Key Insights

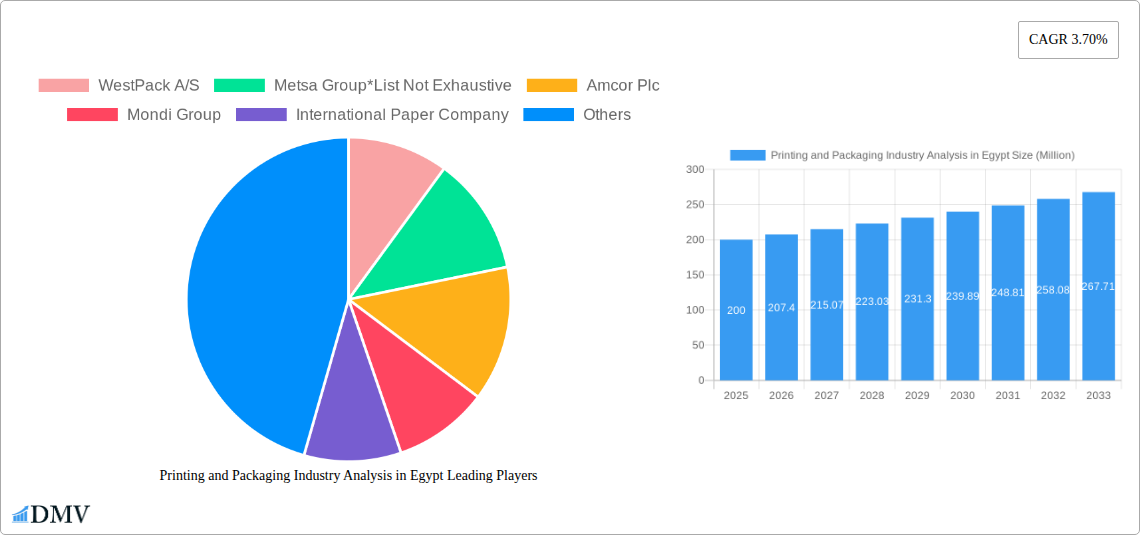

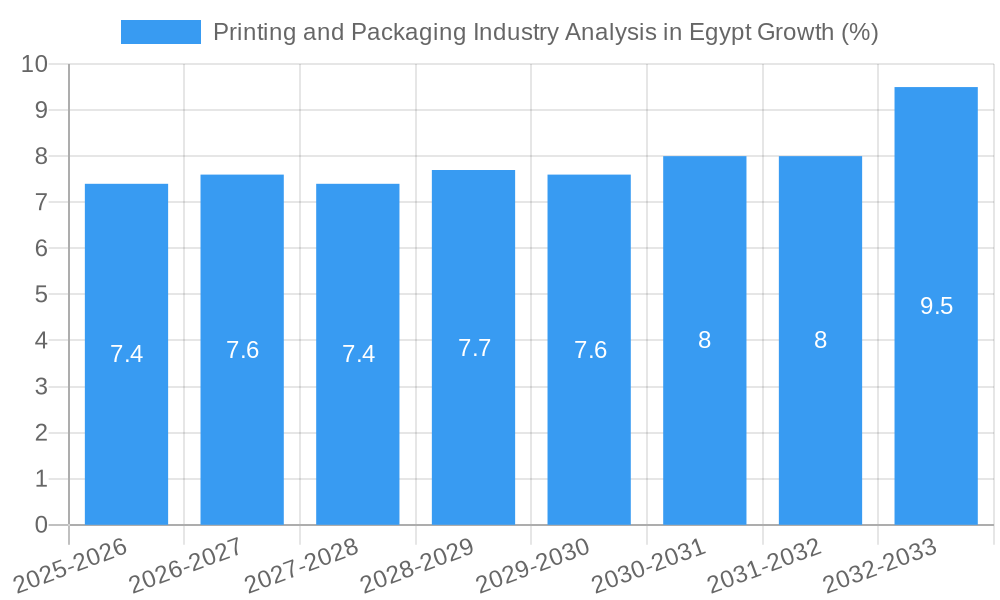

The Egyptian printing and packaging industry, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.70% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning food and beverage sector, coupled with a rising consumer base and increasing demand for attractive and functional packaging, significantly drives market growth. Growth in e-commerce and the consequent need for robust shipping solutions further contributes to the industry's expansion. Furthermore, advancements in printing technology, such as digital printing and flexible packaging solutions, are enhancing product quality and efficiency, thereby attracting investment. However, challenges persist, including fluctuations in raw material prices (particularly paper and board), and intense competition among established players like WestPack A/S, Metsa Group, Amcor Plc, and Mondi Group. The industry is segmented by both industry verticals (food and beverage, personal care, home care, healthcare, retail, and others) and product types (paperboard, container board, corrugated board, and others). While the food and beverage sector currently dominates, the personal care and healthcare segments are showing promising growth potential. The industry’s future success hinges on adapting to evolving consumer preferences, embracing sustainable packaging solutions, and navigating economic uncertainties to maintain a competitive edge in the Egyptian market.

The Egyptian printing and packaging market's robust growth is underpinned by strategic investments in infrastructure and a focus on enhancing supply chain efficiency. Government initiatives promoting industrial development and foreign investment further bolster the sector's prospects. However, regulatory hurdles and potential infrastructural bottlenecks could pose challenges. Companies are increasingly adopting sustainable practices in response to growing environmental awareness among consumers, leading to the adoption of eco-friendly materials and packaging designs. Moreover, the industry is witnessing increased consolidation, with larger players strategically acquiring smaller companies to expand their market share and product portfolios. This dynamic interplay of growth drivers and constraints will shape the future landscape of the Egyptian printing and packaging industry over the forecast period. Further analysis could focus on specific sub-segments to pinpoint opportunities for targeted growth strategies.

Printing and Packaging Industry Analysis in Egypt: 2019-2033

This comprehensive report provides an in-depth analysis of the Egyptian printing and packaging industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and projections to inform strategic decision-making. The analysis covers market size, segmentation, leading players, and future growth potential, incorporating recent key developments and highlighting both opportunities and challenges. The report's data-driven approach, combined with expert analysis, provides a clear picture of the Egyptian printing and packaging landscape, enabling informed investment strategies and business planning. The total market value is projected to reach xx Million by 2033.

Printing and Packaging Industry Analysis in Egypt Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory environment, substitute products, end-user preferences, and merger & acquisition (M&A) activities within the Egyptian printing and packaging industry. The market is characterized by a moderate level of concentration, with several multinational corporations and a number of smaller, local players. Innovation is driven by the demand for sustainable packaging solutions and advancements in printing technologies. Stringent environmental regulations are shaping industry practices, favoring eco-friendly materials and production methods. Substitute products, such as reusable containers and digital printing alternatives, pose a competitive threat, although the demand for traditional printing and packaging remains robust. End-users across various sectors, including food and beverage, personal care, and healthcare, drive demand. M&A activity has been relatively limited in recent years but is expected to increase as larger players consolidate their market position.

- Market Share Distribution: The top five players hold an estimated xx% of the market share in 2025. Smaller players constitute the remaining xx%.

- M&A Deal Values: Total M&A deal value in the period 2019-2024 was estimated at xx Million. The largest deal involved the acquisition of xx by xx for xx Million in 2022.

Printing and Packaging Industry Analysis in Egypt Industry Evolution

The Egyptian printing and packaging industry has witnessed significant evolution over the past few years, marked by notable growth trajectories, technological advancements, and evolving consumer demands. The industry has experienced a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024, driven primarily by growth in the food and beverage sector and increasing demand for customized packaging solutions. The adoption of digital printing technologies has accelerated, enhancing efficiency and personalization options. Consumer preferences are increasingly shifting towards sustainable and eco-friendly packaging materials, creating opportunities for innovative players. Furthermore, e-commerce growth is driving demand for efficient packaging solutions to support online deliveries. The forecast period (2025-2033) anticipates a CAGR of xx%, influenced by continued economic expansion, infrastructural improvements, and ongoing adoption of sustainable practices. The projected market value for 2033 is xx Million. Detailed segment-wise growth analysis is provided within the full report.

Leading Regions, Countries, or Segments in Printing and Packaging Industry Analysis in Egypt

The Egyptian printing and packaging market displays strong regional variations in growth, with the Greater Cairo region dominating. The Food and Beverage and Personal Care sectors are currently the most significant contributors to industry revenue.

Key Drivers:

- Food and Beverage: Strong domestic consumption and increasing demand for processed foods drive this segment’s growth.

- Personal Care: Expanding middle class and growing awareness of hygiene fuels demand for sophisticated packaging in this sector.

- Investment Trends: Foreign direct investment (FDI) flows and government initiatives supporting industrial development fuel capacity expansion.

- Regulatory Support: Government policies promoting local manufacturing and sustainable practices contribute positively.

Dominance Factors:

The Greater Cairo region's dominance stems from its high population density, established industrial base, and superior infrastructure. The Food and Beverage sector benefits from a large and growing consumer market and the Personal Care sector is experiencing rapid growth alongside rising disposable incomes. The dominance factors for both segments include their established distribution networks, brand loyalty, and high consumer demand. Further analysis of all segments, including Home Care, Healthcare, Retail, and Others, is available in the full report, outlining their current market shares and projected growth.

Printing and Packaging Industry Analysis in Egypt Product Innovations

Recent innovations focus on sustainable materials (e.g., recycled paperboard, biodegradable plastics), smart packaging technologies (e.g., RFID tags for traceability), and improved printing techniques offering enhanced visual appeal and functionality. These innovations cater to growing consumer demands for environmentally friendly products and brand differentiation. Performance metrics show significant improvements in packaging efficiency, reduced material waste, and improved product shelf life. Unique selling propositions often include improved sustainability credentials, enhanced brand visibility, and superior product protection.

Propelling Factors for Printing and Packaging Industry Analysis in Egypt Growth

Several factors contribute to the industry's growth, including rising consumer spending, increasing demand for packaged goods, technological advancements in printing and packaging, and government initiatives promoting industrial growth. The expansion of the e-commerce sector also fuels demand for efficient packaging and logistical solutions. Government support for sustainable practices is driving adoption of eco-friendly materials. The influx of FDI further enhances the growth trajectory.

Obstacles in the Printing and Packaging Industry Analysis in Egypt Market

The industry faces challenges like fluctuating raw material prices, competition from imported products, and supply chain disruptions. Strict environmental regulations and the need to invest in advanced technologies can also pose financial hurdles. Economic volatility and infrastructural limitations in certain regions present further constraints. These factors cumulatively influence market profitability and the rate of industry expansion.

Future Opportunities in Printing and Packaging Industry Analysis in Egypt

Future opportunities lie in expanding into new market segments, embracing sustainable packaging solutions, and adopting advanced printing technologies. The growth of e-commerce and the increasing demand for personalized packaging represent promising avenues for growth. Exploring new materials, such as bioplastics and plant-based alternatives, and leveraging digital printing capabilities for customization can unlock further market potential.

Major Players in the Printing and Packaging Industry Analysis in Egypt Ecosystem

- WestPack A/S

- Metsa Group

- Amcor Plc

- Mondi Group

- International Paper Company

- Sappi Limited

- Oji Holdings

- Graphic Packaging International Corporation

- Smurfit Kappa

- DS Smith

- Tetra Laval Group

Key Developments in Printing and Packaging Industry Analysis in Egypt Industry

- April 2022: Mondi acquired paper bag converting lines from Lafarge Cement in Egypt, solidifying its position as a key supplier.

- May 2022: The UAE, Egypt, and Jordan's industrial partnership, involving a USD 10 Billion investment fund, is expected to significantly boost growth in related sectors, including packaging.

Strategic Printing and Packaging Industry Analysis in Egypt Market Forecast

The Egyptian printing and packaging market is poised for robust growth in the coming years, driven by expanding consumer demand, technological advancements, and supportive government policies. The focus on sustainability and the rise of e-commerce will continue to shape industry trends. The market's potential is substantial, offering significant opportunities for both established players and new entrants. The detailed forecast, including segment-wise projections, is presented in the full report.

Printing and Packaging Industry Analysis in Egypt Segmentation

-

1. Products Type

- 1.1. Paperboard

- 1.2. Container Board

- 1.3. Corrugated Board

- 1.4. Others

-

2. Industry Verticals

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Home Care

- 2.4. Healthcare

- 2.5. Retail

- 2.6. Others

Printing and Packaging Industry Analysis in Egypt Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Printing and Packaging Industry Analysis in Egypt REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Sustainable Packaging; Raw material availability & Supportive Government Regulations

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Consumer Consciousness of Sustainable Packaging to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products Type

- 5.1.1. Paperboard

- 5.1.2. Container Board

- 5.1.3. Corrugated Board

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Home Care

- 5.2.4. Healthcare

- 5.2.5. Retail

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Products Type

- 6. North America Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Products Type

- 6.1.1. Paperboard

- 6.1.2. Container Board

- 6.1.3. Corrugated Board

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Home Care

- 6.2.4. Healthcare

- 6.2.5. Retail

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Products Type

- 7. South America Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Products Type

- 7.1.1. Paperboard

- 7.1.2. Container Board

- 7.1.3. Corrugated Board

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Home Care

- 7.2.4. Healthcare

- 7.2.5. Retail

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Products Type

- 8. Europe Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Products Type

- 8.1.1. Paperboard

- 8.1.2. Container Board

- 8.1.3. Corrugated Board

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Home Care

- 8.2.4. Healthcare

- 8.2.5. Retail

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Products Type

- 9. Middle East & Africa Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Products Type

- 9.1.1. Paperboard

- 9.1.2. Container Board

- 9.1.3. Corrugated Board

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 9.2.1. Food and Beverage

- 9.2.2. Personal Care

- 9.2.3. Home Care

- 9.2.4. Healthcare

- 9.2.5. Retail

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Products Type

- 10. Asia Pacific Printing and Packaging Industry Analysis in Egypt Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Products Type

- 10.1.1. Paperboard

- 10.1.2. Container Board

- 10.1.3. Corrugated Board

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Industry Verticals

- 10.2.1. Food and Beverage

- 10.2.2. Personal Care

- 10.2.3. Home Care

- 10.2.4. Healthcare

- 10.2.5. Retail

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Products Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WestPack A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metsa Group*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amcor Plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mondi Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 International Paper Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sappi Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oji Holdings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Graphic Packaging International Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Smurfit Kappa

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DS Smith

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tetra Laval Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 WestPack A/S

List of Figures

- Figure 1: Global Printing and Packaging Industry Analysis in Egypt Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Egypt Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 3: Egypt Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Products Type 2024 & 2032

- Figure 5: North America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Products Type 2024 & 2032

- Figure 6: North America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Industry Verticals 2024 & 2032

- Figure 7: North America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Industry Verticals 2024 & 2032

- Figure 8: North America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Products Type 2024 & 2032

- Figure 11: South America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Products Type 2024 & 2032

- Figure 12: South America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Industry Verticals 2024 & 2032

- Figure 13: South America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Industry Verticals 2024 & 2032

- Figure 14: South America Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Products Type 2024 & 2032

- Figure 17: Europe Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Products Type 2024 & 2032

- Figure 18: Europe Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Industry Verticals 2024 & 2032

- Figure 19: Europe Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Industry Verticals 2024 & 2032

- Figure 20: Europe Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Products Type 2024 & 2032

- Figure 23: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Products Type 2024 & 2032

- Figure 24: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Industry Verticals 2024 & 2032

- Figure 25: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Industry Verticals 2024 & 2032

- Figure 26: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Products Type 2024 & 2032

- Figure 29: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Products Type 2024 & 2032

- Figure 30: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Industry Verticals 2024 & 2032

- Figure 31: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Industry Verticals 2024 & 2032

- Figure 32: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 3: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 4: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 7: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 8: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 13: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 14: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 19: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 20: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 31: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 32: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Products Type 2019 & 2032

- Table 40: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Industry Verticals 2019 & 2032

- Table 41: Global Printing and Packaging Industry Analysis in Egypt Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Printing and Packaging Industry Analysis in Egypt Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Printing and Packaging Industry Analysis in Egypt?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Printing and Packaging Industry Analysis in Egypt?

Key companies in the market include WestPack A/S, Metsa Group*List Not Exhaustive, Amcor Plc, Mondi Group, International Paper Company, Sappi Limited, Oji Holdings, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith, Tetra Laval Group.

3. What are the main segments of the Printing and Packaging Industry Analysis in Egypt?

The market segments include Products Type, Industry Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Sustainable Packaging; Raw material availability & Supportive Government Regulations.

6. What are the notable trends driving market growth?

Consumer Consciousness of Sustainable Packaging to Drive the Growth.

7. Are there any restraints impacting market growth?

; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

May 2022: The UAE, Egypt, and Jordan inked an industrial partnership deal to boost economic growth in a few critical areas, such as food, agriculture, and fertilizers. A USD 10 billion investment fund is assigned through the industrial collaboration agreement and will be administered by ADQ Holding.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Printing and Packaging Industry Analysis in Egypt," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Printing and Packaging Industry Analysis in Egypt report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Printing and Packaging Industry Analysis in Egypt?

To stay informed about further developments, trends, and reports in the Printing and Packaging Industry Analysis in Egypt, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence