Key Insights

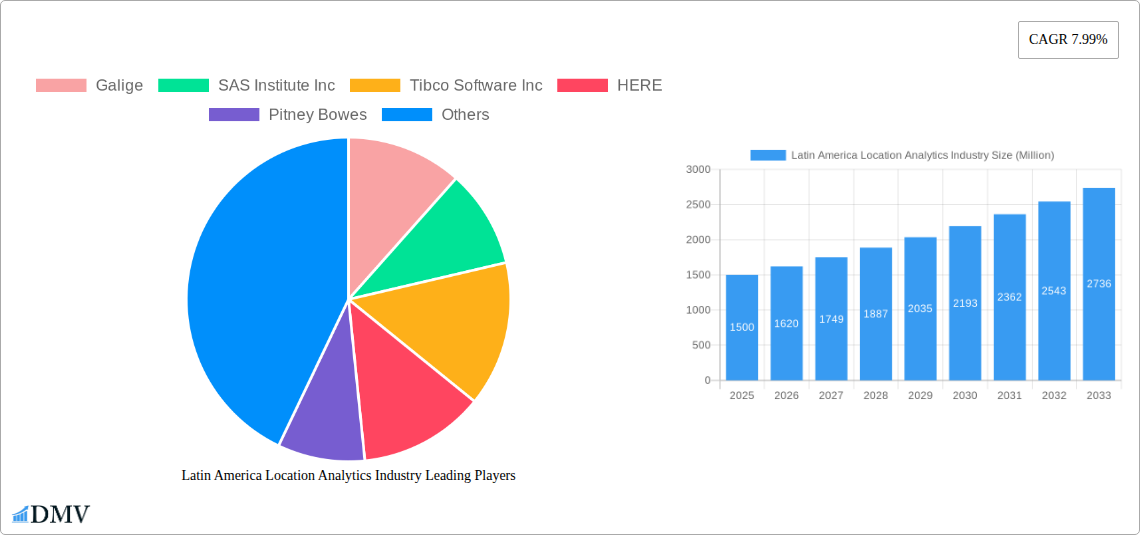

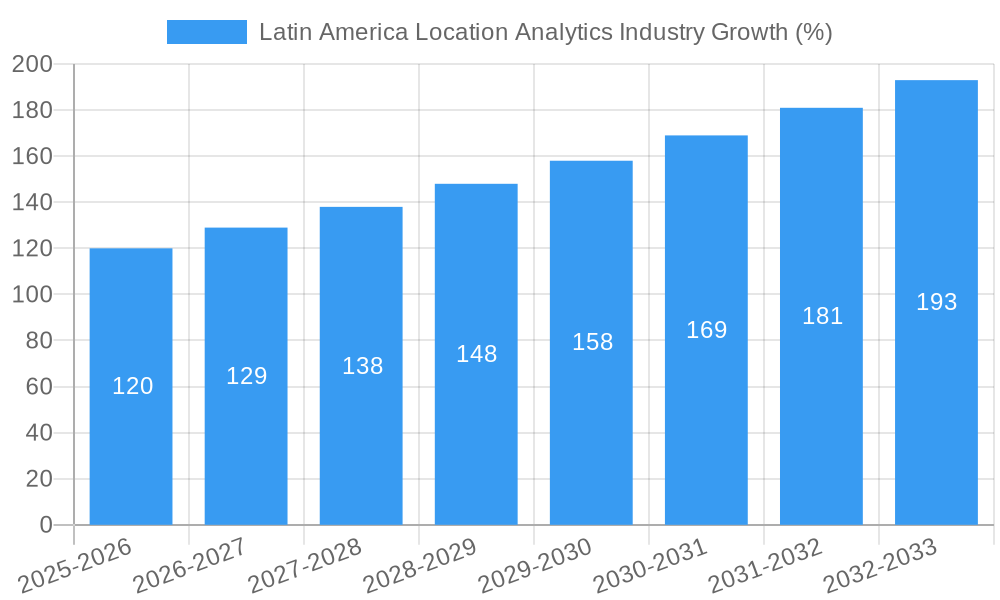

The Latin American Location Analytics market is experiencing robust growth, projected to reach a substantial size driven by the increasing adoption of location-based services across various sectors. The market's Compound Annual Growth Rate (CAGR) of 7.99% from 2019 to 2024 indicates a consistent upward trajectory. This growth is fueled by several key factors. Firstly, the expanding retail, manufacturing, and healthcare sectors in the region are significantly increasing the demand for location intelligence to optimize operations, enhance customer experiences, and improve supply chain efficiency. Government initiatives promoting smart cities and digital transformation are further stimulating market expansion. The rising penetration of smartphones and improved internet connectivity also plays a significant role, providing a fertile ground for location-based data collection and analysis. Furthermore, the growing adoption of cloud-based solutions and the emergence of sophisticated analytical tools are simplifying the implementation and accessibility of location analytics, making it an attractive solution for businesses of all sizes.

However, the market also faces certain challenges. Data privacy concerns and the need for robust data security infrastructure are significant restraints. Furthermore, the varying levels of technological advancement across different Latin American countries and the lack of skilled professionals in data analytics could impede market penetration in certain regions. Nevertheless, the strong underlying drivers and the continuous improvements in technology suggest that the Latin American Location Analytics market will continue its upward trajectory throughout the forecast period (2025-2033), with potential for substantial growth in specific segments like remote monitoring and asset management within sectors such as energy and power, benefiting from smart grid and infrastructure investments. The market is segmented by application (remote monitoring, asset management, facility management), component (software, services), end-user verticals (retail, manufacturing, healthcare, government, energy and power, other), location (outdoor, indoor), and deployment model (on-premise, on-demand). Brazil, Argentina, and Mexico are expected to be the key contributors to regional growth.

Latin America Location Analytics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a deep dive into the dynamic Latin America location analytics market, offering a comprehensive analysis of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the growth opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, representing substantial growth potential.

Latin America Location Analytics Industry Market Composition & Trends

This section meticulously examines the Latin American location analytics market's composition and prevailing trends. We delve into market concentration, identifying key players and their respective market shares. The report analyzes the innovative technologies driving market growth, exploring the regulatory landscape and its influence on market expansion. Further, it assesses the impact of substitute products and the evolving end-user profiles, including a detailed examination of M&A activity within the industry.

- Market Concentration: The market exhibits a moderately concentrated structure with a few major players holding significant market share. Galige, SAS Institute Inc., and Tibco Software Inc. are expected to collectively control approximately xx% of the market in 2025.

- Innovation Catalysts: Advancements in AI, IoT, and big data analytics are pivotal in driving innovation and shaping market trends.

- Regulatory Landscape: Government initiatives focusing on smart cities and digital transformation are creating favorable conditions for market expansion, though regional variations in regulations exist.

- Substitute Products: The emergence of alternative technologies, like GIS-based solutions, presents a competitive challenge.

- End-User Profiles: Retail, manufacturing, and government sectors are currently the leading end-users, with healthcare and energy sectors showing significant growth potential.

- M&A Activity: The report analyzes completed M&A deals over the historical period (2019-2024), noting an aggregate deal value of approximately xx Million. Increased consolidation is anticipated in the forecast period (2025-2033).

Latin America Location Analytics Industry Industry Evolution

This section analyzes the evolution of the Latin America location analytics industry from 2019 to 2033, charting its growth trajectory, technological advancements, and shifting consumer demands. The report details the factors driving market growth, including increasing adoption of location-based services, expanding digital infrastructure, and rising demand for real-time data insights across various sectors. We project a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Detailed analysis of the adoption of key technologies such as AI, GPS, and cloud-based solutions is also provided. Adoption of location analytics software is projected to increase by xx% by 2033.

Leading Regions, Countries, or Segments in Latin America Location Analytics Industry

This section identifies the dominant regions, countries, and segments within the Latin America location analytics market. Brazil and Mexico are expected to lead in terms of market size, driven by factors such as robust digital infrastructure and government investments in smart city initiatives.

- Application: Remote monitoring is currently the leading application segment, driven by growing demand for efficient asset tracking and real-time data analysis in various industries.

- Component: The software segment holds a significant market share, fueled by rising demand for advanced analytical tools and data visualization capabilities.

- End-user Verticals: The government sector is a key driver of growth, followed by the retail and manufacturing sectors.

- Location: The outdoor location analytics segment currently dominates due to applications in logistics, agriculture and urban planning.

- Deployment Model: The on-demand (cloud-based) deployment model is gaining traction due to its scalability and cost-effectiveness.

- Key Drivers: Increased government investment in smart city projects, a growing focus on optimizing operations, and the rising adoption of location intelligence technologies.

Latin America Location Analytics Industry Product Innovations

The Latin America location analytics market is witnessing the emergence of innovative products and solutions, including advanced analytics platforms, real-time tracking systems, and predictive modeling tools. These innovations enhance accuracy, improve data visualization, and enable more effective decision-making across diverse industries. Unique selling propositions focus on integrating various data sources, enhancing the accuracy of location data, and offering improved user interfaces. Technological advancements are characterized by the incorporation of AI/ML algorithms for predictive analytics and automation capabilities.

Propelling Factors for Latin America Location Analytics Industry Growth

Several factors contribute to the robust growth of the Latin America location analytics market. Technological advancements, like the proliferation of IoT devices and improved mobile network infrastructure, enable the collection and analysis of massive datasets. Government initiatives and increased private sector investments in digital transformation further fuel growth. The increasing adoption of cloud-based solutions facilitates accessibility and scalability, lowering the barrier to entry for various businesses.

Obstacles in the Latin America Location Analytics Industry Market

Despite the promising growth outlook, certain challenges hinder market expansion. Data privacy concerns and regulations pose significant hurdles, necessitating robust data security measures. Infrastructure limitations in certain regions restrict the widespread adoption of location-based technologies. Furthermore, intense competition among established and emerging players can create pricing pressures.

Future Opportunities in Latin America Location Analytics Industry

The Latin America location analytics market presents significant future opportunities. The expansion of 5G networks will unlock new applications, particularly in real-time tracking and autonomous systems. Increasing adoption of AI and machine learning for predictive analytics will open doors to enhanced decision-making. Further development of solutions catered to specific industry needs will foster growth within targeted sectors.

Major Players in the Latin America Location Analytics Industry Ecosystem

- Galige

- SAS Institute Inc

- Tibco Software Inc

- HERE

- Pitney Bowes

- Microsoft Corporation

- ESRI (Environmental Systems Research Institute)

- Oracle Corporation

- Cisco Systems

- SAP SE

Key Developments in Latin America Location Analytics Industry Industry

- February 2023: Liberty Latin America partnered with Ribbon Communications Inc. to enhance network performance and security through automated fraud control and centralized network monitoring. This significantly improves key performance indicators (KPIs) and strengthens customer safety.

- November 2022: The Brazilian Ministry of Justice and Public Safety launched a large-scale remote sensing project with SCCON to combat illegal activities and environmental crimes in the Amazon. Over 3,300 public agents utilized satellite imagery and project data in over 120 operations, significantly aiding the Federal Police in reducing crime and corruption.

Strategic Latin America Location Analytics Industry Market Forecast

The Latin America location analytics market is poised for continued robust growth, driven by technological advancements, increasing government support, and rising demand from various sectors. The market's future success hinges on overcoming data privacy concerns and addressing infrastructure limitations. Strategic partnerships and investments in innovative technologies will be crucial for players to thrive in this competitive landscape. The market is anticipated to experience sustained growth, with significant opportunities across various segments and applications in the coming years.

Latin America Location Analytics Industry Segmentation

-

1. Location

- 1.1. Outdoor

- 1.2. Indoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. On-demand

-

3. Application

- 3.1. Remote Monitoring

- 3.2. Asset Management

- 3.3. Facility Management

-

4. Component

- 4.1. Software

- 4.2. Services

-

5. End-user Verticals

- 5.1. Retail

- 5.2. Manufacturing

- 5.3. Healthcare

- 5.4. Government

- 5.5. Energy and Power

- 5.6. Other Verticals

-

6. Geography

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Mexico

Latin America Location Analytics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Mexico

Latin America Location Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT

- 3.3. Market Restrains

- 3.3.1 Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information

- 3.3.2 Out-of-date Information

- 3.3.3 and Limitation of Place Databases

- 3.4. Market Trends

- 3.4.1. Technological Advances in Various Industries Play a Vital Role

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. On-demand

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Remote Monitoring

- 5.3.2. Asset Management

- 5.3.3. Facility Management

- 5.4. Market Analysis, Insights and Forecast - by Component

- 5.4.1. Software

- 5.4.2. Services

- 5.5. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.5.1. Retail

- 5.5.2. Manufacturing

- 5.5.3. Healthcare

- 5.5.4. Government

- 5.5.5. Energy and Power

- 5.5.6. Other Verticals

- 5.6. Market Analysis, Insights and Forecast - by Geography

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Mexico

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Brazil Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Galige

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAS Institute Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Tibco Software Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HERE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Pitney Bowes

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ESRI (Environmental Systems Research Institute)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oracle Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cisco Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Galige

List of Figures

- Figure 1: Latin America Location Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Location Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 7: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Peru Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Latin America Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 18: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 20: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 21: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Location Analytics Industry?

The projected CAGR is approximately 7.99%.

2. Which companies are prominent players in the Latin America Location Analytics Industry?

Key companies in the market include Galige, SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, SAP SE.

3. What are the main segments of the Latin America Location Analytics Industry?

The market segments include Location, Deployment Model, Application, Component, End-user Verticals, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT.

6. What are the notable trends driving market growth?

Technological Advances in Various Industries Play a Vital Role.

7. Are there any restraints impacting market growth?

Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information. Out-of-date Information. and Limitation of Place Databases.

8. Can you provide examples of recent developments in the market?

February 2023: To learn more about its network behavior and improve its business performance, Liberty Latin America collaborated with Ribbon Communications Inc. With automated fraud control and centralized network monitoring, Liberty Latin America's network will perform better in KPIs and keep its customers safer as a result of the addition of Ribbon's expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Location Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Location Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Location Analytics Industry?

To stay informed about further developments, trends, and reports in the Latin America Location Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence