Key Insights

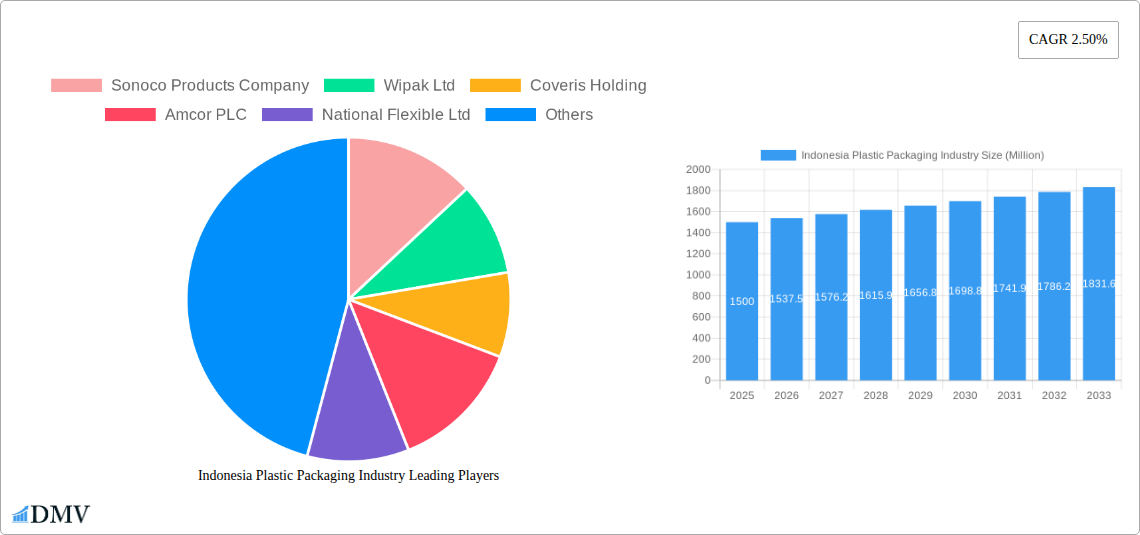

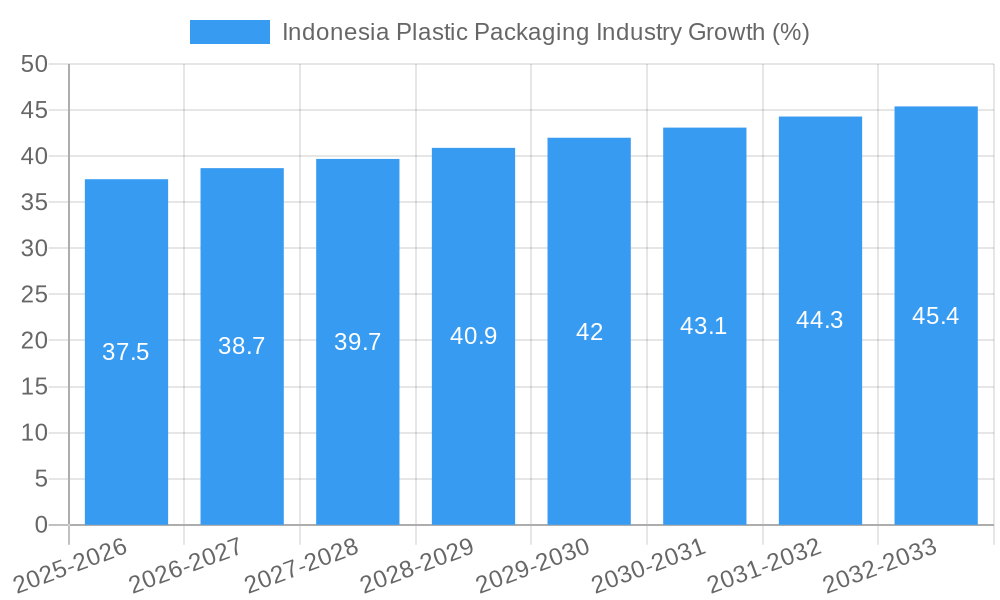

The Indonesian plastic packaging market, valued at approximately $X million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 2.50% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning consumer goods sector, particularly food and beverage, personal care, and pharmaceuticals, significantly contributes to the demand for plastic packaging. Rising disposable incomes and a growing population are further boosting consumption. The increasing adoption of e-commerce also fuels demand for efficient and protective packaging solutions. However, environmental concerns surrounding plastic waste and increasing government regulations aimed at promoting sustainable packaging alternatives pose significant restraints. The market is segmented by type (compartment blister packs, slide blister packs, and others) and component (films, lidding materials, secondary containers, and packaging accessories). Major players like Sonoco Products Company, Wipak Ltd, Coveris Holding, Amcor PLC, and others compete in this dynamic market, focusing on innovation to meet evolving consumer and regulatory demands. The dominance of certain packaging types will likely shift over the forecast period, reflecting trends towards more sustainable and functional designs.

The Indonesian plastic packaging industry shows potential for further specialization within its segments. Companies are likely to focus on developing more eco-friendly options, such as biodegradable or recyclable plastics, to mitigate environmental concerns. The adoption of advanced packaging technologies offering improved barrier properties, extended shelf life, and enhanced product protection is anticipated. Strategic partnerships and mergers and acquisitions are likely strategies employed by major players to expand their market share and product portfolio. Regional variations within Indonesia may also present opportunities for tailored packaging solutions that cater to specific consumer preferences and logistical challenges. Continued growth hinges on effectively balancing the demand for affordable, functional packaging with the increasing push towards sustainability. The successful players will be those that innovate and adapt to these changing market dynamics.

Indonesia Plastic Packaging Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesia plastic packaging industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers crucial data and projections to inform strategic decision-making. The Indonesian plastic packaging market is poised for significant growth, driven by factors such as rising consumer spending, expanding e-commerce, and increasing demand for convenient food and beverage packaging. This report provides a detailed evaluation of market size, segmentation, key players, and future trends, presenting an essential resource for investors, manufacturers, and industry professionals. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Indonesia Plastic Packaging Industry Market Composition & Trends

This section delves into the competitive landscape of the Indonesian plastic packaging industry, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller domestic players. Market share distribution varies significantly across segments, with key players like Amcor PLC and Berry Global Inc holding substantial portions. Innovation is driven by the need for sustainable and recyclable packaging solutions, while regulatory pressures are pushing towards stricter environmental standards. Substitute products, such as biodegradable and compostable packaging, are gaining traction, although they currently hold a relatively small market share. Significant M&A activities have been observed in recent years, with deal values ranging from xx Million to xx Million, reflecting industry consolidation and the quest for market leadership.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share.

- Innovation Catalysts: Growing demand for sustainable packaging, technological advancements in material science.

- Regulatory Landscape: Increasingly stringent environmental regulations impacting material choices and recycling initiatives.

- Substitute Products: Biodegradable and compostable packaging gaining market share, but still a niche sector.

- End-User Profiles: Food & beverage, consumer goods, pharmaceuticals, and industrial goods are major end-users.

- M&A Activities: Significant consolidation observed, with deal values reaching xx Million in recent years.

Indonesia Plastic Packaging Industry Industry Evolution

The Indonesian plastic packaging industry has witnessed significant growth over the past five years, fueled by robust economic expansion and changing consumer preferences. Technological advancements, such as improved barrier films and lightweight packaging designs, are enhancing product efficiency and shelf life. The industry is witnessing a shift towards sustainable and eco-friendly packaging options in response to growing environmental concerns and stricter government regulations. The market’s compound annual growth rate (CAGR) during the historical period (2019-2024) was approximately xx%, and the forecast period (2025-2033) projects a CAGR of xx%, indicating substantial future growth. This growth is further driven by increasing demand from the food and beverage sector, particularly in ready-to-eat meals and convenience foods. E-commerce expansion is another key factor, requiring greater volumes of packaging for online deliveries. Furthermore, consumer preferences are increasingly shifting towards convenient, easy-to-use, and attractive packaging designs.

Leading Regions, Countries, or Segments in Indonesia Plastic Packaging Industry

The Indonesian plastic packaging market exhibits diverse regional and segmental dynamics. While detailed data on regional dominance is unavailable for precise ranking, the most populous and economically active regions likely dominate market share. The segments showing strongest growth are films (driven by flexible packaging demand) and compartment blister packs (driven by the pharmaceutical and consumer goods sectors).

- Key Drivers for Dominant Segments:

- Films: Strong demand from flexible packaging applications (e.g., food and beverage, consumer goods) for their versatility and cost-effectiveness.

- Compartment Blister Packs: Growth spurred by pharmaceutical packaging requirements for organized product presentation and tamper-evidence.

- Lidding Materials: Essential component for various containers, aligned with the demand for sealed and preserved products across diverse segments.

- Secondary Containers: Demand rises with bulk packaging and distribution needs, crucial for supply chain efficiency.

- Packaging Accessories: The growing demand for customized and functional packaging boosts this segment.

Indonesia Plastic Packaging Industry Product Innovations

Recent innovations focus on sustainable materials, improved barrier properties, and enhanced convenience features. The integration of recycled content and the development of biodegradable alternatives are significant trends. Active and intelligent packaging technologies, which enhance product shelf life and freshness, are gaining adoption. Advances in printing and labeling technologies are also contributing to more attractive and informative packaging designs. These innovations are aimed at enhancing product appeal, extending shelf life, and addressing environmental concerns.

Propelling Factors for Indonesia Plastic Packaging Industry Growth

The Indonesian plastic packaging market is fueled by several key factors:

- Rapid Economic Growth: Rising disposable incomes lead to increased consumer spending and demand for packaged goods.

- E-commerce Boom: The surge in online shopping necessitates increased packaging for deliveries.

- Growing Food & Beverage Sector: The expanding food and beverage industry demands significant packaging for various products.

- Favorable Demographics: A large and young population fuels demand for packaged consumer goods.

- Government Initiatives: Policies supporting infrastructure development and manufacturing further boost the sector.

Obstacles in the Indonesia Plastic Packaging Industry Market

Challenges facing the industry include:

- Environmental Concerns: Growing pressure to reduce plastic waste and adopt sustainable packaging solutions.

- Fluctuating Raw Material Prices: Dependence on imported raw materials exposes the industry to price volatility.

- Infrastructure Limitations: Inadequate waste management infrastructure hinders recycling initiatives.

- Competition: The market is becoming increasingly competitive, both from domestic and international players.

- Regulatory Uncertainty: Changes in environmental regulations can affect product development and manufacturing.

Future Opportunities in Indonesia Plastic Packaging Industry

Future opportunities include:

- Sustainable Packaging: Growing demand for eco-friendly alternatives offers significant growth potential.

- E-commerce Packaging Solutions: Innovations in packaging design optimized for e-commerce logistics.

- Specialized Packaging: Meeting niche market demands for tailored packaging solutions in diverse sectors.

- Technological Advancements: Adoption of automation and advanced packaging technologies for efficiency gains.

- Regional Expansion: Reaching underserved regions and expanding market reach.

Major Players in the Indonesia Plastic Packaging Industry Ecosystem

- Sonoco Products Company

- Wipak Ltd

- Coveris Holding

- Amcor PLC

- National Flexible Ltd

- Constantia Flexibles Group

- Silgan Holdings

- Berry Global Inc

- Sealed Air Corporation

- Tetra Laval Group

Key Developments in Indonesia Plastic Packaging Industry Industry

- July 2022: Coca-Cola Euro-Pacific Partners (CCEP) launched the first recycling facility in Indonesia for food-grade PET plastic, fostering a circular economy and supporting local micro-businesses.

- November 2022: CMA CGM Group introduced EASY RECYCLING, a pilot program in Jakarta offering a convenient solution for recycling paper and plastic packaging, aiming to expand to other Asian countries.

Strategic Indonesia Plastic Packaging Industry Market Forecast

The Indonesian plastic packaging industry is projected to experience robust growth over the forecast period, driven by increasing consumer demand, e-commerce expansion, and government support. The shift towards sustainable packaging solutions will present significant opportunities for innovation and investment. However, challenges related to environmental concerns and raw material price volatility will need to be addressed. The market’s growth trajectory will be influenced by the success of sustainability initiatives and the implementation of efficient recycling infrastructure. The long-term outlook remains positive, driven by the country’s economic growth and expanding consumer base.

Indonesia Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Plastic Packaging Industry Segmentation By Geography

- 1. Indonesia

Indonesia Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic

- 3.3. Market Restrains

- 3.3.1. Shift from Conventional Materials to New Recyclable Materials

- 3.4. Market Trends

- 3.4.1. Skincare Segment is Observing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plastic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Holding

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Flexible Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constantia Flexibles Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tetra Laval Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Indonesia Plastic Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Plastic Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plastic Packaging Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Indonesia Plastic Packaging Industry?

Key companies in the market include Sonoco Products Company, Wipak Ltd, Coveris Holding, Amcor PLC, National Flexible Ltd, Constantia Flexibles Group, Silgan Holdings*List Not Exhaustive, Berry Global Inc, Sealed Air Corporation, Tetra Laval Group.

3. What are the main segments of the Indonesia Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic.

6. What are the notable trends driving market growth?

Skincare Segment is Observing Significant Growth.

7. Are there any restraints impacting market growth?

Shift from Conventional Materials to New Recyclable Materials.

8. Can you provide examples of recent developments in the market?

November 2022: The CMA CGM Group, a global player in sea, land, and air logistics, introduced EASY RECYCLING, an innovative recycling solution, to enable its customers with shipments to Jakarta, Indonesia, to dispose of used paper and plastic packaging. In Jakarta, only CMA CGM customers will have access to EASY RECYCLING as part of a pilot that aims to eventually bring the service to other Asian nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Indonesia Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence