Key Insights

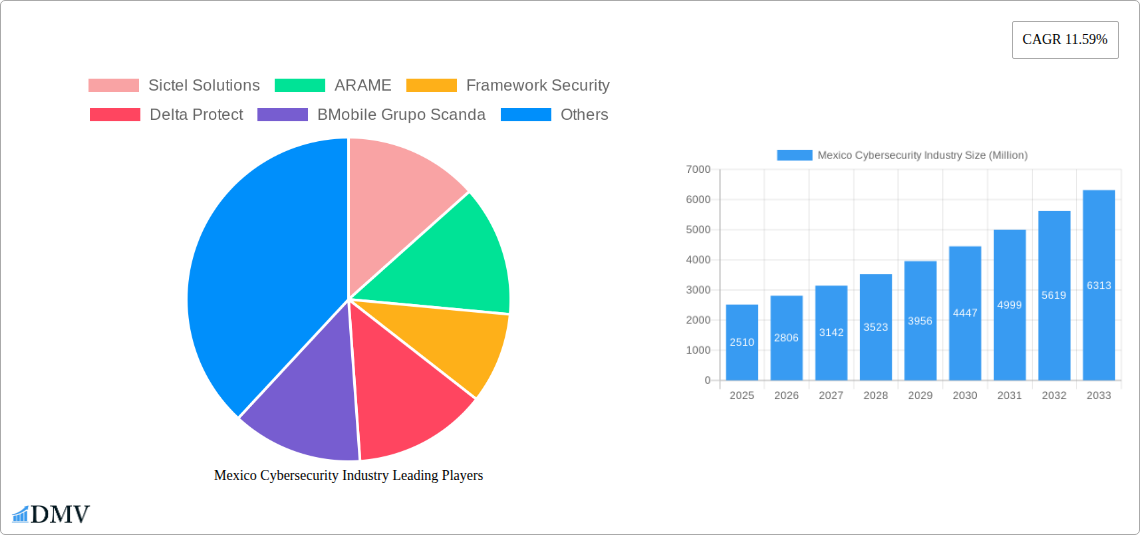

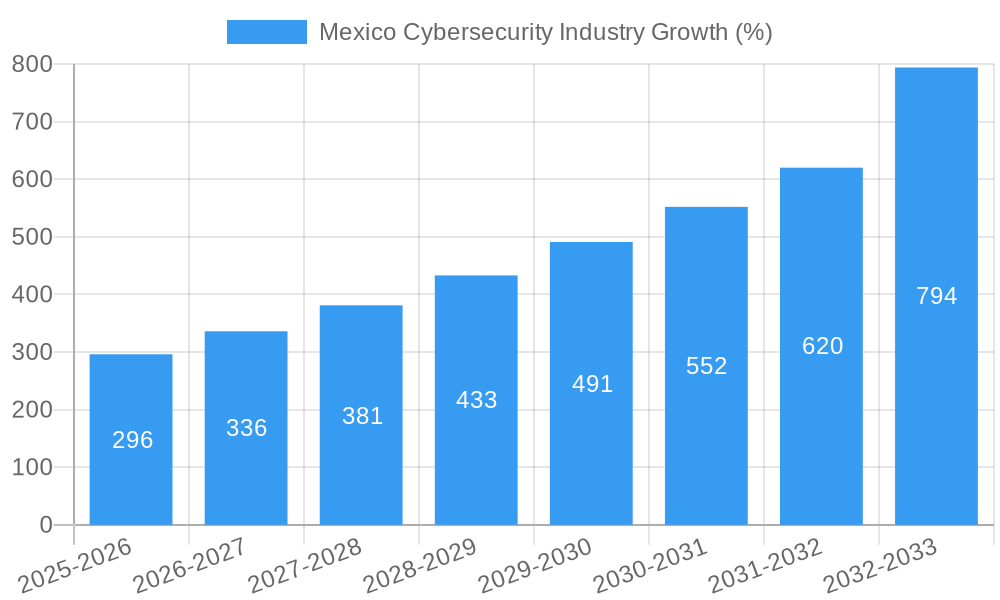

The Mexico cybersecurity market, valued at $2.51 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 11.59% from 2025 to 2033. This surge is fueled by several key drivers. The increasing digitalization of Mexican businesses across sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and retail necessitates robust cybersecurity solutions to protect sensitive data and prevent costly breaches. Furthermore, government initiatives promoting cybersecurity awareness and infrastructure development are bolstering market expansion. The rising adoption of cloud-based solutions, offering scalability and cost-effectiveness, is another significant driver. While the market faces challenges like a skills gap in cybersecurity professionals and the evolving nature of cyber threats, the overall outlook remains positive. The market's segmentation, encompassing solutions (software, hardware), services (managed security services, consulting), on-premise and cloud deployment models, and diverse end-user industries, reflects its maturity and caters to varied organizational needs. Key players like Sictel Solutions, ARAME, and Framework Security are actively shaping the competitive landscape through innovation and strategic partnerships.

The continued growth of e-commerce and the increasing reliance on interconnected systems across all sectors in Mexico are expected to fuel demand for advanced cybersecurity solutions. The adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in cybersecurity is also a significant trend, enhancing threat detection and response capabilities. However, the market faces constraints such as limited cybersecurity awareness among smaller businesses and a lack of standardized regulations, potentially hindering widespread adoption of robust security measures. Nevertheless, the long-term outlook for the Mexican cybersecurity market remains optimistic, driven by sustained economic growth, increasing digitalization, and a rising understanding of the critical importance of cybersecurity across various sectors.

Mexico Cybersecurity Industry: Market Analysis and Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico cybersecurity market, offering invaluable insights for stakeholders seeking to understand its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The report’s findings are crucial for informed decision-making in this rapidly evolving landscape. The market is projected to reach xx Million by 2033, exhibiting substantial growth potential.

Mexico Cybersecurity Industry Market Composition & Trends

This section delves into the competitive dynamics of the Mexican cybersecurity market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The market is characterized by a mix of multinational corporations and domestic players. Market share distribution shows a fragmented landscape, with no single company holding a dominant position. However, several key players, including Sictel Solutions, ARAME, and Framework Security, are emerging as significant contenders.

- Market Concentration: Moderately fragmented, with top 5 players holding an estimated xx% market share in 2025.

- Innovation Catalysts: Government initiatives promoting digital transformation and increasing cyber threats are driving innovation.

- Regulatory Landscape: The evolving regulatory landscape is influencing cybersecurity investment and adoption. Compliance requirements are a significant growth driver.

- Substitute Products: Limited viable substitutes exist; the focus remains on strengthening existing cybersecurity infrastructure and adapting to evolving threats.

- End-User Profiles: BFSI, government, and IT & Telecommunication sectors are leading adopters, followed by healthcare and manufacturing.

- M&A Activities: The past five years have seen xx M&A deals in the Mexican cybersecurity sector, with a total deal value of approximately xx Million. This activity is expected to increase driven by market consolidation and the need for advanced solutions.

Mexico Cybersecurity Industry Industry Evolution

The Mexican cybersecurity market has witnessed significant growth over the past few years, fueled by rising digital adoption, increasing cyber threats, and stringent data protection regulations. Technological advancements, such as the rise of AI-driven security solutions and cloud-based security services, have transformed the market. Consumer demand is shifting towards advanced threat protection, data loss prevention, and proactive security measures. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Adoption of cloud-based security solutions is increasing rapidly, driven by cost efficiency and scalability. The increasing prevalence of sophisticated cyberattacks has also accelerated the adoption of advanced threat detection and response technologies.

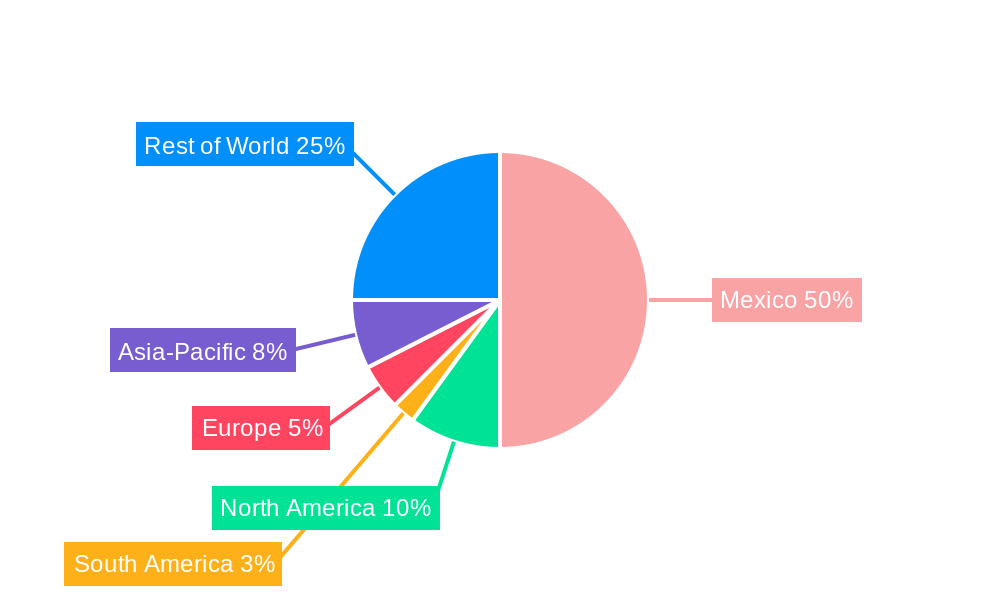

Leading Regions, Countries, or Segments in Mexico Cybersecurity Industry

Mexico City and other major metropolitan areas are leading in cybersecurity adoption due to the concentration of businesses and government entities. The IT & Telecommunication, BFSI, and Government sectors are the dominant end-user industries due to the critical nature of their data and the heightened regulatory scrutiny they face. The cloud deployment model is experiencing accelerated growth due to scalability and cost-effectiveness.

- Key Drivers (By Segment):

- BFSI: Stringent regulatory compliance requirements and the high value of financial data are key drivers.

- Government: Protection of critical infrastructure and citizen data is paramount.

- IT & Telecommunication: Protecting network infrastructure and customer data is crucial.

- Cloud Deployment: Cost optimization, scalability, and ease of management are driving adoption.

- Solutions: Demand for comprehensive solutions covering multiple threat vectors is high.

The dominance of these segments is driven by increasing awareness of cyber threats, growing regulatory pressure, and the significant value of protected assets within these industries.

Mexico Cybersecurity Industry Product Innovations

Recent product innovations encompass AI-powered threat detection, advanced endpoint protection, and secure access service edge (SASE) solutions. These advancements offer enhanced threat prevention, faster response times, and improved visibility into network security. Unique selling propositions frequently involve improved threat detection accuracy, reduced operational costs, and simplified security management. Several companies are incorporating machine learning algorithms to enhance threat detection capabilities and automate response processes.

Propelling Factors for Mexico Cybersecurity Industry Growth

The growth of the Mexican cybersecurity market is propelled by several factors: increasing adoption of digital technologies across various sectors, escalating cyberattacks targeting both businesses and government institutions, rising awareness of data protection regulations (e.g., GDPR influence), and government initiatives promoting cybersecurity awareness and investment. The expansion of cloud computing and the Internet of Things (IoT) also contributes significantly to market growth.

Obstacles in the Mexico Cybersecurity Industry Market

The market faces challenges, including a shortage of skilled cybersecurity professionals, high implementation costs for advanced security solutions, the complexity of integrating diverse security technologies, and a sometimes slow pace of regulatory change and enforcement. These factors can hinder adoption and increase the overall cost of cybersecurity.

Future Opportunities in Mexico Cybersecurity Industry

Emerging opportunities lie in the increasing adoption of cloud security, the expansion of IoT security solutions, and the growing demand for managed security services (MSS). The market for AI-powered security solutions is also expected to witness significant growth. Addressing the skills gap through robust training programs represents a considerable opportunity for market expansion.

Major Players in the Mexico Cybersecurity Industry Ecosystem

- Sictel Solutions

- ARAME

- Framework Security

- Delta Protect

- BMobile Grupo Scanda

- KIO Cyber

- Inflection Point

- CYCSAS

- MCM Telecom

- Scitum

Key Developments in Mexico Cybersecurity Industry Industry

- October 2021: Telefónica Tech and CyberArk partnered to offer enhanced SaaS-based cybersecurity solutions focused on identity-driven risk mitigation across Latin America, including Mexico.

- May 2022: GigNet Mexico launched new cybersecurity products to protect hospitality and corporate clients from cybercrime, ransomware, and other attacks.

Strategic Mexico Cybersecurity Industry Market Forecast

The Mexican cybersecurity market is poised for significant growth driven by increasing digitalization, heightened cyber threats, and strengthening regulatory frameworks. The market's future prospects are positive, particularly in the areas of cloud security, managed security services, and AI-powered threat detection. Continued investment in cybersecurity infrastructure and skilled professionals will be crucial to realizing this market potential.

Mexico Cybersecurity Industry Segmentation

-

1. Product Type

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Consumer Security Software

- 1.1.4. Data Security

- 1.1.5. Identity Access Management

- 1.1.6. Infrastructure Protection

- 1.1.7. Integrated Risk Management

- 1.1.8. Network Security Equipment

- 1.1.9. Other Solution Types

-

1.2. Services

- 1.2.1. Professional

- 1.2.2. Managed

-

1.1. Solutions

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Aerospace and Defense

- 3.4. IT and Telecommunication

- 3.5. Government

- 3.6. Retail

- 3.7. Manufacturing

- 3.8. Other End-user Industries

Mexico Cybersecurity Industry Segmentation By Geography

- 1. Mexico

Mexico Cybersecurity Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting; Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness About Security Testing

- 3.4. Market Trends

- 3.4.1. Cloud Deployment is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Cybersecurity Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Consumer Security Software

- 5.1.1.4. Data Security

- 5.1.1.5. Identity Access Management

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Integrated Risk Management

- 5.1.1.8. Network Security Equipment

- 5.1.1.9. Other Solution Types

- 5.1.2. Services

- 5.1.2.1. Professional

- 5.1.2.2. Managed

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Aerospace and Defense

- 5.3.4. IT and Telecommunication

- 5.3.5. Government

- 5.3.6. Retail

- 5.3.7. Manufacturing

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sictel Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ARAME

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Framework Security

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Protect

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BMobile Grupo Scanda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KIO Cyber

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inflection Point

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CYCSAS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MCM Telecom

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scitum

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sictel Solutions

List of Figures

- Figure 1: Mexico Cybersecurity Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Cybersecurity Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Cybersecurity Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Mexico Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Mexico Cybersecurity Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Mexico Cybersecurity Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico Cybersecurity Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Mexico Cybersecurity Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 9: Mexico Cybersecurity Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Mexico Cybersecurity Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Cybersecurity Industry?

The projected CAGR is approximately 11.59%.

2. Which companies are prominent players in the Mexico Cybersecurity Industry?

Key companies in the market include Sictel Solutions, ARAME, Framework Security, Delta Protect, BMobile Grupo Scanda, KIO Cyber, Inflection Point, CYCSAS, MCM Telecom, Scitum.

3. What are the main segments of the Mexico Cybersecurity Industry?

The market segments include Product Type, Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Cybersecurity Incidents and Regulations Requiring Their Reporting; Growing M2M/IoT Connections Demanding Strengthened Cybersecurity in Enterprises.

6. What are the notable trends driving market growth?

Cloud Deployment is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness About Security Testing.

8. Can you provide examples of recent developments in the market?

October 2021 - Telefónica Tech and CyberArk teamed up to deliver an expanded portfolio of SaaS-based cybersecurity solutions that prioritize a security-first approach to protecting against identity-driven risk. Additionally, the customers will benefit from being able to secure access for all human and machine identities without sacrificing business agility. The services are offered in Latin American countries like Mexico, Peru, Brazil, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Cybersecurity Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Cybersecurity Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Cybersecurity Industry?

To stay informed about further developments, trends, and reports in the Mexico Cybersecurity Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence