Key Insights

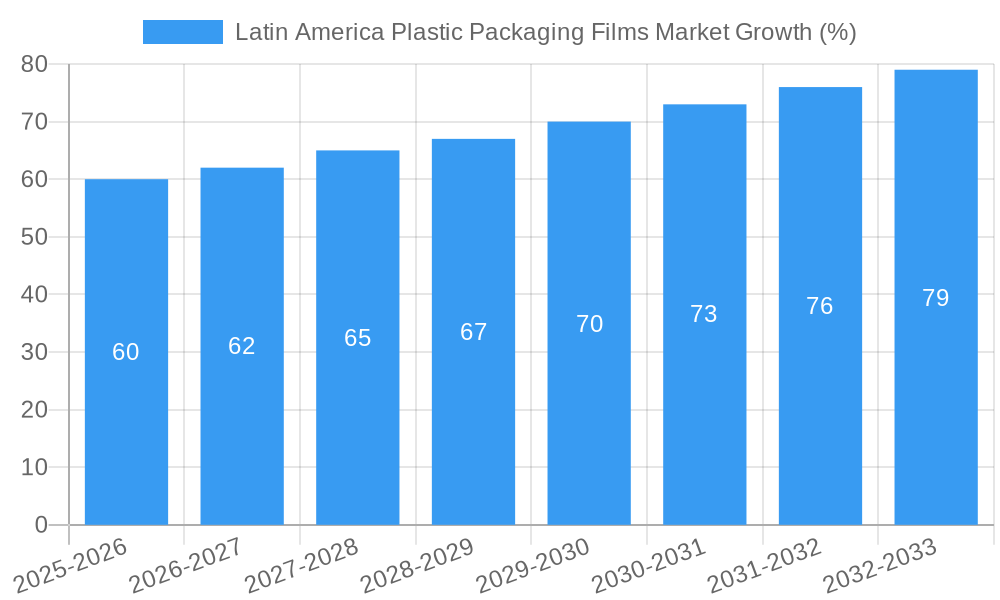

The Latin America Plastic Packaging Films market is experiencing steady growth, projected to reach a substantial size over the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 3.91% indicates a consistent expansion driven by several factors. The rising demand for packaged consumer goods, particularly in the food and beverage sectors, fuels significant market growth. Increasing urbanization and a growing middle class across Latin America contribute to higher consumption levels and a greater reliance on convenient, pre-packaged products. Furthermore, advancements in flexible packaging technologies, including lighter, more sustainable film materials, are driving innovation and adoption within the market. This includes a shift towards biodegradable and recyclable films, responding to increasing environmental concerns and regulatory pressures. However, the market also faces challenges such as fluctuations in raw material prices, particularly petroleum-based polymers, and potential economic instability in certain regions. Competition among established players and new entrants is fierce, necessitating continuous innovation and cost-optimization strategies for sustained success.

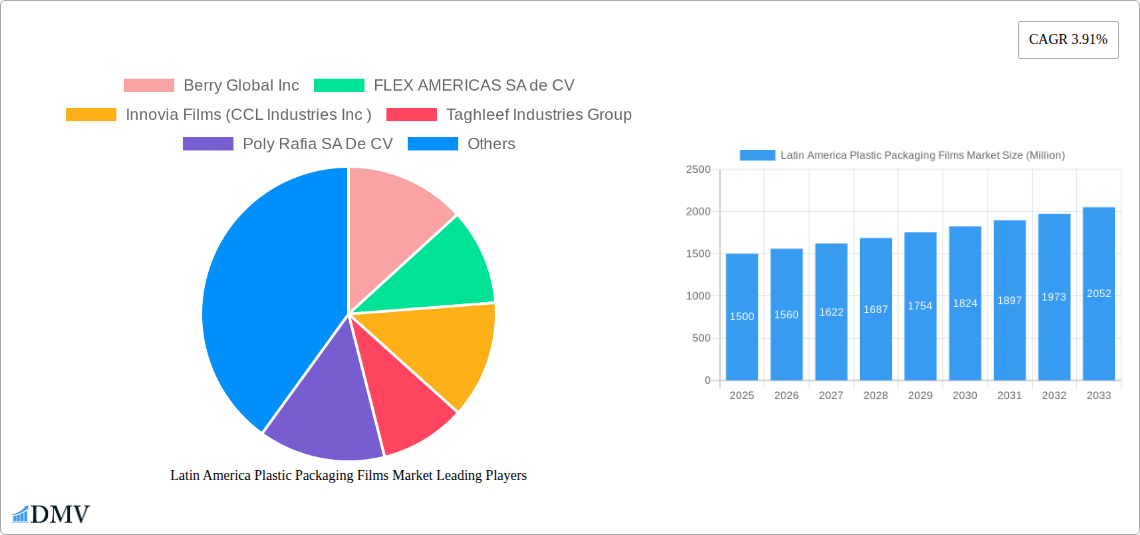

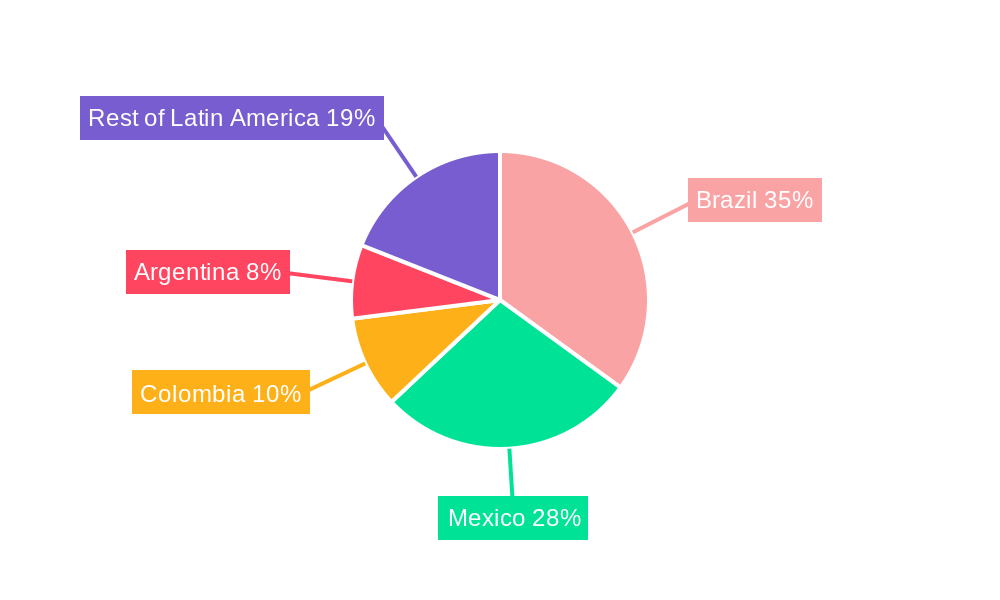

The market segmentation reveals opportunities across various film types and applications. While precise segment data is unavailable, it's likely that sectors like food packaging (flexible pouches, wraps, etc.) and non-food packaging (personal care, industrial goods, etc.) hold the largest shares. Key players like Berry Global Inc., FLEX AMERICAS SA de CV, and Innovia Films are establishing strong market positions through strategic investments, partnerships, and product diversification. Geographic variations exist; Brazil, Mexico, and Colombia are anticipated to be leading markets, given their relatively developed economies and large consumer bases. The forecast period of 2025-2033 indicates significant potential for growth based on the projected market expansion outlined. The established and emerging players are likely focusing on developing new sustainable solutions to meet the rising demand for environmentally friendly packaging options.

Latin America Plastic Packaging Films Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America Plastic Packaging Films Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Latin America Plastic Packaging Films Market Market Composition & Trends

The Latin America plastic packaging films market is characterized by a moderately fragmented landscape, with several major players and numerous smaller regional manufacturers vying for market share. Market concentration is expected to shift slightly towards consolidation as larger companies pursue acquisitions to expand their reach and product portfolios. Innovation in sustainable packaging solutions, driven by increasing environmental concerns and stricter regulations, is a key catalyst for growth. The report analyzes the regulatory landscape across different Latin American countries, highlighting variations in policies concerning plastic waste management and recycled content mandates. This influences the adoption of biodegradable and recyclable films. Substitute products, such as paper-based packaging and alternative materials, pose a competitive threat, although plastic films continue to dominate due to their cost-effectiveness and performance characteristics.

The report profiles key end-users, including the food and beverage, consumer goods, industrial, and agricultural sectors, examining their specific packaging needs and preferences. The market is also witnessing increased Mergers & Acquisitions (M&A) activity, with larger companies seeking to expand their product lines and market reach. Estimated M&A deal values within the last five years totaled approximately xx Million, contributing to significant market reshaping. Key metrics analyzed include market share distribution across segments and leading companies.

- Market Share Distribution (2024): Berry Global Inc (xx%), FLEX AMERICAS SA de CV (xx%), Innovia Films (CCL Industries Inc) (xx%), and others (xx%).

- Estimated M&A Deal Value (2019-2024): xx Million.

Latin America Plastic Packaging Films Market Industry Evolution

The Latin America plastic packaging films market has witnessed consistent growth over the historical period (2019-2024), driven by factors including rising consumption of packaged goods, expanding e-commerce activities, and industrial development across the region. Technological advancements, such as the introduction of improved barrier films, lightweight films, and sustainable packaging options, are reshaping the market. The increased adoption of advanced packaging technologies, like active and intelligent packaging, is contributing to premiumization and product differentiation. Consumer demand for sustainable and eco-friendly packaging is significantly impacting the market. Growth rates have averaged xx% annually in the past five years, with higher growth observed in specific segments like flexible packaging for food applications. Adoption of PCR-content packaging is steadily increasing, with forecasts indicating a xx% increase in the adoption of PCR-LLDPE films by 2033. The shift towards sustainable practices is influencing packaging design, material selection, and recycling initiatives.

Leading Regions, Countries, or Segments in Latin America Plastic Packaging Films Market

Brazil and Mexico are currently the dominant markets in the Latin America plastic packaging films market, driven by their large populations, robust economies, and well-established manufacturing sectors.

- Key Drivers for Brazil:

- High demand from the food and beverage sector

- Significant investments in infrastructure and logistics

- Growing focus on sustainable packaging solutions

- Key Drivers for Mexico:

- Rapid growth of the consumer goods industry

- Proximity to major North American markets

- Increasing adoption of flexible packaging formats

The flexible packaging segment dominates the overall market due to its versatility, cost-effectiveness, and suitability for a wide range of applications. This segment is experiencing substantial growth driven by strong demand from the food industry (especially in the bakery and frozen goods segments). Growth within Brazil and Mexico is further fuelled by supportive government policies encouraging domestic manufacturing and investment in the packaging sector. The presence of major multinational corporations further strengthens market development within these regions.

Latin America Plastic Packaging Films Market Product Innovations

Recent innovations include the introduction of enhanced polyethylene cling films offering improved elasticity and impact resistance, replacing traditional PVC alternatives. The adoption of recycled content is another trend, with companies introducing food-grade films containing at least 30% post-consumer recycled (PCR) plastic, thereby addressing sustainability concerns. Further innovation involves graphene-enhanced stretch films, providing significantly improved thinness and durability, leading to reduced material consumption. These innovations highlight a shift toward higher-performance, sustainable, and cost-effective packaging solutions.

Propelling Factors for Latin America Plastic Packaging Films Market Growth

Several factors are propelling the growth of the Latin American plastic packaging films market. These include:

- Increasing consumer demand: Rising disposable incomes and changing lifestyles drive demand for packaged goods.

- Expansion of e-commerce: The growth of online shopping boosts demand for protective packaging solutions.

- Technological advancements: Innovation in materials, processes and designs enhances packaging performance and sustainability.

- Government regulations: Policies promoting sustainable packaging and waste management initiatives stimulate market development.

Obstacles in the Latin America Plastic Packaging Films Market Market

The Latin American plastic packaging films market faces certain challenges:

- Fluctuating raw material prices: Dependence on global commodity markets causes pricing volatility impacting profitability.

- Environmental regulations: Stringent regulations regarding plastic waste management and recycled content increase compliance costs.

- Supply chain disruptions: Global events impacting logistics and raw material supply cause production inefficiencies.

Future Opportunities in Latin America Plastic Packaging Films Market

Future opportunities lie in:

- Growth of sustainable packaging: Demand for biodegradable, compostable, and recyclable films continues to increase.

- Advancements in active and intelligent packaging: Innovations enhancing food safety and shelf life offer market expansion possibilities.

- Penetration in emerging markets: Expanding into less developed regions presents significant untapped potential.

Major Players in the Latin America Plastic Packaging Films Market Ecosystem

- Berry Global Inc (Berry Global)

- FLEX AMERICAS SA de CV

- Innovia Films (CCL Industries Inc)

- Taghleef Industries Group

- Poly Rafia SA De CV

- Cosmo Films

- Evertis de Mexico S

- PLAMI SA DE CV

- PYLA SA DE CV

- Oben Group

- Lord Brasil

- Nizza Plastic Company Ltd

- PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA

- Bruckner Maschinenbau

- Distripacking Colombia SAS

- Plafilm S

Key Developments in Latin America Plastic Packaging Films Market Industry

- November 2023: Berry Global launches Omni Xtra+, an enhanced polyethylene cling film for fresh food packaging, a high-performance alternative to PVC.

- September 2023: Berry Global introduces food-grade LLDPE films with at least 30% PCR plastic, meeting sustainability goals.

- August 2023: Packseven (Brazil) launches the world's first graphene-enhanced stretch film, increasing packing capacity by 120%.

Strategic Latin America Plastic Packaging Films Market Market Forecast

The Latin America plastic packaging films market is poised for significant growth, driven by a confluence of factors including rising consumer demand, technological advancements, and increasing focus on sustainability. The market's future potential is promising, with opportunities arising from the growing adoption of innovative packaging solutions and expansion into new markets. Continued investment in sustainable packaging options, alongside robust economic growth across the region, will fuel market expansion throughout the forecast period. The shift towards flexible packaging and recycled content will be prominent drivers of future growth.

Latin America Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-based

- 1.6. Polyviny

-

2. End-User Industry

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Latin America Plastic Packaging Films Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.4. Market Trends

- 3.4.1. Polyethylene segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Plastic Packaging Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-based

- 5.1.6. Polyviny

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FLEX AMERICAS SA de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovia Films (CCL Industries Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Taghleef Industries Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Poly Rafia SA De CV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cosmo Films

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evertis de Mexico S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PLAMI SA DE CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PYLA SA de CV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oben Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lord Brasil

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nizza Plastic Company Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Bruckner Maschinenbau

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Distripacking Colombia SAS

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Plafilm S

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: Latin America Plastic Packaging Films Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Plastic Packaging Films Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Plastic Packaging Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Latin America Plastic Packaging Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 7: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Colombia Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Peru Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Venezuela Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Ecuador Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Bolivia Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Paraguay Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Plastic Packaging Films Market?

The projected CAGR is approximately 3.91%.

2. Which companies are prominent players in the Latin America Plastic Packaging Films Market?

Key companies in the market include Berry Global Inc, FLEX AMERICAS SA de CV, Innovia Films (CCL Industries Inc ), Taghleef Industries Group, Poly Rafia SA De CV, Cosmo Films, Evertis de Mexico S, PLAMI SA DE CV, PYLA SA de CV, Oben Group, Lord Brasil, Nizza Plastic Company Ltd, PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA, Bruckner Maschinenbau, Distripacking Colombia SAS, Plafilm S.

3. What are the main segments of the Latin America Plastic Packaging Films Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

6. What are the notable trends driving market growth?

Polyethylene segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

8. Can you provide examples of recent developments in the market?

November 2023 - Berry Global has introduced an enhanced version of its Omni Xtra polyethylene cling film for fresh food packaging. This new product, Omni Xtra+, offers a high-performance alternative to traditional polyvinyl chloride (PVC) cling films. Building on the established Omni Xtra solution for packaging fruits, vegetables, meats, poultry, deli items, and bakery products, Omni Xtra+ features improved elasticity, uniform stretching properties, and enhanced impact resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Latin America Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence