Key Insights

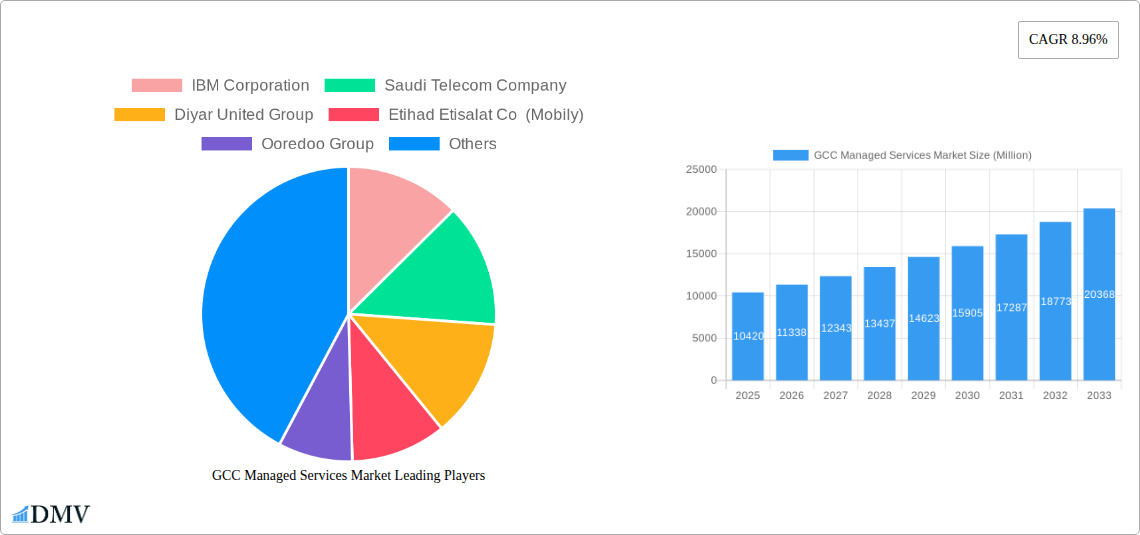

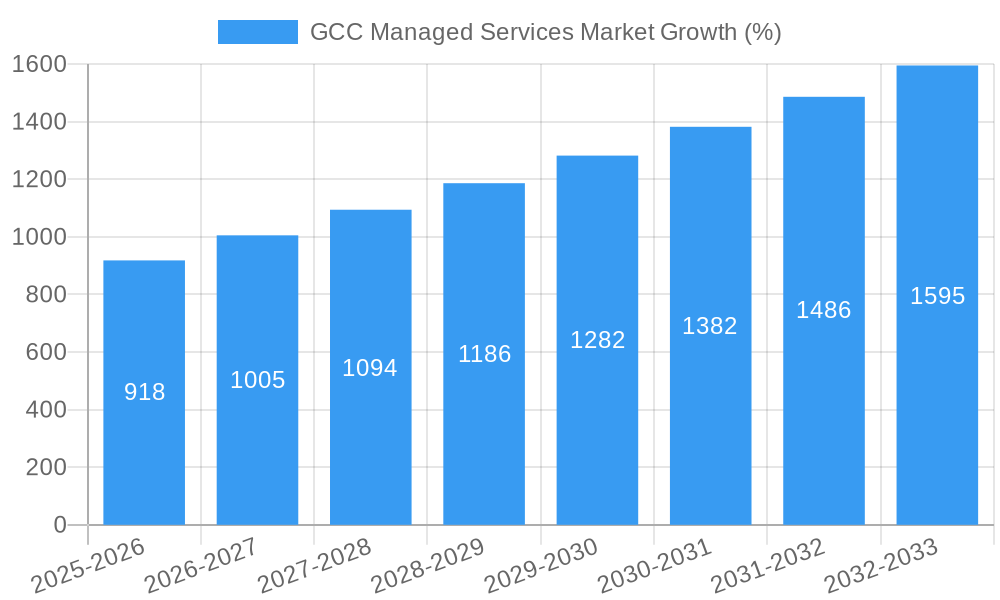

The GCC Managed Services Market, valued at $10.42 billion in 2025, is projected to experience robust growth, driven by increasing digital transformation initiatives across various sectors, a rising need for enhanced cybersecurity measures, and the expanding adoption of cloud-based solutions. The market's Compound Annual Growth Rate (CAGR) of 8.96% from 2025 to 2033 indicates a significant expansion opportunity. Key segments driving this growth include Managed Cloud Services, fueled by the region's substantial investments in cloud infrastructure, and Managed Security Services, reflecting a growing awareness of cyber threats. The BFSI (Banking, Financial Services, and Insurance) and IT & Telecom sectors are major contributors to market demand, followed by the Oil & Gas and Healthcare sectors. The increasing reliance on outsourcing IT operations to streamline costs and improve efficiency is a significant market driver. Companies like IBM, Saudi Telecom Company, and others are key players leveraging this growth, offering a diverse range of managed services to meet the evolving needs of GCC businesses.

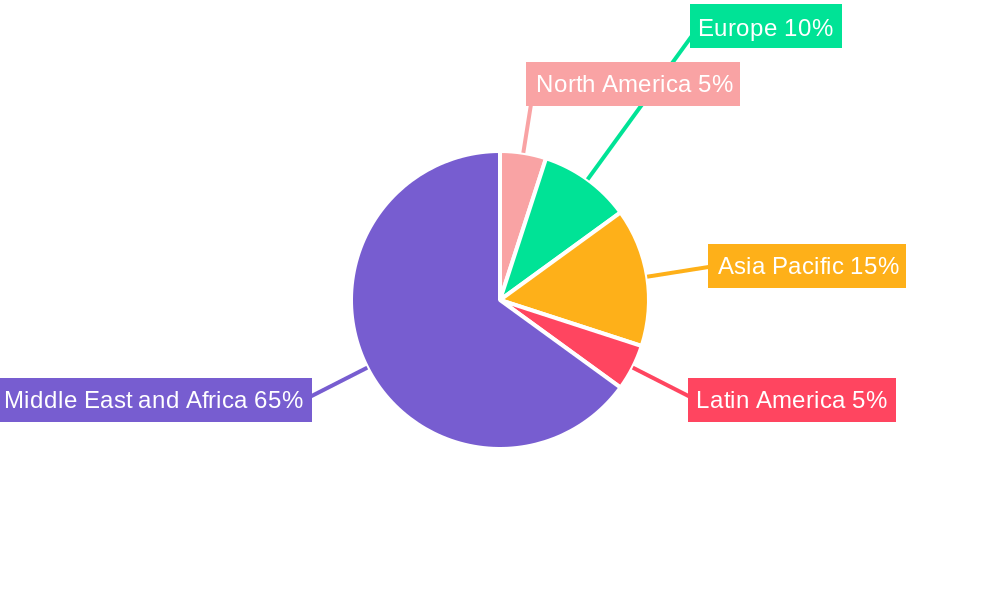

Geographic expansion within the GCC region remains a key trend, with Saudi Arabia and the UAE holding significant market share, followed by Qatar and other GCC countries. However, the market faces some restraints, including a potential skills gap in managing advanced technologies and the need for robust data privacy regulations to ensure secure data handling. Despite these challenges, the overall market outlook remains positive, indicating substantial growth prospects for both established players and emerging technology providers throughout the forecast period. The continued government investments in digital infrastructure and a supportive regulatory environment will further fuel market expansion.

This comprehensive report provides a detailed analysis of the GCC Managed Services Market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report encompasses a historical period from 2019-2024 and projects a robust market evolution.

GCC Managed Services Market Composition & Trends

This section delves into the intricate composition of the GCC Managed Services Market, analyzing key trends impacting its growth trajectory. We examine market concentration, revealing the market share distribution among major players like IBM Corporation, Saudi Telecom Company, and others. We also explore the innovative catalysts driving market evolution, regulatory landscapes shaping market access, and the impact of substitute products on market dynamics. Furthermore, the report profiles end-users across diverse sectors and analyzes M&A activities, including deal values (estimated at xx Million) and their implications for market consolidation.

- Market Concentration: Analysis of market share held by top players. We project xx% market share for the top 5 players in 2025.

- Innovation Catalysts: Examination of technological advancements, such as AI and cloud computing, shaping service offerings.

- Regulatory Landscape: Assessment of governmental policies and their influence on market operations and growth.

- Substitute Products: Evaluation of alternative service providers and their impact on market competition.

- End-User Profiles: Segmentation of end-users across IT & Telecom, BFSI, Oil & Gas, Healthcare, and Government sectors, providing insights into their unique needs and spending patterns.

- M&A Activities: Analysis of significant mergers and acquisitions, detailing deal values and their effects on market consolidation. We estimate xx Million in M&A activity during the forecast period.

GCC Managed Services Market Industry Evolution

This section offers a deep dive into the historical and projected evolution of the GCC Managed Services Market, exploring the underlying growth trajectories, technological advancements that propel innovation, and shifting consumer demands. We present specific data points including growth rates (projected at xx% CAGR from 2025 to 2033) and adoption metrics for key managed services. The analysis considers factors like increasing digital transformation initiatives across various sectors, the rising adoption of cloud technologies, and the growing demand for enhanced cybersecurity solutions. The impact of industry-specific regulations and government support programs on market evolution is also thoroughly investigated. The evolution of the market is also analyzed based on the evolution of the different segments and its contribution to market growth.

Leading Regions, Countries, or Segments in GCC Managed Services Market

This section pinpoints the leading regions, countries, and segments within the GCC Managed Services Market. We identify the dominant player based on revenue contribution and market size, considering the various service types (Managed Infrastructure Services, Managed Hosting Services, Managed Security Services, Managed Cloud Services, Disaster Recovery & Business Continuity Services) and end-user verticals (IT & Telecom, BFSI, Oil & Gas, Healthcare, Government, and Others).

Key Drivers for Dominant Segments:

- Investment Trends: Analysis of investment patterns in specific segments (e.g., significant investments in Managed Cloud Services).

- Regulatory Support: Evaluation of government policies fostering growth in particular segments (e.g., government initiatives promoting cybersecurity).

In-depth Analysis of Dominance Factors: Detailed examination of factors contributing to the leadership of specific segments or regions (e.g., strong adoption of cloud technologies in the UAE). Saudi Arabia is projected to lead the market in terms of revenue with xx Million in 2025.

GCC Managed Services Market Product Innovations

This section showcases recent product innovations, highlighting unique selling propositions (USPs) and technological advancements impacting the competitive landscape. We analyze the performance metrics of new products and their adoption rates, emphasizing the transformative influence of these innovations on market efficiency and scalability. New offerings such as AI-powered managed services and enhanced cybersecurity solutions are discussed.

Propelling Factors for GCC Managed Services Market Growth

Several key factors fuel the growth of the GCC Managed Services Market. Technological advancements such as cloud computing and AI are driving increased adoption of managed services. Economic growth and digital transformation initiatives within various sectors create a significant demand. Supportive government policies and regulatory frameworks also foster a conducive market environment. For example, government-led digitalization programs are significantly boosting the demand for managed IT services.

Obstacles in the GCC Managed Services Market

Despite the significant growth potential, challenges exist. Regulatory complexities in certain sectors can hinder market expansion. Supply chain disruptions can impact service delivery. Intense competition among service providers necessitates continuous innovation and cost optimization. The overall impact of these obstacles is projected to reduce market growth by xx% by 2033.

Future Opportunities in GCC Managed Services Market

The future holds promising opportunities. Expansion into underserved segments like the education sector represents significant potential. Emerging technologies such as edge computing and blockchain present avenues for innovation. Shifting consumer preferences towards more flexible and scalable services create new market demands. The untapped potential in smaller GCC countries also offers exciting possibilities for expansion.

Major Players in the GCC Managed Services Market Ecosystem

- IBM Corporation

- Saudi Telecom Company

- Diyar United Group

- Etihad Etisalat Co (Mobily)

- Ooredoo Group

- EITC Group (du)

- ACS Group

- AGC Networks (An ESSAR Company)

- Emitac

- MEEZA Group

- HP Middle East

- Wipro Group

Key Developments in GCC Managed Services Market Industry

- July 2022: Cisco launched a new Webex Wholesale Route-to-Market (RTM) for service providers, enabling agile and scalable managed service delivery.

- May 2022: Fujitsu partnered with AWS to accelerate clients' digital transformation in finance and retail, offering new services on the AWS Marketplace.

- February 2023: Du (EITC) and Ericsson partnered to transform Du's IT operations using AI and Business and Operations Support Systems, a key step in Du's Digital Transformation Programme.

Strategic GCC Managed Services Market Forecast

The GCC Managed Services Market is poised for sustained growth, driven by technological advancements, robust economic conditions, and government support for digital transformation. The projected growth trajectory indicates significant market potential, presenting attractive opportunities for existing and new players alike. Emerging technologies and the expanding adoption of managed services across various sectors will continue to propel market expansion in the coming years.

GCC Managed Services Market Segmentation

-

1. Type

- 1.1. Managed Infrastructure Services

- 1.2. Managed Hosting Services

- 1.3. Managed Security Services

- 1.4. Managed Cloud Services

- 1.5. Disaster Recovery & Business Continuity Services

-

2. End-user Vertical

- 2.1. IT & Telecom

- 2.2. BFSI

- 2.3. Oil & Gas

- 2.4. Healthcare

- 2.5. Government

- 2.6. Other

GCC Managed Services Market Segmentation By Geography

- 1. Africa

GCC Managed Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market

- 3.3. Market Restrains

- 3.3.1. Integration and Regulatory Issues and Reliability Concerns

- 3.4. Market Trends

- 3.4.1. Managed Hosting Services expected to grow significantly over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Managed Infrastructure Services

- 5.1.2. Managed Hosting Services

- 5.1.3. Managed Security Services

- 5.1.4. Managed Cloud Services

- 5.1.5. Disaster Recovery & Business Continuity Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. IT & Telecom

- 5.2.2. BFSI

- 5.2.3. Oil & Gas

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saudi Telecom Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Diyar United Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Etihad Etisalat Co (Mobily)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ooredoo Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EITC Group (du)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACS Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGC Networks (An ESSAR Company)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emitac

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MEEZA Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HP Middle East

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wipro Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global GCC Managed Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Africa GCC Managed Services Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Africa GCC Managed Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Africa GCC Managed Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: Africa GCC Managed Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Managed Services Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the GCC Managed Services Market?

Key companies in the market include IBM Corporation, Saudi Telecom Company, Diyar United Group, Etihad Etisalat Co (Mobily), Ooredoo Group, EITC Group (du), ACS Group, AGC Networks (An ESSAR Company), Emitac, MEEZA Group, HP Middle East, Wipro Group.

3. What are the main segments of the GCC Managed Services Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market.

6. What are the notable trends driving market growth?

Managed Hosting Services expected to grow significantly over the forecast period.

7. Are there any restraints impacting market growth?

Integration and Regulatory Issues and Reliability Concerns.

8. Can you provide examples of recent developments in the market?

February 2023: Du, from Emirates Integrated Telecommunications Company (EITC), and Ericsson announced a strategic partnership at Mobile World Congress 2023 to transform Du's Information Technology (IT) operations. In order to improve quality, unlock efficiencies, and increase agility, Du will use the services of Ericsson's Artificial Intelligence AI and Business and Operations Support Systems. A significant step forward in the Digital Transformation Programme of Du will be achieved through this partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Managed Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Managed Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Managed Services Market?

To stay informed about further developments, trends, and reports in the GCC Managed Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence