Key Insights

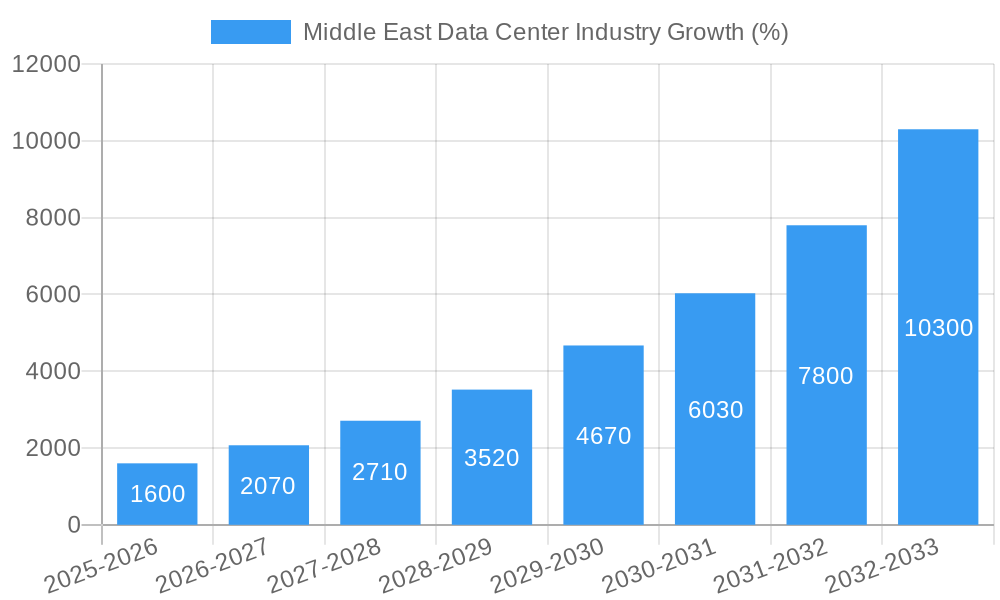

The Middle East data center market is experiencing explosive growth, fueled by a confluence of factors. The region's burgeoning digital economy, driven by increased internet penetration, e-commerce adoption, and government initiatives promoting digital transformation, is creating a significant demand for robust data center infrastructure. A CAGR of 31.78% from 2019 to 2025 indicates a substantial expansion, with the market size exceeding [Estimate based on available data and extrapolation. Example: Assuming a 2025 market size of $5 billion based on the provided CAGR and a plausible 2019 base, this translates to approximately $1 billion in 2019]. This growth is further propelled by the increasing adoption of cloud computing, big data analytics, and the rise of 5G networks, all of which necessitate significant data storage and processing capabilities. The expansion of hyperscale data centers, particularly in key markets like the UAE and Saudi Arabia, is another key driver.

Several factors contribute to the market's segmentation. While large and mega data centers dominate, the smaller segments are also growing, reflecting the diverse needs of different businesses. Tier 1 and Tier 3 facilities represent a significant portion of the market share, reflecting the increasing emphasis on reliability and resilience. The utilized absorption rate suggests strong demand, indicating a relatively healthy supply-demand balance. However, the market faces challenges, including high infrastructure costs, regulatory hurdles, and the need for skilled professionals to manage and operate these complex facilities. Despite these restraints, the overall outlook for the Middle East data center market remains exceptionally positive, promising continued substantial growth throughout the forecast period (2025-2033). Key players are actively investing in expanding capacity and improving services to meet the increasing demand, making it a competitive yet lucrative market.

Middle East Data Center Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a deep dive into the dynamic Middle East data center industry, offering a comprehensive analysis of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the region's burgeoning digital landscape. The report leverages extensive market research and data analysis to deliver actionable insights, enabling informed decision-making across various sectors.

Middle East Data Center Industry Market Composition & Trends

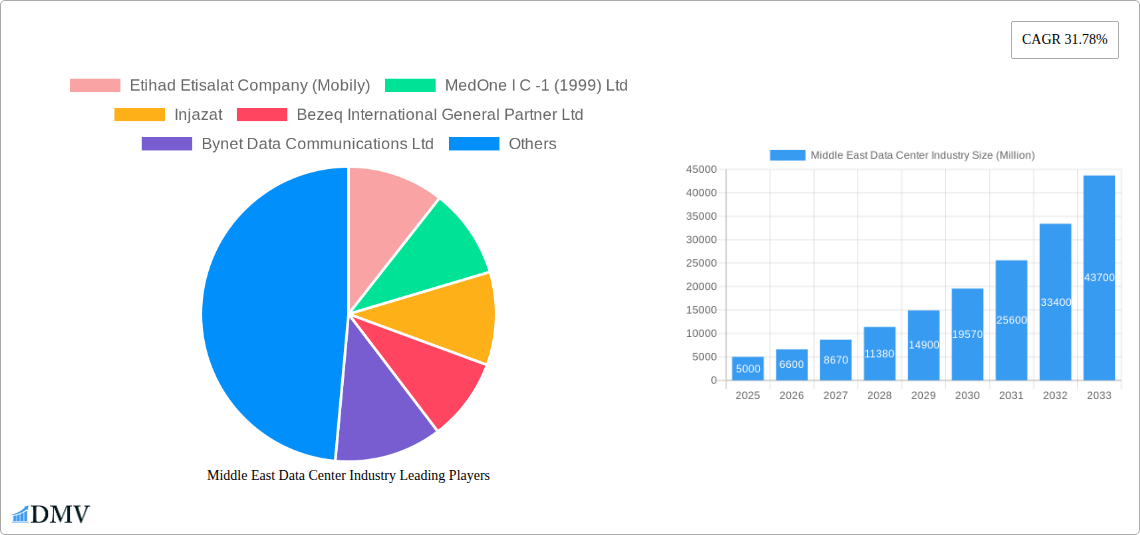

This section meticulously evaluates the competitive landscape of the Middle East data center market, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. We analyze market share distribution amongst key players like Etihad Etisalat Company (Mobily), Injazat, and Etisalat, providing a granular understanding of market dynamics. The report also details the impact of regulatory changes, technological advancements, and evolving consumer preferences on the industry's trajectory. Furthermore, it explores the influence of M&A activities, including deal values (estimated at XX Million USD in the last 5 years), on market consolidation and competitive intensity.

- Market Share Distribution: Etisalat holds an estimated xx% market share, followed by Injazat at xx% and Mobily at xx%. Other significant players account for the remaining xx%.

- M&A Activity: The analysis highlights xx major mergers and acquisitions, resulting in a combined deal value estimated at XX Million USD in the historical period (2019-2024).

- Regulatory Landscape: The report analyzes the impact of varying national regulations and their influence on market expansion and investment.

- Innovation Catalysts: Key technological advancements, such as the adoption of AI and edge computing, are examined for their impact on market growth.

- End-User Profiles: The report segments end-users by industry (e.g., finance, government, telecommunications) to provide targeted insights.

Middle East Data Center Industry Industry Evolution

This section delves into the historical and projected growth trajectories of the Middle East data center market (2019-2033). It examines technological advancements, including the shift towards hyperscale data centers and the increasing adoption of cloud computing, and how these factors are shaping consumer demands. The analysis incorporates specific data points, such as compound annual growth rates (CAGR) which is estimated at xx% during the forecast period, and adoption rates for various technologies to provide a comprehensive overview of the industry's evolution. The section also explores the impact of evolving consumer demands, highlighting the need for increased security, scalability, and cost-effectiveness in data center solutions. The impact of significant industry events, like the launch of M-VAULT 4 in Qatar, are also considered.

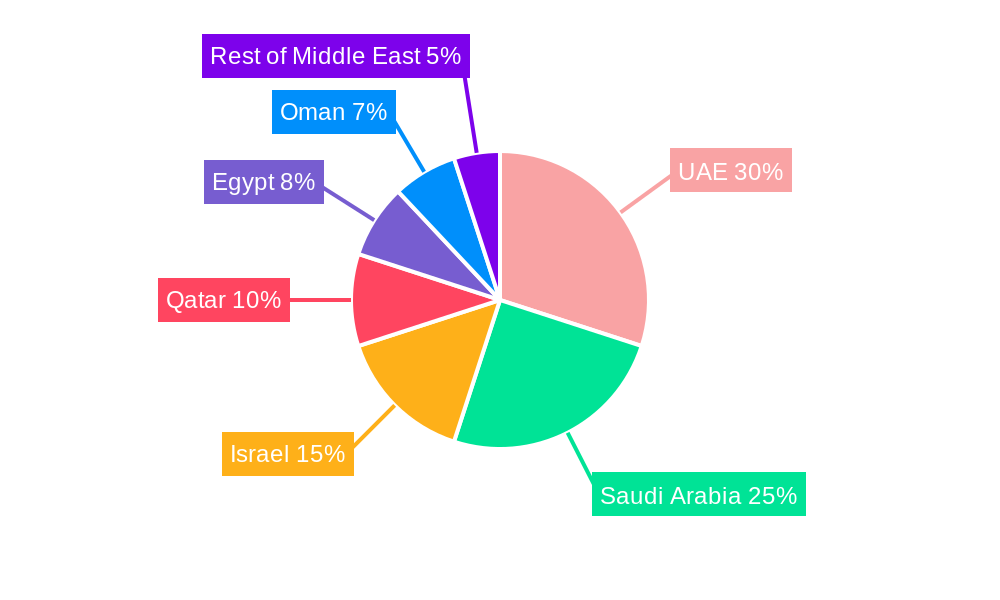

Leading Regions, Countries, or Segments in Middle East Data Center Industry

This section identifies the dominant regions, countries, and segments within the Middle East data center industry, focusing on key drivers of their success. The analysis covers factors such as investment trends, government support (e.g., tax incentives, infrastructure development), and market size across various data center classifications (Large, Massive, Medium, Mega, Small). The UAE, Saudi Arabia, and Israel are analyzed in detail, examining factors contributing to their prominence.

- Key Drivers (UAE): Strong government initiatives, significant investments in digital infrastructure, and a strategic geographic location.

- Key Drivers (Saudi Arabia): Vision 2030's focus on digital transformation, large-scale infrastructure projects, and growing demand for cloud services.

- Key Drivers (Israel): Established tech ecosystem, strong talent pool, and supportive regulatory environment.

- Dominant Segment: Mega data centers are expected to dominate, driven by the demand for high-capacity solutions from hyperscale providers.

- Dominant Tier: Tier III and Tier IV data centers are anticipated to experience strong growth due to their higher reliability and resilience.

- Absorption: Utilized capacity is expected to dominate, reflecting the increasing demand for data center services.

The Rest of the Middle East is analyzed considering its potential for growth and the specific challenges it might face.

Middle East Data Center Industry Product Innovations

Recent years have witnessed significant product innovation within the Middle East data center industry. The introduction of energy-efficient cooling technologies, advanced security measures, and modular data center designs aims to address growing demands for scalability, reliability, and sustainability. These innovations improve operational efficiency and reduce operational expenditure, making data center solutions more attractive to a wider range of clients. This section will highlight unique selling propositions of specific products that have captured market share.

Propelling Factors for Middle East Data Center Industry Growth

Several key factors are driving the growth of the Middle East data center industry. Firstly, the increasing adoption of cloud computing and the growing demand for digital services are fueling the need for robust data center infrastructure. Secondly, government initiatives and investments in digital infrastructure, particularly in countries like the UAE and Saudi Arabia, are providing a significant boost to market expansion. Thirdly, the region's strategic geographic location and its growing role as a hub for international connectivity are further contributing to the industry's rapid growth.

Obstacles in the Middle East Data Center Industry Market

Despite the positive growth outlook, the Middle East data center market faces several challenges. High energy costs, the scarcity of skilled labor, and the complexities of navigating regional regulatory landscapes present significant obstacles. Furthermore, competition from established international players and potential supply chain disruptions due to geopolitical factors pose additional challenges. These challenges translate into an estimated xx Million USD in potential lost revenue annually, as projected for 2025.

Future Opportunities in Middle East Data Center Industry

Future opportunities abound for the Middle East data center industry. The expansion of 5G networks and the Internet of Things (IoT) will drive further demand for data center capacity. The increasing adoption of edge computing will create new opportunities for data center providers closer to end-users, allowing for low latency applications. Investment in renewable energy sources will help mitigate environmental concerns and reduce operational costs.

Major Players in the Middle East Data Center Industry Ecosystem

- Etihad Etisalat Company (Mobily)

- MedOne I C -1 (1999) Ltd

- Injazat

- Bezeq International General Partner Ltd

- Bynet Data Communications Ltd

- EdgeConneX Inc

- Gulf Data Hub

- Khazna Data Center

- Electronia

- HostGee Cloud Hosting Inc

- MEEZA

- Etisalat

Key Developments in Middle East Data Center Industry Industry

- October 2023: Launch of M-VAULT 4's fourth data center building in Qatar, expanding Microsoft Cloud services in the region.

- October 2022: Khazna Data Centers partnered with Masdar and EDF to build a solar PV plant, promoting sustainable data center operations.

- October 2022: Khazna Data Centers announced the development of DXB2 and DXB3 data centers with a combined 43 MW of IT load, expanding its capacity significantly.

Strategic Middle East Data Center Industry Market Forecast

The Middle East data center market is poised for continued robust growth driven by increasing digitalization, government support, and strategic geographic location. Opportunities in cloud computing, edge computing, and sustainable data center solutions will shape the industry's evolution. The market is projected to reach XX Million USD by 2033, representing a significant increase from its current size. This growth will be fueled by expanding digital economies across the region and substantial investments in infrastructure.

Middle East Data Center Industry Segmentation

-

1. Data Center Size

- 1.1. Large

- 1.2. Massive

- 1.3. Medium

- 1.4. Mega

- 1.5. Small

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. End User

- 3.1. BFSI

- 3.2. Cloud

- 3.3. E-Commerce

- 3.4. Government

- 3.5. Manufacturing

- 3.6. Media & Entertainment

- 3.7. Telecom

- 3.8. Other End User

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

Middle East Data Center Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 31.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitization of the BFSI Industry; Cost-efficiency in Managing Personal Finance

- 3.3. Market Restrains

- 3.3.1. Lack of Human Expertise and Empathy; Nascency of the Technology

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 5.1.1. Large

- 5.1.2. Massive

- 5.1.3. Medium

- 5.1.4. Mega

- 5.1.5. Small

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Cloud

- 5.3.3. E-Commerce

- 5.3.4. Government

- 5.3.5. Manufacturing

- 5.3.6. Media & Entertainment

- 5.3.7. Telecom

- 5.3.8. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 6. United Arab Emirates Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Etihad Etisalat Company (Mobily)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MedOne I C -1 (1999) Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Injazat

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bezeq International General Partner Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bynet Data Communications Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EdgeConneX Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gulf Data Hub

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Khazna Data Center

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Electronia

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 HostGee Cloud Hosting Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MEEZA5

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Etisalat

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Etihad Etisalat Company (Mobily)

List of Figures

- Figure 1: Middle East Data Center Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 3: Middle East Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Middle East Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Middle East Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Middle East Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Middle East Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Qatar Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Israel Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Egypt Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Oman Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Middle East Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Middle East Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 17: Middle East Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Middle East Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Middle East Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 20: Middle East Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 21: Middle East Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Saudi Arabia Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Israel Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Qatar Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kuwait Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Oman Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bahrain Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Jordan Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Lebanon Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Industry?

The projected CAGR is approximately 31.78%.

2. Which companies are prominent players in the Middle East Data Center Industry?

Key companies in the market include Etihad Etisalat Company (Mobily), MedOne I C -1 (1999) Ltd, Injazat, Bezeq International General Partner Ltd, Bynet Data Communications Ltd, EdgeConneX Inc, Gulf Data Hub, Khazna Data Center, Electronia, HostGee Cloud Hosting Inc, MEEZA5, Etisalat.

3. What are the main segments of the Middle East Data Center Industry?

The market segments include Data Center Size, Tier Type, End User , Absorption , Colocation Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitization of the BFSI Industry; Cost-efficiency in Managing Personal Finance.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of Human Expertise and Empathy; Nascency of the Technology.

8. Can you provide examples of recent developments in the market?

October 2023: Mohamed bin Ali bin Mohamed Al-Mannai, minister of communications and information technology, has launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.October 2022: The prominent network of hyperscale data centers in the Middle East and North Africa region, a joint venture between Khazna Data Centers, and Masdar and EDF have inked a deal to build a ground-mounted solar photovoltaic (PV) plant to power Khazna's new data center in Masdar City.October 2022: The company announced the development of DXB2 and DXB3 with a joint capacity of 43 MW of IT load. The DXB3 facility is an extension of an existing facility transferred to Khazna following the strategic partnership between G42 and e&.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Industry?

To stay informed about further developments, trends, and reports in the Middle East Data Center Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence