Key Insights

The Indonesia waterproofing solutions market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant infrastructure development projects across the country, including commercial buildings, industrial facilities, and residential complexes, are creating a substantial demand for effective waterproofing solutions. Secondly, the increasing awareness of the importance of building durability and longevity, coupled with rising disposable incomes, is pushing homeowners and businesses to invest in high-quality waterproofing products. Furthermore, the Indonesian government's initiatives promoting sustainable construction practices and improving building codes contribute positively to market growth. The market is segmented by end-use sector (commercial, industrial & institutional, infrastructure, residential) and sub-product (chemicals, loose laid sheet). The segment with the highest growth potential is likely the infrastructure sector due to ongoing large-scale projects and government spending. While the market faces challenges such as price fluctuations in raw materials and potential labor shortages, the overall outlook remains optimistic. The presence of established international players alongside local manufacturers creates a competitive landscape, driving innovation and product diversification. The market's growth trajectory is expected to continue its upward trend, benefiting from sustained economic growth and a growing need for reliable waterproofing solutions in Indonesia's dynamic construction industry. The competitive environment is characterized by both international and local companies vying for market share, resulting in the offering of a diverse range of solutions to meet varied customer requirements.

The forecast for the Indonesian waterproofing solutions market is influenced by macroeconomic factors and specific trends within the construction sector. Government initiatives aimed at improving urban infrastructure, coupled with ongoing investments in residential construction, will continue to spur demand. Furthermore, technological advancements in waterproofing materials and techniques, such as the development of environmentally friendly and high-performance products, are expected to further propel market growth. However, potential challenges include economic downturns that might impact construction activity and the need for consistent regulation and enforcement of building standards to ensure the widespread adoption of effective waterproofing solutions. The market is expected to witness increased penetration of advanced waterproofing technologies, driven by both consumer preference for superior performance and the push from manufacturers to introduce innovative, efficient products. The future market share distribution will likely be shaped by companies’ ability to adapt to evolving consumer needs, comply with increasingly stringent regulations, and offer competitive pricing and after-sales service.

Indonesia Waterproofing Solutions Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesia waterproofing solutions market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic market. The historical period covered is 2019-2024. The market size in 2025 is estimated at xx Million USD.

Indonesia Waterproofing Solutions Market Composition & Trends

The Indonesian waterproofing solutions market exhibits a moderately concentrated landscape, with key players such as Soprem, Saint-Gobain, PT Selaras Cipta Global, PT ASPAL POLIMER EMULSINDO, Fosroc Inc, Ardex Group, MAPEI S p A, Sika AG, Avian Brands, and Normet vying for market share. Innovation is driven by the increasing demand for sustainable and high-performance waterproofing materials, prompting companies to develop advanced chemical formulations and novel application techniques. The regulatory landscape, while evolving, generally supports the adoption of eco-friendly solutions. Substitute products, such as traditional methods like tar and asphalt, are gradually losing ground due to their inferior performance and environmental impact. End-users comprise a diverse mix of commercial, industrial, residential, and infrastructure projects. Significant M&A activity, as exemplified by recent transactions, further shapes the market dynamics.

- Market Share Distribution (2025): Sika AG (xx%), Saint-Gobain (xx%), Soprem (xx%), Others (xx%)

- Recent M&A Activity:

- May 2023: Sika's acquisition of MBCC Group for xx Million USD significantly bolstered its waterproofing solutions portfolio.

- September 2022: Saint-Gobain's acquisition of GCP Applied Technologies Inc. for xx Million USD expanded its reach in the Indonesian market.

- Total M&A deal value (2019-2024): xx Million USD

Indonesia Waterproofing Solutions Market Industry Evolution

The Indonesian waterproofing solutions market has witnessed robust growth throughout the historical period (2019-2024), driven by rapid urbanization, infrastructure development, and rising disposable incomes. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million USD by 2033. Technological advancements, such as the introduction of self-healing membranes and spray-applied coatings, are enhancing product performance and efficiency. Consumer demand is shifting towards environmentally friendly, sustainable solutions, pushing manufacturers to innovate and adopt greener manufacturing practices. The increased adoption of advanced waterproofing techniques, coupled with growing awareness of the long-term benefits of effective waterproofing, is fueling market growth. Specific data points on growth rates and adoption metrics will be provided within the full report.

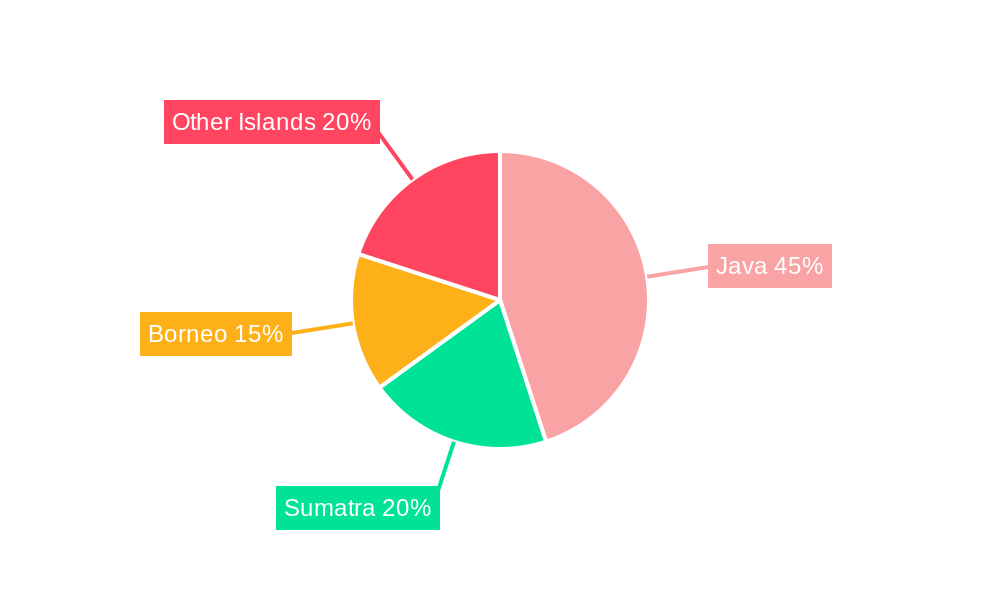

Leading Regions, Countries, or Segments in Indonesia Waterproofing Solutions Market

The Indonesian waterproofing solutions market demonstrates strong growth across all segments, but the Infrastructure sector shows the most significant expansion. This is primarily due to the Indonesian government's extensive infrastructure development plans, including constructing new roads, bridges, and buildings. The Residential segment also contributes considerably due to increasing construction activity across the country.

Key Drivers for Infrastructure Segment Dominance:

- Massive government investments in infrastructure projects under the National Strategic Program.

- Growing demand for robust and durable waterproofing solutions in high-traffic areas.

- Stringent building codes and regulations favoring high-quality waterproofing.

Key Drivers for Residential Segment Growth:

- Rapid urbanization and increasing housing demand.

- Growing disposable incomes driving higher-quality construction standards.

- Rising awareness of the importance of waterproofing in protecting residential properties.

The Chemicals sub-product segment holds the largest market share due to the versatility and effectiveness of chemical-based waterproofing solutions.

Indonesia Waterproofing Solutions Market Product Innovations

Recent product innovations have focused on enhancing waterproofing performance, durability, and sustainability. For example, SOPREMA's Alsan Flashing Neo eliminates the need for a primer, significantly reducing application time and costs. Other advancements include self-healing membranes that automatically repair minor punctures, spray-applied coatings providing seamless waterproofing for complex geometries, and bio-based waterproofing materials that minimize environmental impact. These innovations target specific application challenges, resulting in enhanced product performance and faster project completion times.

Propelling Factors for Indonesia Waterproofing Solutions Market Growth

Several factors drive the growth of the Indonesian waterproofing solutions market. Firstly, the government's emphasis on infrastructure development fuels demand for high-quality waterproofing materials. Secondly, rapid urbanization and rising disposable incomes lead to increased construction activity, driving market expansion. Thirdly, technological advancements in waterproofing materials and application techniques offer improved performance, durability, and sustainability, stimulating market uptake. Finally, stringent building codes and regulations focused on preventing water damage also contribute to market growth.

Obstacles in the Indonesia Waterproofing Solutions Market

The Indonesian waterproofing solutions market faces several challenges. Supply chain disruptions due to global events can lead to material shortages and price fluctuations. Competitive pressures from both domestic and international players put pressure on profit margins. While not overly stringent, regulatory complexities can increase compliance costs for manufacturers.

Future Opportunities in Indonesia Waterproofing Solutions Market

Emerging opportunities lie in the growing demand for sustainable waterproofing solutions and the expansion of infrastructure projects. The development of innovative, eco-friendly materials and technologies will create new market segments. Focusing on niche applications, such as waterproofing in extreme climates or specialized infrastructure projects, offers high-growth potential. Government initiatives promoting green building practices will further drive the adoption of sustainable solutions.

Major Players in the Indonesia Waterproofing Solutions Market Ecosystem

- Soprem

- Saint-Gobain

- PT Selaras Cipta Global

- PT ASPAL POLIMER EMULSINDO

- Fosroc Inc

- Ardex Group

- MAPEI S p A

- Sika AG

- Avian Brands

- Normet

Key Developments in Indonesia Waterproofing Solutions Market Industry

- May 2023: Sika's acquisition of MBCC Group significantly expands its market share and product portfolio in waterproofing solutions.

- September 2022: Saint-Gobain's acquisition of GCP Applied Technologies Inc. strengthens its position in the Indonesian building materials market, including waterproofing solutions.

- January 2022: SOPREMA's launch of Alsan Flashing Neo introduces a significant technological advancement in waterproofing chemicals.

Strategic Indonesia Waterproofing Solutions Market Forecast

The Indonesian waterproofing solutions market is poised for continued growth, fueled by robust infrastructure development, rising urbanization, and the increasing adoption of advanced waterproofing technologies. The focus on sustainable solutions and government support for green building initiatives will further drive market expansion. The market's potential is substantial, offering significant opportunities for both established and emerging players.

Indonesia Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Indonesia Waterproofing Solutions Market Segmentation By Geography

- 1. Indonesia

Indonesia Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Soprem

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Selaras Cipta Global

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT ASPAL POLIMER EMULSINDO

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardex Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAPEI S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sika AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avian Brands

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Normet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Soprem

List of Figures

- Figure 1: Indonesia Waterproofing Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Waterproofing Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 6: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 7: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 12: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 13: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 14: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 15: Indonesia Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Indonesia Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Waterproofing Solutions Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the Indonesia Waterproofing Solutions Market?

Key companies in the market include Soprem, Saint-Gobain, PT Selaras Cipta Global, PT ASPAL POLIMER EMULSINDO, Fosroc Inc, Ardex Group, MAPEI S p A, Sika AG, Avian Brands, Normet.

3. What are the main segments of the Indonesia Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.January 2022: SOPREMA has developed a next-generation waterproofing chemical called Alsan Flashing Neo, which can waterproof any substrate without a primer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Indonesia Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence