Key Insights

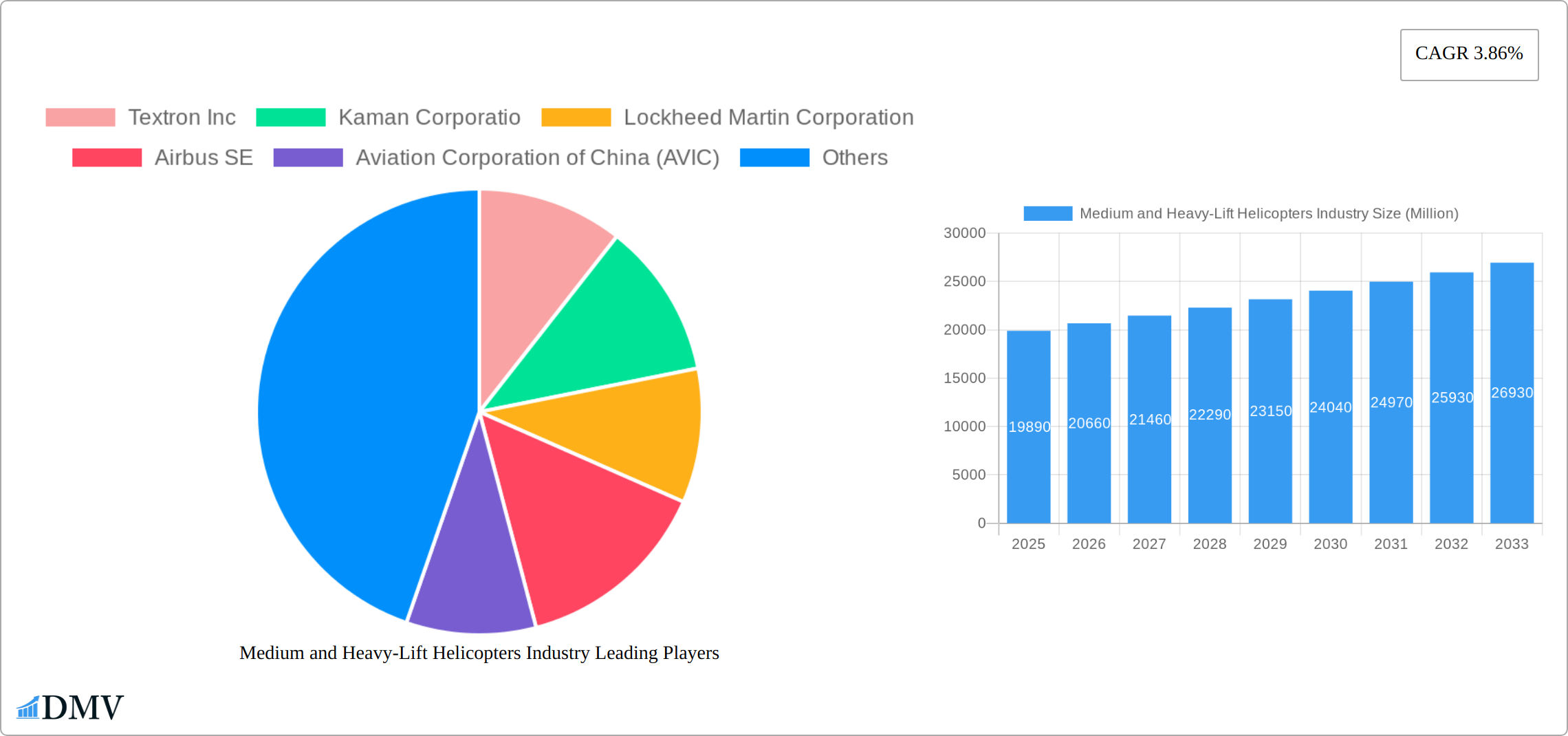

The global medium and heavy-lift helicopter market, valued at $19.89 billion in 2025, is projected to experience robust growth, driven by increasing demand across diverse sectors. The civil and commercial segments, encompassing search and rescue operations, emergency medical services, and offshore wind farm support, are major contributors to market expansion. The military segment, fueled by ongoing geopolitical instability and modernization efforts of armed forces globally, is another significant driver. Technological advancements such as improved rotor designs, enhanced payload capacity, and advanced avionics are further propelling market growth. However, high acquisition and maintenance costs, stringent regulatory compliance, and the dependence on a limited number of key manufacturers present challenges to market expansion. The market is segmented by lift capacity (medium-lift and heavy-lift) and application (civil & commercial, military). Growth is expected to be particularly strong in the Asia-Pacific region, driven by infrastructure development and increasing military spending. North America and Europe, while possessing established markets, will continue to see growth, albeit at a potentially slower pace compared to Asia-Pacific, due to existing infrastructure and a more mature market. The forecast period (2025-2033) anticipates a steady upward trajectory, with the CAGR of 3.86% suggesting a substantial increase in market value by 2033. Key players like Textron, Kaman, Lockheed Martin, Airbus, AVIC, Leonardo, Russian Helicopters, and Boeing are expected to play a crucial role in shaping the market's future.

The competitive landscape is characterized by a mix of established industry giants and emerging players, leading to continuous innovation and fierce competition. This competition drives improvements in helicopter technology, safety features, and operational efficiency. Growth is also contingent upon factors such as government funding for defense programs, economic conditions impacting infrastructure investment, and technological breakthroughs further enhancing the capabilities of these aircraft. The market's growth trajectory will be impacted by fluctuating fuel prices, environmental regulations, and technological disruptions within the aerospace industry. While substantial growth is projected, a detailed understanding of these diverse factors is crucial for making informed decisions within this dynamic sector.

Soar to New Heights: A Comprehensive Analysis of the Medium and Heavy-Lift Helicopters Industry (2019-2033)

This insightful report provides a detailed examination of the global Medium and Heavy-Lift Helicopters industry, projecting a market valued at $xx Million by 2033. It offers a meticulously researched overview of market dynamics, competitive landscapes, technological advancements, and future growth trajectories, equipping stakeholders with the crucial intelligence needed for strategic decision-making. The study period spans 2019-2033, with 2025 serving as both the base and estimated year. This report is your indispensable guide to navigating the complexities of this dynamic sector.

Medium and Heavy-Lift Helicopters Industry Market Composition & Trends

This section delves into the intricacies of the medium and heavy-lift helicopter market, analyzing its current composition and identifying key trends shaping its future. We examine market concentration, revealing the market share distribution amongst key players like Textron Inc, Kaman Corporation, Lockheed Martin Corporation, Airbus SE, Aviation Corporation of China (AVIC), Leonardo S.p.A, Russian Helicopters JSC, and The Boeing Company. The report further explores the innovative catalysts driving growth, including advancements in materials science and avionics. Regulatory landscapes impacting operations and certification are scrutinized, alongside an analysis of substitute products and their market impact. Finally, a detailed overview of M&A activities, including deal values (estimated at $xx Million in total for the period 2019-2024), and their implications for market consolidation are presented.

- Market Concentration: Highly concentrated, with the top 5 players holding approximately xx% market share in 2024.

- Innovation Catalysts: Advancements in rotor technology, hybrid-electric propulsion, and autonomous flight systems.

- Regulatory Landscape: Stringent safety and certification requirements, varying across regions.

- Substitute Products: Limited direct substitutes, with fixed-wing aircraft offering some overlap in certain applications.

- End-User Profiles: Primarily military and civil/commercial sectors, with specific segment breakdown detailed in the report.

- M&A Activities: Significant M&A activity observed between 2019-2024, with an average deal value of $xx Million.

Medium and Heavy-Lift Helicopters Industry Industry Evolution

This section charts the evolutionary journey of the medium and heavy-lift helicopter industry, tracing its growth trajectory from 2019 to 2033. We analyze the historical period (2019-2024), highlighting growth rates and market size fluctuations. The impact of technological advancements, including the adoption of advanced materials and improved flight control systems, on market dynamics is carefully examined. Furthermore, the report explores shifting consumer demands, particularly in the civil and commercial sectors, influenced by factors such as increased demand for heavy-lift capabilities in infrastructure projects and disaster relief efforts. The forecast period (2025-2033) projects a Compound Annual Growth Rate (CAGR) of xx%, driven by factors detailed in subsequent sections. Specific data points, including adoption rates for new technologies and regional growth variations, are provided within the complete report.

Leading Regions, Countries, or Segments in Medium and Heavy-Lift Helicopters Industry

This section identifies the dominant regions, countries, and segments within the medium and heavy-lift helicopter market. We pinpoint the leading region, which is currently [Name of Region], driven by factors such as [insert specific reason]. This dominance is further dissected on a country level, focusing on [Country Name] due to [specific reasons]. The analysis also compares the relative performance of the "Civil and Commercial" and "Military" application segments, and the "Medium-lift" and "Heavy-lift" type segments.

- Key Drivers for Dominance (North America): Strong defense budgets, robust civil infrastructure projects, and a well-established aerospace ecosystem.

- Key Drivers for Dominance (Europe): Significant investments in advanced helicopter technology and a strong presence of major helicopter manufacturers.

- Application Segment Analysis: Military segment currently dominates, but the civil and commercial segment is projected to experience faster growth in the forecast period.

- Type Segment Analysis: Heavy-lift helicopters are witnessing higher demand due to their use in specialized applications.

Medium and Heavy-Lift Helicopters Industry Product Innovations

Recent years have witnessed significant product innovation in the medium and heavy-lift helicopter sector, focusing on enhancing payload capacity, improving fuel efficiency, and integrating advanced avionics. New designs incorporate composite materials for weight reduction and increased durability. Innovative technologies such as fly-by-wire systems and advanced autopilot capabilities enhance flight safety and pilot workload management. These advancements are reflected in improved performance metrics, including increased operational range and reduced maintenance costs. The unique selling propositions (USPs) of leading manufacturers involve advanced technologies, superior operational capabilities, and customized solutions tailored to specific customer needs.

Propelling Factors for Medium and Heavy-Lift Helicopters Industry Growth

The growth of the medium and heavy-lift helicopter industry is propelled by several key factors. Increased investment in defense modernization programs globally fuels demand for military helicopters. The expanding civil infrastructure market, particularly in developing economies, necessitates robust heavy-lift capabilities for large-scale projects. Furthermore, favorable government regulations and policies aimed at supporting the aerospace industry further accelerate market growth. Technological advancements, such as the development of more efficient engines and advanced avionics, contribute to operational cost reductions and improved performance, enhancing market attractiveness.

Obstacles in the Medium and Heavy-Lift Helicopters Industry Market

Despite significant growth potential, the medium and heavy-lift helicopter industry faces several challenges. Stringent regulatory approvals and certification processes can delay product launches and increase development costs. Supply chain disruptions, particularly of critical components, can impact production timelines and profitability. Intense competition from established manufacturers and emerging players also exerts pressure on pricing and profit margins. These factors, coupled with economic downturns, can impact market growth, although their specific quantitative impact varies according to market segment and geographical location.

Future Opportunities in Medium and Heavy-Lift Helicopters Industry

The future of the medium and heavy-lift helicopter market presents exciting opportunities. The rise of offshore wind energy projects presents a significant growth avenue for heavy-lift helicopters involved in turbine installation and maintenance. The development and adoption of hybrid-electric propulsion systems can reduce operating costs and environmental impact, boosting market appeal. Emerging markets in Asia and Africa present substantial growth potential, driven by infrastructure development and increasing demand for specialized transport services.

Major Players in the Medium and Heavy-Lift Helicopters Industry Ecosystem

- Textron Inc

- Kaman Corporation

- Lockheed Martin Corporation

- Airbus SE

- Aviation Corporation of China (AVIC)

- Leonardo S.p.A

- Russian Helicopters JSC

- The Boeing Company

Key Developments in Medium and Heavy-Lift Helicopters Industry Industry

- 2022-03: Airbus Helicopters announces the development of a new hybrid-electric helicopter prototype.

- 2023-10: Lockheed Martin secures a major contract for the supply of heavy-lift helicopters to a foreign military.

- 2024-06: Textron Inc. merges with a smaller helicopter manufacturer, expanding its market share.

- (Further details on key developments with dates and impacts are included in the full report.)

Strategic Medium and Heavy-Lift Helicopters Industry Market Forecast

The medium and heavy-lift helicopter market is poised for robust growth driven by sustained demand from military and civil sectors. Technological advancements will continue to improve efficiency and performance, while the expansion into emerging markets will create new avenues for growth. The focus on sustainability and the adoption of hybrid-electric technologies will reshape the industry landscape. The overall market is expected to experience significant expansion, reaching [estimated market value in Millions] by 2033.

Medium and Heavy-Lift Helicopters Industry Segmentation

-

1. Application

- 1.1. Civil and Commercial

- 1.2. Mlitary

-

2. Type

- 2.1. Medium-lift

- 2.2. Heavy-lift

Medium and Heavy-Lift Helicopters Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Israel

- 4.4. Rest of Middle East and Africa

-

5. Latin America

- 5.1. Mexico

- 5.2. Brazil

- 5.3. Rest of Latin America

Medium and Heavy-Lift Helicopters Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Medium-lift Helicopters Segment to Witness the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil and Commercial

- 5.1.2. Mlitary

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Medium-lift

- 5.2.2. Heavy-lift

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Civil and Commercial

- 6.1.2. Mlitary

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Medium-lift

- 6.2.2. Heavy-lift

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Civil and Commercial

- 7.1.2. Mlitary

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Medium-lift

- 7.2.2. Heavy-lift

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Civil and Commercial

- 8.1.2. Mlitary

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Medium-lift

- 8.2.2. Heavy-lift

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Civil and Commercial

- 9.1.2. Mlitary

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Medium-lift

- 9.2.2. Heavy-lift

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Latin America Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Civil and Commercial

- 10.1.2. Mlitary

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Medium-lift

- 10.2.2. Heavy-lift

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Middle East and Africa Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Arab Emirates

- 14.1.2 Saudi Arabia

- 14.1.3 Israel

- 14.1.4 Rest of Middle East and Africa

- 15. Latin America Medium and Heavy-Lift Helicopters Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Mexico

- 15.1.2 Brazil

- 15.1.3 Rest of Latin America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Textron Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Kaman Corporatio

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Lockheed Martin Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Airbus SE

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Aviation Corporation of China (AVIC)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Leonardo S p A

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Russian Helicopters JSC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 The Boeing Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Textron Inc

List of Figures

- Figure 1: Global Medium and Heavy-Lift Helicopters Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Latin America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Medium and Heavy-Lift Helicopters Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Arab Emirates Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Saudi Arabia Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Israel Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Mexico Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Brazil Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: United Arab Emirates Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Saudi Arabia Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Israel Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Middle East and Africa Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 59: Global Medium and Heavy-Lift Helicopters Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Mexico Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Brazil Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Latin America Medium and Heavy-Lift Helicopters Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medium and Heavy-Lift Helicopters Industry?

The projected CAGR is approximately 3.86%.

2. Which companies are prominent players in the Medium and Heavy-Lift Helicopters Industry?

Key companies in the market include Textron Inc, Kaman Corporatio, Lockheed Martin Corporation, Airbus SE, Aviation Corporation of China (AVIC), Leonardo S p A, Russian Helicopters JSC, The Boeing Company.

3. What are the main segments of the Medium and Heavy-Lift Helicopters Industry?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Medium-lift Helicopters Segment to Witness the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medium and Heavy-Lift Helicopters Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medium and Heavy-Lift Helicopters Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medium and Heavy-Lift Helicopters Industry?

To stay informed about further developments, trends, and reports in the Medium and Heavy-Lift Helicopters Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence