Key Insights

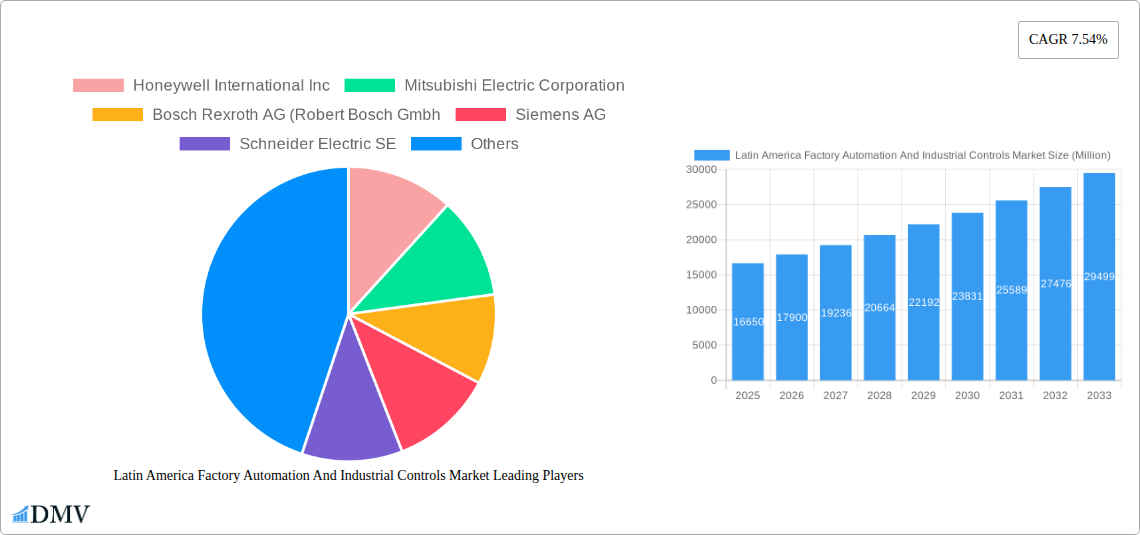

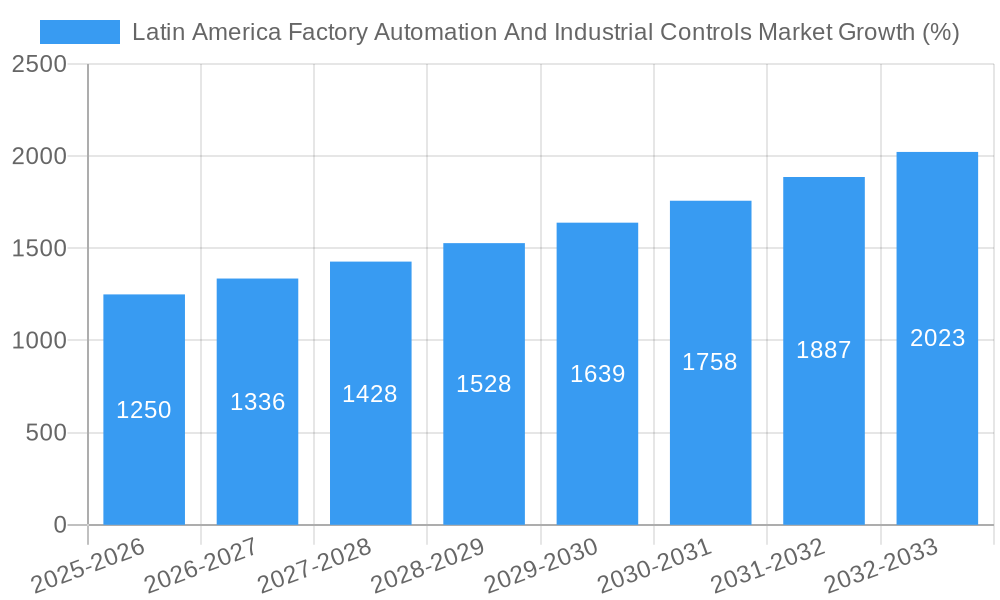

The Latin American Factory Automation and Industrial Controls market is experiencing robust growth, projected to reach \$16.65 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.54% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of Industry 4.0 technologies across various sectors, including oil and gas, chemicals, power utilities, and food and beverage, is fueling demand for advanced automation solutions. The region's burgeoning manufacturing sector, particularly in countries like Brazil, Mexico, and Argentina, further contributes to this growth. Furthermore, government initiatives promoting industrial modernization and technological advancements are creating a favorable environment for market expansion. Investments in smart factories and digital transformation are also playing a significant role. While challenges such as economic volatility and infrastructure limitations exist, the overall market outlook remains positive, driven by strong underlying demand and technological innovation.

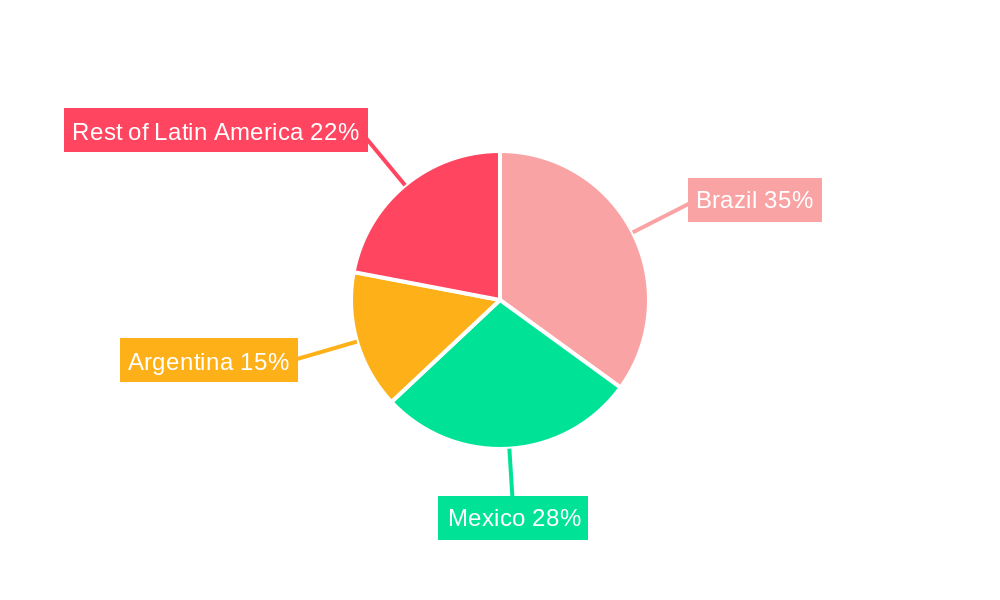

The market segmentation reveals significant opportunities. The Industrial Control Systems segment is expected to dominate, with strong demand for field devices and advanced process control systems. Growth within specific end-user industries will vary, with the oil and gas, and chemical and petrochemical sectors likely leading the way due to their intensive automation needs and ongoing investments in operational efficiency. Geographically, Brazil and Mexico represent the largest markets, driven by their sizable manufacturing bases and significant industrial activity. Key players like Honeywell, Mitsubishi Electric, Siemens, and Rockwell Automation are well-positioned to capitalize on this growth, leveraging their established presence and technological expertise. Future growth will hinge on factors such as the pace of digital transformation, government policies, and the overall economic stability of the region. Continued investment in research and development, along with the development of innovative solutions tailored to the specific needs of Latin American industries, will be crucial for sustained market expansion.

Latin America Factory Automation and Industrial Controls Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America Factory Automation and Industrial Controls market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with 2025 as the base year, this research delves into market dynamics, technological advancements, and emerging opportunities across Brazil, Argentina, and Mexico. The report is essential for stakeholders including manufacturers, investors, and government agencies seeking to understand and capitalize on the growth potential within this dynamic sector. The market is projected to reach xx Million by 2033.

Latin America Factory Automation And Industrial Controls Market Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory frameworks, and market dynamics influencing the Latin America Factory Automation and Industrial Controls market. We explore market concentration, examining the market share distribution among key players like Honeywell International Inc, Mitsubishi Electric Corporation, Bosch Rexroth AG, Siemens AG, Schneider Electric SE, Autodesk Inc, Rockwell Automation Inc, Dassault Systèmes SE, ABB Limited, Aspen Technology Inc, General Electric Company, and Emerson Electric Company. The report also investigates the impact of mergers and acquisitions (M&A) activities, including deal values and their influence on market consolidation. Innovation is analyzed through the lens of technological advancements and their adoption rates within various industry segments. Regulatory landscapes are examined, highlighting their influence on market access and growth. Finally, the report profiles end-users across diverse industries, showcasing their automation adoption patterns and future needs.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025.

- M&A Activity: The historical period (2019-2024) witnessed xx M&A deals, with an aggregate value of approximately xx Million. This activity is expected to continue, driving further consolidation.

- Innovation Catalysts: Government initiatives promoting industrial automation and technological advancements in areas like AI and IoT are significant drivers of innovation.

- Regulatory Landscape: Varying regulatory standards across countries influence the adoption of automation technologies and impact market growth.

- End-User Profiles: Detailed profiles of end-users across oil & gas, chemical, power & utilities, food & beverage, automotive, and pharmaceutical sectors reveal diverse adoption rates and technology preferences.

Latin America Factory Automation And Industrial Controls Market Industry Evolution

This section provides a detailed analysis of the Latin America Factory Automation and Industrial Controls market's evolution, examining market growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2033. We examine the historical growth rate (2019-2024) and project the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033). Technological advancements like the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing are analyzed for their impact on market growth and adoption. The shift in consumer demands towards greater efficiency, sustainability, and reduced operational costs is also examined. Specific data points, such as growth rates for individual segments and adoption metrics for specific technologies, are provided to support the analysis. The market is expected to witness significant growth driven by increasing industrialization, government initiatives promoting automation, and the need for enhanced operational efficiency across various sectors.

Leading Regions, Countries, or Segments in Latin America Factory Automation And Industrial Controls Market

This section identifies the leading regions, countries, and segments within the Latin America Factory Automation and Industrial Controls market.

By Country:

- Brazil: Brazil leads the market due to its large industrial base, government initiatives promoting industrial automation, and significant investments in infrastructure development.

- Mexico: Mexico’s proximity to the US market and its growing manufacturing sector contribute to its strong market position.

- Argentina: Argentina exhibits a comparatively smaller market size, but growth is expected due to increased investments in its industrial sector.

By End-user Industry:

- Oil and Gas: This segment is a key driver due to the extensive use of automation technologies in upstream, midstream, and downstream operations.

- Chemical and Petrochemical: The demand for efficient and safe process control in chemical plants drives the adoption of advanced automation systems.

- Automotive: The automotive industry's focus on efficiency and precision makes it a major adopter of automation technology.

By Product Type:

- Industrial Control Systems: This segment dominates the market, owing to its critical role in managing industrial processes.

- Other Industrial Control Systems (Field Devices): The demand for field devices, essential for data acquisition and control, ensures strong market growth in this segment.

Latin America Factory Automation And Industrial Controls Market Product Innovations

Recent product innovations in the Latin America Factory Automation and Industrial Controls market include the launch of advanced industrial control systems with enhanced functionalities and improved performance metrics. Examples include Rockwell Automation's ArmorKinetix Distributed Servo Drives, offering scalability and sustainability benefits, and ABB Robotics' expansion of its robot offering with new models and variants emphasizing higher payloads, reach, and energy efficiency. These innovations demonstrate the industry’s commitment to providing more efficient, sustainable, and adaptable solutions for diverse industrial applications.

Propelling Factors for Latin America Factory Automation And Industrial Controls Market Growth

Several factors fuel the growth of the Latin America Factory Automation and Industrial Controls market. Technological advancements, such as AI and IoT-enabled solutions, offer improved efficiency and productivity. Economic growth in several Latin American countries creates a favorable environment for investments in automation. Moreover, government initiatives promoting industrial modernization and digital transformation provide further impetus to market expansion.

Obstacles in the Latin America Factory Automation And Industrial Controls Market Market

Challenges facing the market include regulatory hurdles in certain countries, potentially delaying or complicating technology adoption. Supply chain disruptions, particularly concerning critical components, can lead to production delays and increased costs. Intense competition among established players also creates pressure on pricing and margins.

Future Opportunities in Latin America Factory Automation And Industrial Controls Market

The Latin America Factory Automation and Industrial Controls market presents significant future opportunities. Expansion into new market segments, such as renewable energy and smart infrastructure, holds immense potential. The adoption of advanced technologies, like 5G and edge computing, will further enhance automation capabilities. Furthermore, rising consumer demand for customized products and enhanced supply chain resilience will drive the need for flexible and adaptable automation solutions.

Major Players in the Latin America Factory Automation And Industrial Controls Market Ecosystem

- Honeywell International Inc

- Mitsubishi Electric Corporation

- Bosch Rexroth AG

- Siemens AG

- Schneider Electric SE

- Autodesk Inc

- Rockwell Automation Inc

- Dassault Systèmes SE

- ABB Limited

- Aspen Technology Inc

- General Electric Company

- Emerson Electric Company

Key Developments in Latin America Factory Automation And Industrial Controls Market Industry

- August 2023: Rockwell Automation, Inc. launched ArmorKinetix Distributed Servo Drives, enhancing machine design scalability and sustainability.

- June 2023: ABB Robotics expanded its robot offerings with four new models and 22 variants, improving performance and energy efficiency.

Strategic Latin America Factory Automation And Industrial Controls Market Market Forecast

The Latin America Factory Automation and Industrial Controls market is poised for robust growth driven by technological innovation, increasing industrialization, and government support for automation. The market's future potential lies in embracing emerging technologies, expanding into new sectors, and catering to evolving customer needs for enhanced efficiency, sustainability, and resilience. This presents significant opportunities for existing and new market entrants alike.

Latin America Factory Automation And Industrial Controls Market Segmentation

-

1. Product Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programmable Logic Controller (PLC )

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Human Machine Interface (HMI)

- 1.1.6. Manufacturing Execution System (MES)

- 1.1.7. Enterprise Resource Planning (ERP)

- 1.1.8. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Robotics (Industrial)

- 1.2.3. Sensors and Transmitters

- 1.2.4. Motors and Drives

- 1.2.5. Relays and Switches

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverages

- 2.5. Automotive

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

Latin America Factory Automation And Industrial Controls Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Factory Automation And Industrial Controls Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

- 3.4. Market Trends

- 3.4.1. Automotive End User Industry Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programmable Logic Controller (PLC )

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Human Machine Interface (HMI)

- 5.1.1.6. Manufacturing Execution System (MES)

- 5.1.1.7. Enterprise Resource Planning (ERP)

- 5.1.1.8. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Robotics (Industrial)

- 5.1.2.3. Sensors and Transmitters

- 5.1.2.4. Motors and Drives

- 5.1.2.5. Relays and Switches

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverages

- 5.2.5. Automotive

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Factory Automation And Industrial Controls Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Mitsubishi Electric Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bosch Rexroth AG (Robert Bosch Gmbh

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Schneider Electric SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Autodesk Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rockwell Automation Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dassault Systemes SE

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ABB Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Aspen Technology Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 General Electric Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Emerson Electric Company

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Factory Automation And Industrial Controls Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Factory Automation And Industrial Controls Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Latin America Factory Automation And Industrial Controls Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Factory Automation And Industrial Controls Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Factory Automation And Industrial Controls Market?

The projected CAGR is approximately 7.54%.

2. Which companies are prominent players in the Latin America Factory Automation And Industrial Controls Market?

Key companies in the market include Honeywell International Inc, Mitsubishi Electric Corporation, Bosch Rexroth AG (Robert Bosch Gmbh, Siemens AG, Schneider Electric SE, Autodesk Inc, Rockwell Automation Inc, Dassault Systemes SE, ABB Limited, Aspen Technology Inc, General Electric Company, Emerson Electric Company.

3. What are the main segments of the Latin America Factory Automation And Industrial Controls Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies.

6. What are the notable trends driving market growth?

Automotive End User Industry Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation.

8. Can you provide examples of recent developments in the market?

August 2023: Rockwell Automation, Inc. launched ArmorKinetixDistributed Servo Drives. This unique distributed servo drive is an extension of the Kinetix5700 platform and delivers users with a scalable drive solution that helps provide cleaner, greener, and more influential machine designs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Factory Automation And Industrial Controls Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Factory Automation And Industrial Controls Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Factory Automation And Industrial Controls Market?

To stay informed about further developments, trends, and reports in the Latin America Factory Automation And Industrial Controls Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence