Key Insights

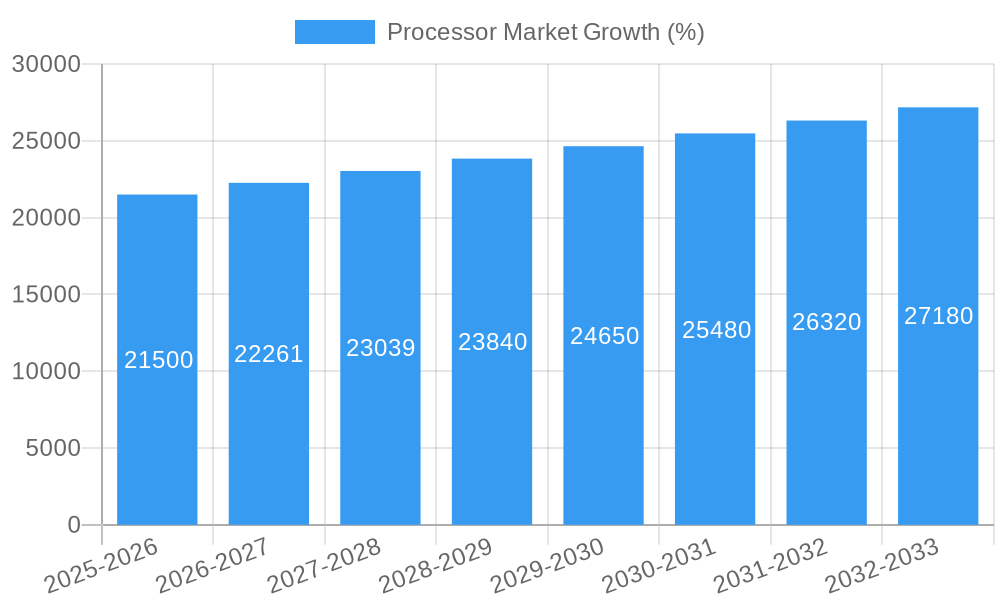

The global processor market, encompassing CPUs, APUs, and server processors, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 4.30% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of high-performance computing (HPC) across various sectors, including artificial intelligence (AI), machine learning (ML), and big data analytics, necessitates advanced processors capable of handling complex computations. Furthermore, the proliferation of mobile devices, Internet of Things (IoT) gadgets, and the expansion of 5G networks significantly boosts demand for energy-efficient and high-performance processors in embedded systems. The rising demand for cloud computing services also contributes substantially to market growth, driving increased server processor sales. Competitive innovation among leading players such as Intel, AMD, Nvidia, Qualcomm, Mediatek and Apple, continuously pushing technological boundaries and releasing new generations of processors with enhanced capabilities, fuels further market expansion.

However, market growth faces certain restraints. The global chip shortage, which intermittently impacts production capabilities, can create supply chain bottlenecks. Furthermore, the increasing cost of research and development associated with creating advanced processor technologies presents a challenge for some market participants. Lastly, the cyclical nature of the electronics industry and fluctuations in consumer spending can influence overall processor demand. Despite these challenges, the long-term outlook for the processor market remains positive, driven by consistent technological advancement and the persistent demand for powerful computing capabilities across various industries. Market segmentation reveals a strong demand for both CPUs and APUs, with the server processor segment experiencing particularly robust growth due to the expansion of data centers and cloud infrastructure. Regional analysis likely indicates strong growth in regions like China and the United States, mirroring the significant technological advancements and economic activity within these regions.

Processor Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global processor market, covering the period 2019-2033, with a focus on market trends, technological advancements, and future growth opportunities. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts for the period 2025-2033. It offers a comprehensive overview of the market, including market size estimations in Millions, key players, and emerging trends, making it an invaluable resource for stakeholders across the industry.

Processor Market Composition & Trends

This section delves into the intricate composition of the processor market, evaluating its concentration, innovation drivers, regulatory landscape, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. The analysis includes a detailed assessment of market share distribution across key players like Intel, AMD, Nvidia, Qualcomm, MediaTek, and Apple, revealing the competitive dynamics within this rapidly evolving sector.

- Market Concentration: The processor market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Intel and AMD hold a considerable share in the server and desktop CPU segments, while Nvidia leads in GPU and specialized processors. Qualcomm and MediaTek are significant players in the mobile processor segment.

- Innovation Catalysts: Continuous advancements in semiconductor technology, particularly in areas like process node shrinking (e.g., TSMC's 4nm process), core architecture improvements (Arm Cortex-A715), and specialized AI accelerators are driving innovation. Increased demand for high-performance computing (HPC) in data centers and artificial intelligence (AI) applications is further spurring innovation.

- Regulatory Landscape: Government regulations concerning data privacy, cybersecurity, and anti-trust issues are influencing market dynamics. Subsidies and tax incentives for semiconductor manufacturing in various regions are also affecting the industry landscape. The value of M&A deals in the processor market has been significant over the past years and xx Million in 2024, indicating increased consolidation.

- Substitute Products: While traditional processors are dominant, the emergence of specialized processors, such as AI accelerators and FPGAs, poses a degree of competitive pressure.

- End-User Profiles: The end-user base spans a wide range of industries, including consumer electronics, data centers, automotive, and healthcare. Demand variations across these sectors are driving market segmentation and tailored product development.

- M&A Activities: Recent M&A activities have been significant, with a total value of approximately xx Million in 2024, indicating consolidation trends and strategic acquisitions.

Processor Market Industry Evolution

This section analyzes the evolution of the processor market, exploring its growth trajectories, technological progress, and shifting consumer demands. The analysis integrates quantitative and qualitative data to illustrate the market's dynamic nature and future outlook. The global processor market is projected to reach xx Million by 2033, driven by factors such as increasing demand for mobile devices, cloud computing, and IoT applications.

The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including:

- The increasing adoption of high-performance computing (HPC) in various industries.

- The rise of artificial intelligence (AI) and machine learning (ML) applications.

- The growth of the Internet of Things (IoT) market.

- The increasing demand for mobile devices and wearable technologies.

The market is also witnessing significant technological advancements, including the development of more powerful and energy-efficient processors, the adoption of new architectures such as chiplets, and the increasing use of advanced packaging technologies. Consumer demand is shifting towards higher performance, lower power consumption, and improved energy efficiency.

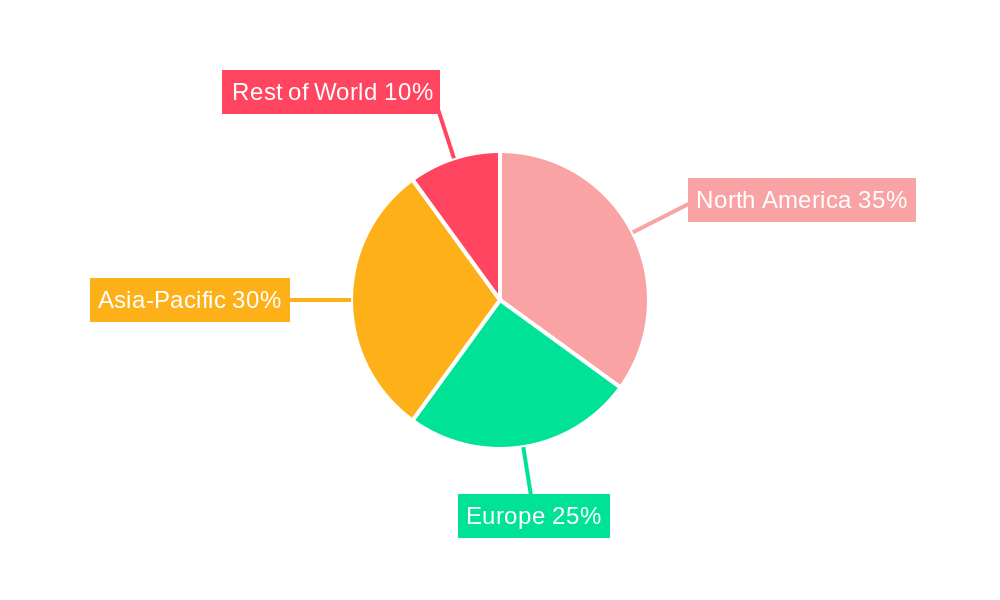

Leading Regions, Countries, or Segments in Processor Market

This section identifies the leading regions, countries, and segments within the processor market, focusing on CPU and APU segments.

- Dominant Region: North America currently holds a dominant position in the processor market, driven by strong demand from the data center and consumer electronics sectors. However, the Asia-Pacific region is projected to witness significant growth in the coming years, fueled by increasing smartphone adoption and the expansion of the IT infrastructure in developing economies.

- Key Drivers for North America's Dominance: High R&D investment, strong technological infrastructure, and the presence of major processor manufacturers.

- Key Drivers for Asia-Pacific's Growth: Rapidly expanding consumer electronics market, increasing smartphone penetration, and growing demand for data centers.

- Dominant Segment (By Type of Product): The CPU segment holds the largest market share currently due to its widespread application in PCs, servers, and mobile devices. However, the APU segment is showing significant growth, driven by its increasing adoption in embedded systems and gaming consoles.

Processor Market Product Innovations

Recent years have witnessed significant advancements in processor technology, resulting in improved performance, power efficiency, and specialized functionalities. Key innovations include the introduction of chiplet-based designs enabling greater scalability and customization, the integration of AI accelerators for enhanced machine learning capabilities, and advancements in manufacturing processes, pushing the boundaries of transistor density and clock speeds. This continuous innovation directly translates into enhanced user experiences in gaming, mobile applications, and data center operations. The introduction of high-core-count processors, such as Intel's 13th Gen processors, and specialized AI chips by companies like Nvidia, demonstrate a significant push towards enhanced processing power tailored to specific user needs.

Propelling Factors for Processor Market Growth

Several factors are driving the growth of the processor market. Technological advancements such as the development of smaller and more powerful processors, coupled with increasing demand from rapidly growing sectors such as data centers, cloud computing, and AI, are prominent contributors. Government initiatives promoting the growth of the semiconductor industry through tax incentives and subsidies, further accelerate market expansion. The rise of IoT, mobile computing, and autonomous vehicles also creates substantial demand for processors.

Obstacles in the Processor Market

Despite the promising growth trajectory, the processor market encounters several obstacles. Supply chain disruptions, geopolitical uncertainties, and manufacturing complexities present significant challenges. Increased competition, coupled with escalating research and development costs, pose a considerable hurdle. Regulatory scrutiny regarding antitrust concerns and data security also adds to the complexities. These factors can impact production schedules, cost structures, and market entry strategies.

Future Opportunities in Processor Market

Future opportunities abound in the processor market. The expansion of 5G networks and the growth of edge computing will spur demand for high-bandwidth, low-latency processors. The increasing adoption of AI and ML, coupled with the development of specialized processors for these applications, presents a significant growth avenue. Moreover, the emergence of new applications such as AR/VR and quantum computing will create a whole new set of opportunities for processor manufacturers.

Major Players in the Processor Market Ecosystem

Key Developments in Processor Market Industry

- September 2022: Intel introduced the 13th Gen Intel Core processor family, significantly enhancing gaming, streaming, and recording capabilities with up to 24 cores and 32 threads.

- February 2023: MediaTek launched the Dimensity 7200 chipset, optimized for gaming and photography in smartphones, leveraging TSMC's 4nm process for enhanced performance and power efficiency.

Strategic Processor Market Forecast

The processor market is poised for robust growth in the coming years, propelled by strong technological advancements and sustained demand from various sectors. The convergence of several trends, including the expansion of cloud computing, the proliferation of IoT devices, and the rising adoption of AI, will collectively drive market expansion. The continuous innovation in processor architecture and manufacturing processes will further accelerate market growth, creating significant opportunities for key players and new entrants alike. The projected market size reflects a positive outlook, promising substantial growth and value creation in the coming decade.

Processor Market Segmentation

-

1. Type of Product

-

1.1. CPU

- 1.1.1. Client (Desktop and Laptop)

- 1.1.2. Server

-

1.2. APU

- 1.2.1. Smartphone

- 1.2.2. Tablet

- 1.2.3. Smart Television

- 1.2.4. Smart Speakers

- 1.2.5. Other Ap

-

1.1. CPU

-

2. Geography ***

- 2.1. China (including Hong Kong)

- 2.2. Taiwan

- 2.3. United States

- 2.4. Latin America

- 2.5. Middle East and Africa

Processor Market Segmentation By Geography

- 1. China

- 2. Taiwan

- 3. United States

- 4. Latin America

- 5. Middle East and Africa

Processor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones; Growing Adoption of Cloud Computing

- 3.2.2 Big Data Analytics

- 3.2.3 and AI

- 3.3. Market Restrains

- 3.3.1. Cyber Security concerns may hinder the growth of the sports betting kiosk market

- 3.4. Market Trends

- 3.4.1. APUs to Acquire a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. CPU

- 5.1.1.1. Client (Desktop and Laptop)

- 5.1.1.2. Server

- 5.1.2. APU

- 5.1.2.1. Smartphone

- 5.1.2.2. Tablet

- 5.1.2.3. Smart Television

- 5.1.2.4. Smart Speakers

- 5.1.2.5. Other Ap

- 5.1.1. CPU

- 5.2. Market Analysis, Insights and Forecast - by Geography ***

- 5.2.1. China (including Hong Kong)

- 5.2.2. Taiwan

- 5.2.3. United States

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Taiwan

- 5.3.3. United States

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. China Processor Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. CPU

- 6.1.1.1. Client (Desktop and Laptop)

- 6.1.1.2. Server

- 6.1.2. APU

- 6.1.2.1. Smartphone

- 6.1.2.2. Tablet

- 6.1.2.3. Smart Television

- 6.1.2.4. Smart Speakers

- 6.1.2.5. Other Ap

- 6.1.1. CPU

- 6.2. Market Analysis, Insights and Forecast - by Geography ***

- 6.2.1. China (including Hong Kong)

- 6.2.2. Taiwan

- 6.2.3. United States

- 6.2.4. Latin America

- 6.2.5. Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. Taiwan Processor Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. CPU

- 7.1.1.1. Client (Desktop and Laptop)

- 7.1.1.2. Server

- 7.1.2. APU

- 7.1.2.1. Smartphone

- 7.1.2.2. Tablet

- 7.1.2.3. Smart Television

- 7.1.2.4. Smart Speakers

- 7.1.2.5. Other Ap

- 7.1.1. CPU

- 7.2. Market Analysis, Insights and Forecast - by Geography ***

- 7.2.1. China (including Hong Kong)

- 7.2.2. Taiwan

- 7.2.3. United States

- 7.2.4. Latin America

- 7.2.5. Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. United States Processor Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. CPU

- 8.1.1.1. Client (Desktop and Laptop)

- 8.1.1.2. Server

- 8.1.2. APU

- 8.1.2.1. Smartphone

- 8.1.2.2. Tablet

- 8.1.2.3. Smart Television

- 8.1.2.4. Smart Speakers

- 8.1.2.5. Other Ap

- 8.1.1. CPU

- 8.2. Market Analysis, Insights and Forecast - by Geography ***

- 8.2.1. China (including Hong Kong)

- 8.2.2. Taiwan

- 8.2.3. United States

- 8.2.4. Latin America

- 8.2.5. Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Latin America Processor Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. CPU

- 9.1.1.1. Client (Desktop and Laptop)

- 9.1.1.2. Server

- 9.1.2. APU

- 9.1.2.1. Smartphone

- 9.1.2.2. Tablet

- 9.1.2.3. Smart Television

- 9.1.2.4. Smart Speakers

- 9.1.2.5. Other Ap

- 9.1.1. CPU

- 9.2. Market Analysis, Insights and Forecast - by Geography ***

- 9.2.1. China (including Hong Kong)

- 9.2.2. Taiwan

- 9.2.3. United States

- 9.2.4. Latin America

- 9.2.5. Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. Middle East and Africa Processor Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. CPU

- 10.1.1.1. Client (Desktop and Laptop)

- 10.1.1.2. Server

- 10.1.2. APU

- 10.1.2.1. Smartphone

- 10.1.2.2. Tablet

- 10.1.2.3. Smart Television

- 10.1.2.4. Smart Speakers

- 10.1.2.5. Other Ap

- 10.1.1. CPU

- 10.2. Market Analysis, Insights and Forecast - by Geography ***

- 10.2.1. China (including Hong Kong)

- 10.2.2. Taiwan

- 10.2.3. United States

- 10.2.4. Latin America

- 10.2.5. Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. China Processor Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Taiwan Processor Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. United States Processor Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World Processor Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Nvidia

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Mediatek

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Intel

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 AMD

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Apple*List Not Exhaustive

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Qualcomm

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Nvidia

List of Figures

- Figure 1: Global Processor Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: China Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 3: China Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Taiwan Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Taiwan Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: United States Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 7: United States Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: China Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 11: China Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 12: China Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 13: China Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 14: China Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 15: China Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Taiwan Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 17: Taiwan Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 18: Taiwan Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 19: Taiwan Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 20: Taiwan Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Taiwan Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: United States Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 23: United States Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 24: United States Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 25: United States Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 26: United States Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 27: United States Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 29: Latin America Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 30: Latin America Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 31: Latin America Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 32: Latin America Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Latin America Processor Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Processor Market Revenue (Million), by Type of Product 2024 & 2032

- Figure 35: Middle East and Africa Processor Market Revenue Share (%), by Type of Product 2024 & 2032

- Figure 36: Middle East and Africa Processor Market Revenue (Million), by Geography *** 2024 & 2032

- Figure 37: Middle East and Africa Processor Market Revenue Share (%), by Geography *** 2024 & 2032

- Figure 38: Middle East and Africa Processor Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Middle East and Africa Processor Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 3: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 4: Global Processor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Processor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 14: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 15: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 17: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 18: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 20: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 21: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 23: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 24: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Global Processor Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 26: Global Processor Market Revenue Million Forecast, by Geography *** 2019 & 2032

- Table 27: Global Processor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processor Market?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Processor Market?

Key companies in the market include Nvidia, Mediatek, Intel, AMD, Apple*List Not Exhaustive, Qualcomm.

3. What are the main segments of the Processor Market?

The market segments include Type of Product, Geography ***.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones; Growing Adoption of Cloud Computing. Big Data Analytics. and AI.

6. What are the notable trends driving market growth?

APUs to Acquire a Significant Share.

7. Are there any restraints impacting market growth?

Cyber Security concerns may hinder the growth of the sports betting kiosk market.

8. Can you provide examples of recent developments in the market?

February 2023: MediaTek introduced the Dimensity 7200 chipset to amplify gaming and photography smartphone experiences. Dimensity 7200 utilizes the same TSMC 4nm second-generation process as the Dimensity 9200 and is highly suitable for ultra-slim designs in a range of shapes. The octa-core CPU combines two Arm Cortex-A715 cores, which have the ability to run at up to 2.8GHz, with six Cortex-A510 cores, enabling users to easily switch between apps and get the most out of each one.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processor Market?

To stay informed about further developments, trends, and reports in the Processor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence