Key Insights

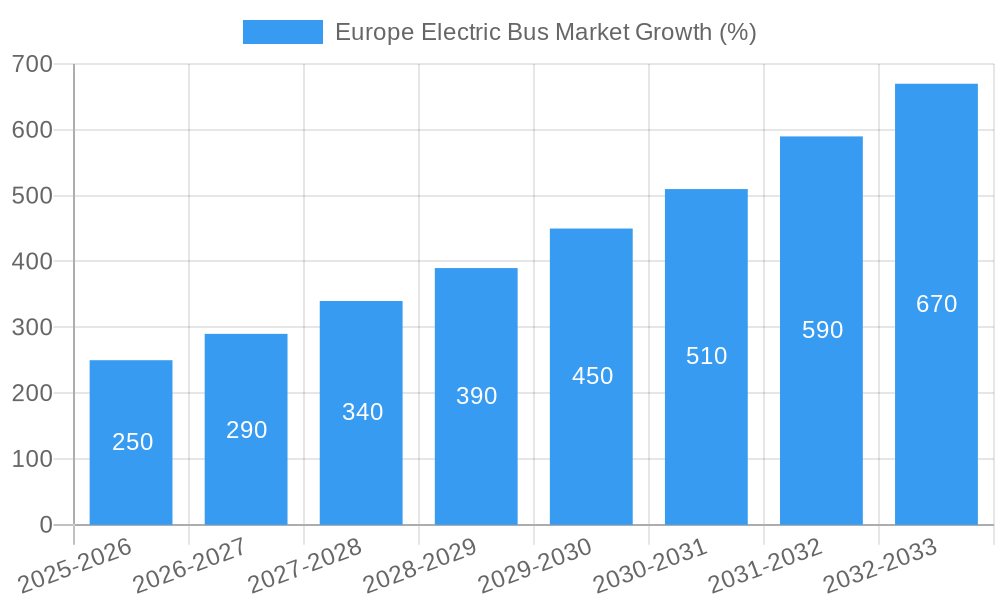

The European electric bus market is experiencing robust growth, projected to reach €1.76 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.56% from 2025 to 2033. This expansion is driven by several key factors. Stringent emission regulations across major European nations are compelling public transportation systems to adopt cleaner alternatives, making electric buses a necessity rather than a choice. Furthermore, substantial government subsidies and incentives are significantly reducing the upfront cost of electric bus adoption, making them economically viable for both government entities and private fleet operators. Technological advancements, including improved battery technology (like Lithium-ion) leading to longer ranges and faster charging times, are also fueling market growth. The increasing focus on sustainable transportation and reducing carbon footprints within cities further strengthens the market's positive trajectory. Germany, the United Kingdom, France, and other key European countries are leading the charge in electric bus deployment, though significant opportunities remain in smaller nations. Competition is intense, with established players like Mercedes-Benz, Volvo, and BYD alongside specialized electric bus manufacturers like EBUSCO and Solaris vying for market share. The market segmentation by propulsion type (battery electric, plug-in hybrid, fuel cell) reflects the diverse technological approaches and caters to varying operational needs.

The market's continued growth will be influenced by several factors. The successful integration of charging infrastructure, crucial for efficient fleet management, will be paramount. Furthermore, fluctuations in raw material prices impacting battery costs could potentially influence adoption rates. However, ongoing technological improvements are expected to mitigate these challenges. The expansion of electric bus routes within urban areas and the exploration of innovative business models, including bus-as-a-service (BaaS) initiatives, will play a significant role in shaping the market’s future. The increasing demand for enhanced passenger comfort and safety features will also influence design and technological innovations. Finally, the broader shift towards sustainable urban mobility solutions across Europe is a crucial tailwind that is expected to drive sustained growth in the coming years.

Europe Electric Bus Market Market Composition & Trends

The Europe Electric Bus Market is characterized by a mix of established manufacturers and emerging innovators, resulting in a moderately concentrated market. Key players such as EBUSCO, Solaris Bus & Coach sp z o o, and IVECO Group hold significant market shares, with EBUSCO and Solaris commanding around 15% each, while IVECO holds approximately 10%. Innovation is driven by stringent EU regulations aimed at reducing emissions, which have spurred advancements in battery technology and alternative propulsion systems. The regulatory landscape is supportive, with initiatives like the Clean Vehicles Directive encouraging the adoption of electric buses. Substitute products, such as diesel and CNG buses, are gradually being phased out due to environmental concerns.

- Market Share Distribution: EBUSCO and Solaris Bus & Coach sp z o o each have about 15%, IVECO Group at 10%.

- Innovation Catalysts: EU emissions regulations, advancements in battery technology.

- Regulatory Landscape: Clean Vehicles Directive, incentives for electric bus adoption.

- Substitute Products: Diesel and CNG buses are being replaced by electric alternatives.

- End-User Profiles: Predominantly government and fleet operators seeking sustainable transport solutions.

- M&A Activities: Notable deals include Traton Group's acquisition of Navistar for xx Million, enhancing its electric bus portfolio.

The market's dynamic nature is evident in the continuous M&A activities, which are aimed at consolidating technological capabilities and expanding market presence. These trends indicate a robust growth trajectory for the Europe Electric Bus Market, supported by a favorable regulatory environment and a strong push towards sustainability.

Europe Electric Bus Market Industry Evolution

The Europe Electric Bus Market has experienced significant growth over the past decade, driven by technological advancements and increasing consumer demand for sustainable transportation solutions. From 2019 to 2024, the market grew at a CAGR of approximately 20%, with projections indicating a continued rise at a CAGR of 15% from 2025 to 2033. The adoption of electric buses has been particularly pronounced in countries like Germany and the Netherlands, where government incentives and infrastructure development have facilitated rapid deployment.

Technological advancements have played a crucial role in this evolution. Innovations in battery technology, particularly lithium-ion batteries, have increased the range and efficiency of electric buses, making them more viable for urban and intercity transport. The development of fast-charging infrastructure has further supported the widespread adoption of these vehicles. Additionally, the introduction of fuel cell electric buses, powered by hydrogen, presents a promising alternative for zero-emission public transport.

Consumer demand has shifted towards eco-friendly solutions, driven by heightened environmental awareness and government policies promoting clean transportation. In 2025, it is estimated that over 50% of new bus procurements in major European cities will be electric, reflecting a significant shift in consumer preferences. The integration of smart technologies, such as IoT for real-time monitoring and route optimization, has also enhanced the appeal of electric buses to both operators and passengers.

Overall, the Europe Electric Bus Market's evolution is marked by a confluence of technological innovation, regulatory support, and changing consumer demands, setting the stage for continued growth and transformation in the sector.

Leading Regions, Countries, or Segments in Europe Electric Bus Market

The Europe Electric Bus Market showcases varied dominance across different segments and regions, with key drivers such as investment trends, regulatory support, and technological advancements playing pivotal roles.

By Propulsion Type: Battery Electric Buses (BEBs) lead the market, driven by their efficiency and the extensive charging infrastructure across Europe. BEBs accounted for over 60% of the market share in 2025, with a projected increase to 70% by 2033 due to continuous improvements in battery technology and cost reductions.

By Battery Type: Lithium-ion batteries dominate, holding over 80% of the market share in 2025. Their high energy density and decreasing costs make them the preferred choice for electric bus manufacturers.

By Consumer Type: Government procurement is a significant driver, with public transport authorities in major cities investing heavily in electric fleets to meet emission reduction targets. Fleet operators are also increasingly adopting electric buses, driven by economic incentives and operational savings.

By Country: Germany stands out as a leader, with a robust market supported by strong government policies and investments. In 2025, Germany's electric bus market was valued at approximately 1,500 Million, with a projected growth to 3,000 Million by 2033. The Netherlands and Norway follow closely, benefiting from favorable regulations and high public awareness of environmental issues.

Germany's Dominance: Germany's leadership in the electric bus market can be attributed to several factors. The country has implemented stringent emissions regulations, which have accelerated the transition to electric vehicles. Additionally, significant investments in charging infrastructure and government incentives for electric bus procurement have created a conducive environment for market growth. The presence of major manufacturers like VDL Bus & Coach BV and Mercedes-Benz Group AG further bolsters the market, as these companies continue to innovate and expand their electric bus offerings.

Netherlands and Norway: Both countries have set ambitious targets for reducing carbon emissions, leading to high adoption rates of electric buses. The Netherlands, in particular, benefits from a well-developed public transport system and supportive government policies, while Norway's focus on sustainable transport has resulted in a significant market for electric buses, especially in urban areas.

Overall, the Europe Electric Bus Market's leadership in various segments and regions is driven by a combination of technological advancements, regulatory frameworks, and consumer trends, positioning these areas for sustained growth and innovation.

Europe Electric Bus Market Product Innovations

The Europe Electric Bus Market has seen significant product innovations that enhance performance and sustainability. Key developments include advanced battery systems that offer longer ranges and faster charging times, as well as the integration of smart technologies for improved operational efficiency. For instance, the introduction of lithium-ion batteries with higher energy density has revolutionized the market, allowing electric buses to travel further on a single charge. Additionally, the adoption of fuel cell technology, powered by hydrogen, presents a promising zero-emission alternative. These innovations are complemented by unique selling propositions such as silent operation and reduced maintenance costs, making electric buses increasingly attractive to both operators and passengers.

Propelling Factors for Europe Electric Bus Market Growth

Several key factors are driving the growth of the Europe Electric Bus Market:

- Technological Advancements: Innovations in battery technology and hydrogen fuel cells are enhancing the range and efficiency of electric buses.

- Economic Incentives: Government subsidies and incentives for electric bus procurement are making these vehicles more affordable for operators.

- Regulatory Support: Stringent emissions regulations and initiatives like the Clean Vehicles Directive are accelerating the transition to electric buses.

- Environmental Awareness: Increasing public demand for sustainable transportation solutions is pushing operators to adopt electric buses.

These factors collectively create a favorable environment for the expansion of the electric bus market in Europe.

Obstacles in the Europe Electric Bus Market Market

Despite the promising growth, the Europe Electric Bus Market faces several obstacles:

- Regulatory Challenges: Compliance with varying regional regulations can be complex and costly for manufacturers.

- Supply Chain Disruptions: The global supply chain issues, particularly in battery production, can delay the rollout of new electric buses.

- Competitive Pressures: The market is becoming increasingly competitive, with new entrants and established players vying for market share, which can lead to price wars and reduced profit margins.

These challenges necessitate strategic planning and innovation to overcome and sustain market growth.

Future Opportunities in Europe Electric Bus Market

The Europe Electric Bus Market presents several future opportunities:

- New Markets: Emerging markets within Eastern Europe offer untapped potential for electric bus adoption.

- Technological Advancements: Continued advancements in battery and fuel cell technologies will further enhance the appeal of electric buses.

- Consumer Trends: A growing preference for sustainable transport solutions among consumers will drive demand for electric buses.

These opportunities highlight the potential for continued expansion and innovation in the electric bus market.

Major Players in the Europe Electric Bus Market Ecosystem

- EBUSCO

- Solaris Bus & Coach sp z o o

- IVECO Group

- Van Hool*List Not Exhaustive

- Traton Group

- VDL Bus & Coach BV

- Otokar Otomotiv Ve Savunma Sanayi AS

- BYD Auto Co Ltd

- Mercedes-Benz Group AG

- AB Volvo

Key Developments in Europe Electric Bus Market Industry

- June 2022: Van Hool introduced a new range of zero-emission public buses, the A-Series, at the European Mobility Expo in Paris. The A-series features options of battery-electric and fuel cell (hydrogen) powertrains, with four different lengths (12m, 13m, 18m, and 24m), each having two to five passenger doors. This launch significantly expands Van Hool's portfolio and supports the shift towards zero-emission public transport.

- April 2022: Switch Mobility showcased its new Metrocity electric bus at BUS2BUS in Berlin. Later in June 2022, the company launched its new 12-meter bus at the European Mobility Expo in Paris, enhancing its offerings and market presence.

- August 2021: Alexander Dennis Limited (ADL), a subsidiary of NFI Group Inc. (NFI), was selected by the Liverpool City Region Combined Authority to supply 20 zero-emission hydrogen double-deck buses. These buses will serve the City Region's busiest route, the 10A between St Helens and Liverpool city Centre, aligning with Liverpool's goal to become net-zero carbon emission by 2040.

- July 2021: Toyota and Caetano Bus announced the co-branding of the battery-electric city bus, the e-City Gold, and the fuel cell electric bus, the H2.City Gold. This collaboration enhances the market presence of both companies and promotes the adoption of electric and hydrogen buses.

Strategic Europe Electric Bus Market Market Forecast

The Europe Electric Bus Market is poised for robust growth over the forecast period from 2025 to 2033, driven by technological advancements, supportive regulatory frameworks, and increasing consumer demand for sustainable transportation. The market is expected to expand at a CAGR of 15%, reaching a value of approximately 10,000 Million by 2033. Key growth catalysts include the continued development of battery and hydrogen fuel cell technologies, which will enhance the efficiency and range of electric buses. Additionally, government incentives and initiatives aimed at reducing carbon emissions will further propel market growth. The integration of smart technologies for fleet management and passenger experience will also contribute to the market's expansion, presenting significant opportunities for manufacturers and operators alike.

Europe Electric Bus Market Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Bus

- 1.2. Plug-in Hybrid Electric Bus

- 1.3. Fuel Cell Electric Bus

-

2. Battery Type

- 2.1. Lithium-ion

- 2.2. Nickel-Metal Hydride Battery (NiMH),

- 2.3. Others

-

3. Consumer Type

- 3.1. Government

- 3.2. Fleet Operators

Europe Electric Bus Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Transitions Of Urban Bus Fleet To Electric Power

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Bus

- 5.1.2. Plug-in Hybrid Electric Bus

- 5.1.3. Fuel Cell Electric Bus

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lithium-ion

- 5.2.2. Nickel-Metal Hydride Battery (NiMH),

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Consumer Type

- 5.3.1. Government

- 5.3.2. Fleet Operators

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Germany Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 EBUSCO

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Solaris Bus & Coach sp z o o

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IVECO Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Van Hool*List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Traton Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 VDL Bus & Coach BV

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Otokar Otomotiv Ve Savunma Sanayi AS

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BYD Auto Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mercedes-Benz Group AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 AB Volvo

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 EBUSCO

List of Figures

- Figure 1: Europe Electric Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Bus Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Europe Electric Bus Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: Europe Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 5: Europe Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 15: Europe Electric Bus Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 16: Europe Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 17: Europe Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Bus Market?

The projected CAGR is approximately 14.56%.

2. Which companies are prominent players in the Europe Electric Bus Market?

Key companies in the market include EBUSCO, Solaris Bus & Coach sp z o o, IVECO Group, Van Hool*List Not Exhaustive, Traton Group, VDL Bus & Coach BV, Otokar Otomotiv Ve Savunma Sanayi AS, BYD Auto Co Ltd, Mercedes-Benz Group AG, AB Volvo.

3. What are the main segments of the Europe Electric Bus Market?

The market segments include Propulsion Type, Battery Type, Consumer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Rising Transitions Of Urban Bus Fleet To Electric Power.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

In June 2022, Van Hool Introduced a new range of zero-emission public buses A-Series, at the European Mobility Expo in Paris. The A-series of zero-emission buses will feature options of a battery-electric and fuel cell (hydrogen) powertrain. There will also be four different lengths (12m, 13m, 18m, and 24m), each having two to five passenger doors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Bus Market?

To stay informed about further developments, trends, and reports in the Europe Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence