Key Insights

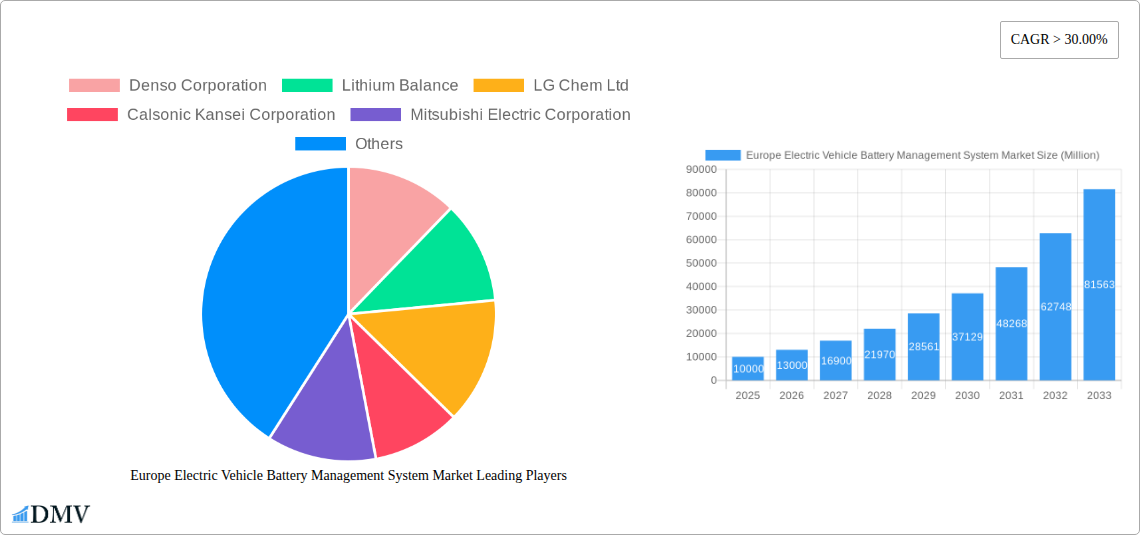

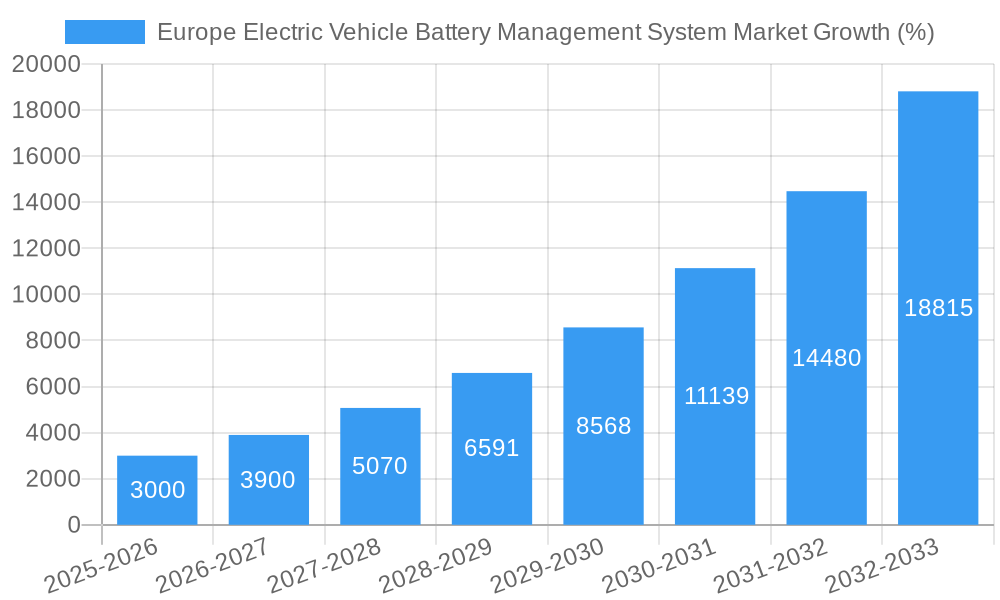

The European Electric Vehicle (EV) Battery Management System (BMS) market is experiencing robust growth, driven by the escalating adoption of electric vehicles across the region. The market, valued at approximately €[Estimate based on "Market size XX" and "Value Unit Million"— let's assume €10 Billion in 2025 for example purposes, adjusting based on actual XX value if available], is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 30% from 2025 to 2033. This surge is fueled by several key factors. Stringent emission regulations implemented by European governments are incentivizing the shift towards electric mobility, creating significant demand for EVs and consequently, the BMS systems crucial for their efficient operation. Furthermore, advancements in battery technology, leading to increased energy density and improved lifespan, are bolstering the market's growth trajectory. The increasing range and performance of EVs, coupled with decreasing battery costs, further contribute to consumer adoption. Market segmentation reveals strong growth in both passenger car and commercial vehicle applications, with Plug-in Hybrid Electric Vehicles (PHEVs) and Battery Electric Vehicles (BEVs) driving the demand for sophisticated BMS solutions that optimize battery life, safety, and performance. Key players like Denso, LG Chem, and Bosch are actively investing in R&D and strategic partnerships to capitalize on this expanding market opportunity.

The competitive landscape within the European EV BMS market is characterized by a mix of established automotive suppliers and specialized battery technology companies. These companies are engaged in intense competition to provide innovative and cost-effective BMS solutions. This competition is driving technological advancements and improving the overall performance and reliability of EV BMS systems. Growth within specific European regions, such as Germany and France, will be particularly strong due to robust domestic EV production and supportive governmental policies. The market will likely see further consolidation as larger players acquire smaller specialized firms to gain a competitive edge and enhance their product portfolios. Challenges remain, however, including the need for further improvements in battery charging infrastructure and the ongoing efforts to address concerns about battery safety and longevity. Nonetheless, the long-term outlook for the European EV BMS market remains highly positive, promising significant growth opportunities for industry participants in the coming years.

Europe Electric Vehicle Battery Management System (EV BMS) Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Electric Vehicle Battery Management System (EV BMS) market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The market is segmented by propulsion type (Plug-in Hybrid Electric Vehicle, Battery Electric Vehicle) and vehicle type (Passenger Cars, Commercial Vehicles). The total market size is predicted to reach xx Million by 2033.

Europe Electric Vehicle Battery Management System Market Market Composition & Trends

The European EV BMS market is characterized by a moderately concentrated landscape, with key players like Denso Corporation, LG Chem Ltd, Robert Bosch GmbH, and Panasonic Corporation holding significant market share. However, the market is witnessing increased competition from emerging players and technology providers. Innovation is driven by the need for enhanced battery life, safety, and performance, leading to the development of advanced BMS technologies such as AI-powered systems and improved thermal management solutions. Stringent EU regulations on emissions and battery safety are further shaping market dynamics, pushing for higher efficiency and reliability standards. Substitute products are limited, with BMS remaining an integral component of EV batteries. The end-user profile encompasses automakers, Tier 1 suppliers, and battery manufacturers. The market has seen significant M&A activity in recent years, with deal values totaling approximately xx Million in the last five years, reflecting strategic consolidation and technology acquisition.

- Market Share Distribution (2024): Robert Bosch GmbH (xx%), LG Chem Ltd (xx%), Denso Corporation (xx%), Others (xx%).

- M&A Deal Value (2019-2024): Approximately xx Million.

Europe Electric Vehicle Battery Management System Market Industry Evolution

The European EV BMS market has experienced significant growth over the past few years, driven by the increasing adoption of electric vehicles across the region. The market's Compound Annual Growth Rate (CAGR) from 2019 to 2024 was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is fueled by several factors, including supportive government policies promoting EV adoption, decreasing battery costs, and advancements in battery technologies. The integration of advanced features like over-the-air (OTA) updates, improved diagnostics, and predictive maintenance capabilities is further enhancing the appeal of EV BMS systems. Consumer demand for longer driving ranges, faster charging times, and enhanced safety features is pushing the development of more sophisticated and efficient BMS solutions. The market is also witnessing a shift towards higher voltage battery systems, requiring more advanced BMS technologies to manage increased power and energy density. The adoption rate of advanced BMS features, such as predictive maintenance, is steadily increasing, with an estimated xx% of new EVs incorporating these features in 2024.

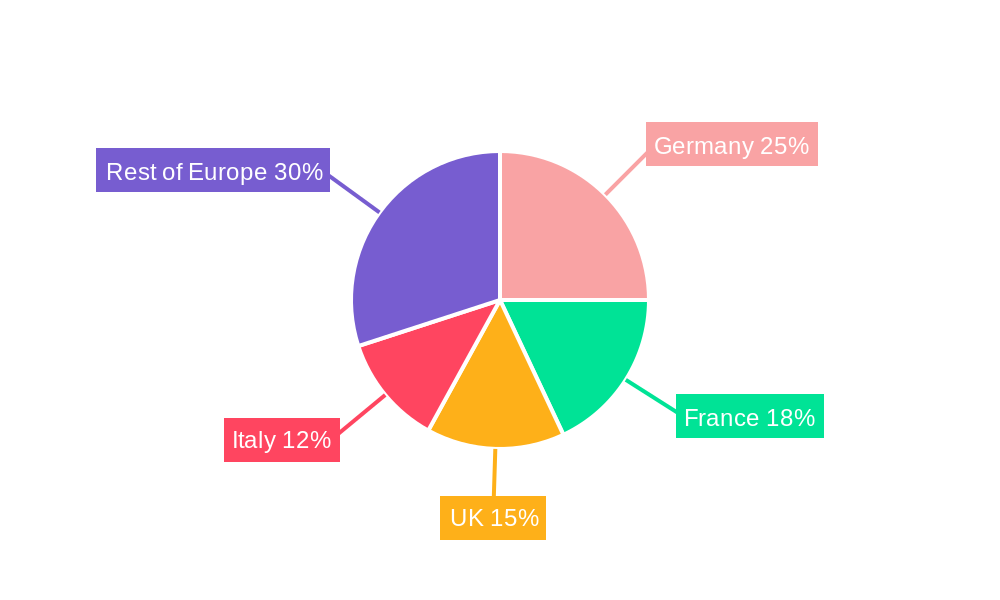

Leading Regions, Countries, or Segments in Europe Electric Vehicle Battery Management System Market

Germany, France, and the UK currently represent the leading markets within Europe for EV BMS. The dominance of these regions is attributed to several key factors:

- Germany: Strong domestic automotive industry, substantial government investments in EV infrastructure, and a robust research and development ecosystem.

- France: Government incentives for EV purchases, a growing focus on sustainable transportation, and a developing domestic battery manufacturing sector.

- UK: Government support for EV adoption, a significant presence of major automakers, and a developing EV charging infrastructure.

The Passenger Car segment holds the largest market share currently, driven by the high volume of EV passenger car sales in Europe. However, the Commercial Vehicle segment is expected to experience significant growth in the coming years due to increasing demand for electric trucks and buses.

- Key Drivers for Passenger Car Segment Dominance: High EV sales volume, established supply chains, and readily available charging infrastructure.

- Key Drivers for Commercial Vehicle Segment Growth: Stringent emission regulations, government incentives for electric commercial vehicles, and the need for efficient battery management in heavy-duty applications.

Europe Electric Vehicle Battery Management System Market Product Innovations

Recent innovations in EV BMS include the integration of artificial intelligence (AI) for predictive maintenance and optimized energy management, improved thermal management systems to enhance battery life and safety, and the use of advanced communication protocols for seamless data exchange. These innovations are enabling greater efficiency, longer battery lifespan, and enhanced safety features, thereby increasing the overall appeal and adoption rate of electric vehicles. Unique selling propositions focus on improved accuracy in state-of-charge (SOC) estimation, enhanced diagnostics capabilities, and minimized system weight and size.

Propelling Factors for Europe Electric Vehicle Battery Management System Market Growth

The growth of the European EV BMS market is significantly propelled by several factors: stringent government regulations aimed at reducing carbon emissions, increasing investments in research and development of advanced battery technologies, growing consumer demand for electric vehicles, and the development of robust charging infrastructure across Europe. The expansion of the EV charging network directly impacts battery management system demand, as more efficient charging processes become necessary. Furthermore, the decreasing cost of battery production makes EVs more accessible, driving the need for efficient BMS to manage the battery's performance optimally.

Obstacles in the Europe Electric Vehicle Battery Management System Market Market

Challenges hindering market growth include supply chain disruptions affecting the availability of critical raw materials for battery production, intense competition among established and emerging players, and the high cost of developing and implementing advanced BMS technologies. Regulatory uncertainties and evolving standards can also pose significant hurdles for manufacturers. The impact of supply chain disruptions is estimated to have reduced market growth by approximately xx% in 2022.

Future Opportunities in Europe Electric Vehicle Battery Management System Market

Future opportunities lie in the development of advanced BMS for next-generation battery chemistries, such as solid-state batteries, integration with vehicle-to-grid (V2G) technology, and the expansion into new markets such as electric buses and commercial vehicles. The increasing adoption of connected car technologies also presents opportunities for integrating BMS with other vehicle systems for enhanced functionality and data analysis. Growth in the use of electric two-wheelers and three-wheelers also presents a significant opportunity.

Major Players in the Europe Electric Vehicle Battery Management System Market Ecosystem

- Denso Corporation

- Lithium Balance

- LG Chem Ltd

- Calsonic Kansei Corporation

- Mitsubishi Electric Corporation

- Continental AG

- Hitachi Automotive Systems Ltd

- Robert Bosch GmbH

- Panasonic Corporation

- Preh Gmb

Key Developments in Europe Electric Vehicle Battery Management System Market Industry

- May 2023: Bramble Energy partnered with Equipmake, Aeristech, and the University of Cranfield to develop a hydrogen double-deck bus with a cutting-edge battery management system. This signifies growing collaboration in the development of advanced BMS for alternative fuel vehicles.

- March 2023: Airways expanded its European Tech Center in Munich, focusing on optimizing load management for 12V onboard batteries and catering to the growing demand for advanced BMS. This highlights the increasing focus on optimizing battery management across various vehicle applications.

- March 2023: Designwerk Technologies AG launched a new generation of batteries for commercial vehicles equipped with a specially developed BMS. This showcases the increasing importance of BMS in heavy-duty electric vehicle applications.

Strategic Europe Electric Vehicle Battery Management System Market Market Forecast

The European EV BMS market is poised for robust growth over the next decade, driven by the accelerating adoption of electric vehicles, supportive government policies, and continuous advancements in battery and BMS technologies. Opportunities abound in developing advanced BMS solutions for next-generation batteries and integrating them with smart grid technologies. The market's potential is substantial, promising significant returns for companies that can innovate and adapt to the changing landscape.

Europe Electric Vehicle Battery Management System Market Segmentation

-

1. Propulsion Type

- 1.1. Plug-in Hybrid Electric Vehicle

- 1.2. Battery Electric Vehicle

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Europe Electric Vehicle Battery Management System Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Norway

- 6. Rest of Europe

Europe Electric Vehicle Battery Management System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 30.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Passenger Cars Segment is Driving the Demand for Battery Management Systems; Others

- 3.3. Market Restrains

- 3.3.1. Disturbances in Supply Chain4.2.2

- 3.4. Market Trends

- 3.4.1. The Passenger Cars Segment is Driving the Demand for Battery Management Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Plug-in Hybrid Electric Vehicle

- 5.1.2. Battery Electric Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Norway

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. United Kingdom Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Plug-in Hybrid Electric Vehicle

- 6.1.2. Battery Electric Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. Germany Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Plug-in Hybrid Electric Vehicle

- 7.1.2. Battery Electric Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. France Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Plug-in Hybrid Electric Vehicle

- 8.1.2. Battery Electric Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Italy Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Plug-in Hybrid Electric Vehicle

- 9.1.2. Battery Electric Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Norway Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Plug-in Hybrid Electric Vehicle

- 10.1.2. Battery Electric Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger Cars

- 10.2.2. Commercial Vehicle

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Rest of Europe Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11.1.1. Plug-in Hybrid Electric Vehicle

- 11.1.2. Battery Electric Vehicle

- 11.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.2.1. Passenger Cars

- 11.2.2. Commercial Vehicle

- 11.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 12. Germany Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Electric Vehicle Battery Management System Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Denso Corporation

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Lithium Balance

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 LG Chem Ltd

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Calsonic Kansei Corporation

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Mitsubishi Electric Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Continental AG

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Hitachi Automotive Systems Ltd

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Robert Bosch GmbH

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Panasonic Corporation

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Preh Gmb

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Denso Corporation

List of Figures

- Figure 1: Europe Electric Vehicle Battery Management System Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Vehicle Battery Management System Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Electric Vehicle Battery Management System Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 14: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 17: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 18: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 20: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 21: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 23: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 24: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 26: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 29: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 30: Europe Electric Vehicle Battery Management System Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Vehicle Battery Management System Market?

The projected CAGR is approximately > 30.00%.

2. Which companies are prominent players in the Europe Electric Vehicle Battery Management System Market?

Key companies in the market include Denso Corporation, Lithium Balance, LG Chem Ltd, Calsonic Kansei Corporation, Mitsubishi Electric Corporation, Continental AG, Hitachi Automotive Systems Ltd, Robert Bosch GmbH, Panasonic Corporation, Preh Gmb.

3. What are the main segments of the Europe Electric Vehicle Battery Management System Market?

The market segments include Propulsion Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Passenger Cars Segment is Driving the Demand for Battery Management Systems; Others.

6. What are the notable trends driving market growth?

The Passenger Cars Segment is Driving the Demand for Battery Management Systems.

7. Are there any restraints impacting market growth?

Disturbances in Supply Chain4.2.2.

8. Can you provide examples of recent developments in the market?

May 2023: Bramble Energy partnered with Equipmake, Aerstech, and the University of Cranfield to collaboratively develop an innovative hydrogen double-deck bus. The project will leverage the expertise of each entity: Aeristech will provide its high-efficiency air compressor, and Equipmake will contribute to motor power electronics and a cutting-edge battery management system. The University of Bath will optimize the powertrain through advanced vehicle simulations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Vehicle Battery Management System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Vehicle Battery Management System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Vehicle Battery Management System Market?

To stay informed about further developments, trends, and reports in the Europe Electric Vehicle Battery Management System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence