Key Insights

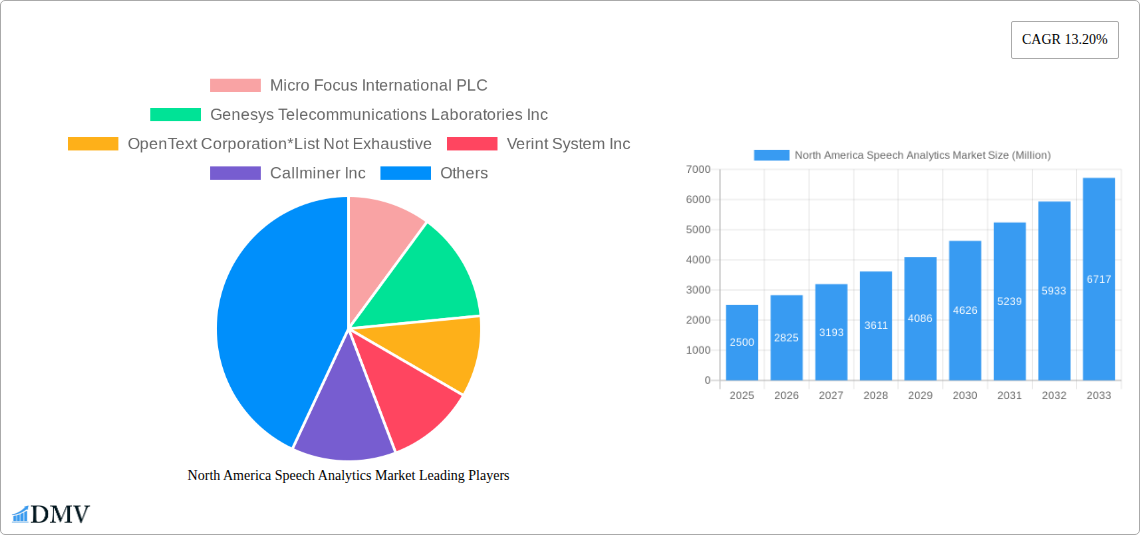

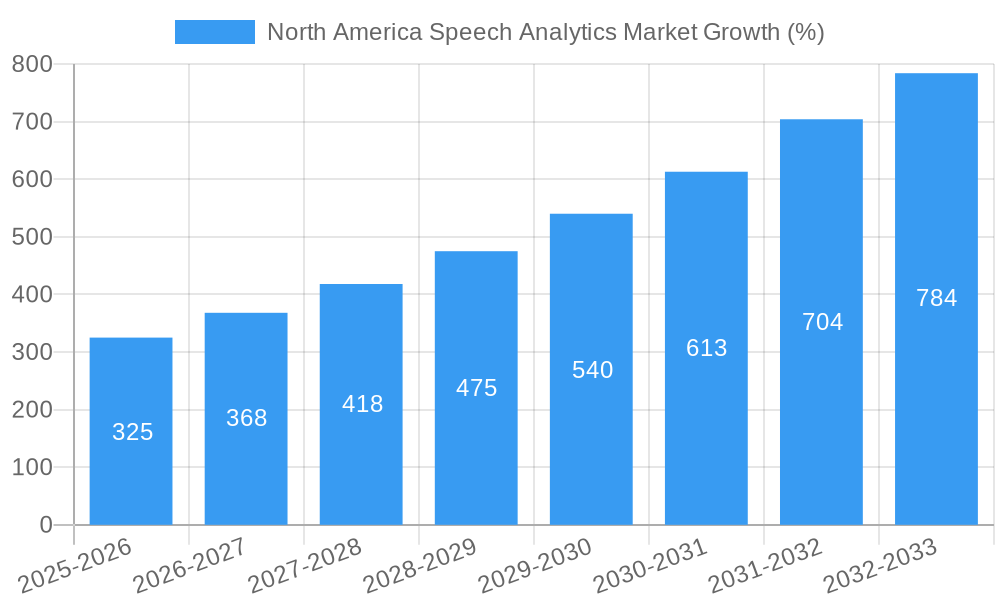

The North American speech analytics market, currently experiencing robust growth, is projected to reach a substantial size in the coming years. Driven by the increasing adoption of cloud-based solutions, the rising need for enhanced customer experience management, and the growing demand for improved operational efficiency across various sectors, this market is poised for significant expansion. The 13.20% CAGR indicates a healthy trajectory, particularly within key segments like BFSI (Banking, Financial Services, and Insurance), Healthcare, and Retail, where the need to analyze large volumes of customer interactions for improved service and risk mitigation is paramount. Large enterprises are leading the adoption, leveraging speech analytics to gain valuable insights into customer sentiment, agent performance, and compliance adherence. However, implementation costs and concerns about data privacy and security remain potential restraints. The on-demand deployment model is gaining traction due to its scalability and cost-effectiveness. Geographic concentration in the United States and Canada is expected to continue, with potential for growth in Mexico and other North American regions. Competitive landscape is characterized by a mix of established players like Micro Focus, Genesys, and Verint, alongside emerging innovative companies, fostering a dynamic and evolving market.

The market segmentation highlights the varied applications of speech analytics across diverse industries. The BFSI sector heavily utilizes speech analytics for fraud detection, risk management, and regulatory compliance. Healthcare providers leverage it for quality assurance, patient satisfaction improvement, and operational optimization. The retail sector benefits from improved customer service, personalized marketing, and trend analysis derived from customer interactions. Government agencies use it for improving citizen services and enhancing security. The continued expansion across these segments, coupled with technological advancements in natural language processing (NLP) and artificial intelligence (AI) will likely drive further market growth. The shift towards more sophisticated analytics capabilities, including emotion detection and sentiment analysis, will further enhance the value proposition for businesses across North America.

North America Speech Analytics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America speech analytics market, covering the period from 2019 to 2033. It offers a comprehensive overview of market size, growth drivers, challenges, key players, and future opportunities across the United States and Canada. The report is essential for stakeholders including investors, vendors, and market entrants seeking a deep understanding of this rapidly evolving sector. With a base year of 2025 and a forecast period extending to 2033, this report provides critical insights for strategic decision-making. The total market value is projected to reach xx Million by 2033.

North America Speech Analytics Market Composition & Trends

The North America speech analytics market is characterized by a moderately concentrated landscape, with key players like Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, OpenText Corporation, Verint System Inc, Callminer Inc, Nice Ltd, Avaya Inc, VoiceBase Inc, Calabrio Inc, and Raytheon BBN Technologies holding significant market share. However, the market is also witnessing increased competition from smaller, specialized players. Market share distribution is dynamic, with larger players focusing on comprehensive solutions and smaller players specializing in niche applications. Innovation is driven by advancements in artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), enabling more accurate speech-to-text conversion and sentiment analysis. Regulatory landscapes, particularly concerning data privacy (e.g., GDPR, CCPA), significantly impact market adoption and vendor strategies. Substitute products, such as manual transcription services, are gradually losing ground due to the cost-effectiveness and scalability of speech analytics solutions. M&A activities have been relatively moderate, with deal values averaging xx Million, but are expected to increase as the market consolidates.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Catalysts: AI, ML, and NLP advancements.

- Regulatory Landscape: Data privacy regulations influence adoption.

- Substitute Products: Manual transcription services.

- M&A Activities: Average deal value: xx Million. Number of deals: xx

North America Speech Analytics Market Industry Evolution

The North America speech analytics market has witnessed robust growth during the historical period (2019-2024), expanding at a CAGR of xx%. This growth is attributed to the increasing adoption of speech analytics across various sectors, driven by the need for improved customer experience, operational efficiency, and risk mitigation. Technological advancements, particularly in AI-powered analytics, have significantly enhanced the accuracy and capabilities of speech analytics solutions. Consumer demand is shifting towards more sophisticated solutions that offer comprehensive insights into customer behavior, sentiment, and agent performance. The forecast period (2025-2033) anticipates continued growth, driven by factors such as the increasing volume of voice data, rising adoption of cloud-based solutions, and the growing need for real-time insights. The market is expected to reach xx Million by 2033, with a projected CAGR of xx%.

- Historical Growth (2019-2024): CAGR of xx%

- Forecast Growth (2025-2033): CAGR of xx%

- Key Growth Drivers: Increased voice data, cloud adoption, demand for real-time insights.

- Adoption Metrics: xx% of organizations currently utilize speech analytics.

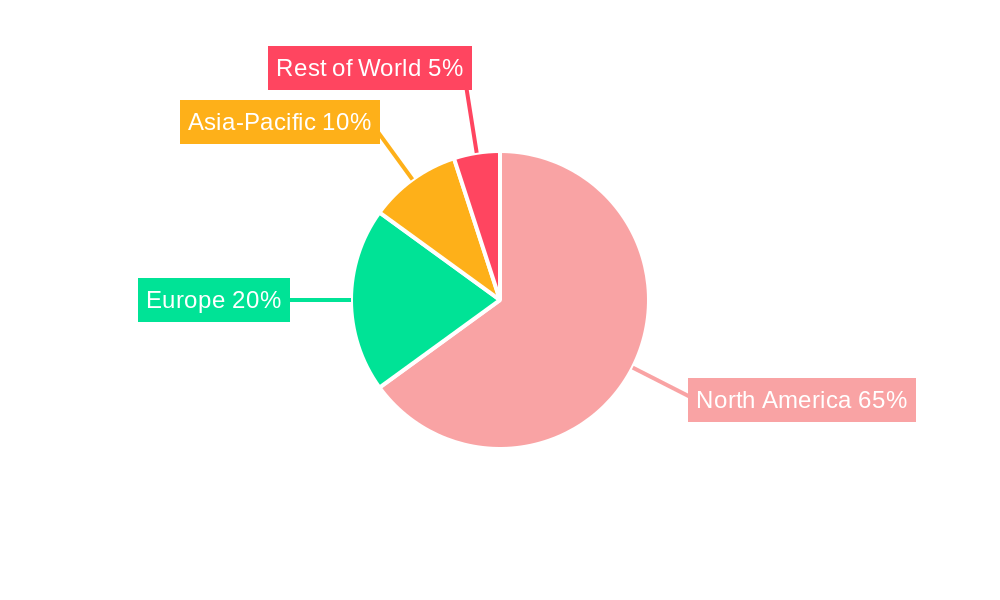

Leading Regions, Countries, or Segments in North America Speech Analytics Market

The United States dominates the North America speech analytics market, driven by its large and technologically advanced economy. Canada follows as a significant contributor. Within the market segmentation:

- By Size of Organization: Large enterprises account for a larger market share due to higher budgets and greater need for sophisticated solutions.

- By End-User: The BFSI (Banking, Financial Services, and Insurance) sector is a leading adopter, followed by healthcare and retail, driven by regulatory compliance, customer service optimization, and fraud detection needs. The government sector is also a significant end-user.

- By Deployment: On-demand deployments are gaining traction due to their flexibility and scalability.

Key Drivers:

- United States: High technology adoption, large enterprises' strong presence.

- BFSI: Stringent regulatory compliance, high customer interaction volume.

- Large Enterprises: Higher budgets, demand for advanced analytics.

- On-Demand Deployment: Flexibility, scalability, cost-effectiveness.

North America Speech Analytics Market Product Innovations

Recent innovations in speech analytics include advancements in AI-powered transcription, sentiment analysis, and speaker diarization. These innovations offer higher accuracy, real-time insights, and more granular data analysis capabilities. Key features such as enhanced NLP, improved multilingual support, and integration with CRM systems are driving adoption. The unique selling propositions include improved customer experience, streamlined operations, reduced costs, and better risk management.

Propelling Factors for North America Speech Analytics Market Growth

Several factors fuel the growth of the North America speech analytics market. Technological advancements like improved AI algorithms enhance accuracy and efficiency. The rising need for enhanced customer service and operational efficiency drives adoption across industries. Favorable regulatory environments in certain sectors encourage the use of speech analytics for compliance purposes. The increasing availability of cloud-based solutions ensures scalability and affordability.

Obstacles in the North America Speech Analytics Market

The market faces challenges such as high implementation costs, data privacy concerns, and the need for specialized expertise. Integration complexities with existing systems can also pose hurdles. Competition from established players and new entrants puts pressure on pricing and margins. Supply chain disruptions can impact the availability of hardware and software components.

Future Opportunities in North America Speech Analytics Market

Future opportunities lie in the expansion into emerging sectors such as education and legal services. Integration with other technologies, like IoT and blockchain, can create new functionalities. The development of more sophisticated AI-driven solutions will open doors to advanced analytics. The focus on improving data security and compliance will also drive demand for enhanced privacy features.

Major Players in the North America Speech Analytics Market Ecosystem

- Micro Focus International PLC

- Genesys Telecommunications Laboratories Inc

- OpenText Corporation

- Verint System Inc

- Callminer Inc

- Nice Ltd

- Avaya Inc

- VoiceBase Inc

- Calabrio Inc

- Raytheon BBN Technologies

Key Developments in North America Speech Analytics Market Industry

- February 2022: Verint released a new transcription engine powered by Verint Da Vinci AI & Analytics, utilizing cutting-edge deep neural network (DNN) models for improved accuracy.

- March 2022: Spitch.ai, a conversational AI solutions provider, launched in the United States with an omnichannel solution, reporting 400% year-over-year growth following a successful fundraising round in 2021. This highlights the increasing investment in AI-powered speech analytics solutions.

Strategic North America Speech Analytics Market Forecast

The North America speech analytics market is poised for significant growth, driven by technological advancements, increasing data volumes, and the rising demand for actionable insights. The market's expansion will be fueled by the adoption of AI-powered solutions across various sectors, further enhancing customer experience and operational efficiency. The continued development of innovative solutions and the rising focus on data security will contribute to sustained market growth throughout the forecast period, promising significant returns for market players.

North America Speech Analytics Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. On-demand

-

2. Size of Organization

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. Government

- 3.5. Other En

North America Speech Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Speech Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Call Center Capacity

- 3.2.2 Especially in the United States; Increase in the Number of Migrant Population Speaking Different Languages

- 3.3. Market Restrains

- 3.3.1. High Implementation Costs

- 3.4. Market Trends

- 3.4.1. Increasing Call Center Capacity Expected to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Speech Analytics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. On-demand

- 5.2. Market Analysis, Insights and Forecast - by Size of Organization

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. Government

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. United States North America Speech Analytics Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Speech Analytics Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Speech Analytics Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Speech Analytics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Micro Focus International PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Genesys Telecommunications Laboratories Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 OpenText Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Verint System Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Callminer Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nice Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Avaya Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 VoiceBase Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Calabrio Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Raytheon BBN Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Micro Focus International PLC

List of Figures

- Figure 1: North America Speech Analytics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Speech Analytics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Speech Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Speech Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: North America Speech Analytics Market Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 4: North America Speech Analytics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America Speech Analytics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Speech Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Speech Analytics Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 12: North America Speech Analytics Market Revenue Million Forecast, by Size of Organization 2019 & 2032

- Table 13: North America Speech Analytics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America Speech Analytics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Speech Analytics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Speech Analytics Market?

The projected CAGR is approximately 13.20%.

2. Which companies are prominent players in the North America Speech Analytics Market?

Key companies in the market include Micro Focus International PLC, Genesys Telecommunications Laboratories Inc, OpenText Corporation*List Not Exhaustive, Verint System Inc, Callminer Inc, Nice Ltd, Avaya Inc, VoiceBase Inc, Calabrio Inc, Raytheon BBN Technologies.

3. What are the main segments of the North America Speech Analytics Market?

The market segments include Deployment, Size of Organization, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Call Center Capacity. Especially in the United States; Increase in the Number of Migrant Population Speaking Different Languages.

6. What are the notable trends driving market growth?

Increasing Call Center Capacity Expected to Boost the Market Growth.

7. Are there any restraints impacting market growth?

High Implementation Costs.

8. Can you provide examples of recent developments in the market?

March 2022: With omnichannel conversational AI solutions, Spitch launched in the United States, followed by 400% year-over-year growth and a successful first fundraising round in 2021, Spitch.ai, a leader in conversational AI solutions, announced its launch in the United States. The company declares its entry with its cutting-edge omnichannel solution utilizing natural language processing (NLP), artificial intelligence (AI), and machine learning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Speech Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Speech Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Speech Analytics Market?

To stay informed about further developments, trends, and reports in the North America Speech Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence