Key Insights

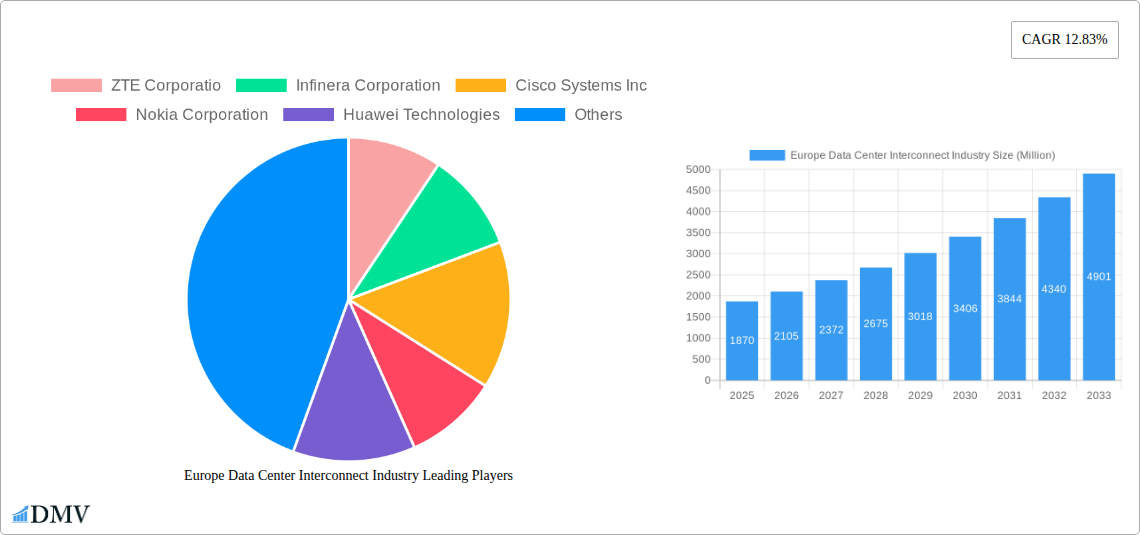

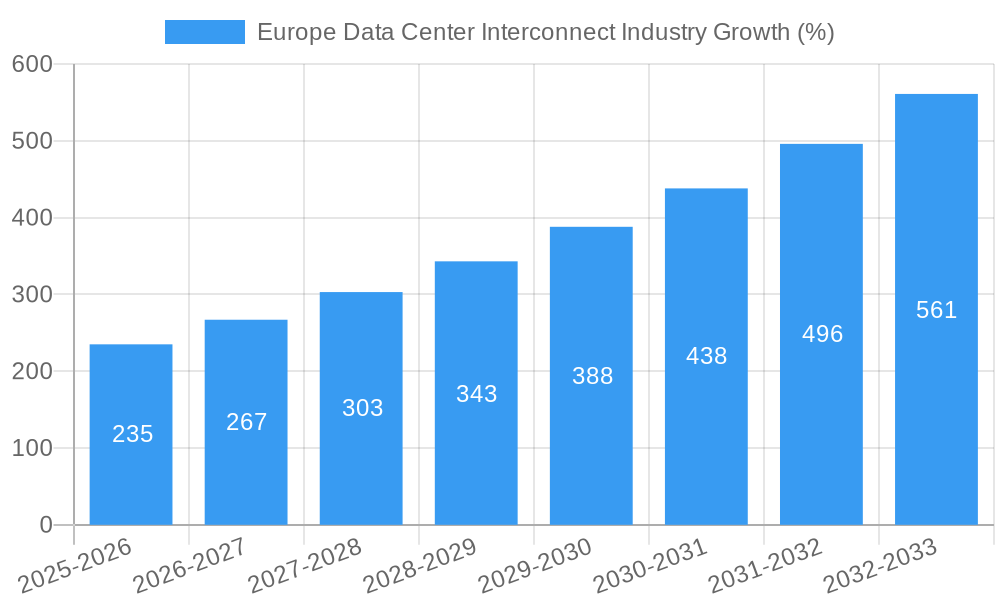

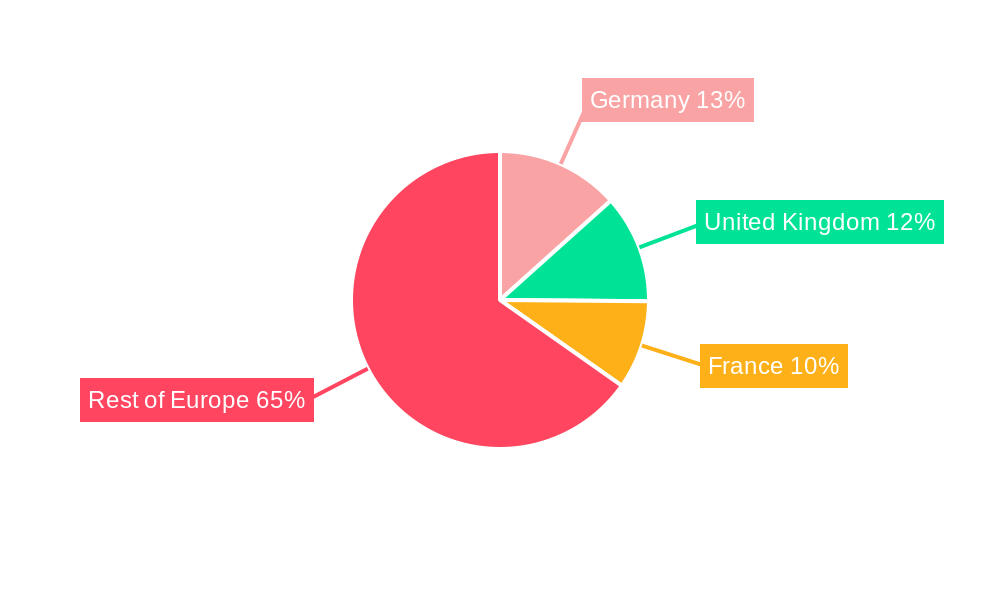

The European Data Center Interconnect (DCI) market, valued at €1.87 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.83% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing and the burgeoning demand for high-bandwidth, low-latency connectivity are fueling the need for robust DCI solutions. Furthermore, the rise of 5G networks and the expanding Internet of Things (IoT) ecosystem are creating significant opportunities for market players. Germany, the United Kingdom, and France represent the largest national markets within Europe, benefiting from established digital infrastructure and substantial investments in data center capacity. However, the market also faces challenges, including the high cost of deploying and maintaining DCI infrastructure, as well as the complexities of navigating diverse regulatory landscapes across different European nations. The competitive landscape is characterized by a mix of established telecommunications giants like Cisco, Nokia, and Huawei, alongside specialized DCI providers such as Ciena and Infinera. These companies are actively investing in advanced technologies, including optical networking solutions and software-defined networking (SDN), to enhance network performance and efficiency.

Looking ahead, the European DCI market is expected to witness sustained growth, driven by increasing digital transformation initiatives across various sectors. The continued expansion of hyperscale data centers and the growing adoption of edge computing are further contributing to the market's upward trajectory. However, potential restraints include the need for substantial investment in fiber optic infrastructure to support the rising bandwidth demands and the ongoing competition among providers, leading to price pressure. The market's future success hinges on the ability of companies to innovate and adapt to the evolving technological landscape, addressing the need for greater agility, scalability, and security in DCI solutions. Strategic partnerships and mergers and acquisitions are likely to play a significant role in shaping the competitive dynamics and accelerating market consolidation.

Europe Data Center Interconnect Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Data Center Interconnect industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report unveils crucial market trends, technological advancements, and competitive landscapes. The analysis covers key segments including Germany, United Kingdom, France, Ireland, Spain, and the Rest of Europe, offering granular data for strategic decision-making. Expect detailed breakdowns of market size (in Millions), growth rates, and competitive dynamics, empowering you to capitalize on emerging opportunities and mitigate potential risks.

Europe Data Center Interconnect Industry Market Composition & Trends

This section delves into the intricate composition of the European Data Center Interconnect market, examining its concentration levels, innovative drivers, regulatory frameworks, substitute products, and end-user profiles. We explore the landscape of mergers and acquisitions (M&A), analyzing deal values and their influence on market share distribution. The analysis reveals a dynamic market characterized by ongoing consolidation and technological innovation.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. xx% of the market is held by the top five players. Further concentration is expected through M&A activity.

- Innovation Catalysts: The increasing demand for high-bandwidth, low-latency connectivity fuels innovation in areas such as 5G deployment, Software-Defined Networking (SDN), and Network Function Virtualization (NFV).

- Regulatory Landscape: EU regulations concerning data privacy (GDPR) and network neutrality significantly shape the industry's practices and investment strategies. Compliance costs are a significant factor for many operators.

- Substitute Products: While direct substitutes are limited, alternative solutions such as private networks and satellite communication pose indirect competition, particularly for niche applications.

- End-User Profiles: Major end users include cloud service providers, telecommunication companies, content delivery networks (CDNs), and large enterprises with substantial data processing needs.

- M&A Activities: The historical period (2019-2024) witnessed xx Million in M&A deals, with an anticipated xx Million in deals during the forecast period (2025-2033). These deals are driven by consolidation efforts, expansion into new markets, and access to advanced technologies.

Europe Data Center Interconnect Industry Industry Evolution

This section provides a comprehensive overview of the Europe Data Center Interconnect industry's evolution, analyzing market growth trajectories, technological advancements, and the shifting demands of consumers and businesses. The report draws on extensive data analysis and industry insights to project future trends.

The European Data Center Interconnect market experienced significant growth during the historical period (2019-2024), achieving a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to the increasing adoption of cloud computing, the expansion of 5G networks, and the rising demand for high-bandwidth connectivity across various sectors. The forecast period (2025-2033) is projected to witness a CAGR of xx%, driven by factors such as the rise of edge computing, the growth of the Internet of Things (IoT), and the increasing reliance on digital services. Technological advancements, such as the adoption of 400G and 800G technologies, are further accelerating market growth.

Leading Regions, Countries, or Segments in Europe Data Center Interconnect Industry

Germany, the United Kingdom, and France are the leading markets within Europe. Their dominance stems from a confluence of factors, including strong digital economies, substantial investments in data center infrastructure, and supportive regulatory environments.

- Key Drivers for Germany: Robust digital infrastructure, presence of major hyperscale data centers, strong government support for digital initiatives.

- Key Drivers for United Kingdom: Significant investment in data center facilities, a mature telecommunications industry, and a substantial pool of skilled labor.

- Key Drivers for France: Growing cloud adoption, governmental focus on digital transformation, and the presence of several large telecommunication operators.

While Germany, the UK, and France currently lead, other countries in Europe are witnessing considerable growth. Spain, for instance, is benefiting from increasing foreign investment and the development of new data center facilities. Ireland's strong data center cluster also contributes to the overall regional growth, driven by its attractiveness to multinational corporations and its favorable tax environment. The Rest of Europe region showcases a diverse landscape with pockets of high growth potential, particularly in countries with emerging digital economies and improving infrastructure.

Europe Data Center Interconnect Industry Product Innovations

Recent product innovations focus on increasing bandwidth, reducing latency, and improving security. This includes the development of high-capacity optical transmission systems, advanced routing protocols, and software-defined interconnection solutions. The emphasis is on scalability and flexibility to meet the evolving needs of a diverse customer base, with features like automated provisioning and network slicing gaining prominence. These advancements enhance efficiency and offer tailored solutions for different bandwidth requirements, bolstering the industry's competitive edge.

Propelling Factors for Europe Data Center Interconnect Industry Growth

Several key factors drive the growth of the Europe Data Center Interconnect industry. These include the escalating demand for cloud services and bandwidth-intensive applications, coupled with supportive government policies and investments in digital infrastructure. The expansion of 5G networks significantly contributes, enabling faster speeds and lower latencies. Furthermore, the rising adoption of edge computing necessitates more interconnected data centers closer to end-users, fueling growth in this sector.

Obstacles in the Europe Data Center Interconnect Industry Market

The industry faces significant challenges, including regulatory complexities surrounding data privacy and security, coupled with potential supply chain disruptions impacting the availability of crucial components. Intense competition among established players and new entrants adds to the pressures on margins. These factors impact investment decisions and overall market growth. Furthermore, the cost of deploying and maintaining advanced networking infrastructure represents a substantial hurdle for smaller operators.

Future Opportunities in Europe Data Center Interconnect Industry

Future opportunities lie in the expansion of edge computing, the deployment of next-generation optical networks, and the development of innovative solutions for specific industry verticals (e.g., healthcare, finance). The increasing demand for data center interconnection in remote and underserved areas presents significant untapped potential. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) for network optimization and automation offers a promising avenue for future growth.

Major Players in the Europe Data Center Interconnect Industry Ecosystem

- ZTE Corporation

- Infinera Corporation

- Cisco Systems Inc

- Nokia Corporation

- Huawei Technologies

- Ciena Corporation

Key Developments in Europe Data Center Interconnect Industry Industry

- September 2023: DE-CIX establishes a new Point of Presence (PoP) at Start Campus in Sines, Portugal, expanding its reach in Southern Europe and supporting sustainable data center development.

- May 2022: Interxion expands its Mediterranean presence with a new colocation and connectivity hub in Barcelona, strengthening its position in the Iberian Peninsula.

- May 2022: Nokia deploys its 7750 Service Routers for team.blue Denmark, enhancing the company's network infrastructure and supporting the growth of its SME customer base.

Strategic Europe Data Center Interconnect Industry Market Forecast

The Europe Data Center Interconnect market is poised for robust growth, driven by ongoing digital transformation across various sectors and the increasing adoption of cloud-based services. The continued expansion of 5G and the emergence of new technologies such as edge computing and the metaverse will fuel demand for high-bandwidth, low-latency connectivity solutions. This presents significant opportunities for both established players and new entrants. The forecast suggests a positive outlook, with substantial growth potential in various European regions and segments.

Europe Data Center Interconnect Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Data Center Interconnect Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Data Center Interconnect Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Adoption of Public Safety LTE.; Growing Demand For High Speed BroadBand In Rural Areas; Positive Outlook of Fixed LTE Compared to DSL

- 3.2.2 Fiber and Cable

- 3.3. Market Restrains

- 3.3.1. Network Performance Concerns

- 3.4. Market Trends

- 3.4.1. Ongoing Trend Toward Cloud Migration is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Data Center Interconnect Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ZTE Corporatio

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Infinera Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cisco Systems Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Nokia Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Huawei Technologies

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ciena Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 ZTE Corporatio

List of Figures

- Figure 1: Europe Data Center Interconnect Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Data Center Interconnect Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Data Center Interconnect Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Data Center Interconnect Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Data Center Interconnect Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Data Center Interconnect Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Data Center Interconnect Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Data Center Interconnect Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Data Center Interconnect Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Data Center Interconnect Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Data Center Interconnect Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Data Center Interconnect Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Data Center Interconnect Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Data Center Interconnect Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Data Center Interconnect Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Data Center Interconnect Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Data Center Interconnect Industry?

The projected CAGR is approximately 12.83%.

2. Which companies are prominent players in the Europe Data Center Interconnect Industry?

Key companies in the market include ZTE Corporatio, Infinera Corporation, Cisco Systems Inc, Nokia Corporation, Huawei Technologies, Ciena Corporation.

3. What are the main segments of the Europe Data Center Interconnect Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Public Safety LTE.; Growing Demand For High Speed BroadBand In Rural Areas; Positive Outlook of Fixed LTE Compared to DSL. Fiber and Cable.

6. What are the notable trends driving market growth?

Ongoing Trend Toward Cloud Migration is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Network Performance Concerns.

8. Can you provide examples of recent developments in the market?

September 2023: Start Campus announced that DE-CIX, an internet exchange (IX) operator, will establish a new Point of Presence (PoP) at its SINES Project in SINES, Portugal. This move marked DE-CIX's expansion in the internet exchange market in southern Europe. Situated around 120 km from Lisbon, Portugal, Start Campus's sustainable data center campus will be the location for DE-CIX Lisbon's future access point. It is expected to enable direct connectivity to other DE-CIX IXs in Southern Europe, including Madrid, Barcelona, and Marseille. The data center campus is powered by 24x7 renewable energy facilities, emphasizing its commitment to sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Data Center Interconnect Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Data Center Interconnect Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Data Center Interconnect Industry?

To stay informed about further developments, trends, and reports in the Europe Data Center Interconnect Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence