Key Insights

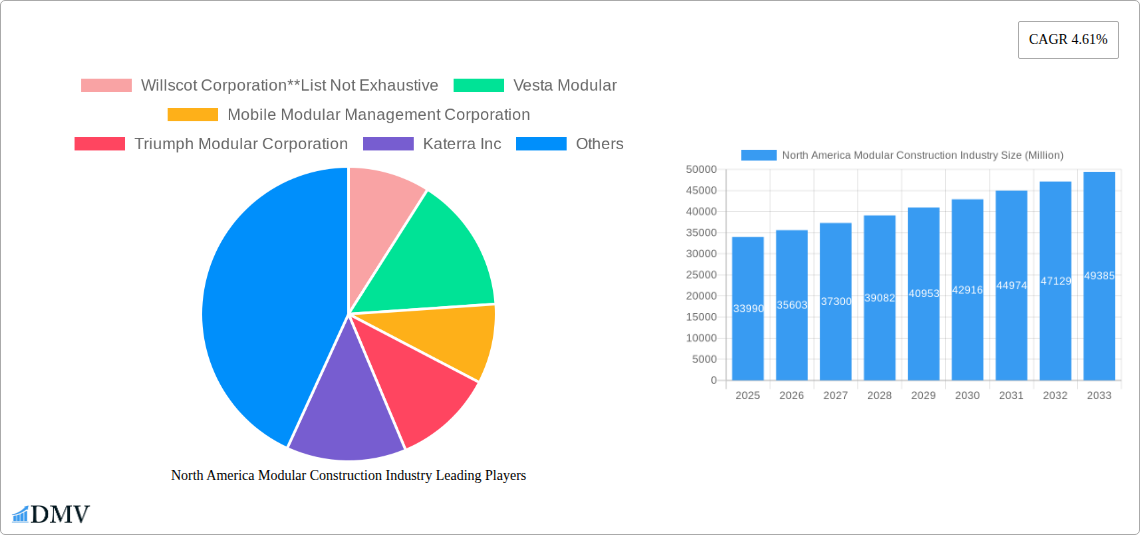

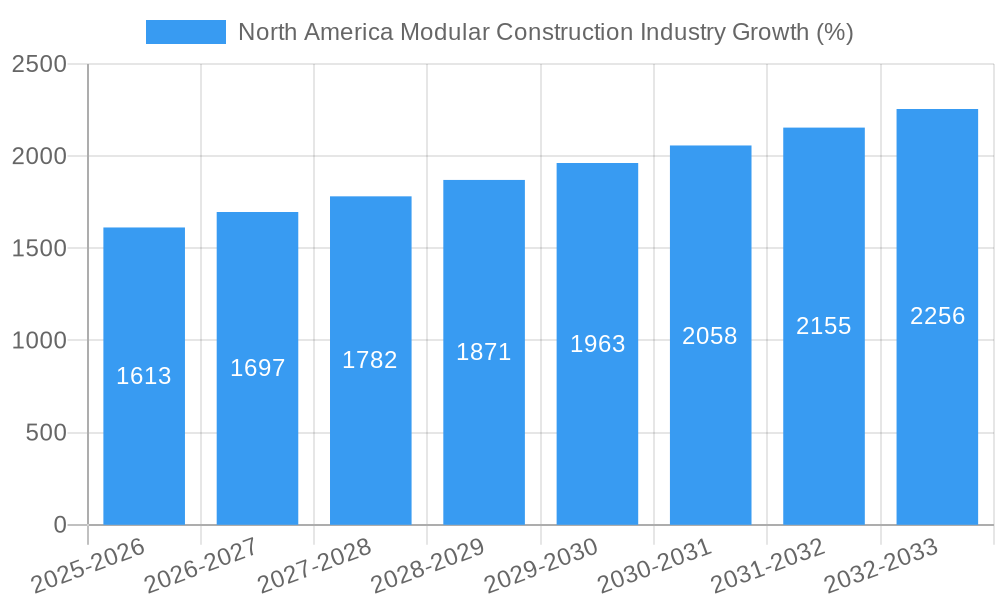

The North American modular construction industry is experiencing robust growth, projected to reach a market size of $33.99 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 4.61% from 2025 to 2033. This expansion is driven by several key factors. Increased demand for faster construction timelines, particularly in the residential and commercial sectors, is a major catalyst. Modular construction offers significant advantages in terms of speed, cost-effectiveness, and reduced on-site disruption, making it an attractive option for developers and builders facing labor shortages and rising material costs. Furthermore, growing environmental concerns are fueling adoption, as modular building methods often generate less waste and have a lower carbon footprint compared to traditional construction. The increasing sophistication of modular designs and the integration of advanced technologies, such as Building Information Modeling (BIM), are also contributing to market growth. The segmentation within the market reveals strong performance across all divisions (permanent modular, relocatable modular) and sectors (residential, commercial), with the United States, Canada, and Mexico representing the core markets within North America.

The leading players in this dynamic market, including Willscot Corporation, Vesta Modular, Mobile Modular Management Corporation, and others, are strategically expanding their product portfolios and geographical reach to capitalize on the rising demand. However, challenges remain. Regulatory hurdles and a potential lack of awareness among consumers regarding the benefits of modular construction could hinder growth in certain regions. Successfully navigating these challenges will be crucial for sustained market expansion. The continued adoption of innovative construction techniques and a focus on addressing environmental concerns will likely shape the future trajectory of the North American modular construction market throughout the forecast period. The market's growth is expected to continue, driven by the aforementioned factors, despite potential short-term economic fluctuations. Long-term market projections indicate a sustained upward trend.

North America Modular Construction Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America modular construction industry, offering a comprehensive overview of market trends, key players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the dynamic opportunities within this rapidly evolving sector. The report values are expressed in Millions.

North America Modular Construction Industry Market Composition & Trends

This section delves into the competitive landscape of the North American modular construction market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user preferences, and merger & acquisition (M&A) activities. The market is characterized by a moderate level of concentration, with a few large players like Willscot Corporation, Vesta Modular, and Triumph Modular Corporation holding significant market share, while numerous smaller companies cater to niche segments. The estimated total market size in 2025 is $xx Million.

- Market Share Distribution (2025 Estimate): Willscot Corporation (xx%), Vesta Modular (xx%), Triumph Modular (xx%), Others (xx%).

- Innovation Catalysts: Advancements in design software, prefabrication techniques, and sustainable building materials are driving innovation.

- Regulatory Landscape: Building codes and zoning regulations vary across different regions, impacting market growth.

- Substitute Products: Traditional construction methods remain a key substitute, though modular construction’s speed and cost-effectiveness provide a compelling alternative.

- End-User Profiles: Key end-users include residential developers, commercial real estate firms, educational institutions, and government agencies.

- M&A Activities: The past five years have witnessed a moderate level of M&A activity, with deal values totaling approximately $xx Million. Notable transactions include [mention specific deals, if available].

North America Modular Construction Industry Industry Evolution

This section examines the historical and projected growth trajectory of the North American modular construction industry, analyzing technological advancements and evolving consumer preferences. The industry has witnessed significant growth during the historical period (2019-2024), driven by factors such as increasing urbanization, rising construction costs, and the growing adoption of sustainable building practices. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of $xx Million by 2033. This growth is further fueled by technological advancements such as Building Information Modeling (BIM) and 3D printing, which are improving design efficiency and construction speed. Consumer demand is shifting towards more sustainable and efficient building solutions, further bolstering the adoption of modular construction.

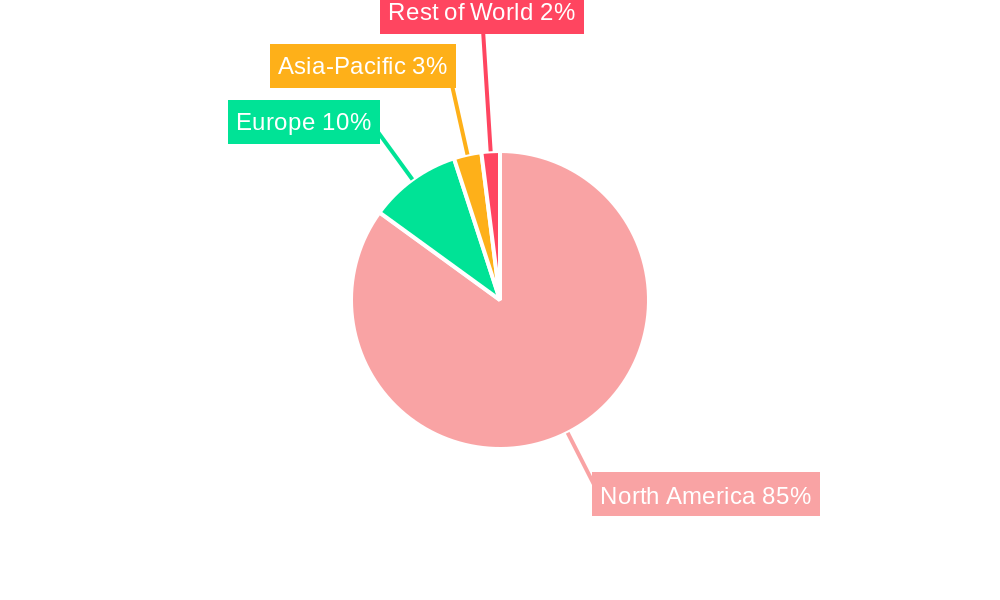

Leading Regions, Countries, or Segments in North America Modular Construction Industry

This section identifies the dominant regions, countries, and segments within the North American modular construction market.

- By Division: The Permanent Modular segment currently dominates, accounting for approximately xx% of the market in 2025. Relocatable Modular holds a smaller but growing share.

- By Sector: The Commercial sector is currently the largest segment, driven by demand for office spaces, retail outlets, and educational facilities. The Residential sector shows significant growth potential.

- By Country: The United States is the largest market, followed by Canada and Mexico.

Key Drivers for Dominance:

- United States: High construction activity, favorable government policies, and a large pool of skilled labor.

- Permanent Modular Segment: Cost-effectiveness, speed of construction, and suitability for a wide range of applications.

- Commercial Sector: Strong demand from businesses seeking efficient and cost-effective solutions for office and retail spaces.

North America Modular Construction Industry Product Innovations

Recent innovations in modular construction include the development of prefabricated modules with integrated MEP (Mechanical, Electrical, and Plumbing) systems, improved insulation and energy efficiency features, and advanced façade designs. These innovations have resulted in improved building performance, reduced construction time, and increased sustainability. Many companies are also incorporating smart home technologies and sustainable materials into their modular designs to meet the growing demand for energy-efficient and eco-friendly buildings.

Propelling Factors for North America Modular Construction Industry Growth

Several factors are driving the growth of the North American modular construction industry. Technological advancements such as BIM and 3D printing enhance design efficiency and speed. Government initiatives promoting sustainable building practices and supportive regulatory frameworks are also contributing factors. Furthermore, the increasing demand for affordable housing and the need for rapid construction in disaster relief situations are significantly boosting market growth.

Obstacles in the North America Modular Construction Industry Market

Despite its potential, the North American modular construction industry faces several challenges. Transportation logistics, especially for larger modules, can be complex and costly. Building codes and zoning regulations may vary across jurisdictions, creating hurdles for standardization and expansion. Lastly, competition from traditional construction methods and the need to address public perception issues regarding modular construction's quality and aesthetics remain significant barriers.

Future Opportunities in North America Modular Construction Industry

Future growth opportunities lie in the expansion of modular construction into new market segments, such as healthcare and data centers. The increasing demand for sustainable building solutions creates opportunities for companies offering eco-friendly modular structures. Furthermore, technological advancements in materials science and automation will further enhance the efficiency and affordability of modular construction.

Major Players in the North America Modular Construction Industry Ecosystem

- Willscot Corporation

- Vesta Modular

- Mobile Modular Management Corporation

- Triumph Modular Corporation

- Katerra Inc

- Vanguard Modular Building Systems

- Boxx Modular (Black Diamond Group)

- Satellite Shelters

- Modular Genius

- ATCO Ltd

- Aries Building Systems

Key Developments in North America Modular Construction Industry Industry

- 2022 Q3: Triumph Modular launched a new line of sustainable modular buildings.

- 2023 Q1: Willscot Corporation announced a significant expansion of its manufacturing facilities.

- 2024 Q2: A major merger between two smaller modular construction firms was finalized. [Add more developments with year/month if available]

Strategic North America Modular Construction Industry Market Forecast

The North American modular construction industry is poised for sustained growth over the forecast period (2025-2033), driven by technological advancements, supportive government policies, and increasing demand for efficient and sustainable building solutions. The market is expected to witness increased consolidation as larger players acquire smaller firms. Innovative product development and strategic partnerships will be critical for success in this dynamic market. New technologies and construction methods like 3D printing are set to revolutionize the way modular structures are created.

North America Modular Construction Industry Segmentation

-

1. Division

- 1.1. Permanent Modular

- 1.2. Relocatable Modular

-

2. Sector

- 2.1. Residential

- 2.2. Commercial

North America Modular Construction Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Modular Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector

- 3.3. Market Restrains

- 3.3.1. Loss of Energy During Hydrogen Production; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Hospitality Industry Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Division

- 5.1.1. Permanent Modular

- 5.1.2. Relocatable Modular

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Division

- 6. United States North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Modular Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Willscot Corporation**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vesta Modular

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mobile Modular Management Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Triumph Modular Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Katerra Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vanguard Modular Building Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Boxx Modular (Black Diamond Group)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Satellite Shelters

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Modular Genius

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ATCO Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Aries Building Systems

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Willscot Corporation**List Not Exhaustive

List of Figures

- Figure 1: North America Modular Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Modular Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 3: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: North America Modular Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Modular Construction Industry Revenue Million Forecast, by Division 2019 & 2032

- Table 11: North America Modular Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: North America Modular Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Modular Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Modular Construction Industry?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the North America Modular Construction Industry?

Key companies in the market include Willscot Corporation**List Not Exhaustive, Vesta Modular, Mobile Modular Management Corporation, Triumph Modular Corporation, Katerra Inc, Vanguard Modular Building Systems, Boxx Modular (Black Diamond Group), Satellite Shelters, Modular Genius, ATCO Ltd, Aries Building Systems.

3. What are the main segments of the North America Modular Construction Industry?

The market segments include Division, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Application of Blue Hydrogen in Fuel Cell Electric Vehicles; Rising Demand from the Chemical Sector.

6. What are the notable trends driving market growth?

Hospitality Industry Driving the Market Growth.

7. Are there any restraints impacting market growth?

Loss of Energy During Hydrogen Production; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Modular Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Modular Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Modular Construction Industry?

To stay informed about further developments, trends, and reports in the North America Modular Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence