Key Insights

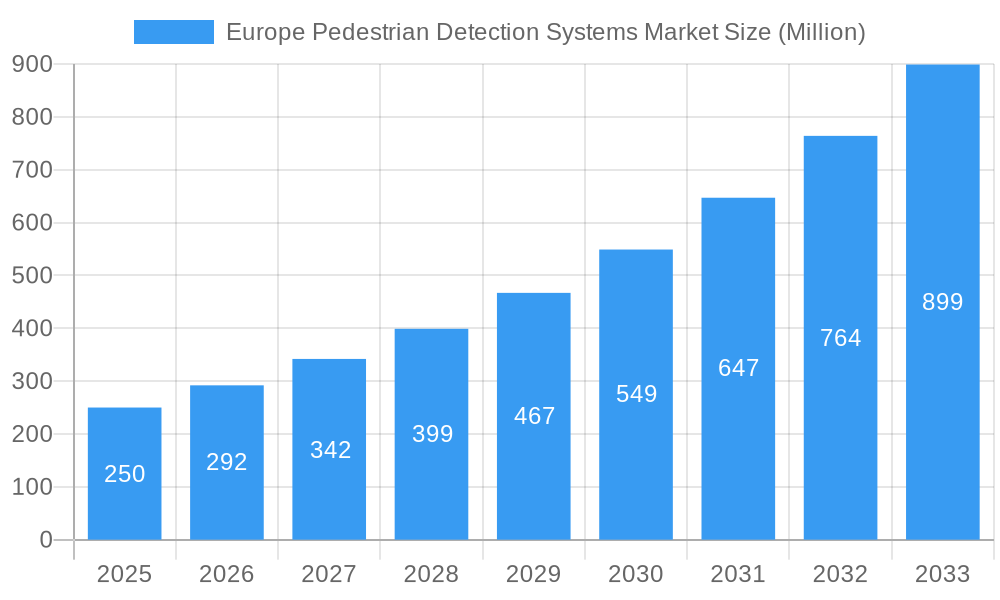

The European pedestrian detection systems market is poised for significant expansion, driven by heightened road safety imperatives and continuous advancements in sensor technology. The market, valued at 15.46 billion in the base year 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.15% from 2025 to 2033. This growth is underpinned by critical factors, including increasingly stringent government regulations mandating the integration of advanced pedestrian detection systems to mitigate accidents. Technological innovations, particularly in radar, camera, and hybrid systems, are enhancing detection accuracy and reliability, accelerating market adoption. The burgeoning prevalence of autonomous vehicles and the escalating demand for Advanced Driver-Assistance Systems (ADAS) are further propelling this market's upward trajectory. Germany, France, and the United Kingdom currently dominate the European landscape, reflecting their robust automotive sectors and proactive road safety initiatives.

Europe Pedestrian Detection Systems Market Market Size (In Billion)

Market segmentation reveals that video-based systems command a substantial share due to their cost-efficiency and technological maturity. However, infrared and hybrid systems are experiencing accelerated growth, offering superior performance in challenging environmental conditions. Within component types, sensors and radar lead the market, with cameras critically supporting visual data for enhanced detection. The competitive environment features established automotive component manufacturers alongside innovative technology startups, all focused on delivering cutting-edge solutions. Future market dynamics will be shaped by ongoing advancements in Artificial Intelligence (AI) and Machine Learning (ML) algorithms, promising to further elevate the precision and resilience of pedestrian detection systems, ultimately contributing to safer roadways and fewer fatalities.

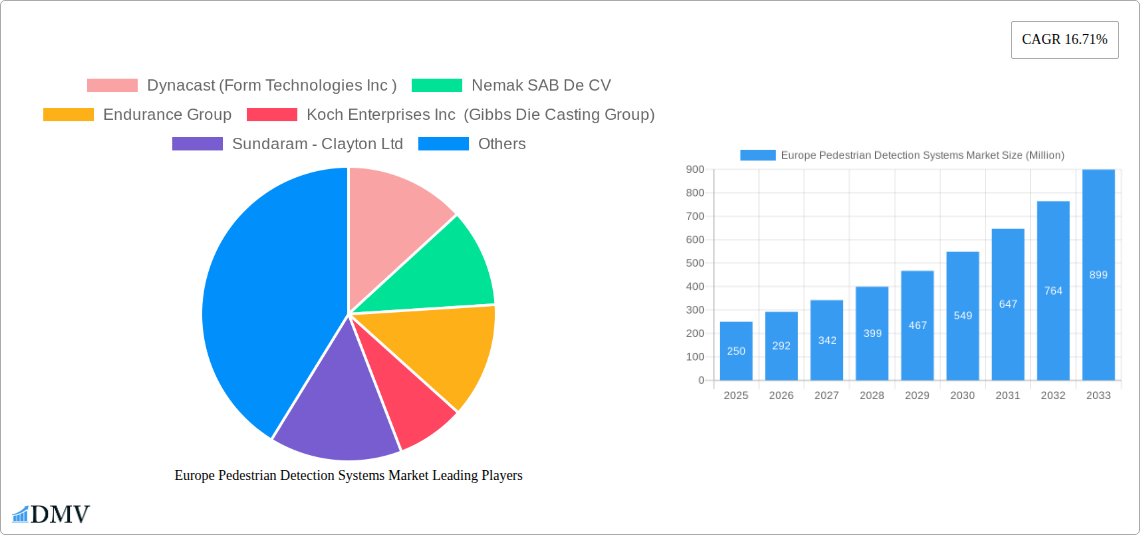

Europe Pedestrian Detection Systems Market Company Market Share

Europe Pedestrian Detection Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Pedestrian Detection Systems Market, offering a comprehensive overview of market trends, key players, and future growth prospects. From market size and segmentation to technological advancements and regulatory influences, this report equips stakeholders with the critical information needed for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Pedestrian Detection Systems Market Market Composition & Trends

This section offers a comprehensive analysis of the European pedestrian detection systems market, meticulously dissecting its current landscape and projecting its future trajectory. We delve into market concentration, illustrating the distribution of market share among key industry players. Furthermore, the report identifies pivotal innovation catalysts, such as groundbreaking advancements in sensor technologies (including radar, lidar, and advanced camera systems) and sophisticated AI-driven algorithms, which are fundamentally reshaping the market's evolution. A thorough examination of the regulatory environment is also undertaken, highlighting critical legislation and industry standards that are actively influencing the widespread adoption of pedestrian detection systems across the continent. The analysis extends to substitute products, including traditional mirror systems and emerging driver assistance features, to provide a nuanced perspective on market competition. End-user profiles, encompassing automotive manufacturers (OEMs), extensive fleet operators, and forward-thinking municipalities, are profiled to understand their distinct needs, procurement strategies, and adoption patterns. Finally, the report scrutinizes M&A activities within the industry, detailing deal values and their profound impact on market consolidation. Significant M&A activity is anticipated, with a projected total deal value of approximately [Insert Value Here] Million during the forecast period.

- Market Concentration: The market is characterized by a high degree of fragmentation, with the top 5 players estimated to hold approximately [Insert Percentage Here]% of the market share in 2025.

- Innovation Catalysts: Key drivers include continuous advancements in radar, lidar, and vision processing technologies, alongside the integration of sophisticated AI and machine learning for enhanced object recognition and predictive analysis.

- Regulatory Landscape: Increasingly stringent safety regulations and upcoming Euro NCAP ratings are a significant catalyst for widespread adoption across various vehicle types, from passenger cars to commercial fleets.

- Substitute Products: While traditional mirrors and enhanced driver awareness programs exist, their effectiveness is being surpassed by integrated electronic detection systems.

- End-User Profiles: The primary end-users are Automotive Original Equipment Manufacturers (OEMs), large-scale fleet management companies, and progressive municipalities focused on urban safety initiatives.

- M&A Activities: Consolidation within the market is expected to accelerate, with an estimated deal value of [Insert Value Here] Million anticipated between 2025-2033.

Europe Pedestrian Detection Systems Market Industry Evolution

This section provides a detailed examination of the Europe Pedestrian Detection Systems Market's evolution, analyzing its robust growth trajectories from 2019 to 2024 and offering precise forecasts for expansion through to 2033. We explore the critical technological advancements propelling market expansion, with a particular emphasis on the seamless integration of Artificial Intelligence (AI), cutting-edge machine learning techniques, and sophisticated sensor fusion strategies. The profound impact of evolving consumer demands for enhanced vehicle safety and proactive accident prevention is also meticulously examined. Market growth is primarily fueled by the accelerating pace of urbanisation, the implementation of increasingly stringent safety regulations by governmental bodies, and the burgeoning demand for advanced driver-assistance systems (ADAS). The market experienced a notable growth rate of [Insert Percentage Here]% during the historical period (2019-2024) and is projected to expand at a compound annual growth rate (CAGR) of [Insert Percentage Here]% during the forecast period (2025-2033). Adoption rates are poised for a significant surge, with penetration rates expected to climb from approximately [Insert Percentage Here]% in 2025 to an impressive [Insert Percentage Here]% by 2033, demonstrating particularly strong growth in the commercial vehicle segment.

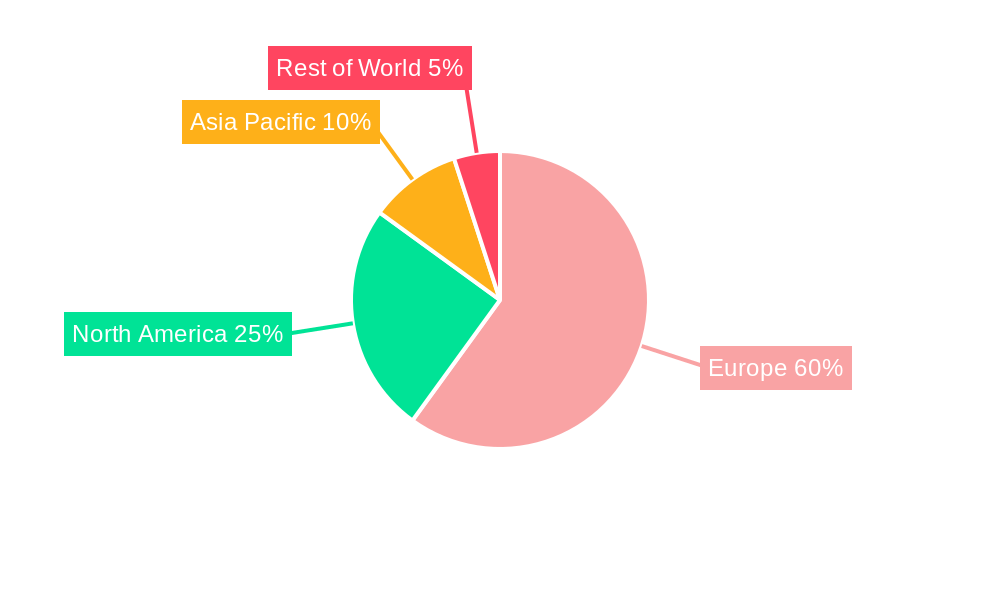

Leading Regions, Countries, or Segments in Europe Pedestrian Detection Systems Market

This section identifies the dominant regions, countries, and technological segments within the dynamic European pedestrian detection systems market. Germany and the United Kingdom are anticipated to emerge as leading markets, driven by the strong presence of established automotive manufacturers, a well-developed automotive supply chain, and the enforcement of stringent safety regulations. The Video-based systems segment is projected to command the largest market share, followed closely by the Hybrid and Infrared segments, each catering to specific operational environments and performance requirements.

- Key Drivers for Germany and UK Dominance:

- High concentration of leading automotive manufacturers and Tier-1 suppliers.

- Robust safety regulations and proactive government initiatives promoting vehicle safety technologies.

- Significant ongoing investments in research and development (R&D) and advanced automotive infrastructure.

- Heightened consumer awareness and demand for advanced vehicle safety features.

- Segment Analysis:

- Type: Video systems continue to dominate due to their cost-effectiveness and high accuracy in various lighting conditions. Infrared systems are gaining traction for their superior performance in low-light and adverse weather. The Hybrid segment is poised for strong growth, leveraging the combined strengths of multiple sensor types for enhanced reliability and performance.

- Component Type: Sensors, encompassing radar, lidar, and advanced camera modules, are expected to hold the largest market share due to their fundamental role in accurate detection and precise ranging. Cameras are critical for detailed image processing, object recognition, and classification of pedestrians and other road users.

Europe Pedestrian Detection Systems Market Product Innovations

Recent innovations focus on improving the accuracy and reliability of pedestrian detection systems, particularly in challenging environments such as low-light conditions or adverse weather. The integration of AI and machine learning algorithms allows for more robust object recognition and classification, minimizing false positives and improving overall system performance. Key innovations include the development of more compact and energy-efficient sensors, advancements in sensor fusion techniques, and the integration of pedestrian detection with other ADAS features such as automatic emergency braking. This has resulted in improved safety outcomes, reduced accident rates, and increased consumer acceptance.

Propelling Factors for Europe Pedestrian Detection Systems Market Growth

Several factors contribute to the growth of the European pedestrian detection systems market. Increasing urbanization and higher pedestrian traffic in cities necessitate advanced safety features. Stricter safety regulations and government mandates, along with growing consumer awareness regarding safety features, are driving adoption rates. Furthermore, the rapid development of advanced sensor technologies and AI-powered algorithms are making these systems more accurate, reliable, and affordable.

Obstacles in the Europe Pedestrian Detection Systems Market Market

Despite the significant growth potential and increasing market demand, several obstacles can impede the widespread expansion of pedestrian detection systems in Europe. The substantial initial investment costs associated with the integration of advanced systems can present a considerable barrier for some vehicle manufacturers and fleet operators, particularly smaller enterprises. The inherent complexity of system integration, requiring specialized expertise and rigorous testing, along with the need for highly skilled technicians for maintenance and calibration, can also pose significant challenges. Furthermore, growing concerns regarding data privacy and cybersecurity, particularly in relation to the collection and processing of data by advanced sensor technologies, could potentially influence adoption rates. Finally, intense competition from well-established industry players and the continuous emergence of innovative new entrants contribute to the complex and dynamic competitive landscape of this market.

Future Opportunities in Europe Pedestrian Detection Systems Market

Future opportunities lie in expanding into new markets such as autonomous vehicles and smart city infrastructure. The integration of pedestrian detection with other ADAS features and advanced connectivity solutions, such as V2X communication, will further enhance safety and efficiency. The development of more robust and reliable systems capable of operating in challenging environmental conditions also presents significant opportunities.

Major Players in the Europe Pedestrian Detection Systems Market Ecosystem

- Dynacast (Form Technologies Inc )

- Nemak SAB De CV

- Endurance Group

- Koch Enterprises Inc (Gibbs Die Casting Group)

- Sundaram - Clayton Ltd

- Georg Fischer AG

- Ryobi Die Casting Inc

- Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- Officine Meccaniche Rezzatesi SpA

- Rockman Industries

- Engtek Group

- Shiloh Industries Ltd

Key Developments in Europe Pedestrian Detection Systems Market Industry

- July 2022: Volvo Trucks introduced its innovative Side Collision Avoidance Support system, strategically employing twin radars to effectively detect cyclists and pedestrians entering the vehicle's blind spot, thereby significantly enhancing safety for vulnerable road users.

- February 2022: Skoda Auto underscored its unwavering commitment to pedestrian safety by conducting over 200 rigorous pedestrian safety tests during the development of its new vehicle models, highlighting the paramount importance of pedestrian protection in modern vehicle design.

- January 2022: Ficosa announced a pioneering initiative to replace traditional front mirrors with advanced camera systems in MAN commercial vehicles. This strategic move is set to substantially enhance driver visibility and improve the overall effectiveness of pedestrian detection capabilities, signalling a notable shift towards camera-centric safety solutions.

Strategic Europe Pedestrian Detection Systems Market Market Forecast

The Europe Pedestrian Detection Systems Market is poised for significant growth in the coming years, driven by increasing demand for enhanced safety features, advancements in sensor technology, and supportive regulations. The market will witness continued innovation and expansion into new segments, offering lucrative opportunities for both established players and new entrants. The forecast period promises considerable market expansion, with anticipated growth largely fueled by technology advancements and an increasing focus on road safety.

Europe Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

-

2. Component Type

- 2.1. Sensors

- 2.2. Radars

- 2.3. Cameras

- 2.4. Other Component Types

Europe Pedestrian Detection Systems Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Italy

- 7. Rest of Europe

Europe Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of Europe Pedestrian Detection Systems Market

Europe Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of ADAS Systems Driving the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of ADAS Systems Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Sensors

- 5.2.2. Radars

- 5.2.3. Cameras

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Infrared

- 6.1.3. Hybrid

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Component Type

- 6.2.1. Sensors

- 6.2.2. Radars

- 6.2.3. Cameras

- 6.2.4. Other Component Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Infrared

- 7.1.3. Hybrid

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Component Type

- 7.2.1. Sensors

- 7.2.2. Radars

- 7.2.3. Cameras

- 7.2.4. Other Component Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Infrared

- 8.1.3. Hybrid

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Component Type

- 8.2.1. Sensors

- 8.2.2. Radars

- 8.2.3. Cameras

- 8.2.4. Other Component Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Infrared

- 9.1.3. Hybrid

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Component Type

- 9.2.1. Sensors

- 9.2.2. Radars

- 9.2.3. Cameras

- 9.2.4. Other Component Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Video

- 10.1.2. Infrared

- 10.1.3. Hybrid

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Component Type

- 10.2.1. Sensors

- 10.2.2. Radars

- 10.2.3. Cameras

- 10.2.4. Other Component Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Italy Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Video

- 11.1.2. Infrared

- 11.1.3. Hybrid

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Component Type

- 11.2.1. Sensors

- 11.2.2. Radars

- 11.2.3. Cameras

- 11.2.4. Other Component Types

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Europe Europe Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Video

- 12.1.2. Infrared

- 12.1.3. Hybrid

- 12.1.4. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Component Type

- 12.2.1. Sensors

- 12.2.2. Radars

- 12.2.3. Cameras

- 12.2.4. Other Component Types

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dynacast (Form Technologies Inc )

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nemak SAB De CV

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Endurance Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koch Enterprises Inc (Gibbs Die Casting Group)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sundaram - Clayton Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Georg Fischer AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ryobi Die Casting Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Officine Meccaniche Rezzatesi SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Rockman Industries

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Engtek Group

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Shiloh Industries Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Europe Pedestrian Detection Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 3: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 9: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 12: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 15: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 18: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 21: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 24: Europe Pedestrian Detection Systems Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pedestrian Detection Systems Market?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Europe Pedestrian Detection Systems Market?

Key companies in the market include Dynacast (Form Technologies Inc ), Nemak SAB De CV, Endurance Group, Koch Enterprises Inc (Gibbs Die Casting Group), Sundaram - Clayton Ltd, Georg Fischer AG, Ryobi Die Casting Inc, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Officine Meccaniche Rezzatesi SpA, Rockman Industries, Engtek Group, Shiloh Industries Ltd.

3. What are the main segments of the Europe Pedestrian Detection Systems Market?

The market segments include Type, Component Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of ADAS Systems Driving the Market.

6. What are the notable trends driving market growth?

Increasing Adoption of ADAS Systems Driving the Market.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

July 2022: Volvo Trucks announced the launch of a new safety technology aimed at improving road safety. The device utilizes twin radars on each side of the truck to recognize when other road users, such as bicycles, enter the danger zone. Known as the Side Collision Avoidance Support system, it alerts the driver by flashing a red light on the appropriate side mirror when something is in the blind spot area. If the driver signals a lane change with the turn signal, the red light starts to flash, and an audible warning sound is emitted from the side of the potential accident. This provides the driver with timely information and the option to apply the brakes, allowing, for example, a bike to safely pass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the Europe Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence