Key Insights

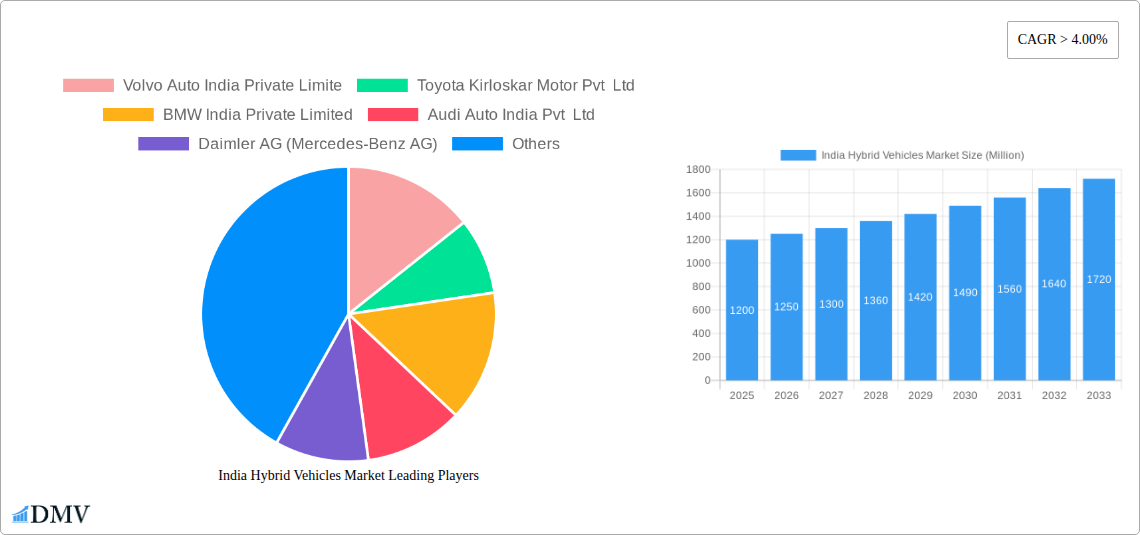

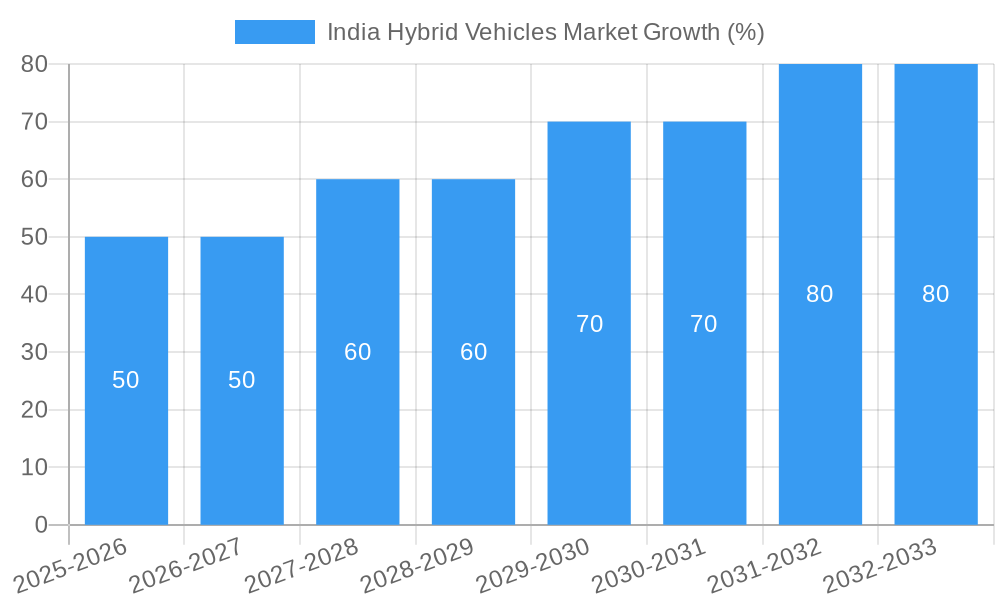

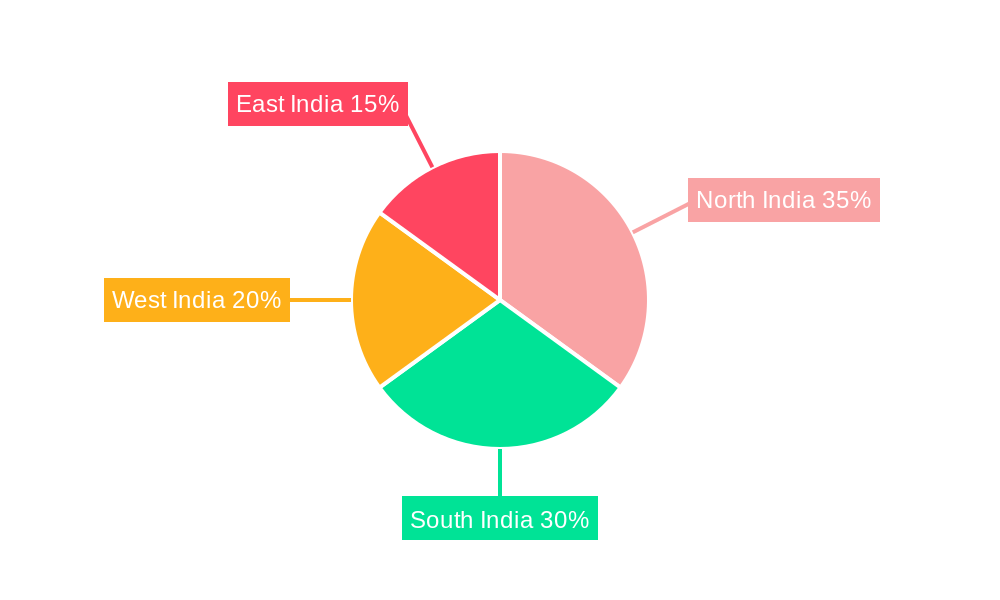

The India hybrid vehicle market is experiencing robust growth, fueled by increasing environmental concerns, stringent emission norms, and government incentives promoting eco-friendly transportation. With a current market size exceeding ₹1000 million (estimated based on a CAGR of >4% and considering the base year of 2025 and the overall market size being in the millions), the market is projected to reach ₹2000 million by 2033. This significant expansion is driven by rising fuel prices, a growing middle class with increased purchasing power, and a shift towards sustainable mobility solutions. The commercial vehicle segment is a key driver, contributing significantly to the overall market value, as businesses seek fuel-efficient and environmentally responsible options for their fleets. Major players like Maruti Suzuki, Hyundai, Toyota, and Volvo are strategically investing in hybrid technology and expanding their product portfolios to capture market share. The government's push for electric and hybrid vehicles further enhances market prospects. Regional variations exist, with North and South India potentially leading the market due to higher adoption rates in urban areas and greater awareness of environmental issues.

However, challenges remain. High initial purchase costs compared to conventional vehicles, limited charging infrastructure in certain regions, and consumer apprehension regarding hybrid technology adoption continue to act as restraints. Overcoming these obstacles requires continued government support through subsidies and infrastructural development, coupled with aggressive marketing campaigns by manufacturers to educate consumers about the long-term benefits of hybrid vehicles. The market is also likely to witness increased competition, with both domestic and international players vying for a larger share of this burgeoning sector. Further growth will depend on technological advancements, price reductions, and a concerted effort to address range anxiety and charging infrastructure concerns. The forecast period of 2025-2033 presents substantial opportunities for market players to capitalize on this dynamic and expanding segment of the Indian automotive industry.

India Hybrid Vehicles Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Hybrid Vehicles Market, offering a comprehensive overview of market trends, growth drivers, challenges, and future prospects. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this dynamic sector. The study covers key segments including Commercial Vehicles and profiles major players such as Volvo Auto India Private Limited, Toyota Kirloskar Motor Pvt Ltd, BMW India Private Limited, Audi Auto India Pvt Ltd, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited, and Hyundai Motor India Limited.

India Hybrid Vehicles Market Composition & Trends

This section meticulously evaluates the competitive landscape of the Indian hybrid vehicle market, encompassing market concentration, innovative advancements, regulatory frameworks, substitute products, end-user demographics, and mergers & acquisitions (M&A) activities. The report delves into the market share distribution among key players, revealing the competitive intensity and market dominance. Further, it examines the total value of M&A deals impacting the market, offering insights into strategic partnerships and industry consolidation. The analysis also highlights the role of government regulations in shaping market growth, the impact of substitute products, and the evolving needs of end-users. Innovation catalysts, including technological advancements and consumer preferences, are analyzed, providing a comprehensive understanding of market dynamics. The report also offers a detailed evaluation of market concentration, suggesting a market share distribution of approximately xx% for the top three players in 2024, and predicting a xx% change by 2033. M&A activities show a total deal value of approximately INR xx Million in the historical period, with an expected increase to INR xx Million during the forecast period.

- Market Concentration: Analysis of market share distribution among major players.

- Innovation Catalysts: Examination of technological advancements and consumer preferences.

- Regulatory Landscape: Assessment of government policies and their impact on market growth.

- Substitute Products: Evaluation of alternative transportation options and their competitiveness.

- End-User Profiles: Characterization of different user segments and their purchasing behavior.

- M&A Activities: Analysis of mergers, acquisitions, and strategic partnerships, including deal values.

India Hybrid Vehicles Market Industry Evolution

This in-depth analysis traces the evolution of the Indian hybrid vehicle market, examining market growth trajectories, technological innovations, and shifting consumer demands. The report presents detailed data points, including growth rates and adoption metrics for hybrid vehicles across various segments. The analysis specifically highlights the impact of technological advancements such as improved battery technology, enhanced engine efficiency, and the introduction of plug-in hybrid electric vehicles (PHEVs). The influence of evolving consumer preferences, including a growing preference for environmentally friendly vehicles and government incentives promoting hybrid adoption, is also meticulously examined. The historical period (2019-2024) showed an average annual growth rate (AAGR) of xx%, while the forecast period (2025-2033) is projected to witness an AAGR of xx%. Adoption metrics indicate a xx% penetration rate in 2024, with a projected increase to xx% by 2033.

Leading Regions, Countries, or Segments in India Hybrid Vehicles Market

This section focuses on the dominant region, country, or segment within the Commercial Vehicles category of the Indian Hybrid Vehicles Market. The analysis identifies key drivers for this dominance, such as investment trends, regulatory support, and infrastructure development. A thorough examination of factors contributing to the leading segment's superior performance is provided. The report utilizes bullet points to highlight these key drivers and uses paragraphs for detailed analysis.

- Key Drivers:

- Robust government incentives and policies supporting commercial hybrid vehicle adoption.

- Significant investments in infrastructure development, supporting the widespread use of commercial hybrids.

- Growing demand for fuel-efficient and environmentally friendly transportation solutions in the commercial sector.

- Increasing awareness of environmental concerns and corporate social responsibility among businesses.

The dominance of this segment is largely attributed to the increasing focus on reducing carbon emissions in the commercial sector, coupled with government initiatives to promote cleaner transportation options. The economic benefits of reduced fuel costs are also compelling businesses to adopt hybrid commercial vehicles. This segment's growth trajectory is projected to remain strong throughout the forecast period.

India Hybrid Vehicles Market Product Innovations

This section details the latest product innovations, applications, and performance metrics of hybrid vehicles in the Indian market. It highlights unique selling propositions (USPs) and technological advancements that are shaping the competitive landscape. Innovations include improved battery technology leading to extended driving ranges on electric power, advancements in engine efficiency resulting in reduced fuel consumption, and the integration of advanced driver-assistance systems (ADAS) for enhanced safety and convenience. These innovations are driving increased consumer adoption and contributing to the overall growth of the market.

Propelling Factors for India Hybrid Vehicles Market Growth

Several factors are driving the growth of the India Hybrid Vehicles Market. Government regulations promoting cleaner transportation, including stricter emission norms and incentives for hybrid vehicle purchases, are significantly impacting market expansion. Economic factors, such as rising fuel prices and the increasing cost of ownership for traditional vehicles, are further encouraging consumer adoption of hybrid options. Technological advancements, such as improved battery technology and enhanced engine efficiency, are also contributing to the market's growth. The rising awareness of environmental issues and a growing preference for environmentally friendly vehicles among consumers are further propelling market growth.

Obstacles in the India Hybrid Vehicles Market

The India Hybrid Vehicles Market faces several obstacles hindering its rapid growth. Regulatory challenges, including the complexities of implementing and enforcing emission standards, create uncertainties. Supply chain disruptions, particularly related to the availability of crucial components like batteries, pose another significant challenge. Furthermore, intense competitive pressures from established automobile manufacturers and the entry of new players create a dynamic and challenging landscape. These combined factors contribute to the overall complexity of market development.

Future Opportunities in India Hybrid Vehicles Market

The future of the India Hybrid Vehicles Market holds promising opportunities. The expansion into untapped rural markets with growing demand for affordable transportation presents significant potential. The development of advanced hybrid technologies, such as plug-in hybrid electric vehicles (PHEVs) and fuel-cell hybrid vehicles, promises to unlock new market segments. Furthermore, evolving consumer preferences towards eco-friendly transportation will continue to drive market demand in the coming years. These factors combine to create a favorable outlook for future market growth.

Major Players in the India Hybrid Vehicles Market Ecosystem

- Volvo Auto India Private Limited

- Toyota Kirloskar Motor Pvt Ltd

- BMW India Private Limited

- Audi Auto India Pvt Ltd

- Daimler AG (Mercedes-Benz AG)

- Honda Cars India Limited

- Maruti Suzuki India Limited

- Hyundai Motor India Limited

Key Developments in India Hybrid Vehicles Market Industry

- August 2023: TVS Motor and BMW Motorrad announced discussions to expand their partnership beyond India. This collaboration could lead to the development and introduction of new hybrid vehicles in the Indian market.

- August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) at a starting price of INR 11.99 Million, going up to INR 12.99 Million. This launch signifies the increasing availability of premium hybrid vehicles in the Indian market.

- July 2023: BMW India launched the 2023 X5 SUV in India, priced between INR 9.39 Million (Drive40i xLine variant) and INR 10.7 Million (xDrive30d M sport variant). This launch demonstrates the ongoing efforts of luxury car manufacturers to introduce hybrid vehicles in the Indian market.

Strategic India Hybrid Vehicles Market Forecast

The India Hybrid Vehicles Market is poised for significant growth in the coming years, driven by a confluence of factors. Government support for green initiatives, increasing consumer awareness of environmental concerns, and technological advancements in hybrid technology all contribute to a positive outlook. The market's potential is substantial, with opportunities for both established players and new entrants to capture market share and benefit from the growth trajectory of the sector. The continued development of advanced hybrid technologies, such as plug-in hybrids and fuel-cell hybrids, will further fuel market expansion.

India Hybrid Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

India Hybrid Vehicles Market Segmentation By Geography

- 1. India

India Hybrid Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Hybrid Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volvo Auto India Private Limite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Kirloskar Motor Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 BMW India Private Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Audi Auto India Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daimler AG (Mercedes-Benz AG)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honda Cars India Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Maruti Suzuki India Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hyundai Motor India Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volvo Auto India Private Limite

List of Figures

- Figure 1: India Hybrid Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Hybrid Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Hybrid Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Hybrid Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Hybrid Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 10: India Hybrid Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hybrid Vehicles Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Hybrid Vehicles Market?

Key companies in the market include Volvo Auto India Private Limite, Toyota Kirloskar Motor Pvt Ltd, BMW India Private Limited, Audi Auto India Pvt Ltd, Daimler AG (Mercedes-Benz AG), Honda Cars India Limited, Maruti Suzuki India Limited, Hyundai Motor India Limited.

3. What are the main segments of the India Hybrid Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: TVS Motor and BMW Motorrad discussing expansion of partnership beyond India.August 2023: Toyota Kirloskar Motor launched the all-new MPV Vellfire strong hybrid electric vehicle (SHEV) for a starting price of INR 11.99 million and going to INR 12.99 million.July 2023: BMW India launches the 2023 X5 SUV in India for a starting price of INR 9.39 million (Drive40i xLine variant) and going to INR 10.7 million (xDrive30d M sport variant).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hybrid Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hybrid Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hybrid Vehicles Market?

To stay informed about further developments, trends, and reports in the India Hybrid Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence