Key Insights

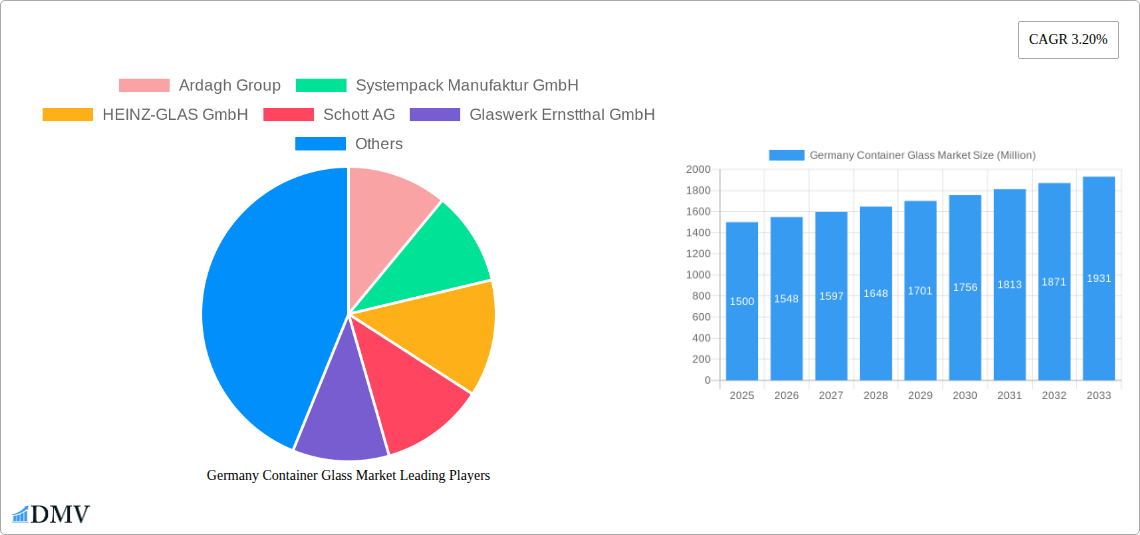

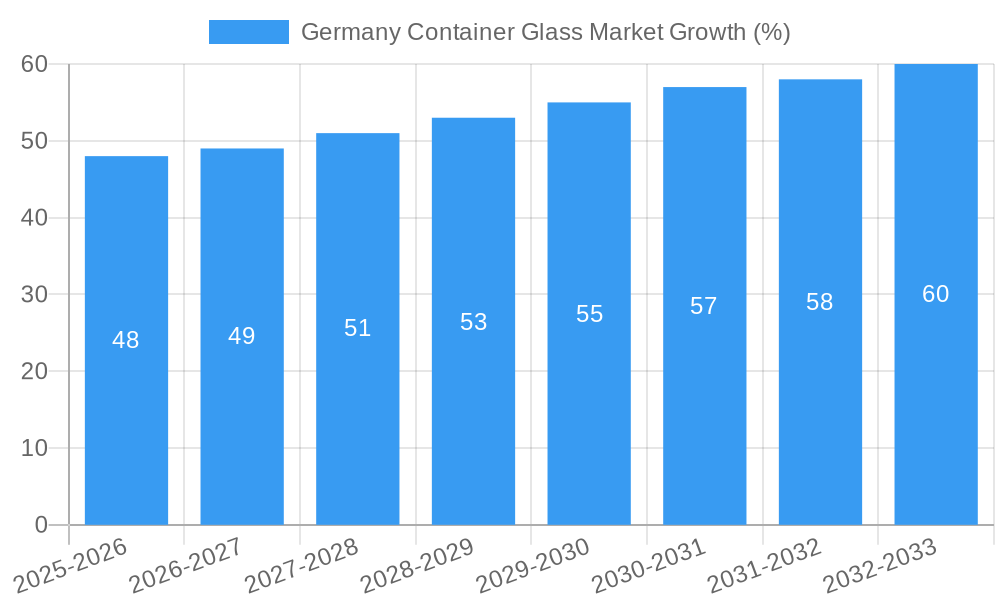

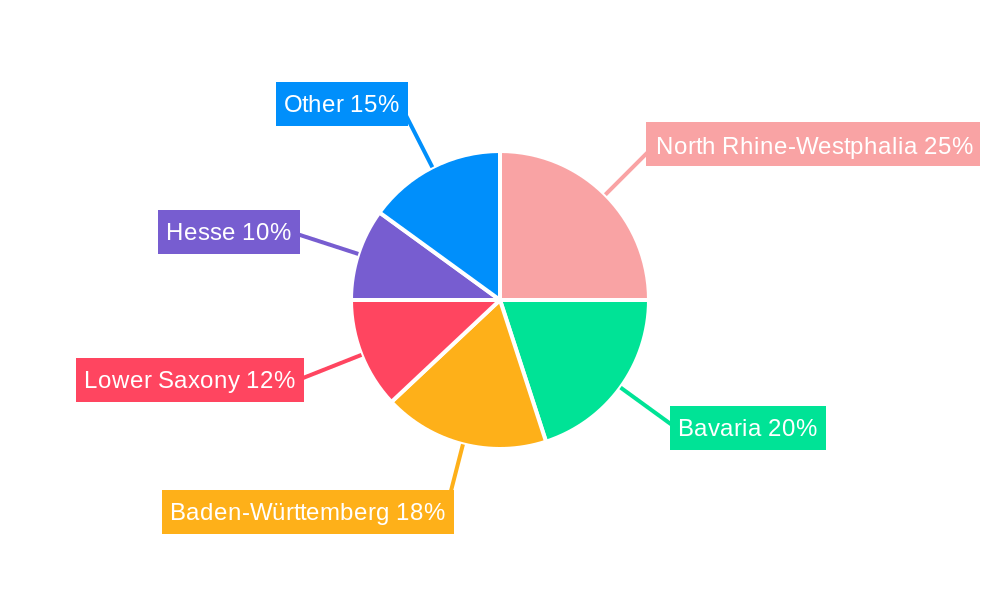

The German container glass market, valued at approximately €X million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning food and beverage industry in Germany, particularly the increasing demand for premium packaged products, is a significant contributor. Furthermore, the growing popularity of sustainable packaging solutions is boosting demand for glass containers, which are widely perceived as recyclable and environmentally friendly. The cosmetics and pharmaceuticals sectors also represent substantial end-user industries contributing to market expansion. However, the market faces challenges such as fluctuating raw material prices (primarily silica sand and soda ash), and increasing energy costs associated with glass manufacturing, potentially impacting production costs and profitability. Competition among established players like Ardagh Group, Heinz-Glas, and Schott AG, alongside smaller regional manufacturers, remains intense, requiring continuous innovation and efficient production processes to maintain market share. Regional variations in growth are expected, with populous and economically strong states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg likely to dominate the market. The forecast period suggests a continued upward trend, driven by consumer preferences and regulatory support for sustainable packaging. However, manufacturers will need to strategically address the challenges related to cost management and resource efficiency to fully capitalize on the market's potential.

The forecast period, 2025-2033, promises further expansion of the German container glass market. Industry players are actively investing in advanced technologies and sustainable manufacturing practices to meet growing demand and reduce environmental impact. This includes exploring lighter-weight glass designs and enhancing recycling infrastructure. The trend toward e-commerce and online grocery shopping is also anticipated to positively influence demand, albeit indirectly, as consumers increasingly receive goods packaged in glass containers. Maintaining a robust supply chain and adapting to evolving consumer preferences will be crucial for success in this market. The strong focus on sustainability in Germany presents a significant opportunity for companies committed to eco-friendly solutions. However, regulatory changes related to packaging waste management and potential carbon taxes could significantly influence market dynamics in the coming years. Precise estimations of market size beyond 2025 require a more detailed analysis of these evolving factors.

Germany Container Glass Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany container glass market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Germany Container Glass Market Composition & Trends

The German container glass market exhibits a moderately concentrated landscape, with key players vying for market share. Innovation is driven by sustainability concerns and evolving consumer preferences, leading to the development of lightweight, reusable, and recycled glass containers. Stringent environmental regulations and increasing focus on circular economy principles shape the industry's trajectory. Substitute packaging materials like plastics pose a significant competitive challenge, necessitating continuous innovation and value proposition enhancement. The market is segmented by end-user industry: Beverages, Food, Cosmetics, Pharmaceuticals, and Other. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Catalysts: Sustainability, lightweighting, recyclability, and consumer demand for premium packaging.

- Regulatory Landscape: Stringent environmental regulations promoting sustainable packaging solutions.

- Substitute Products: Plastics and other alternative packaging materials present a competitive threat.

- End-User Profiles: Diverse, spanning the food & beverage, pharmaceutical, cosmetic, and other sectors.

- M&A Activity: Moderate activity, with recent deals valued between xx Million and xx Million.

Germany Container Glass Market Industry Evolution

The German container glass market has witnessed steady growth over the past few years, driven by factors such as population growth, rising disposable incomes, and increasing demand for packaged goods. Technological advancements in glass manufacturing, including the adoption of energy-efficient furnaces and automation, have contributed to improved productivity and reduced production costs. However, fluctuating raw material prices and economic downturns can impact market growth. Consumer demand is shifting towards sustainable and eco-friendly packaging options, influencing the industry’s focus on recyclability and reduced environmental impact. The market experienced a growth rate of xx% during the historical period (2019-2024) and is expected to grow at xx% during the forecast period (2025-2033). The adoption rate of sustainable glass container technologies is projected to increase by xx% annually.

Leading Regions, Countries, or Segments in Germany Container Glass Market

The beverage sector (including alcoholic and non-alcoholic drinks) currently dominates the German container glass market. This dominance is attributable to several key factors:

- High Per Capita Consumption: Germany boasts a high per capita consumption of beverages packaged in glass containers.

- Consumer Preference: Consumers often associate glass with premium quality and safety, especially for beverages.

- Strong Brand Loyalty: Many established beverage brands rely heavily on glass packaging to maintain brand identity.

- Investment in Modernization: Significant investment in advanced glass manufacturing facilities.

- Regulatory Support: Government initiatives promoting sustainable packaging solutions benefit the glass industry.

The Food segment holds a considerable share, boosted by increasing demand for premium food products and consumer preference for glass packaging. The Cosmetics and Pharmaceuticals sectors display strong growth potential driven by an increasing focus on premium product presentation and enhanced shelf life, respectively.

Germany Container Glass Market Product Innovations

Recent innovations focus on lightweighting to reduce transportation costs and environmental impact. The industry is also exploring new functionalities, such as enhanced barrier properties to improve product shelf life and innovative designs to enhance brand appeal. The use of recycled glass content is also increasing, responding to environmental concerns and circular economy goals. These innovations result in improved performance metrics, including reduced weight, enhanced durability, and improved recyclability.

Propelling Factors for Germany Container Glass Market Growth

The German container glass market is propelled by several key factors. Rising disposable incomes lead to increased consumption of packaged goods. The growing emphasis on sustainability and environmental consciousness drives demand for recyclable glass packaging. Technological advancements, like the adoption of energy-efficient furnaces, enhance production efficiency and reduce costs. Furthermore, supportive government regulations promote the use of eco-friendly packaging, creating a positive business environment.

Obstacles in the Germany Container Glass Market

The market faces challenges including fluctuating raw material prices (sand, soda ash, and cullet), which can affect production costs. Supply chain disruptions, particularly concerning energy resources, can significantly impact production. Competition from alternative packaging materials, such as plastics, necessitates ongoing innovation and cost optimization to remain competitive. Stringent environmental regulations, while positive in the long run, can add to compliance costs in the short term.

Future Opportunities in Germany Container Glass Market

Future opportunities lie in the development of innovative glass packaging solutions tailored to specific market needs. The integration of smart packaging technologies and increasing use of recycled glass content can unlock significant growth. Expanding into niche markets, such as premium food products and specialized pharmaceutical packaging, offers further potential. Focusing on e-commerce packaging solutions to meet the growing demands of online retail is also crucial.

Major Players in the Germany Container Glass Market Ecosystem

- Ardagh Group

- Systempack Manufaktur GmbH

- HEINZ-GLAS GmbH

- Schott AG

- Glaswerk Ernstthal GmbH

- Saint-Gobain Oberland AG (Verallia Deutschland)

- Rixius AG

- O-I Germany GmbH & Co KG

- Gerresheimer AG

- Wiegand-Glas GmBH

Key Developments in Germany Container Glass Market Industry

- February 2021: Ardagh Group launched Absolut's limited-edition vodka bottle, showcasing innovative design and promoting sustainability.

- July 2022: Gerresheimer Group announced plans for a large-scale hybrid furnace utilizing renewable energy, emphasizing its commitment to sustainable production practices.

Strategic Germany Container Glass Market Forecast

The German container glass market is poised for continued growth, driven by increasing demand for sustainable packaging and technological advancements in glass manufacturing. The growing focus on the circular economy and government support for eco-friendly packaging will create favorable market conditions. Innovation in product design, functionality, and recyclability will be crucial for maintaining competitiveness and achieving sustained growth in the coming years.

Germany Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverages

- 1.1.1. Alcoholic Beverages

- 1.1.2. Non-Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End-user Industries

-

1.1. Beverages

Germany Container Glass Market Segmentation By Geography

- 1. Germany

Germany Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways

- 3.3. Market Restrains

- 3.3.1 However

- 3.3.2 container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides

- 3.3.3 sulfur dioxides

- 3.3.4 and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma

- 3.3.5 chronic bronchitis

- 3.3.6 mucus secretion

- 3.3.7 and lung cancer.

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverages

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End-user Industries

- 5.1.1. Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North Rhine-Westphalia Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ardagh Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Systempack Manufaktur GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HEINZ-GLAS GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schott AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Glaswerk Ernstthal GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saint-Gobain Oberland AG (Verallia Deutschland)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rixius AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 O-I Germany GmbH & Co KG*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gerresheimer AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Wiegand-Glas GmBH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ardagh Group

List of Figures

- Figure 1: Germany Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: Germany Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Container Glass Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Container Glass Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Container Glass Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Container Glass Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Container Glass Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Container Glass Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 11: Germany Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Container Glass Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Germany Container Glass Market?

Key companies in the market include Ardagh Group, Systempack Manufaktur GmbH, HEINZ-GLAS GmbH, Schott AG, Glaswerk Ernstthal GmbH, Saint-Gobain Oberland AG (Verallia Deutschland), Rixius AG, O-I Germany GmbH & Co KG*List Not Exhaustive, Gerresheimer AG, Wiegand-Glas GmBH.

3. What are the main segments of the Germany Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Glass containers for food and beverages are 100% recyclable and hence can be recycled endlessly without loss in quality or purity - something few food and beverage packaging options can claim. Manufacturers benefit from recycling in several ways: Recycled glass reduces emissions and consumption of raw materials. extends the life of plant equipment. such as furnaces. and saves energy.; The growth in population in the country in the recent years has led to a rise in the building & construction sector where soda-lime-silica-based glass is used in windowpanes. owing to their hardness and ease of workability..

6. What are the notable trends driving market growth?

Pharmaceutical Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

However. container glass is manufactured by a process called annealing in which different air polluting compounds such as nitrogen oxides. sulfur dioxides. and other harmful particulates are released. Exposure to these harmful compounds at high concentrations can cause severe respiratory diseases such as asthma. chronic bronchitis. mucus secretion. and lung cancer..

8. Can you provide examples of recent developments in the market?

February 2021 - Ardagh Group launched Absolut's latest limited-edition vodka bottle Absolut Movement to inspire people to celebrate inclusivity. The frosted blue glass bottle features an upward spiral design of 16 swirls, symbolic of the never-ending cycle of change. The upward flow of the swirling spiral indicates social growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Container Glass Market?

To stay informed about further developments, trends, and reports in the Germany Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence