Key Insights

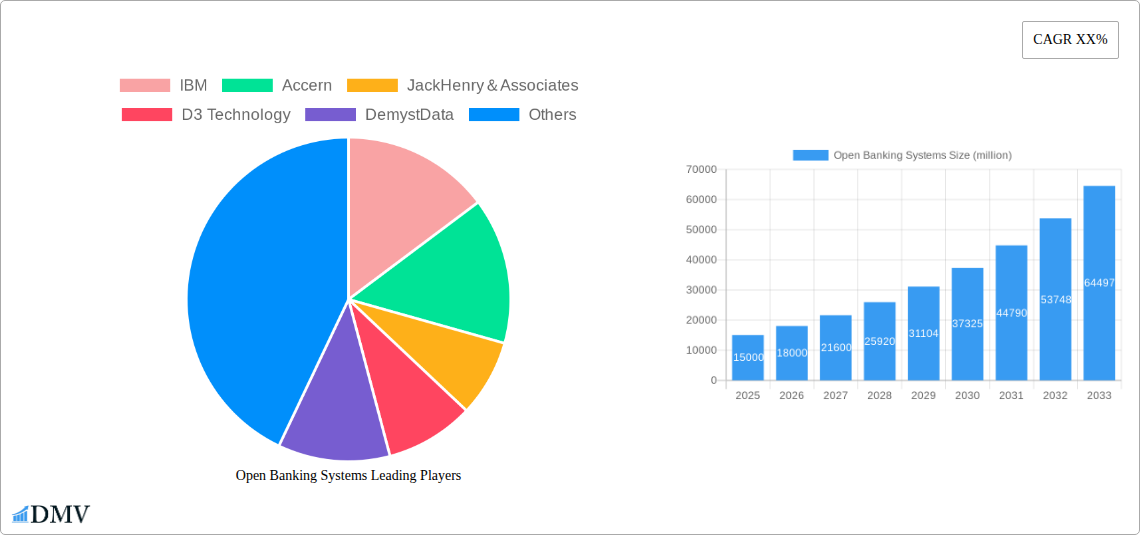

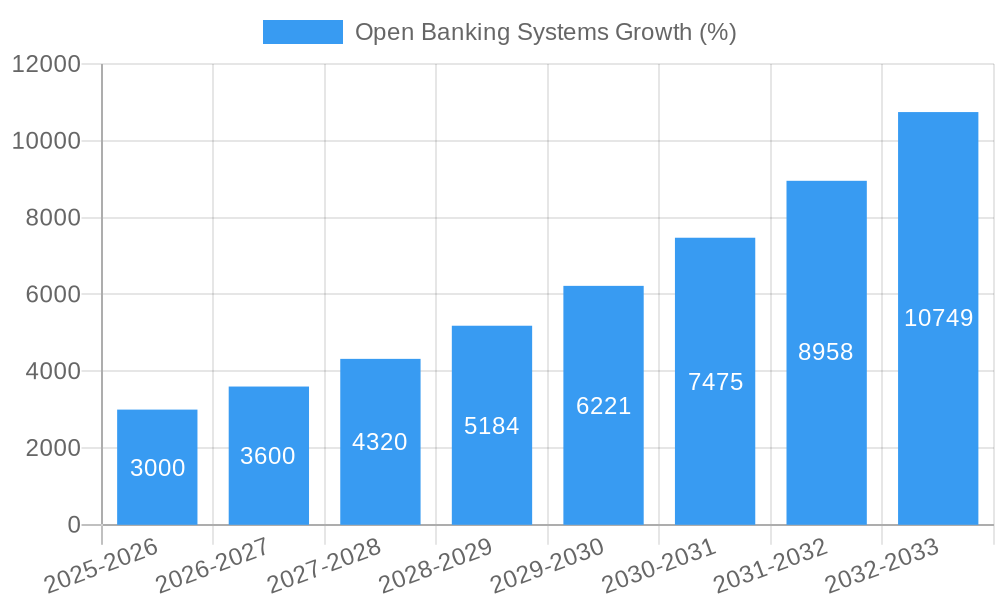

The Open Banking Systems market is experiencing robust growth, driven by increasing regulatory mandates promoting data sharing, the rising adoption of digital financial services, and the burgeoning demand for personalized financial products. The market, estimated at $15 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 20% from 2025 to 2033, reaching approximately $60 billion by 2033. Key drivers include the need for enhanced customer experiences through improved financial management tools, the expansion of fintech partnerships leveraging open banking APIs, and the development of innovative financial products based on aggregated consumer data. This growth is further fueled by the increasing adoption of cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness compared to traditional on-premise systems. Leading companies such as IBM, Accern, Jack Henry & Associates, and others are actively shaping the market landscape through strategic partnerships, technological advancements, and acquisitions.

However, challenges persist. Security and privacy concerns surrounding data sharing remain a significant restraint, necessitating robust security measures and transparent data governance frameworks. Interoperability issues across different banking systems and platforms also pose a barrier to widespread adoption. Furthermore, the varying levels of regulatory frameworks across different geographies present complexities in market expansion. To overcome these challenges, collaboration between financial institutions, fintech companies, and regulatory bodies is crucial to establish standardized protocols, enhance security measures, and foster trust amongst consumers. The segmentation of the market includes solutions for various financial services such as payments, lending, and investment management, with significant growth potential in emerging markets across Asia and Latin America.

Open Banking Systems Market Report: A Comprehensive Analysis (2019-2033)

This insightful report provides a comprehensive analysis of the Open Banking Systems market, projecting a market value exceeding $xx million by 2033. Leveraging data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study offers crucial insights for stakeholders seeking to navigate this rapidly evolving landscape. The report meticulously examines market composition, trends, leading players, and future opportunities, providing actionable intelligence for strategic decision-making.

Open Banking Systems Market Composition & Trends

This section delves into the intricate dynamics of the Open Banking Systems market, offering a granular view of its composition and prevailing trends. The market exhibits a moderately concentrated structure, with key players like IBM, Accern, and Jack Henry & Associates commanding significant shares. However, the entry of innovative startups and the ongoing consolidation through mergers and acquisitions (M&A) are reshaping the competitive landscape. The total value of M&A deals in the sector reached $xx million in 2024, indicating robust investor interest and industry consolidation.

- Market Share Distribution (2024): IBM (xx%), Accern (xx%), Jack Henry & Associates (xx%), Others (xx%). Note: These figures are estimates based on available market data.

- Innovation Catalysts: Advancements in API technologies, rising consumer demand for personalized financial services, and supportive regulatory frameworks are fueling market expansion.

- Regulatory Landscape: Varying regulations across different jurisdictions influence market penetration and adoption rates. Compliance requirements and data security protocols are significant considerations for market participants.

- Substitute Products: While traditional banking models remain dominant, the emergence of fintech solutions and alternative financial service providers presents increasing competition.

- End-User Profiles: The market caters to a broad range of end-users, including financial institutions, fintech companies, and individual consumers.

- M&A Activities: The increase in M&A activity reflects the consolidation and expansion efforts of major players, aiming to enhance their market position and technological capabilities.

Open Banking Systems Industry Evolution

The Open Banking Systems market has witnessed remarkable growth over the past few years, driven by technological advancements and evolving consumer preferences. The market expanded at a CAGR of xx% during 2019-2024, and is projected to maintain a healthy growth trajectory of xx% from 2025 to 2033, reaching an estimated value of $xx million by 2033. This growth is fueled by several factors, including the rising adoption of mobile banking, the increasing popularity of personalized financial services, and the growing need for secure and efficient financial transactions.

Key technological advancements, such as improvements in cloud computing, artificial intelligence, and blockchain technology, have significantly improved the capabilities of open banking systems, enabling financial institutions to offer innovative products and services to their customers. Simultaneously, shifting consumer demands for seamless, secure, and personalized financial experiences are driving increased adoption and fueling market expansion. The increasing prevalence of data privacy regulations, while presenting challenges, also highlights the growing importance of secure data management within the open banking ecosystem.

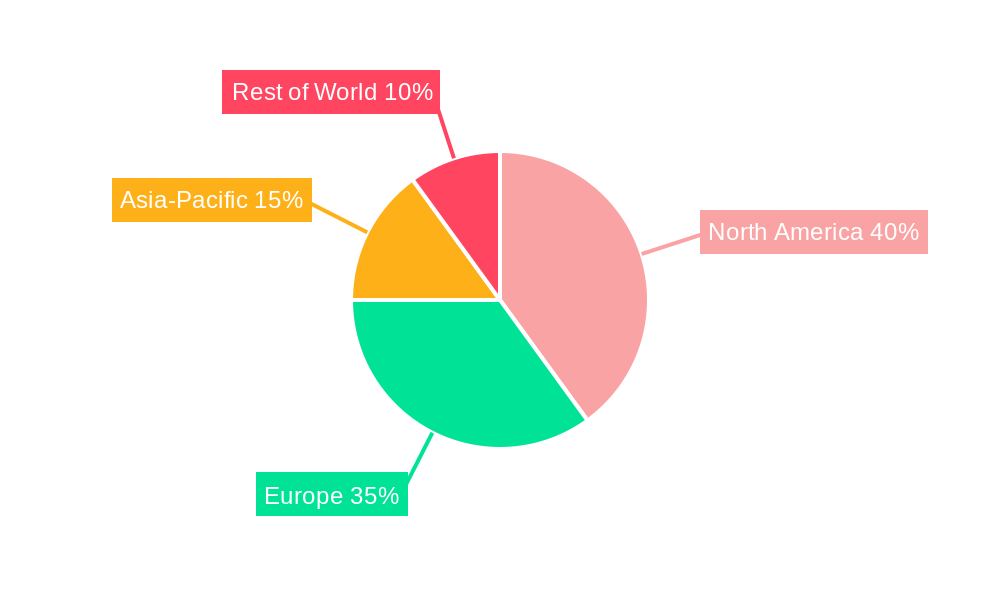

Leading Regions, Countries, or Segments in Open Banking Systems

The European Union has emerged as a leading region in Open Banking Systems adoption, primarily driven by the strong regulatory push from the PSD2 directive. The UK, in particular, has witnessed significant advancements in the sector, showcasing high rates of adoption and innovation.

- Key Drivers in the EU:

- Strong Regulatory Support: PSD2 and other related regulations have mandated open banking practices, fostering innovation and competition.

- High Investment in Fintech: Significant venture capital funding is flowing into innovative fintech companies in the region.

- Tech-Savvy Population: A high level of digital literacy and smartphone penetration accelerates the adoption of open banking solutions.

- Other Regions: North America and Asia-Pacific are also witnessing substantial growth, albeit at varying paces, influenced by factors such as regulatory frameworks and technological infrastructure. The US market is showing significant potential, spurred by technological advancement and increased demand.

Open Banking Systems Product Innovations

Recent innovations in Open Banking Systems include improved API security protocols, enhanced data aggregation capabilities, and the integration of advanced analytics for personalized financial insights. These enhancements deliver unique selling propositions, enabling financial institutions to offer customized financial products and services, bolstering user engagement and driving market growth.

Propelling Factors for Open Banking Systems Growth

Several factors fuel the growth of Open Banking Systems. Technological advancements, particularly in artificial intelligence and cloud computing, empower the development of sophisticated applications. Government regulations mandating data sharing and interoperability in certain regions further accelerate adoption. Finally, the increasing consumer demand for personalized and convenient financial services creates a strong market pull.

Obstacles in the Open Banking Systems Market

Despite the significant growth potential, Open Banking Systems face several challenges. Varying regulatory landscapes across different jurisdictions create fragmentation and compliance hurdles, potentially slowing down market expansion. Data security and privacy concerns, coupled with the potential for fraudulent activities, necessitate robust security protocols to maintain consumer trust. Moreover, competitive pressures from traditional financial institutions and emerging fintech players can impact market dynamics. The estimated annual cost of addressing these challenges is $xx million.

Future Opportunities in Open Banking Systems

The future of Open Banking Systems holds immense potential. Expansion into emerging markets with growing digital penetration presents vast opportunities for growth. The integration of blockchain technology promises enhanced security and transparency, while the use of AI and machine learning can further personalize financial services. The emergence of embedded finance is also creating new avenues for growth and innovation.

Major Players in the Open Banking Systems Ecosystem

- IBM

- Accern

- Jack Henry & Associates

- D3 Technology

- DemystData

- Figo

- FormFree Holdings

- Malauzai Software

- Mambu GmbH

- MineralTree

Key Developments in Open Banking Systems Industry

- 2024 Q4: IBM launched a new API security platform for Open Banking Systems, enhancing data protection capabilities.

- 2024 Q3: Accern acquired a smaller fintech startup, expanding its data aggregation capabilities.

- 2023 Q2: New data privacy regulations were implemented in the EU, impacting data sharing protocols within the Open Banking ecosystem. (Further developments can be added here)

Strategic Open Banking Systems Market Forecast

The Open Banking Systems market is poised for sustained growth, driven by continued technological advancements, increasing regulatory support, and growing consumer demand for personalized financial experiences. The market's expansion into new geographical regions and the integration of innovative technologies will further fuel this growth, creating significant opportunities for both established players and emerging startups. The forecast period of 2025-2033 presents a compelling investment opportunity, with the market expected to reach a value exceeding $xx million.

Open Banking Systems Segmentation

-

1. Application

- 1.1. Financial

- 1.2. Retail

- 1.3. Other

-

2. Types

- 2.1. Communicative Services

- 2.2. Informative Services

Open Banking Systems Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Open Banking Systems REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Financial

- 5.1.2. Retail

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Communicative Services

- 5.2.2. Informative Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Financial

- 6.1.2. Retail

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Communicative Services

- 6.2.2. Informative Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Financial

- 7.1.2. Retail

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Communicative Services

- 7.2.2. Informative Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Financial

- 8.1.2. Retail

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Communicative Services

- 8.2.2. Informative Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Financial

- 9.1.2. Retail

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Communicative Services

- 9.2.2. Informative Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Open Banking Systems Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Financial

- 10.1.2. Retail

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Communicative Services

- 10.2.2. Informative Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accern

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JackHenry&Associates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 D3 Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DemystData

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Figo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FormFree Holdings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Malauzai Software

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mambu GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MineralTree

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IBM

List of Figures

- Figure 1: Global Open Banking Systems Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Open Banking Systems Revenue (million), by Application 2024 & 2032

- Figure 3: North America Open Banking Systems Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Open Banking Systems Revenue (million), by Types 2024 & 2032

- Figure 5: North America Open Banking Systems Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Open Banking Systems Revenue (million), by Country 2024 & 2032

- Figure 7: North America Open Banking Systems Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Open Banking Systems Revenue (million), by Application 2024 & 2032

- Figure 9: South America Open Banking Systems Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Open Banking Systems Revenue (million), by Types 2024 & 2032

- Figure 11: South America Open Banking Systems Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Open Banking Systems Revenue (million), by Country 2024 & 2032

- Figure 13: South America Open Banking Systems Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Open Banking Systems Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Open Banking Systems Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Open Banking Systems Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Open Banking Systems Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Open Banking Systems Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Open Banking Systems Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Open Banking Systems Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Open Banking Systems Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Open Banking Systems Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Open Banking Systems Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Open Banking Systems Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Open Banking Systems Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Open Banking Systems Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Open Banking Systems Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Open Banking Systems Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Open Banking Systems Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Open Banking Systems Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Open Banking Systems Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Open Banking Systems Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Open Banking Systems Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Open Banking Systems Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Open Banking Systems Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Open Banking Systems Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Open Banking Systems Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Open Banking Systems Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Open Banking Systems Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Open Banking Systems Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Open Banking Systems Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Open Banking Systems?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Open Banking Systems?

Key companies in the market include IBM, Accern, JackHenry&Associates, D3 Technology, DemystData, Figo, FormFree Holdings, Malauzai Software, Mambu GmbH, MineralTree.

3. What are the main segments of the Open Banking Systems?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Open Banking Systems," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Open Banking Systems report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Open Banking Systems?

To stay informed about further developments, trends, and reports in the Open Banking Systems, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence