles and hybrid cars into rental fleets reflects the ongoing shift towards sustainable mobility solutions. These advancements are creating unique selling propositions for rental companies and driving the market's evolution.

Propelling Factors for Saudi Arabia Car Rental & Leasing Market Growth

Several factors contribute to the growth of the Saudi Arabia car rental and leasing market. Economic expansion and rising disposable incomes are increasing consumer spending on transportation services. Government initiatives promoting tourism and infrastructure development have significantly boosted demand. The ease of online booking and flexible leasing options cater to evolving consumer preferences, further stimulating growth. Technological advancements in fleet management and vehicle telematics enhance operational efficiency and sustainability.

Obstacles in the Saudi Arabia Car Rental & Leasing Market Market

Challenges facing the market include fluctuating fuel prices, which impact operating costs. Competition from ride-hailing services puts pressure on rental companies, particularly in short-term segments. Stringent regulatory requirements and bureaucratic procedures can complicate business operations. Supply chain disruptions and vehicle availability can impact fleet size and rental availability. The overall impact of these obstacles is estimated at an xx% reduction in potential market growth each year.

Future Opportunities in Saudi Arabia Car Rental & Leasing Market

Future opportunities lie in expanding into underserved regions, developing specialized rental services (e.g., luxury vehicles, electric vehicles), and leveraging data analytics to personalize customer experiences and optimize pricing. The introduction of innovative subscription models and the expansion of partnerships with hotels and tourism companies will present further growth opportunities. The increasing adoption of autonomous vehicles presents a long-term, potentially transformative opportunity, although significant technological and regulatory hurdles remain.

Major Players in the Saudi Arabia Car Rental & Leasing Market Ecosystem

- Bin Hadi

- National Car Rental

- Turo

- Zipcar

- Best Rent A Car

- Hanco Automotive

- Budget Rent-A-Car

- Auto Rent

- Theeb Rent A Car

- Ejaro

- Key Car Rental

- Strong Rent a Car

- Yelo Corporation (Al Wefaq)

- Hertz Corporation

- Sixt SE

- Samara Land Transportation Services

- Autoworld (Al-Jazira Equipment Company Limited)

- Esar International Group

- Europcar Mobility Group

- Avis Budget Group Inc

Key Developments in Saudi Arabia Car Rental & Leasing Market Industry

- November 2023: Budget Saudi secured a SAR 39.8 Million (USD 10.6 Million) four-year leasing deal with SABIC for 263 vehicles.

- June 2023: Lumi Rental Company signed a SAR 42 Million (USD 11.2 Million) agreement with Saudi Post for 855 vehicles (34-month term).

- April 2023: ALTAWKILAT Premium partnered with PEAX to supply 100 Hongqi Ousado 2023 cars, expanding PEAX's luxury fleet.

- October 2022: Lumi opened a used car showroom in Riyadh, capitalizing on customer demand.

Strategic Saudi Arabia Car Rental & Leasing Market Market Forecast

The Saudi Arabia car rental and leasing market is poised for continued growth, driven by ongoing economic development, infrastructure expansion, and increasing tourism. The strategic focus on technological innovation, enhanced customer experience, and sustainable transportation solutions will be crucial for success. The market is expected to witness a significant increase in the adoption of online booking platforms and the expansion of the premium and luxury vehicle segments. Opportunities exist in tapping into the growing demand for electric and hybrid vehicles, as well as in developing innovative subscription models tailored to the changing needs of the market. The overall market potential is substantial, promising attractive returns for investors and operators who successfully adapt to the evolving market dynamics.

Saudi Arabia Car Rental & Leasing Market Segmentation

-

1. Duration

- 1.1. Short-term Leasing

- 1.2. Long-term Leasing

-

2. Vehicle Type

- 2.1. Economy/Budget

- 2.2. Premium/Luxury

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Multi Utility Vehicle and Sports Utility Vehicle

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

Saudi Arabia Car Rental & Leasing Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Car Rental & Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market

- 3.3. Market Restrains

- 3.3.1. Impact of Inflation on Costs and Consumer Spending is a Key Challenge

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sports Utility Vehicles to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 5.1.1. Short-term Leasing

- 5.1.2. Long-term Leasing

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Economy/Budget

- 5.2.2. Premium/Luxury

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Multi Utility Vehicle and Sports Utility Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 6. Central Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bin Hadi

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 National Car Rental

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Turo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zipcar

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Best Rent A Car

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hanco Automotive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Budget Rent-A-Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Auto Rent

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Theeb Rent A Car

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ejaro

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Key Car Rental

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Strong Rent a Car

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yelo Corporation (Al Wefaq)

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Hertz Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Sixt SE

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Samara Land Transportation Services

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Autoworld (Al-Jazira Equipment Company Limited

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 Esar International Group

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 Europcar Mobility Group

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Avis Budget Group Inc

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 Bin Hadi

List of Figures

- Figure 1: Saudi Arabia Car Rental & Leasing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Car Rental & Leasing Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 3: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 5: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 6: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Central Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southern Saudi Arabia Car Rental & Leasing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2019 & 2032

- Table 13: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 15: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 16: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Car Rental & Leasing Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Saudi Arabia Car Rental & Leasing Market?

Key companies in the market include Bin Hadi, National Car Rental, Turo, Zipcar, Best Rent A Car, Hanco Automotive, Budget Rent-A-Car, Auto Rent, Theeb Rent A Car, Ejaro, Key Car Rental, Strong Rent a Car, Yelo Corporation (Al Wefaq), Hertz Corporation, Sixt SE, Samara Land Transportation Services, Autoworld (Al-Jazira Equipment Company Limited, Esar International Group, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Saudi Arabia Car Rental & Leasing Market?

The market segments include Duration, Vehicle Type, Body Type, Booking Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Sports Utility Vehicles to Drive the Market.

7. Are there any restraints impacting market growth?

Impact of Inflation on Costs and Consumer Spending is a Key Challenge.

8. Can you provide examples of recent developments in the market?

November 2023: The United International Transportation Company, Budget Saudi, secured a long-term deal with Saudi Basic Industries Corp. (SABIC) for leasing the transport firm’s 263 vehicles. The contract, valued at SAR 39.8 million (USD 10.6 million), is for four years. The leasing deal will be automatically renewed for 12 months at the end of the initial term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Car Rental & Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Car Rental & Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Car Rental & Leasing Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Car Rental & Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence