Key Insights

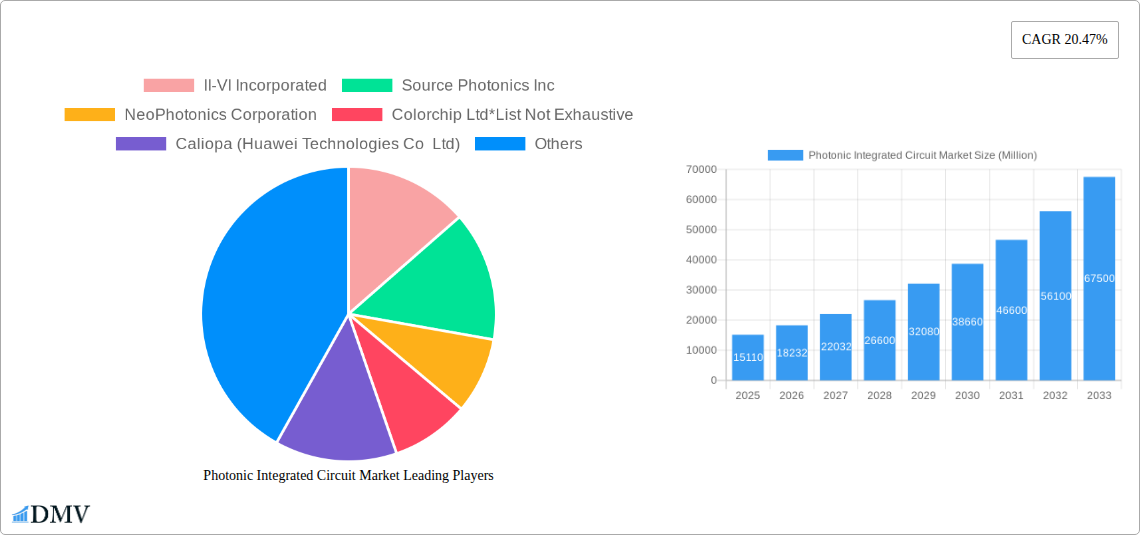

The Photonic Integrated Circuit (PIC) market is experiencing robust growth, projected to reach \$15.11 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 20.47% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-bandwidth, low-latency communication networks in data centers and telecommunications is a major catalyst. Advancements in materials science, particularly in III-V materials and Lithium Niobate, are enabling the development of more efficient and powerful PICs. Furthermore, the growing adoption of PICs in biomedical applications, such as optical coherence tomography (OCT) and flow cytometry, is contributing to market growth. Monolithic integration processes are gaining traction due to their superior performance and cost-effectiveness compared to hybrid approaches. The market is segmented by raw material type (III-V, Lithium Niobate, Silica-on-silicon, others), integration process (hybrid, monolithic), and application (telecommunications, biomedical, data centers, and other applications including LiDAR and metrology). Leading companies like II-VI Incorporated, Lumentum Holdings, and Intel Corporation are at the forefront of innovation, driving competition and further market expansion.

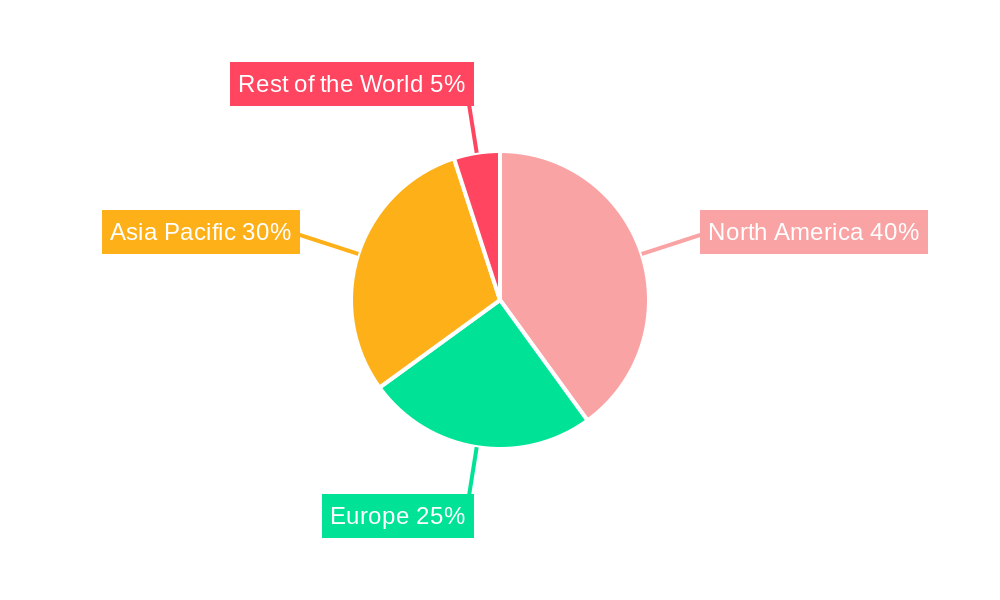

The geographic distribution of the PIC market is expected to be diverse, with North America and Asia-Pacific likely holding significant shares, driven by strong technological advancements and substantial investments in infrastructure. Europe and the Rest of the World will also contribute to overall market growth, albeit potentially at a slower pace. The continued miniaturization of PICs, along with increasing integration of functionalities, will further fuel market growth in the forecast period. The market will likely witness significant consolidation as companies pursue strategic mergers and acquisitions to expand their market share and technological capabilities. Challenges such as high manufacturing costs and the need for specialized expertise could somewhat restrain market growth, but the overall positive trends in communication, sensing, and data processing will outweigh these limitations.

Photonic Integrated Circuit Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Photonic Integrated Circuit (PIC) market, offering a comprehensive overview of its current state, future trends, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report covers market size, segmentation, competitive landscape, technological advancements, and growth projections, providing valuable insights for stakeholders across the industry. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Photonic Integrated Circuit Market Market Composition & Trends

This section delves into the intricate structure of the Photonic Integrated Circuit market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated landscape, with key players holding significant market share. However, the emergence of innovative startups is challenging the status quo.

- Market Share Distribution: II-VI Incorporated, Lumentum Holdings, and Infinera Corporation hold a combined xx% market share in 2025, indicating a high level of market concentration in the established segment. Smaller players collectively account for the remaining xx%.

- Innovation Catalysts: Ongoing advancements in materials science (III-V materials, Lithium Niobate, and Silica-on-silicon) and integration processes (Hybrid and Monolithic) are driving significant market innovation, fostering the creation of high-performance PICs.

- Regulatory Landscape: Government initiatives promoting technological advancements in telecommunications and data centers are boosting PIC adoption globally. Stringent regulatory standards concerning safety and performance also create opportunities and challenges for market players.

- Substitute Products: While PICs offer superior performance in several applications, alternative technologies like traditional optical components still hold a significant market presence. The competitive landscape is shaped by the continuous performance enhancements and cost-effectiveness of PIC technology against such alternatives.

- End-User Profiles: The key end-users are predominantly in the telecommunications, data center, and biomedical sectors. The increasing demand for high-speed data transmission, coupled with the advancements in sensing technologies (LiDAR, metrology), is fueling market expansion.

- M&A Activities: The PIC market has witnessed significant M&A activity in recent years, with deal values exceeding xx Million annually. These activities are primarily driven by the consolidation of market share and acquisition of specialized technologies.

Photonic Integrated Circuit Market Industry Evolution

This section explores the evolutionary path of the Photonic Integrated Circuit market, analyzing market growth trajectories, technological advancements, and evolving consumer needs. The PIC market has experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), driven largely by the surging demand for high-bandwidth communication solutions and the increasing adoption of PIC technology in data centers. The forecast period (2025-2033) projects a CAGR of xx%, propelled by the growing use of PICs in various applications, including sensing and biomedical imaging. Technological advancements such as the development of more efficient and cost-effective manufacturing processes are contributing to this growth. The demand for smaller, faster, and more energy-efficient solutions is also driving the adoption of PICs, as evidenced by the increasing deployment of 400G and beyond optical transceivers. Shifting consumer demands towards higher data rates and improved network performance are key drivers for market expansion.

Leading Regions, Countries, or Segments in Photonic Integrated Circuit Market

By Type of Raw Material: Silica-on-silicon currently dominates the market due to its cost-effectiveness and compatibility with existing silicon manufacturing processes. III-V materials, although more expensive, offer superior performance, and their market share is projected to increase steadily due to growing demand in high-performance applications. Lithium Niobate remains a niche segment but holds significant potential in specific applications demanding high electro-optic coefficients.

By Integration Process: Monolithic integration is gaining traction owing to its ability to provide superior performance and reduced costs. However, hybrid integration still holds significant market share, offering versatility in design and integration of different components.

By Application: The Telecommunications sector represents the largest segment, primarily driven by the demand for high-speed data transmission in 5G and beyond networks. Data centers are also a major growth driver, with PICs playing a vital role in high-bandwidth interconnects. The biomedical segment, while currently smaller, shows strong potential driven by applications like optical coherence tomography (OCT) and advanced microscopy.

Key Drivers:

- Significant investments in research and development are fostering technological advancements.

- Favorable government policies and regulatory support are accelerating adoption.

- The increasing demand for high-speed data transmission and advanced sensing capabilities is a major impetus.

Photonic Integrated Circuit Market Product Innovations

Recent innovations in PICs focus on enhanced performance, miniaturization, and reduced power consumption. The development of advanced packaging technologies, including 3D integration, is enabling the creation of more complex and integrated devices. Silicon photonics, particularly, is experiencing rapid growth, with high-performance 400G and 800G transceivers emerging as key products. Unique selling propositions (USPs) include increased bandwidth, lower latency, and improved energy efficiency compared to traditional optical components. These advancements lead to smaller form factors and cost-effectiveness, enabling wider adoption in various applications.

Propelling Factors for Photonic Integrated Circuit Market Growth

Several factors are propelling the growth of the Photonic Integrated Circuit market. Technological advancements, such as the development of novel materials and improved fabrication techniques, are driving performance improvements and cost reductions. The increasing demand for high-bandwidth applications in telecommunications, data centers, and sensing is another major growth driver. Government support and investments in research and development further fuel market expansion. The development of advanced packaging technologies, facilitating the integration of more functionality onto a single chip, also plays a significant role in market growth.

Obstacles in the Photonic Integrated Circuit Market Market

Despite the substantial growth potential, the Photonic Integrated Circuit market faces certain challenges. High manufacturing costs and complex design processes can hinder wider adoption. Supply chain disruptions, particularly in the availability of specialized materials, can create production bottlenecks. Furthermore, intense competition from established players and emerging startups can put pressure on profit margins. These challenges necessitate continuous innovation and strategic partnerships to ensure sustained market growth.

Future Opportunities in Photonic Integrated Circuit Market

Emerging opportunities for the Photonic Integrated Circuit market are extensive. The expansion of 5G and beyond networks will fuel significant demand for high-speed optical interconnects. Growing applications in advanced sensing and biomedical imaging provide new market avenues. The development of integrated photonic circuits for artificial intelligence (AI) and machine learning (ML) applications presents a significant long-term growth potential. Expanding into emerging markets, coupled with the creation of innovative applications, offers considerable untapped market potential.

Major Players in the Photonic Integrated Circuit Market Ecosystem

- II-VI Incorporated

- Source Photonics Inc

- NeoPhotonics Corporation

- Colorchip Ltd

- Caliopa (Huawei Technologies Co Ltd)

- Cisco Systems Inc

- Infinera Corporation

- Lumentum Holdings

- Effect Photonics

- Intel Corporation

- POET Technologies

Key Developments in Photonic Integrated Circuit Market Industry

May 2023: ANELLO Photonics partnered with NVIDIA Inception, leveraging its patented photonic gyroscope integrated circuit technology for low-noise, low-drift optical sensors. This collaboration signals the growing importance of PICs in high-precision sensing applications.

August 2022: DustPhotonics partnered with MaxLinear to showcase high-performance silicon photonics chipsets with integrated lasers, eliminating the need for external driver chips. This demonstrates progress towards more integrated and cost-effective solutions.

March 2022: Source Photonics sampled its Silicon-Photonics 400G DR4 QSFP56-DD products, exceeding IEEE 802.3bs specifications. This product launch highlights the advancement of high-speed optical transceivers and their growing adoption in data centers and telecommunications networks.

Strategic Photonic Integrated Circuit Market Market Forecast

The Photonic Integrated Circuit market is poised for significant growth driven by technological advancements, increasing demand in high-bandwidth applications, and favorable regulatory support. The market's future trajectory is characterized by continuous innovation in materials, integration processes, and packaging technologies, leading to smaller, faster, and more energy-efficient PICs. The expansion into new applications like LiDAR and advanced biomedical imaging, combined with the ongoing growth in telecommunications and data centers, further propels market expansion. The continued development of sophisticated manufacturing techniques is also expected to increase production volumes and reduce costs. These factors strongly suggest significant market potential and sustained growth in the coming years.

Photonic Integrated Circuit Market Segmentation

-

1. Type of Raw Material

- 1.1. III-V Material

- 1.2. Lithium Niobate

- 1.3. Silica-on-silicon

- 1.4. Other Raw Materials

-

2. Integration Process

- 2.1. Hybrid

- 2.2. Monolithic

-

3. Application

- 3.1. Telecommunications

- 3.2. Biomedical

- 3.3. Data Centers

- 3.4. Other Ap

Photonic Integrated Circuit Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Photonic Integrated Circuit Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Applications in Telecommunications and Data Centers; Investments and Research to Miniaturize the PICs

- 3.3. Market Restrains

- 3.3.1. Complexity in System Design and Function

- 3.4. Market Trends

- 3.4.1. Growing Applications in Telecommunications and Data Centers to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 5.1.1. III-V Material

- 5.1.2. Lithium Niobate

- 5.1.3. Silica-on-silicon

- 5.1.4. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Integration Process

- 5.2.1. Hybrid

- 5.2.2. Monolithic

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Telecommunications

- 5.3.2. Biomedical

- 5.3.3. Data Centers

- 5.3.4. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 6. North America Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 6.1.1. III-V Material

- 6.1.2. Lithium Niobate

- 6.1.3. Silica-on-silicon

- 6.1.4. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Integration Process

- 6.2.1. Hybrid

- 6.2.2. Monolithic

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Telecommunications

- 6.3.2. Biomedical

- 6.3.3. Data Centers

- 6.3.4. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 7. Europe Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 7.1.1. III-V Material

- 7.1.2. Lithium Niobate

- 7.1.3. Silica-on-silicon

- 7.1.4. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Integration Process

- 7.2.1. Hybrid

- 7.2.2. Monolithic

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Telecommunications

- 7.3.2. Biomedical

- 7.3.3. Data Centers

- 7.3.4. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 8. Asia Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 8.1.1. III-V Material

- 8.1.2. Lithium Niobate

- 8.1.3. Silica-on-silicon

- 8.1.4. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Integration Process

- 8.2.1. Hybrid

- 8.2.2. Monolithic

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Telecommunications

- 8.3.2. Biomedical

- 8.3.3. Data Centers

- 8.3.4. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 9. Australia and New Zealand Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 9.1.1. III-V Material

- 9.1.2. Lithium Niobate

- 9.1.3. Silica-on-silicon

- 9.1.4. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Integration Process

- 9.2.1. Hybrid

- 9.2.2. Monolithic

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Telecommunications

- 9.3.2. Biomedical

- 9.3.3. Data Centers

- 9.3.4. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 10. Latin America Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 10.1.1. III-V Material

- 10.1.2. Lithium Niobate

- 10.1.3. Silica-on-silicon

- 10.1.4. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Integration Process

- 10.2.1. Hybrid

- 10.2.2. Monolithic

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Telecommunications

- 10.3.2. Biomedical

- 10.3.3. Data Centers

- 10.3.4. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 11. Middle East and Africa Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 11.1.1. III-V Material

- 11.1.2. Lithium Niobate

- 11.1.3. Silica-on-silicon

- 11.1.4. Other Raw Materials

- 11.2. Market Analysis, Insights and Forecast - by Integration Process

- 11.2.1. Hybrid

- 11.2.2. Monolithic

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Telecommunications

- 11.3.2. Biomedical

- 11.3.3. Data Centers

- 11.3.4. Other Ap

- 11.1. Market Analysis, Insights and Forecast - by Type of Raw Material

- 12. North America Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Photonic Integrated Circuit Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 II-VI Incorporated

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Source Photonics Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 NeoPhotonics Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Colorchip Ltd*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Caliopa (Huawei Technologies Co Ltd)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cisco Systems Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Infinera Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Lumentum Holdings

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Effect Photonics

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Intel Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 POET Technologies

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 II-VI Incorporated

List of Figures

- Figure 1: Global Photonic Integrated Circuit Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 11: North America Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 12: North America Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 13: North America Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 14: North America Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 19: Europe Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 20: Europe Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 21: Europe Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 22: Europe Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 27: Asia Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 28: Asia Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 29: Asia Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 30: Asia Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Australia and New Zealand Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 35: Australia and New Zealand Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 36: Australia and New Zealand Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 37: Australia and New Zealand Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 38: Australia and New Zealand Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Australia and New Zealand Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Australia and New Zealand Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Australia and New Zealand Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 43: Latin America Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 44: Latin America Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 45: Latin America Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 46: Latin America Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Latin America Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Latin America Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Latin America Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa Photonic Integrated Circuit Market Revenue (Million), by Type of Raw Material 2024 & 2032

- Figure 51: Middle East and Africa Photonic Integrated Circuit Market Revenue Share (%), by Type of Raw Material 2024 & 2032

- Figure 52: Middle East and Africa Photonic Integrated Circuit Market Revenue (Million), by Integration Process 2024 & 2032

- Figure 53: Middle East and Africa Photonic Integrated Circuit Market Revenue Share (%), by Integration Process 2024 & 2032

- Figure 54: Middle East and Africa Photonic Integrated Circuit Market Revenue (Million), by Application 2024 & 2032

- Figure 55: Middle East and Africa Photonic Integrated Circuit Market Revenue Share (%), by Application 2024 & 2032

- Figure 56: Middle East and Africa Photonic Integrated Circuit Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Middle East and Africa Photonic Integrated Circuit Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 3: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 4: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Photonic Integrated Circuit Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Photonic Integrated Circuit Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Photonic Integrated Circuit Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Photonic Integrated Circuit Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 15: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 16: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 19: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 20: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 23: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 24: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 27: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 28: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 31: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 32: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Type of Raw Material 2019 & 2032

- Table 35: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Integration Process 2019 & 2032

- Table 36: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Global Photonic Integrated Circuit Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Photonic Integrated Circuit Market?

The projected CAGR is approximately 20.47%.

2. Which companies are prominent players in the Photonic Integrated Circuit Market?

Key companies in the market include II-VI Incorporated, Source Photonics Inc, NeoPhotonics Corporation, Colorchip Ltd*List Not Exhaustive, Caliopa (Huawei Technologies Co Ltd), Cisco Systems Inc, Infinera Corporation, Lumentum Holdings, Effect Photonics, Intel Corporation, POET Technologies.

3. What are the main segments of the Photonic Integrated Circuit Market?

The market segments include Type of Raw Material, Integration Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Applications in Telecommunications and Data Centers; Investments and Research to Miniaturize the PICs.

6. What are the notable trends driving market growth?

Growing Applications in Telecommunications and Data Centers to Drive the Market.

7. Are there any restraints impacting market growth?

Complexity in System Design and Function.

8. Can you provide examples of recent developments in the market?

May 2023: ANELLO Photonics announced a partnership with NVIDIA Inception to nurture start-ups that radically change industries with advances in technology. In order to produce low noise and low drift optical sensors, the company uses ANELLO's patented photonic gyroscope integrated circuit technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Photonic Integrated Circuit Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Photonic Integrated Circuit Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Photonic Integrated Circuit Market?

To stay informed about further developments, trends, and reports in the Photonic Integrated Circuit Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence