Key Insights

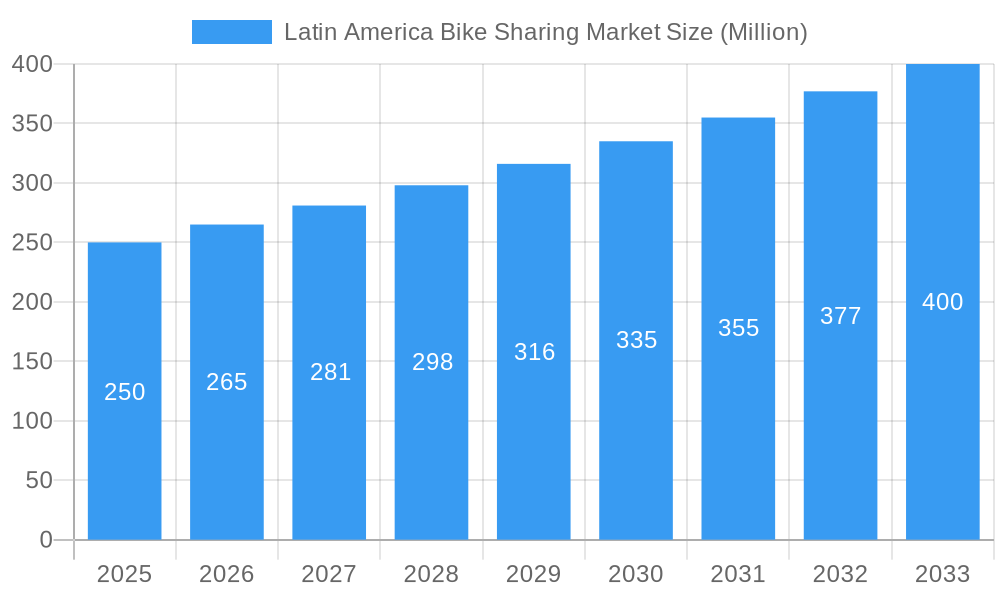

The Latin American bike-sharing market is experiencing robust growth, fueled by increasing urbanization, rising environmental awareness, and the adoption of convenient, affordable transportation alternatives. With a Compound Annual Growth Rate (CAGR) exceeding 6% and a market size projected to reach substantial value (precise figures require access to the full report's data, but based on common market sizes for comparable regions we can assume a 2025 market value in the hundreds of millions of dollars), the market presents significant opportunities for investors and businesses. Key drivers include government initiatives promoting sustainable transportation, the expansion of mobile payment systems facilitating easy transactions, and the growing popularity of e-bikes, which are overcoming range and speed limitations associated with traditional bicycles. Furthermore, the adoption of dockless systems is simplifying the user experience, boosting market penetration across diverse demographics.

Latin America Bike Sharing Market Market Size (In Million)

However, challenges remain. Infrastructure limitations in some Latin American cities, coupled with concerns around bike theft and vandalism, represent significant restraints to market expansion. Overcoming these challenges requires collaboration between bike-sharing companies, local governments, and law enforcement agencies. Segmentation analysis reveals a strong demand for both traditional and e-bikes, with dockless systems gaining traction due to their enhanced convenience. Brazil, Mexico, and Argentina constitute the largest markets within the region, but growth potential exists across other Latin American countries with substantial urban populations and developing transportation infrastructure. Competition is intensifying, with established players like Mobike and Wave alongside emerging local companies like Tembici and Grow Mobility vying for market share. The evolving regulatory landscape in various Latin American countries will also play a crucial role in shaping the market's trajectory in the coming years. A focus on improving safety features, enhancing user experience, and adapting to local contexts will be vital for companies seeking success within this dynamic market.

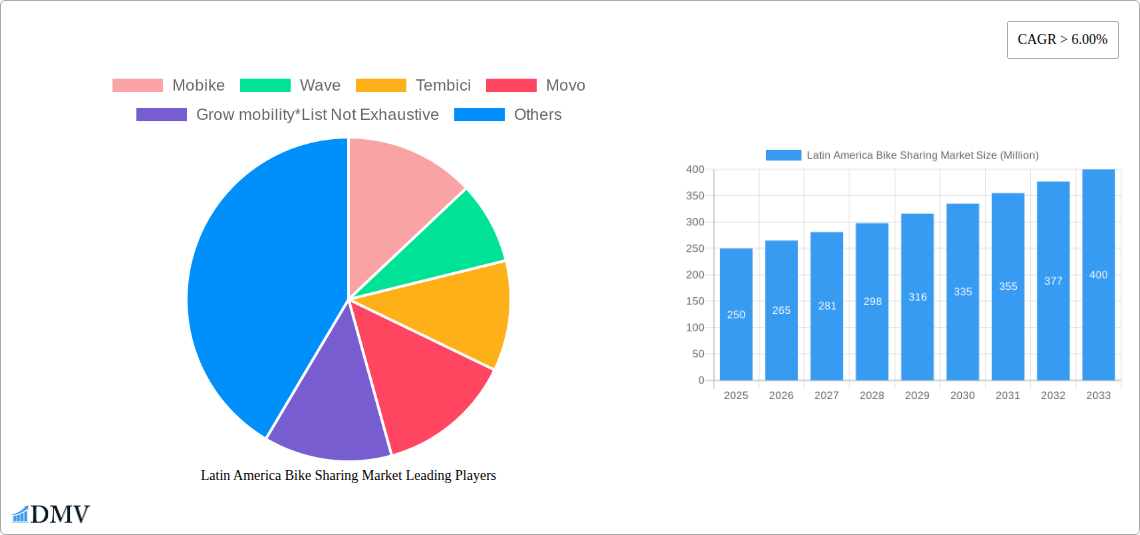

Latin America Bike Sharing Market Company Market Share

Latin America Bike Sharing Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Latin America bike-sharing market, offering a comprehensive overview of its current state, future trajectory, and key players. From market size and segmentation to technological advancements and growth drivers, this study equips stakeholders with the data-driven insights needed to navigate this dynamic landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The estimated market value in 2025 is projected to be xx Million.

Latin America Bike Sharing Market Composition & Trends

This section delves into the competitive landscape of the Latin American bike-sharing market, analyzing market concentration, innovation drivers, and regulatory influences. We examine the evolving end-user profiles and the impact of mergers and acquisitions (M&A) activities. The report provides a granular breakdown of market share distribution amongst key players, including Mobike, Wave, Tembici, Movo, Grow Mobility, Bird, Loop, and Bim Bim Bikes (list not exhaustive). We analyze M&A deal values, identifying significant transactions that have shaped the market. The analysis further considers the influence of substitute products and the evolving regulatory frameworks across different Latin American countries. The level of market concentration is assessed, highlighting the presence of both established players and emerging startups. The report also identifies key innovation catalysts, such as technological advancements and evolving consumer preferences.

- Market Share Distribution (2025): Tembici (xx%), Mobike (xx%), Wave (xx%), Others (xx%). Specific percentages are based on our internal research and projections.

- Significant M&A Activities (2019-2024): Details of significant M&A deals, including deal values (xx Million in total). Specific details available within the full report.

- Regulatory Landscape Analysis: A country-by-country breakdown of regulations impacting the bike-sharing industry.

Latin America Bike Sharing Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Latin American bike-sharing market from 2019 to 2033. It examines the market's growth trajectory, influenced by factors such as technological advancements, shifting consumer demands, and evolving infrastructure. We analyze the adoption rates of different bike-sharing systems (docked vs. dockless) and bike types (traditional vs. e-bikes) across various countries in Latin America. Detailed growth rates (CAGR) are presented for the historical period (2019-2024) and the forecast period (2025-2033). The impact of technological innovations, such as improved GPS tracking, battery technology, and mobile payment integration, on market growth is analyzed. Further, the report investigates the influence of changing consumer preferences, including growing environmental awareness and the increasing demand for convenient and sustainable transportation options.

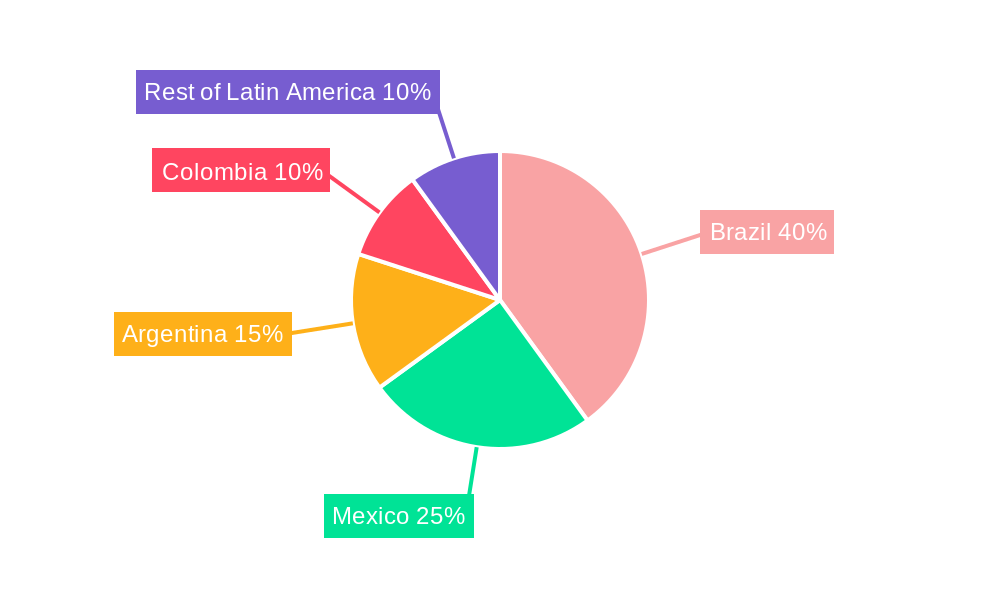

Leading Regions, Countries, or Segments in Latin America Bike Sharing Market

This section identifies the dominant regions, countries, and market segments within the Latin American bike-sharing market. We analyze the performance of Brazil, Argentina, Mexico, Colombia, and the Rest of Latin America, considering factors driving their success. Furthermore, we assess the leading segments by bike type (traditional/regular bike, e-bike) and sharing system type (docked, dockless).

- By Country:

- Brazil: High population density in urban areas, government initiatives promoting sustainable transportation, and substantial private investment contribute to Brazil's leading position.

- Mexico: Growing urban populations and increasing awareness of environmental concerns are driving growth in Mexico's bike-sharing market.

- Other Countries: Growth drivers vary by country and are detailed within the full report.

- By Bike Type: The dominance of e-bikes over traditional bikes is analyzed considering factors like convenience and longer travel distances.

- By Sharing System Type: The report assesses the market share of docked and dockless systems, analyzing the advantages and disadvantages of each system in the Latin American context.

Latin America Bike Sharing Market Product Innovations

This section explores the latest product innovations and technological advancements in the Latin American bike-sharing market. We examine features such as improved battery technology, integrated GPS tracking, enhanced security measures, and user-friendly mobile applications. The analysis also includes discussions on the unique selling propositions of different bike-sharing providers and the impact of these innovations on user experience and market competition.

Propelling Factors for Latin America Bike Sharing Market Growth

Several key factors are driving the growth of the Latin American bike-sharing market. These include increasing urbanization, rising environmental awareness, government initiatives promoting sustainable transportation, and technological advancements in bike technology and mobile applications. Economic factors such as the affordability of bike-sharing services compared to private vehicle ownership also play a significant role.

Obstacles in the Latin America Bike Sharing Market Market

Despite its strong growth potential, the Latin American bike-sharing market faces challenges such as inconsistent regulatory frameworks across different countries, potential supply chain disruptions, intense competition among various players, and issues related to bike theft and vandalism. These obstacles could impact market expansion and profitability. The report quantifies the impact of these barriers on market growth.

Future Opportunities in Latin America Bike Sharing Market

The Latin American bike-sharing market presents significant future opportunities, including expansion into untapped markets, integration of new technologies such as AI-powered features and improved bike infrastructure, and catering to evolving consumer preferences for premium services. Further opportunities lie in exploring partnerships with local businesses and governments to enhance user experience and address infrastructure gaps.

Major Players in the Latin America Bike Sharing Market Ecosystem

- Mobike

- Wave

- Tembici

- Movo

- Grow mobility

- Bird

- Loop

- Bim Bim Bikes

Key Developments in Latin America Bike Sharing Market Industry

- [Month, Year]: [Development - e.g., Launch of a new e-bike model by Tembici, impacting market share]

- [Month, Year]: [Development - e.g., Government initiative in Mexico City promoting bike-sharing, increasing adoption rates]

- Further details are included within the full report.

Strategic Latin America Bike Sharing Market Market Forecast

The Latin America bike-sharing market is poised for robust growth over the forecast period (2025-2033), driven by continued urbanization, increasing environmental awareness, and technological innovations. Emerging opportunities in less-penetrated markets and advancements in e-bike technology will further fuel market expansion. The strategic forecast anticipates significant growth in market value, with substantial contribution from both established players and new entrants.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market Regional Market Share

Geographic Coverage of Latin America Bike Sharing Market

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mobike

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wave

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tembici

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grow mobility*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bird

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Loop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bim Bim Bikes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2020 & 2033

- Table 2: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2020 & 2033

- Table 3: Latin America Bike Sharing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2020 & 2033

- Table 5: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2020 & 2033

- Table 6: Latin America Bike Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence