Key Insights

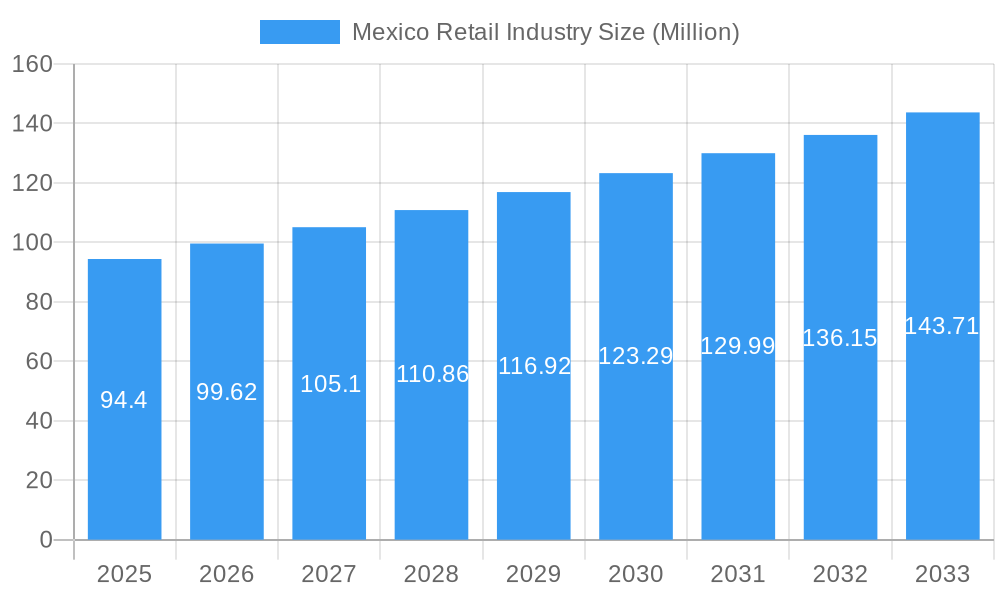

The Mexico retail industry, valued at $94.40 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5.0% from 2025 to 2033. This positive trajectory is driven by several key factors. A burgeoning middle class with increasing disposable income fuels consumer spending, particularly on apparel, electronics, and groceries. The rise of e-commerce and omnichannel strategies, adopted by major players like Walmart International and FEMSA Comercio, are reshaping the retail landscape, offering convenience and broader market reach. Furthermore, strategic investments in logistics and supply chain infrastructure are enhancing operational efficiency and driving down costs, contributing to increased competitiveness. However, challenges remain. Economic volatility and inflation can impact consumer confidence and spending patterns. Intense competition among established players and the emergence of new entrants necessitates continuous innovation and adaptation. The industry also faces regulatory hurdles and the need for effective strategies to address concerns about sustainability and ethical sourcing.

Mexico Retail Industry Market Size (In Million)

Segmentation within the Mexican retail market is diverse, encompassing hypermarkets (Walmart, Soriana), department stores (Liverpool, El Palacio de Hierro), convenience stores (FEMSA Comercio), and specialty retailers (Coppel). Each segment caters to specific consumer needs and preferences, creating a dynamic and complex market structure. Future growth will likely be driven by the continued penetration of e-commerce, the adoption of advanced technologies like artificial intelligence and data analytics for personalized marketing, and the expansion into underserved regions. Successfully navigating these trends while managing economic uncertainty will be crucial for sustained success within the Mexican retail sector. The period from 2019-2024 provides a solid foundation to project future growth based on historical trends, adjusted for economic forecasts and market dynamics.

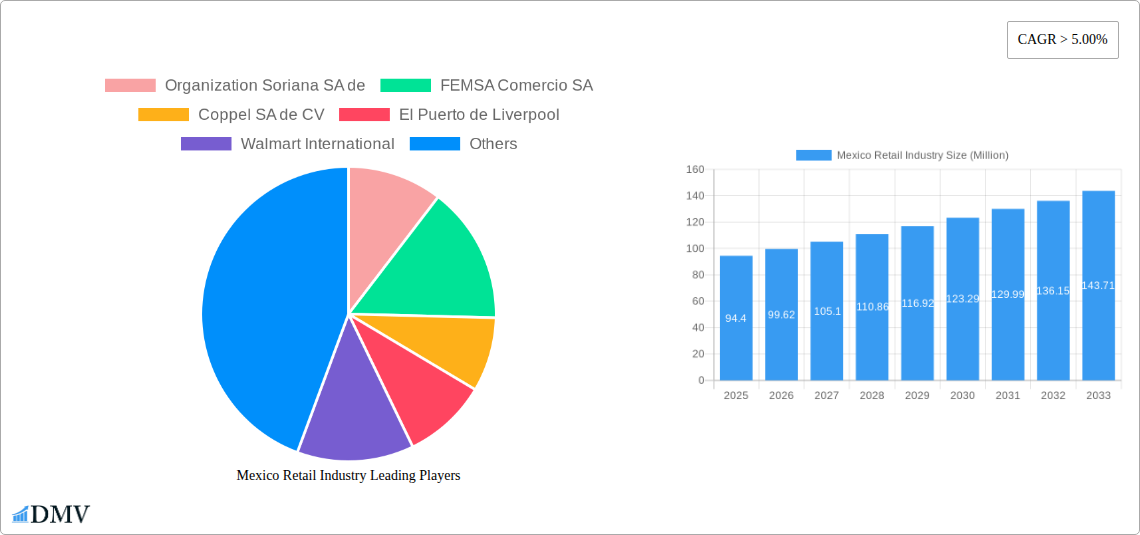

Mexico Retail Industry Company Market Share

Mexico Retail Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Mexico retail industry, covering its evolution, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this thriving market. The report delves into market composition, leading segments, technological advancements, and strategic growth drivers, offering actionable intelligence for informed decision-making. The total market size is projected to reach xx Million by 2033.

Mexico Retail Industry Market Composition & Trends

This section evaluates the competitive landscape of the Mexican retail market, focusing on market concentration, innovation, regulation, and M&A activity. We analyze the market share distribution among key players such as Walmart International, FEMSA Comercio SA, Organización Soriana SA de CV, and Coppel SA de CV, revealing the degree of market concentration. The report also examines the impact of regulatory changes on market dynamics, identifies substitute products impacting growth, and profiles key end-user segments. We quantify the value and frequency of M&A deals within the historical period (2019-2024), providing insights into strategic consolidation trends. Furthermore, this analysis highlights innovation catalysts driving market growth.

- Market Share Distribution: Walmart International holds the largest share (xx%), followed by FEMSA Comercio SA (xx%), Organización Soriana SA de CV (xx%), and Coppel SA de CV (xx%). The remaining share is distributed amongst numerous smaller players.

- M&A Activity (2019-2024): Total M&A deal value reached approximately xx Million, with an average deal size of xx Million. The majority of deals involved smaller retailers being acquired by larger players.

- Regulatory Landscape: Analysis of key regulations impacting retail operations and their influence on market access and competition.

- Innovation Catalysts: Exploration of e-commerce adoption, omnichannel strategies, and technological disruptions driving retail innovation in Mexico.

Mexico Retail Industry Industry Evolution

This section provides a comprehensive analysis of the Mexican retail industry's dynamic growth trajectory, extending from 2019 through to a projected outlook for 2033. We delve into the profound evolution of the market, meticulously highlighting the pivotal technological advancements and the transformative shifts in consumer behavior that have fundamentally reshaped the industry's development. Growth rates are rigorously analyzed across diverse segments, including but not limited to grocery, apparel, electronics, and home goods, vividly illustrating the inherent dynamism of this expansive market. The widespread adoption of e-commerce, the proliferation of mobile payment solutions, and the strategic implementation of omnichannel approaches are quantified, underscoring their significant impact on contemporary market dynamics. Furthermore, a detailed examination of evolving consumer preferences is presented, encompassing critical factors such as brand loyalty, price sensitivity, and the burgeoning demand for specific product categories. The intricate impact of macroeconomic forces, including inflation, economic growth rates, and evolving trade policies, on consumer spending patterns and overall retail performance is also thoroughly evaluated.

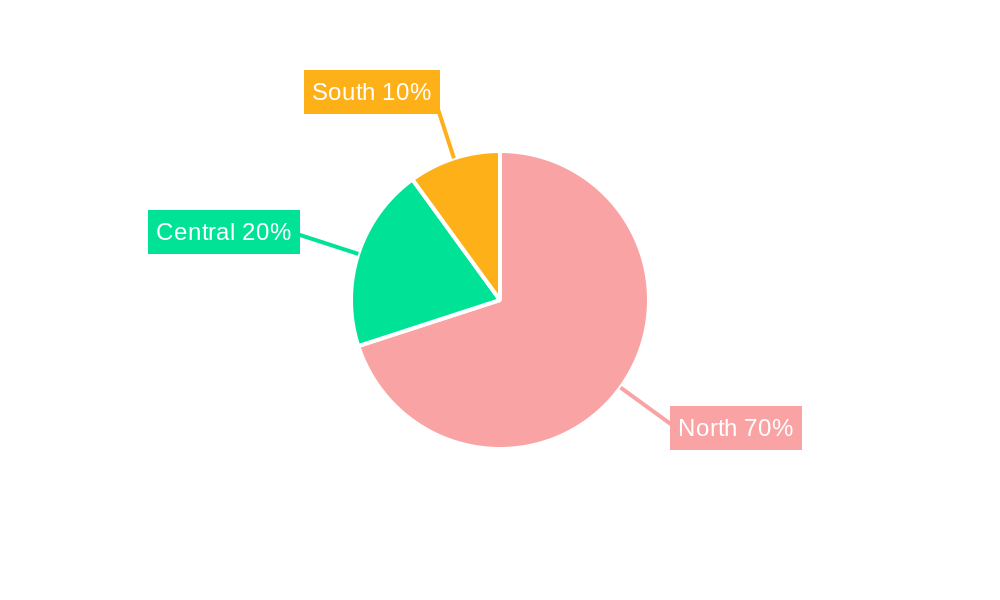

Leading Regions, Countries, or Segments in Mexico Retail Industry

This section identifies the dominant regions and segments within the Mexican retail industry. We analyze the factors driving their dominance, including investment trends, regulatory support, and consumer demographics. The analysis provides insights into the geographical concentration of retail activity and the specific segments exhibiting the highest growth rates.

- Key Drivers of Dominance:

- Strong consumer base with growing disposable incomes.

- Government initiatives promoting retail development.

- Strategic investments in infrastructure and logistics.

- Dominant Regions: Mexico City and its surrounding metropolitan area consistently demonstrates the highest retail sales, followed by other major urban centers like Guadalajara, Monterrey, and Tijuana.

- Dominant Segments: Grocery and food retail currently leads the sector, fueled by increasing urbanization and rising consumer spending.

Mexico Retail Industry Product Innovations

Recent years have witnessed significant product innovations within the Mexican retail landscape. This section highlights some notable examples. Companies are increasingly leveraging technology to enhance customer experience through personalized recommendations, loyalty programs, and mobile applications. The adoption of advanced analytics and data-driven decision-making is also transforming inventory management and supply chain optimization within the industry. Additionally, omnichannel strategies, integrating online and offline shopping experiences, have become increasingly prevalent, enabling seamless and convenient shopping experiences for consumers. The incorporation of sustainable and ethically sourced products is gaining traction as consumer awareness of environmental and social issues grows.

Propelling Factors for Mexico Retail Industry Growth

The robust growth of the Mexican retail industry is propelled by a confluence of powerful and interconnected factors. Primarily, a steadily expanding middle class, characterized by increasing disposable incomes, is a significant driver of elevated consumer spending. Concurrently, rapid technological advancements, particularly in the realms of e-commerce platforms and mobile payment infrastructure, are continuously unveiling novel avenues for market expansion and enhanced customer accessibility. Supportive government policies, coupled with strategic infrastructure investments in logistics and digital connectivity, are actively cultivating a more favorable and dynamic business environment. Finally, the accelerating urbanization of the Mexican population is concentrating consumer demand within key urban centers, fostering greater retail density and creating concentrated opportunities for businesses. These synergistic forces collectively contribute to the remarkable dynamism and sustained growth characterizing the Mexican retail sector.

Obstacles in the Mexico Retail Industry Market

Despite its potential, the Mexican retail market faces challenges. Supply chain disruptions, such as those caused by global events or infrastructure limitations, can lead to stock-outs and increased costs. Competition, especially from international players, is intense, creating price pressure. Furthermore, regulatory hurdles, including complicated bureaucratic processes and varying local regulations across the country, can add complexity for retailers. These combined factors can hinder profitability and sustainable growth. The combined impact on profitability is estimated at approximately xx Million annually.

Future Opportunities in Mexico Retail Industry

The Mexican retail industry presents significant future opportunities. The expansion of e-commerce presents a massive growth potential, particularly in underserved regions. The growing adoption of omnichannel strategies, focusing on seamless integration between physical and online retail, creates additional avenues for revenue generation. Additionally, the rising demand for sustainable and ethical products provides a niche for retailers focused on eco-friendly and socially responsible practices. These trends offer considerable opportunities for existing players to expand their business and for new entrants to create a strong market presence.

Major Players in the Mexico Retail Industry Ecosystem

- Organización Soriana SA de CV - A leading hypermarket and supermarket chain, a cornerstone of Mexican retail.

- FEMSA Comercio SA - Beyond its well-known OXXO convenience stores, FEMSA plays a significant role in various retail formats and distribution.

- Coppel SA de CV - A prominent department store chain specializing in furniture, electronics, and apparel, with a strong presence across the country.

- El Puerto de Liverpool - A long-standing department store offering a wide range of products, from fashion to home goods, with a focus on customer experience.

- Walmart International - A dominant global retailer with a substantial and expanding footprint in Mexico, operating various formats.

- El Palacio de Hierro - A luxury department store known for its high-end merchandise and premium shopping experience.

- Superama - A well-established supermarket chain focused on quality and service.

- Sears Operadora Mexico SA De CV - A department store offering a diverse range of consumer goods.

- Auchan - (Note: Auchan has had a presence in Mexico, but market dynamics may lead to variations in current operational status.)

- Carrefour - (Note: Similar to Auchan, Carrefour's direct retail presence in Mexico has evolved over time.)

List Not Exhaustive - The landscape is constantly evolving with new entrants and strategic partnerships.

Key Developments in Mexico Retail Industry Industry

- March 2023: Walmart's strategic expansion into Nuevo Leon, with the inauguration of 22 new stores, signifies a substantial investment in the region's retail infrastructure. This milestone, coinciding with its 12th anniversary in Monterrey, underscores Walmart's unwavering commitment to fortifying and expanding its market share within Mexico through a localized and responsive growth strategy.

- January 2023: FEMSA's innovative launch of Andretti Drive, a novel app-enabled drive-thru coffee shop concept piloted in Nuevo León, demonstrates a forward-thinking approach. This initiative strategically leverages FEMSA's extensive operational expertise and the vast network of its OXXO convenience stores, showcasing its ambition to explore and capture new market segments and evolving consumer demands within the dynamic Mexican retail landscape.

Strategic Mexico Retail Industry Market Forecast

The Mexican retail market is robustly positioned for sustained and significant growth in the coming years. A combination of strong underlying economic fundamentals, a continually expanding and increasingly affluent middle class, and ongoing rapid technological advancements will collectively forge substantial opportunities for both established retail giants and agile new market entrants. The accelerating integration of e-commerce capabilities and the strategic adoption of sophisticated omnichannel strategies are set to redefine the competitive arena, compelling retailers to embrace continuous adaptation and innovation to maintain their edge. Moreover, a growing consumer consciousness around sustainability and ethical sourcing practices is anticipated to become an increasingly influential driver of future market expansion, aligning with evolving consumer values. We project significant market growth, with the sector poised to reach an estimated **[Insert Specific Projected Value in Millions/Billions] Million by 2033**, representing a substantial increase in market value and consumer engagement.

Mexico Retail Industry Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

-

2. Distribution Channel

- 2.1. Hypermarkets

- 2.2. Supermarkets

- 2.3. Convenience Stores

- 2.4. Department Stores

- 2.5. Specialty Stores

Mexico Retail Industry Segmentation By Geography

- 1. Mexico

Mexico Retail Industry Regional Market Share

Geographic Coverage of Mexico Retail Industry

Mexico Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.3. Market Restrains

- 3.3.1. Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce Sector Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets

- 5.2.2. Supermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Department Stores

- 5.2.5. Specialty Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Organization Soriana SA de

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FEMSA Comercio SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coppel SA de CV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 El Puerto de Liverpool

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Walmart International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 El Palacio de Hierro

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Superama

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sears Operadora Mexico SA De CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Auchan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carrefour**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Organization Soriana SA de

List of Figures

- Figure 1: Mexico Retail Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 3: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Mexico Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Retail Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Retail Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Mexico Retail Industry Volume Billion Forecast, by Product 2020 & 2033

- Table 9: Mexico Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Mexico Retail Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Mexico Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Retail Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Retail Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Mexico Retail Industry?

Key companies in the market include Organization Soriana SA de, FEMSA Comercio SA, Coppel SA de CV, El Puerto de Liverpool, Walmart International, El Palacio de Hierro, Superama, Sears Operadora Mexico SA De CV, Auchan, Carrefour**List Not Exhaustive.

3. What are the main segments of the Mexico Retail Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 94.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

6. What are the notable trends driving market growth?

Growth of E-commerce Sector Drives the Market.

7. Are there any restraints impacting market growth?

Easy Shopping Experience Drives The Market; Greater Inventory Options Drives The Market.

8. Can you provide examples of recent developments in the market?

March 2023 - Walmart opened 22 new stores across the state of Nuevo Leon as a part of an investment in the region’s infrastructure. Walmart made the decision during its 12th anniversary in Monterrey.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Retail Industry?

To stay informed about further developments, trends, and reports in the Mexico Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence