Key Insights

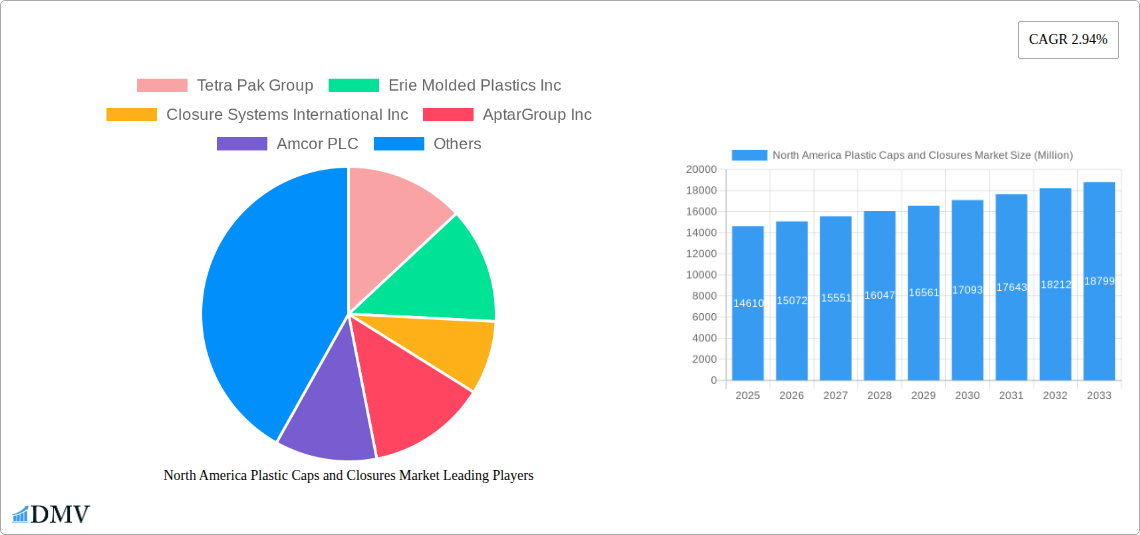

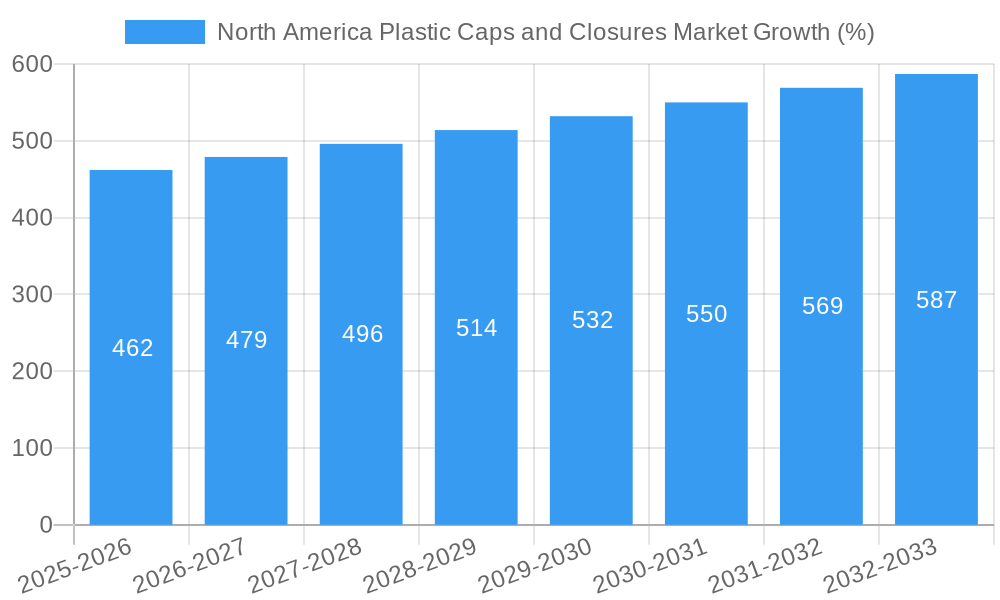

The North American plastic caps and closures market, valued at $14.61 billion in 2025, is projected to experience steady growth, driven by the robust beverage and food industries. A compound annual growth rate (CAGR) of 2.94% from 2025 to 2033 indicates a sustained market expansion, primarily fueled by increasing demand for convenient packaging solutions across diverse sectors including pharmaceuticals, cosmetics, and household chemicals. The prevalence of plastic in these applications stems from its cost-effectiveness, versatility in design (threaded, dispensing, child-resistant options), and efficient sealing properties. Growth is further propelled by consumer preference for single-serve and portable products, increasing product variety, and ongoing innovations in material science leading to lighter, more durable, and sustainable plastic cap and closure solutions. However, growing environmental concerns regarding plastic waste and stricter regulations aimed at reducing plastic consumption represent significant headwinds. The market's segmentation by material (PE, PET, PP), type, and end-user industry highlights the diverse applications and evolving needs within the sector. Within North America, the United States is expected to maintain its dominant position, followed by Canada, with Mexico exhibiting moderate growth. Competition is intense, with major players like Tetra Pak, AptarGroup, and Amcor vying for market share through product innovation, strategic acquisitions, and regional expansion.

The market's future trajectory is likely shaped by several factors. Sustainable packaging solutions, including the increasing adoption of recycled plastics and biodegradable alternatives, will play a critical role. This trend necessitates manufacturers to adapt their production processes and explore eco-friendly materials without compromising performance. Technological advancements in closure designs, focused on improved tamper-evidence and enhanced convenience, will also contribute to the market's continued growth. Furthermore, fluctuating raw material prices and supply chain disruptions will exert influence on pricing strategies and profitability. The market's long-term success hinges on striking a balance between meeting consumer demand for efficient and convenient packaging while addressing escalating environmental concerns and complying with increasingly stringent regulations. Strong industry consolidation through mergers and acquisitions is also anticipated, leading to further market concentration.

North America Plastic Caps and Closures Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America plastic caps and closures market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is estimated to be valued at xx Million in 2025.

North America Plastic Caps and Closures Market Market Composition & Trends

This section delves into the competitive landscape, innovation drivers, and regulatory factors shaping the North America plastic caps and closures market. The market exhibits a moderately consolidated structure, with key players like Berry Global Inc, AptarGroup Inc, and Silgan Holdings Inc holding significant market share. However, smaller, specialized companies also play a crucial role. Innovation is driven by factors like sustainability concerns (increased demand for recyclable materials), advancements in closure technology (e.g., dispensing caps, child-resistant closures), and evolving consumer preferences. The regulatory landscape, particularly concerning plastic waste reduction and recyclability, significantly influences market trends. Substitute products, such as metal or paper closures, present a moderate level of competition. The market sees frequent M&A activity, with deal values varying significantly depending on the size and strategic importance of the acquired companies. Examples include recent deals in the range of xx Million to xx Million, reflecting the consolidation trend.

- Market Concentration: Moderately consolidated, with several major players and numerous smaller companies.

- Innovation Catalysts: Sustainability, technological advancements, and shifting consumer preferences.

- Regulatory Landscape: Increasing focus on plastic waste reduction and recyclability.

- Substitute Products: Metal and paper closures.

- M&A Activity: Frequent mergers and acquisitions, with deal values varying considerably.

- Market Share Distribution: Berry Global Inc, AptarGroup Inc, and Silgan Holdings Inc hold significant shares, with the remaining market share distributed among numerous smaller players.

North America Plastic Caps and Closures Market Industry Evolution

The North America plastic caps and closures market has witnessed consistent growth over the historical period (2019-2024), driven by factors such as population growth, increasing demand for packaged goods, and expansion in end-use industries. Technological advancements, particularly in material science and manufacturing processes, have enhanced product functionality, recyclability, and cost-effectiveness. Consumer demand for convenience and tamper-evident packaging has also fueled market expansion. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace due to environmental concerns and increased focus on sustainable packaging alternatives. Growth rates are projected to average xx% annually during the forecast period. The adoption of advanced materials like bioplastics and recycled content is expected to gain significant traction. Furthermore, the increasing prevalence of e-commerce further fuels demand for robust and secure closures.

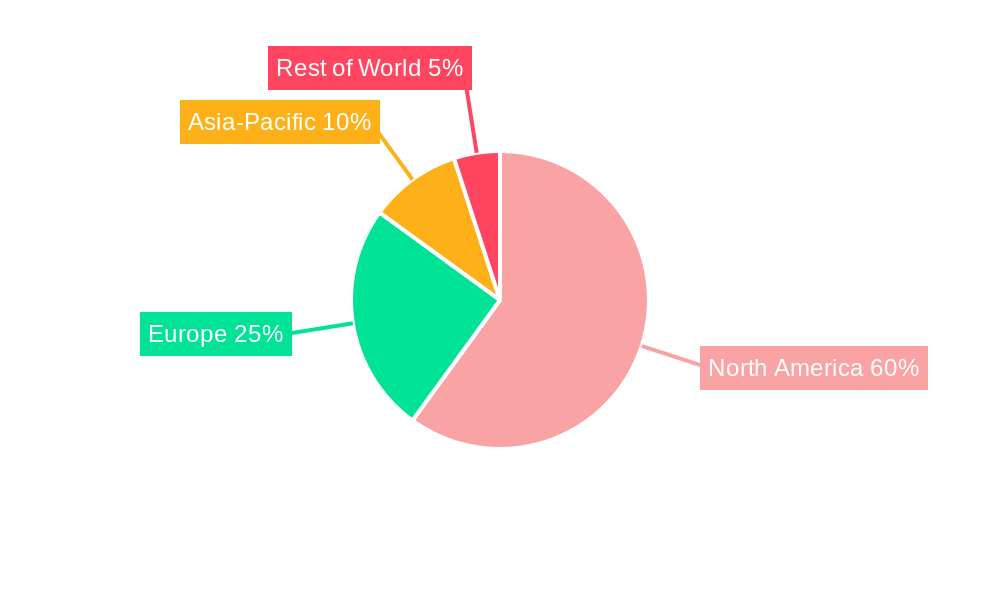

Leading Regions, Countries, or Segments in North America Plastic Caps and Closures Market

The United States dominates the North American plastic caps and closures market, accounting for a significantly larger share than Canada. This dominance is attributed to a larger population, higher consumption levels of packaged goods, and a more developed manufacturing sector.

By Material:

- Polyethylene (PE): Largest segment due to its versatility, cost-effectiveness, and suitability for various applications. Key drivers include its widespread use in food and beverage packaging, along with continuous improvement in its properties to enhance barrier protection and recyclability.

- Polyethylene Terephthalate (PET): Strong growth due to its lightweight nature, recyclability, and suitability for carbonated beverage bottles. Drivers include ongoing improvements in barrier properties and increasing regulations promoting PET recycling.

- Polypropylene (PP): Significant segment due to its high chemical resistance and suitability for applications requiring higher temperature resistance. Investment in PP-based closures with improved seal performance and enhanced recyclability is a strong growth catalyst.

- Other Materials: This segment comprises materials like bioplastics and other specialized polymers, which are gaining traction due to sustainability concerns and niche applications.

By Type:

- Threaded Closures: Largest segment, reflecting their widespread use across various applications due to their ease of use and secure sealing capabilities. Investment in innovative designs that improve consumer convenience and recyclability are driving growth.

- Dispensing Closures: Growing segment driven by increasing demand for convenience and portion control in various products, such as personal care and food items. The increasing emphasis on product safety and convenience drives investment and innovation in dispensing caps.

- Child-Resistant Closures: Crucial for safety applications, and its growth is driven by stringent regulatory requirements and consumer demand for child-proofing mechanisms.

- Unthreaded Closures: Smaller segment used in specific applications, often where tamper evidence is critical. Technological advancements that focus on improving tamper-evidence capabilities and recyclability are driving growth.

By End-user Industry:

- Beverage: Largest segment due to the significant volume of packaged beverages. Increased focus on sustainable closures is influencing product innovation in this space.

- Food: Strong segment due to the wide range of packaged food items, driving demand for closures that ensure food safety and preservation.

- Pharmaceutical and Healthcare: Significant segment driven by strict regulatory requirements for tamper evidence and child-resistant features.

- Cosmetics and Toiletries: Growing segment influenced by trends in luxury packaging, sustainable materials, and e-commerce compatibility.

- Household Chemicals: A substantial segment driven by the high volume of packaged chemicals. The segment’s growth is influenced by the evolving regulatory landscape promoting safer and sustainable products.

Key Drivers:

- Investment in sustainable materials and technologies: Strong push toward eco-friendly and recyclable options.

- Stringent regulatory requirements: Regulations concerning plastic waste and child safety are influencing innovation and material choices.

- Growing demand for convenience: Consumers increasingly seek user-friendly and tamper-evident packaging.

- Expanding e-commerce: The rise of online shopping demands robust closures that can withstand shipping and handling.

North America Plastic Caps and Closures Market Product Innovations

Recent innovations focus on enhancing recyclability, improving consumer convenience, and addressing e-commerce compatibility. For example, Aptar Closures' Future Disc Top prioritizes these three key areas. Technological advancements in materials, manufacturing, and design contribute to lighter weight, improved sealing performance, and enhanced tamper-evident features. Many closures now incorporate features designed to improve consumer experience and minimize environmental impact.

Propelling Factors for North America Plastic Caps and Closures Market Growth

The market's growth is fueled by several key factors. Firstly, increased consumer demand for packaged goods across various sectors is driving up the need for closures. Secondly, technological advancements, such as the development of more sustainable and efficient materials, are creating new opportunities. Finally, stricter regulations aimed at reducing plastic waste are also fostering innovation and driving the adoption of eco-friendly alternatives.

Obstacles in the North America Plastic Caps and Closures Market Market

The market faces challenges including fluctuating raw material prices, which impact production costs and profitability. Supply chain disruptions can also lead to delays and increased costs. Intense competition from both established and emerging players further adds pressure. Stricter environmental regulations, while creating opportunities for sustainable solutions, also add complexity and compliance costs.

Future Opportunities in North America Plastic Caps and Closures Market

Significant opportunities exist in developing and deploying more sustainable and recyclable closures. Growth is expected in specialized closures for niche applications and e-commerce packaging. Further innovations in materials science, offering improved barrier properties and enhanced recyclability, will open up new avenues. The growing demand for tamper-evident packaging, particularly in sensitive industries like pharmaceuticals, represents another key opportunity.

Major Players in the North America Plastic Caps and Closures Market Ecosystem

- Tetra Pak Group

- Erie Molded Plastics Inc

- Closure Systems International Inc

- AptarGroup Inc

- Amcor PLC

- O Berk Company LLC

- Pano Cap Canada Ltd

- TriMas Corporation

- Berry Global Inc

- Guala Closures SpA

- Silgan Holdings Inc

- BERICAP Holding GmbH

Key Developments in North America Plastic Caps and Closures Market Industry

- April 2024: Aptar Closures launched Future Disc Top, a new closure designed for recyclability, e-commerce compatibility, and consumer convenience. This launch highlights the industry's focus on sustainability and e-commerce trends.

- April 2024: The Kroger Co.'s introduction of MCoBeauty Australia showcases the growing demand for affordable and innovative beauty products in the US market, influencing packaging needs. The increased volume of products introduced requires robust and cost-effective closures.

Strategic North America Plastic Caps and Closures Market Market Forecast

The North America plastic caps and closures market is poised for continued growth, driven by the factors mentioned previously. The increasing emphasis on sustainability will further accelerate the adoption of eco-friendly materials and designs. Emerging trends in e-commerce and changing consumer preferences will continue to shape product innovation and market dynamics. The forecast period indicates significant potential for expansion across various segments, with continued dominance expected from leading players alongside emergence of innovative entrants.

North America Plastic Caps and Closures Market Segmentation

-

1. Material

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Types of Materials

-

2. Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-resistant

-

3. End-user Industry

-

3.1. Beverage

- 3.1.1. Bottled Water

- 3.1.2. Soft Drinks

- 3.1.3. Spirits

- 3.1.4. Other Beverages

- 3.2. Food

- 3.3. Pharmaceutical and Healthcare

- 3.4. Cosmetics and Toiletries

- 3.5. Househol

- 3.6. Other End-user Industries

-

3.1. Beverage

North America Plastic Caps and Closures Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Bottled Beverages Drive the Demand for Plastic Caps and Closures; Increased Demand for Innovative Solutions from Different End Users

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations on Manufacturers Pertaining to Environmental Degradation; Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives

- 3.4. Market Trends

- 3.4.1. Beverages to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Types of Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.1.1. Bottled Water

- 5.3.1.2. Soft Drinks

- 5.3.1.3. Spirits

- 5.3.1.4. Other Beverages

- 5.3.2. Food

- 5.3.3. Pharmaceutical and Healthcare

- 5.3.4. Cosmetics and Toiletries

- 5.3.5. Househol

- 5.3.6. Other End-user Industries

- 5.3.1. Beverage

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Tetra Pak Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Erie Molded Plastics Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Closure Systems International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AptarGroup Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amcor PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 O Berk Company LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pano Cap Canada Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TriMas Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Berry Global Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Guala Closures SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Silgan Holdings Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BERICAP Holding GmbH

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Tetra Pak Group

List of Figures

- Figure 1: North America Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Plastic Caps and Closures Market Share (%) by Company 2024

List of Tables

- Table 1: North America Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Plastic Caps and Closures Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: North America Plastic Caps and Closures Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Plastic Caps and Closures Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Plastic Caps and Closures Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Plastic Caps and Closures Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: North America Plastic Caps and Closures Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: North America Plastic Caps and Closures Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Plastic Caps and Closures Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Plastic Caps and Closures Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Plastic Caps and Closures Market?

The projected CAGR is approximately 2.94%.

2. Which companies are prominent players in the North America Plastic Caps and Closures Market?

Key companies in the market include Tetra Pak Group, Erie Molded Plastics Inc, Closure Systems International Inc, AptarGroup Inc, Amcor PLC, O Berk Company LLC, Pano Cap Canada Ltd, TriMas Corporation, Berry Global Inc, Guala Closures SpA, Silgan Holdings Inc, BERICAP Holding GmbH.

3. What are the main segments of the North America Plastic Caps and Closures Market?

The market segments include Material, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Bottled Beverages Drive the Demand for Plastic Caps and Closures; Increased Demand for Innovative Solutions from Different End Users.

6. What are the notable trends driving market growth?

Beverages to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Stringent Regulations on Manufacturers Pertaining to Environmental Degradation; Lightweight and Cost-effective Stand-up Pouch Packaging Alternatives.

8. Can you provide examples of recent developments in the market?

April 2024: Aptar Closures launched Future Disc Top, a new closure designed to address the beauty and personal care industry’s evolving needs. This disc top closure prioritizes three key areas: recyclability, e-commerce compatibility, and consumer convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the North America Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence