Key Insights

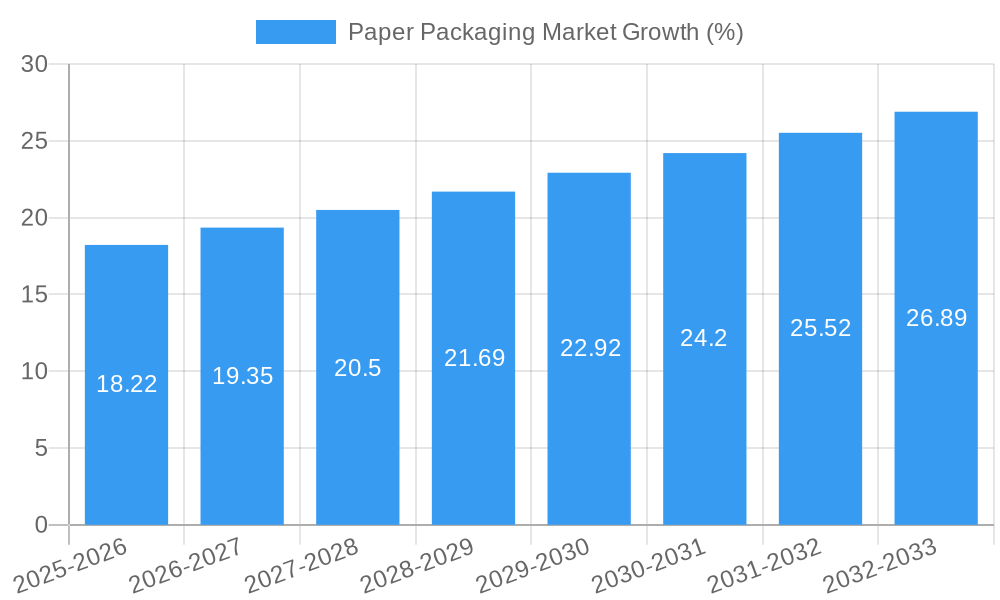

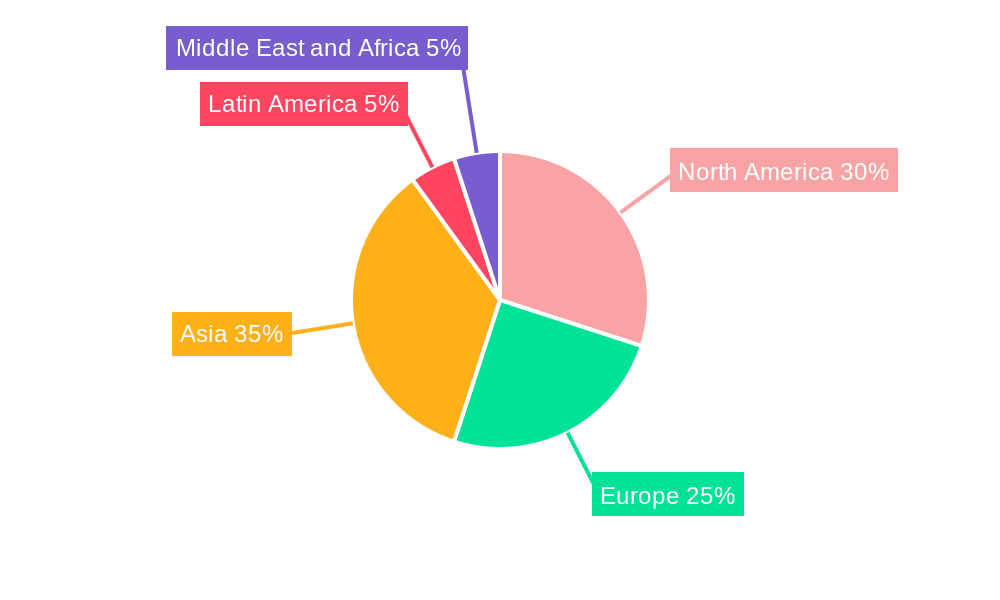

The global paper packaging market, valued at $398.65 million in 2025, is projected to experience robust growth, driven by the increasing demand for sustainable and eco-friendly packaging solutions across various industries. A Compound Annual Growth Rate (CAGR) of 4.68% from 2025 to 2033 indicates a significant market expansion, fueled by several key factors. The rising e-commerce sector necessitates efficient and protective packaging, boosting demand for corrugated boxes and folding cartons. Furthermore, the growing focus on food safety and hygiene within the food and beverage industry is driving the adoption of high-quality paper-based packaging materials. The healthcare sector also contributes significantly, requiring specialized packaging for pharmaceuticals and medical devices. While potential restraints such as fluctuating raw material prices and increasing environmental regulations exist, innovation in sustainable packaging materials and efficient manufacturing processes are mitigating these challenges. Market segmentation reveals significant opportunities within specific product types (e.g., the high demand for corrugated boxes), end-user industries (e.g., the substantial contribution of the food and beverage sector), and grades of paperboard (e.g., the widespread use of carton board). Leading players like WestRock, Smurfit Kappa, and Sonoco are leveraging these trends through strategic acquisitions, capacity expansions, and the development of innovative packaging solutions to maintain their market leadership. Regional analysis indicates strong growth potential across North America, Europe, and Asia, driven by established consumer markets and rising disposable incomes.

The projected market size for 2033 can be estimated using the CAGR. Assuming consistent growth, the market is expected to expand considerably by 2033. The market's regional distribution will likely shift, with Asia-Pacific potentially witnessing faster growth due to expanding economies and urbanization. Growth in specific segments such as e-commerce packaging and sustainable packaging solutions within the various end-user industries will be pivotal to the market's trajectory. Competitive landscape analysis suggests a trend toward mergers and acquisitions as companies strive to enhance their market share and product portfolios. This competitive landscape, coupled with the overall market growth, creates a dynamic and promising outlook for the paper packaging industry over the next decade.

Paper Packaging Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the global Paper Packaging Market, offering a comprehensive overview of market dynamics, trends, and future prospects. From examining market concentration and competitive landscapes to exploring technological advancements and emerging opportunities, this report equips stakeholders with the critical intelligence needed to navigate this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market value is projected to reach xx Million by 2033.

Paper Packaging Market Composition & Trends

This section delves into the intricate structure of the paper packaging market, evaluating key aspects that shape its current state and future trajectory. We analyze market concentration, revealing the market share distribution among key players such as WestRock Company, Smurfit Kappa Group, Sonoco Products Company, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, and Cascades Inc. The report also examines the impact of innovation catalysts, including advancements in barrier coatings and sustainable materials, on market growth. Furthermore, we explore the regulatory landscape, focusing on policies promoting sustainability and reducing plastic waste, and assess the competitive pressures from substitute products, such as plastic and biodegradable alternatives. End-user profiles across diverse sectors, including food, beverage, healthcare, and personal care, are meticulously examined. Finally, a detailed analysis of recent mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation, is presented.

- Market Share Distribution: WestRock Company holds an estimated xx% market share, followed by Smurfit Kappa Group with xx%, and Sonoco Products Company with xx%. The remaining market share is distributed among other major players.

- M&A Activity: Over the historical period (2019-2024), M&A deal values totaled approximately xx Million, indicating significant consolidation within the industry.

- Regulatory Landscape: Growing regulations aimed at reducing plastic waste are expected to drive market growth for paper packaging.

Paper Packaging Market Industry Evolution

This section charts the evolution of the paper packaging industry, tracing its growth trajectory, highlighting technological advancements, and examining the influence of shifting consumer preferences. We analyze historical growth rates (2019-2024) and project future growth rates (2025-2033), considering factors like increased demand for sustainable packaging and the rising adoption of innovative packaging solutions. We also explore technological advancements, such as the development of improved barrier coatings, biodegradable materials, and smart packaging solutions. This analysis encompasses the rising consumer preference for eco-friendly and convenient packaging and its impact on the industry. Specific data points on growth rates and adoption of new technologies are included. For instance, the adoption rate of recycled paper packaging is projected to increase by xx% from 2025 to 2033.

Leading Regions, Countries, or Segments in Paper Packaging Market

This section pinpoints the dominant regions, countries, and segments within the paper packaging market. We analyze market performance by product type (Folding Cartons, Corrugated Boxes, Other Types), end-user industry (Food, Beverage, Healthcare, Personal Care, Household Care, Electrical Products, Other End User Industries), and grade (Carton Board, Containerboard). This analysis identifies leading segments based on factors such as market size, growth rate, and unique market drivers.

- By Product: Corrugated boxes dominate the market due to its versatility and cost-effectiveness.

- By End User Industry: The food and beverage industry represents the largest segment due to the high demand for packaging in this sector.

- By Grade: Carton board is a major segment due to its widespread use in folding cartons and other packaging applications.

Key Drivers:

- Strong growth in the e-commerce sector is driving demand for corrugated boxes.

- Increasing consumer preference for sustainable packaging solutions is boosting demand for recycled paper packaging.

- Favorable government regulations promoting the use of eco-friendly packaging materials are fostering market growth.

Paper Packaging Market Product Innovations

Recent innovations in paper packaging technology have focused on enhancing barrier properties, improving recyclability, and creating more sustainable packaging solutions. For example, the development of new barrier coatings that extend shelf life and protect products while reducing the reliance on plastic liners. Sealed Air’s new paper bottom web, made with 90% FSC-certified fibers, demonstrates this progress, offering a 77% reduction in plastic usage compared to traditional PET/PE bottom webs. The focus on user-friendliness is also evident, as seen in ITC Sunfeast Farmlite's 100% paper packaging for its biscuits. These innovations offer unique selling propositions, such as improved product protection, enhanced sustainability, and improved consumer experience, boosting market competitiveness.

Propelling Factors for Paper Packaging Market Growth

Several factors are propelling the growth of the paper packaging market. These include the increasing demand for sustainable and eco-friendly packaging solutions driven by consumer awareness of environmental issues and stricter government regulations on plastic waste. Economic factors, such as the growing global population and rising disposable incomes, also contribute to higher demand for packaged goods. Furthermore, technological advancements in paper packaging, such as improved barrier properties and enhanced printability, are widening the range of applications.

Obstacles in the Paper Packaging Market

The paper packaging market faces certain challenges. Fluctuations in raw material prices, particularly pulp and paper, can impact profitability. Supply chain disruptions, such as those caused by geopolitical instability or natural disasters, can affect production and delivery. Intense competition from alternative packaging materials, such as plastics and bioplastics, also presents a challenge. These obstacles can lead to pricing pressures and reduced profit margins.

Future Opportunities in Paper Packaging Market

Emerging opportunities include the expansion into new markets, particularly in developing economies with rapidly growing populations. The development of innovative packaging solutions, such as smart packaging with embedded sensors and improved barrier properties, will also drive growth. The increasing demand for sustainable and recyclable packaging presents significant opportunities for companies that can offer eco-friendly options. Furthermore, the growing use of paper packaging in the e-commerce sector provides a further growth driver.

Major Players in the Paper Packaging Market Ecosystem

- WestRock Company (WestRock Company)

- Smurfit Kappa Group (Smurfit Kappa Group)

- Sonoco Products Company (Sonoco Products Company)

- Nippon Paper Industries Ltd (Nippon Paper Industries Ltd)

- DS Smith PLC (DS Smith PLC)

- Mondi Group (Mondi Group)

- International Paper Company (International Paper Company)

- Eastern Pak Limited

- Packaging Corporation of America (Packaging Corporation of America)

- Cascades Inc (Cascades Inc)

Key Developments in Paper Packaging Market Industry

- March 2024: Sealed Air launched a new paper bottom web, reducing plastic consumption by 77% in certain applications.

- January 2024: ITC Sunfeast Farmlite launched a biscuit pack using 100% paper packaging, highlighting a shift towards sustainable choices.

Strategic Paper Packaging Market Forecast

The paper packaging market is poised for robust growth, driven by the confluence of consumer preference for sustainability, stringent environmental regulations, and technological advancements. The continued focus on innovation in barrier technologies and recyclable materials will unlock new applications and expand market penetration across diverse sectors. The forecast period (2025-2033) presents significant opportunities for market expansion, particularly in regions with developing economies and growing demand for packaged goods. The market is expected to witness continuous consolidation and strategic partnerships to enhance competitiveness and sustainability efforts.

Paper Packaging Market Segmentation

-

1. Grade

-

1.1. Carton Board

- 1.1.1. Solid Bleached Sulphate (SBS)

- 1.1.2. Solid Unbleached Sulphate (SUS)

- 1.1.3. Folding Boxboard (FBB)

- 1.1.4. Coated Recycled Board (CRB)

- 1.1.5. Uncoated Recycled Board (URB)

- 1.1.6. Othder Graes

-

1.2. Containerboard

- 1.2.1. White-top Kraftliner

- 1.2.2. Other Kraftliners

- 1.2.3. White top Testliner

- 1.2.4. Other Testliners

- 1.2.5. Semi Chemical Fluting

- 1.2.6. Recycled Fluting

-

1.1. Carton Board

-

2. Product

- 2.1. Folding Cartons

- 2.2. Corrugated Boxes

- 2.3. Other Types

-

3. End User Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Personal Care

- 3.5. Household Care

- 3.6. Electrical Products

- 3.7. Other End User Industries

Paper Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Italy

- 2.4. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of Barrier-coated Paperboard Products; Growing Consumer Awareness on Paper Packaging

- 3.3. Market Restrains

- 3.3.1. Effects of Deforestation on Paper Packaging; Increasing Operational Costs

- 3.4. Market Trends

- 3.4.1. The Food and Beverage Segments are Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 5.1.1. Carton Board

- 5.1.1.1. Solid Bleached Sulphate (SBS)

- 5.1.1.2. Solid Unbleached Sulphate (SUS)

- 5.1.1.3. Folding Boxboard (FBB)

- 5.1.1.4. Coated Recycled Board (CRB)

- 5.1.1.5. Uncoated Recycled Board (URB)

- 5.1.1.6. Othder Graes

- 5.1.2. Containerboard

- 5.1.2.1. White-top Kraftliner

- 5.1.2.2. Other Kraftliners

- 5.1.2.3. White top Testliner

- 5.1.2.4. Other Testliners

- 5.1.2.5. Semi Chemical Fluting

- 5.1.2.6. Recycled Fluting

- 5.1.1. Carton Board

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Folding Cartons

- 5.2.2. Corrugated Boxes

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Personal Care

- 5.3.5. Household Care

- 5.3.6. Electrical Products

- 5.3.7. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Grade

- 6. North America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 6.1.1. Carton Board

- 6.1.1.1. Solid Bleached Sulphate (SBS)

- 6.1.1.2. Solid Unbleached Sulphate (SUS)

- 6.1.1.3. Folding Boxboard (FBB)

- 6.1.1.4. Coated Recycled Board (CRB)

- 6.1.1.5. Uncoated Recycled Board (URB)

- 6.1.1.6. Othder Graes

- 6.1.2. Containerboard

- 6.1.2.1. White-top Kraftliner

- 6.1.2.2. Other Kraftliners

- 6.1.2.3. White top Testliner

- 6.1.2.4. Other Testliners

- 6.1.2.5. Semi Chemical Fluting

- 6.1.2.6. Recycled Fluting

- 6.1.1. Carton Board

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Folding Cartons

- 6.2.2. Corrugated Boxes

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare

- 6.3.4. Personal Care

- 6.3.5. Household Care

- 6.3.6. Electrical Products

- 6.3.7. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Grade

- 7. Europe Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 7.1.1. Carton Board

- 7.1.1.1. Solid Bleached Sulphate (SBS)

- 7.1.1.2. Solid Unbleached Sulphate (SUS)

- 7.1.1.3. Folding Boxboard (FBB)

- 7.1.1.4. Coated Recycled Board (CRB)

- 7.1.1.5. Uncoated Recycled Board (URB)

- 7.1.1.6. Othder Graes

- 7.1.2. Containerboard

- 7.1.2.1. White-top Kraftliner

- 7.1.2.2. Other Kraftliners

- 7.1.2.3. White top Testliner

- 7.1.2.4. Other Testliners

- 7.1.2.5. Semi Chemical Fluting

- 7.1.2.6. Recycled Fluting

- 7.1.1. Carton Board

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Folding Cartons

- 7.2.2. Corrugated Boxes

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare

- 7.3.4. Personal Care

- 7.3.5. Household Care

- 7.3.6. Electrical Products

- 7.3.7. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Grade

- 8. Asia Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 8.1.1. Carton Board

- 8.1.1.1. Solid Bleached Sulphate (SBS)

- 8.1.1.2. Solid Unbleached Sulphate (SUS)

- 8.1.1.3. Folding Boxboard (FBB)

- 8.1.1.4. Coated Recycled Board (CRB)

- 8.1.1.5. Uncoated Recycled Board (URB)

- 8.1.1.6. Othder Graes

- 8.1.2. Containerboard

- 8.1.2.1. White-top Kraftliner

- 8.1.2.2. Other Kraftliners

- 8.1.2.3. White top Testliner

- 8.1.2.4. Other Testliners

- 8.1.2.5. Semi Chemical Fluting

- 8.1.2.6. Recycled Fluting

- 8.1.1. Carton Board

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Folding Cartons

- 8.2.2. Corrugated Boxes

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare

- 8.3.4. Personal Care

- 8.3.5. Household Care

- 8.3.6. Electrical Products

- 8.3.7. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Grade

- 9. Latin America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 9.1.1. Carton Board

- 9.1.1.1. Solid Bleached Sulphate (SBS)

- 9.1.1.2. Solid Unbleached Sulphate (SUS)

- 9.1.1.3. Folding Boxboard (FBB)

- 9.1.1.4. Coated Recycled Board (CRB)

- 9.1.1.5. Uncoated Recycled Board (URB)

- 9.1.1.6. Othder Graes

- 9.1.2. Containerboard

- 9.1.2.1. White-top Kraftliner

- 9.1.2.2. Other Kraftliners

- 9.1.2.3. White top Testliner

- 9.1.2.4. Other Testliners

- 9.1.2.5. Semi Chemical Fluting

- 9.1.2.6. Recycled Fluting

- 9.1.1. Carton Board

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Folding Cartons

- 9.2.2. Corrugated Boxes

- 9.2.3. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare

- 9.3.4. Personal Care

- 9.3.5. Household Care

- 9.3.6. Electrical Products

- 9.3.7. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Grade

- 10. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 10.1.1. Carton Board

- 10.1.1.1. Solid Bleached Sulphate (SBS)

- 10.1.1.2. Solid Unbleached Sulphate (SUS)

- 10.1.1.3. Folding Boxboard (FBB)

- 10.1.1.4. Coated Recycled Board (CRB)

- 10.1.1.5. Uncoated Recycled Board (URB)

- 10.1.1.6. Othder Graes

- 10.1.2. Containerboard

- 10.1.2.1. White-top Kraftliner

- 10.1.2.2. Other Kraftliners

- 10.1.2.3. White top Testliner

- 10.1.2.4. Other Testliners

- 10.1.2.5. Semi Chemical Fluting

- 10.1.2.6. Recycled Fluting

- 10.1.1. Carton Board

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Folding Cartons

- 10.2.2. Corrugated Boxes

- 10.2.3. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare

- 10.3.4. Personal Care

- 10.3.5. Household Care

- 10.3.6. Electrical Products

- 10.3.7. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Grade

- 11. North America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 Italy

- 12.1.4 France

- 13. Asia Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia and New Zealand

- 14. Latin America Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 15. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WestRock Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Smurfit Kappa Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonoco Products Compan

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nippon Paper Industries Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DS Smith PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mondi Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 International Paper Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Eastern Pak Limited

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Packaging Corporation of America

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Cascades Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 WestRock Company

List of Figures

- Figure 1: Global Paper Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 13: North America Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 14: North America Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 15: North America Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 16: North America Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: North America Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: North America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 21: Europe Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 22: Europe Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 23: Europe Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 24: Europe Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 25: Europe Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 26: Europe Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 29: Asia Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 30: Asia Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 31: Asia Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 32: Asia Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 33: Asia Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Asia Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 37: Latin America Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 38: Latin America Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 39: Latin America Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 40: Latin America Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 41: Latin America Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 42: Latin America Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Paper Packaging Market Revenue (Million), by Grade 2024 & 2032

- Figure 45: Middle East and Africa Paper Packaging Market Revenue Share (%), by Grade 2024 & 2032

- Figure 46: Middle East and Africa Paper Packaging Market Revenue (Million), by Product 2024 & 2032

- Figure 47: Middle East and Africa Paper Packaging Market Revenue Share (%), by Product 2024 & 2032

- Figure 48: Middle East and Africa Paper Packaging Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 49: Middle East and Africa Paper Packaging Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 50: Middle East and Africa Paper Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Paper Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 3: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 5: Global Paper Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Australia and New Zealand Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United Arab Emirates Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 27: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 29: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 33: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 34: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 35: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 41: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 43: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Australia and New Zealand Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 49: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 51: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Mexico Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Paper Packaging Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 55: Global Paper Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 56: Global Paper Packaging Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 57: Global Paper Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: United Arab Emirates Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Saudi Arabia Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Paper Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Paper Packaging Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Paper Packaging Market?

Key companies in the market include WestRock Company, Smurfit Kappa Group, Sonoco Products Compan, Nippon Paper Industries Ltd, DS Smith PLC, Mondi Group, International Paper Company, Eastern Pak Limited, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the Paper Packaging Market?

The market segments include Grade, Product, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 398.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of Barrier-coated Paperboard Products; Growing Consumer Awareness on Paper Packaging.

6. What are the notable trends driving market growth?

The Food and Beverage Segments are Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Effects of Deforestation on Paper Packaging; Increasing Operational Costs.

8. Can you provide examples of recent developments in the market?

March 2024: Sealed Air developed a new paper bottom web to meet the needs of food processors, retailers, and consumers looking to reduce plastic consumption and meet paper packaging demand. CRYOVAC’s new barrier formable paper, branded under Sealed Air, is made of 90% fibers certified by the FSC. According to SEE, this paper bottom web can reduce plastic by 77% when replacing PET/PE bottom web packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence