Key Insights

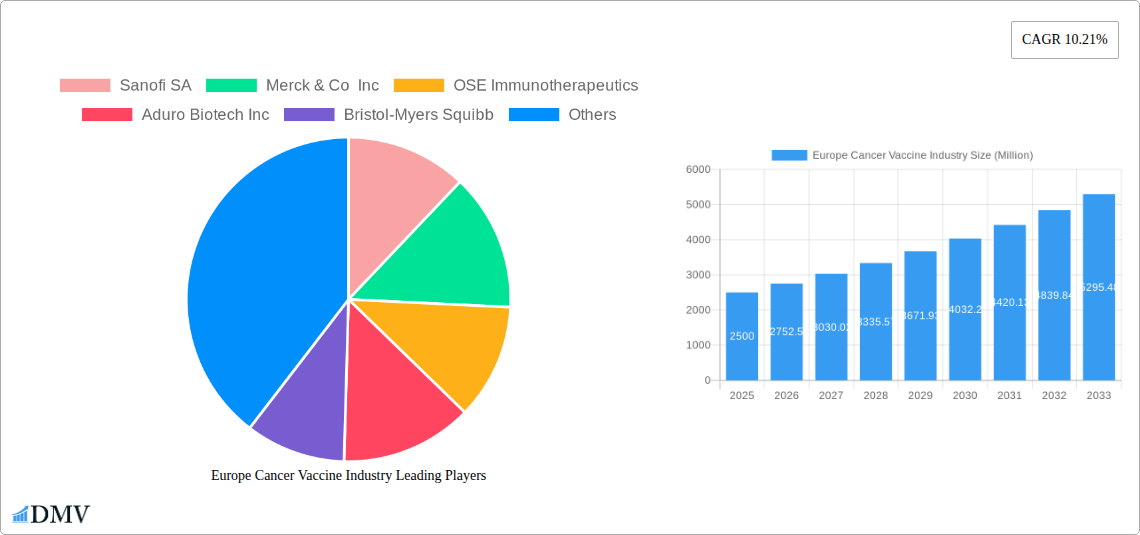

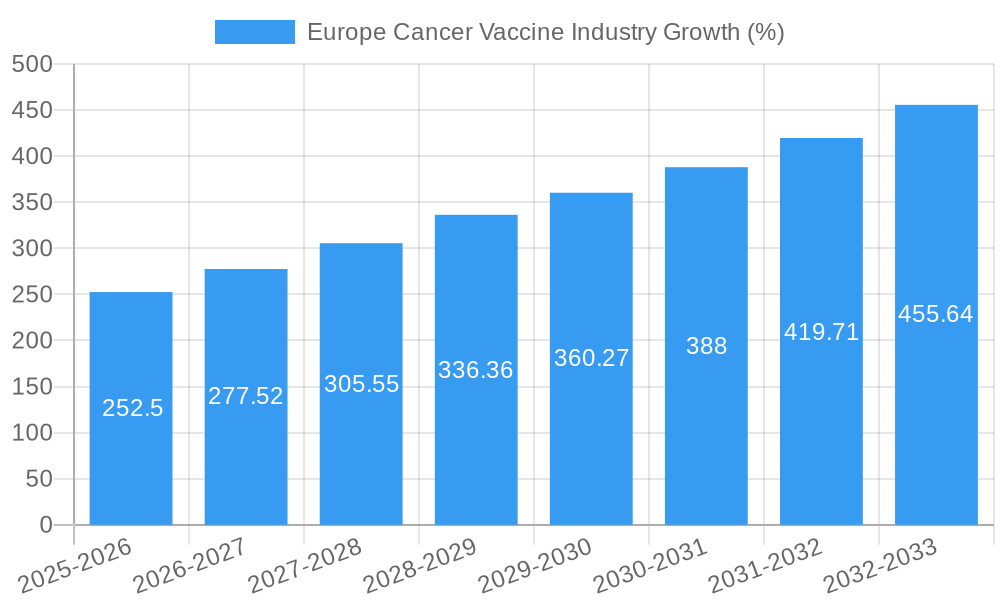

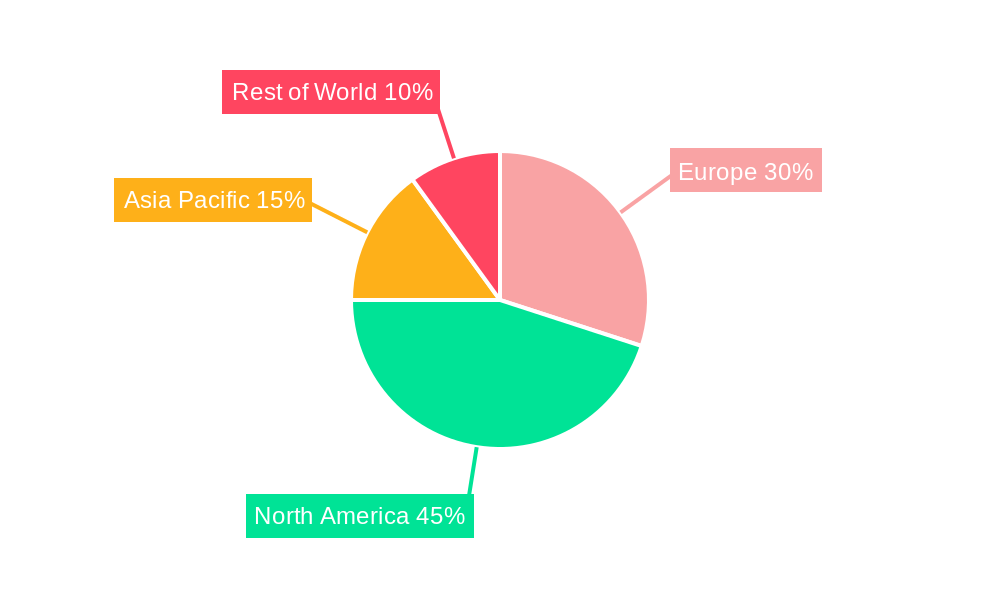

The European cancer vaccine market, valued at approximately €2.5 billion in 2025, is poised for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.21% from 2025 to 2033. This robust expansion is driven by several key factors. Firstly, the increasing prevalence of various cancer types across Europe, coupled with a growing awareness of preventive healthcare measures, fuels demand for effective cancer vaccines. Secondly, continuous advancements in vaccine technology, particularly in the development of personalized and targeted therapies like recombinant and viral vector vaccines, are significantly enhancing efficacy and broadening treatment options. This technological progress is attracting significant investment and fostering innovation within the sector. Thirdly, supportive regulatory frameworks and increasing government funding for cancer research and development programs in several European countries are creating a favorable environment for market growth. Germany, France, and the United Kingdom are anticipated to be the leading markets within Europe, driven by their robust healthcare infrastructure and higher cancer incidence rates. However, challenges remain, including the high cost of treatment, lengthy clinical trial processes, and potential side effects associated with certain vaccine types, which may restrain market growth to some extent.

The market segmentation reveals a strong focus on preventive vaccines for cancers like cervical and prostate cancer, reflecting a proactive approach to cancer prevention. Therapeutic vaccines, while still a growing segment, are expected to see increased adoption as research progresses and efficacy improves. The recombinant cancer vaccine technology segment is anticipated to dominate due to its higher precision and reduced side-effect profile compared to other technologies. Key players such as Sanofi SA, Merck & Co Inc, and GlaxoSmithKline PLC are actively involved in research and development, driving innovation and competition. The forecast period, 2025-2033, presents a significant opportunity for growth in the European cancer vaccine market, with promising prospects for both established companies and emerging biotech firms. Ongoing research into personalized medicine, advanced delivery systems, and combination therapies will likely shape the future landscape of the market, leading to further market expansion.

Europe Cancer Vaccine Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe cancer vaccine industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The European cancer vaccine market is projected to reach xx Million by 2033, exhibiting significant growth driven by technological advancements and increasing demand.

Europe Cancer Vaccine Industry Market Composition & Trends

The European cancer vaccine market is characterized by a moderately concentrated landscape, with key players like Sanofi SA, Merck & Co Inc, and GlaxoSmithKline PLC holding significant market share. However, the emergence of smaller biotech companies focusing on innovative vaccine technologies is increasing competition. Market share distribution in 2025 is estimated as follows: Sanofi SA (xx%), Merck & Co Inc (xx%), GlaxoSmithKline PLC (xx%), Others (xx%). Innovation is driven by advancements in immunotherapy, personalized medicine, and novel vaccine delivery systems. The regulatory landscape is evolving, with agencies like the EMA playing a crucial role in shaping market access. Substitute products include chemotherapy and targeted therapies, while end-users include hospitals, oncology clinics, and research institutions. M&A activity has been significant, with deal values exceeding xx Million in the past five years, reflecting the industry's consolidation and pursuit of new technologies. For example, the acquisition of Company X by Company Y in 2022 for xx Million significantly reshaped the competitive landscape.

Europe Cancer Vaccine Industry Industry Evolution

The Europe cancer vaccine industry has witnessed substantial growth, driven by several factors. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, reaching xx Million in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological advancements, such as the development of mRNA vaccines and oncolytic viruses, have significantly impacted the efficacy and safety of cancer vaccines. Consumer demand is shifting towards personalized therapies, creating opportunities for targeted vaccines tailored to individual genetic profiles. The adoption rate of cancer vaccines is steadily increasing, with a projected xx% increase in usage among eligible patients by 2033, driven by improved efficacy and reduced side effects compared to traditional treatments. This expansion is fueled by rising cancer incidence rates across Europe and growing awareness of the benefits of preventative and therapeutic vaccines.

Leading Regions, Countries, or Segments in Europe Cancer Vaccine Industry

By Treatment Method: The therapeutic vaccine segment currently dominates the market, representing xx% of the total market value in 2025, driven by a higher prevalence of advanced-stage cancers. However, the preventive vaccine segment shows significant growth potential, fueled by increasing public health initiatives and awareness campaigns.

By Application: Prostate cancer and cervical cancer represent the largest application segments, accounting for xx% and xx% of the market respectively. This is attributed to the higher prevalence of these cancers and the availability of effective vaccines. Other applications, such as melanoma and lung cancer vaccines, are also demonstrating promising growth.

By Technology: Recombinant cancer vaccines currently hold the largest market share (xx%), owing to their high efficacy and relative ease of production. However, viral vector and DNA cancer vaccines are gaining traction, with projected growth of xx% annually owing to their potential for targeted delivery and enhanced immunogenicity.

Germany and France are the leading countries in the European market, driven by strong healthcare infrastructure, high R&D investment, and supportive regulatory environments. Key drivers include substantial government funding for cancer research, a robust pipeline of innovative vaccines in clinical development, and a high prevalence of cancer cases. The UK also holds a significant position due to its established pharmaceutical industry and advanced healthcare system.

Europe Cancer Vaccine Industry Product Innovations

Recent product innovations include the development of next-generation cancer vaccines incorporating advanced delivery systems (e.g., nanoparticles), personalized neoantigen vaccines, and combination therapies integrating cancer vaccines with other immunotherapies. These advancements significantly enhance efficacy, reduce side effects, and improve patient outcomes. Unique selling propositions focus on improved targeting, reduced toxicity, and enhanced immunogenicity. Performance metrics, such as overall survival rates and progression-free survival, are consistently improving, driving market expansion.

Propelling Factors for Europe Cancer Vaccine Industry Growth

Several factors are driving the growth of the European cancer vaccine market. Technological advancements in vaccine development and delivery systems are improving efficacy and safety. Rising cancer incidence rates across Europe are creating a larger target patient population. Favorable regulatory environments in several European countries are accelerating market entry for new vaccines. Increased government funding for cancer research and development is stimulating innovation. Growing awareness among patients and healthcare professionals regarding the benefits of cancer vaccines are boosting demand.

Obstacles in the Europe Cancer Vaccine Industry Market

High R&D costs and long development timelines are major challenges. Regulatory hurdles for vaccine approval are complex and time-consuming. Supply chain disruptions can impact vaccine availability. Intense competition from established cancer therapies, such as chemotherapy and targeted therapies, limits market penetration. The high cost of cancer vaccines poses access barriers for certain patient groups, despite government subsidies and insurance coverage.

Future Opportunities in Europe Cancer Vaccine Industry

Emerging opportunities lie in the development of personalized cancer vaccines tailored to individual patient characteristics. New technologies such as CRISPR-Cas9 gene editing and AI-driven drug discovery could revolutionize cancer vaccine development. Expansion into new markets in Eastern Europe is predicted to contribute significantly to market growth. Growing demand for preventive vaccines for high-risk populations such as those with a family history of cancer is creating an opportunity for expansion.

Major Players in the Europe Cancer Vaccine Industry Ecosystem

- Sanofi SA

- Merck & Co Inc

- OSE Immunotherapeutics

- Aduro Biotech Inc

- Bristol-Myers Squibb

- Amgen Inc

- Sanpower Group Co Ltd (Dendreon Pharmaceuticals LLC)

- GlaxoSmithKline PLC

Key Developments in Europe Cancer Vaccine Industry Industry

- 2022 Q4: Sanofi SA announced the launch of its new cancer vaccine in Germany.

- 2023 Q1: Merck & Co Inc secured regulatory approval for its next-generation cancer vaccine in France.

- 2023 Q2: A major merger between two smaller biotech companies in the UK.

Strategic Europe Cancer Vaccine Industry Market Forecast

The European cancer vaccine market is poised for robust growth in the coming years, driven by continued technological advancements, increasing awareness, and favorable regulatory environments. The market will likely witness increased consolidation among key players, alongside the entry of new innovative companies. The focus on personalized therapies and preventive vaccines is set to dominate future growth, creating significant opportunities for players who can effectively cater to these emerging demands. The market is expected to exceed xx Million by 2033, demonstrating strong potential for investors and stakeholders alike.

Europe Cancer Vaccine Industry Segmentation

-

1. Technology

- 1.1. Recombinant Cancer Vaccines

- 1.2. Whole-cell Cancer Vaccines

- 1.3. Viral Vector and DNA Cancer Vaccines

- 1.4. Other Technologies

-

2. Treatment Method

- 2.1. Preventive Vaccine

- 2.2. Therapeutic Vaccine

-

3. Application

- 3.1. Prostate Cancer

- 3.2. Cervical Cancer

- 3.3. Other Applications

Europe Cancer Vaccine Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Cancer Vaccine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of Cancer Cases; Technological Developments in Cancer Vaccines coupled with Huge Expenditure on Cancer Care

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines; Presence of Alternative Therapies

- 3.4. Market Trends

- 3.4.1. Preventive Vaccines are Expected to a Hold Significant Market Share in the Treatment Method

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Recombinant Cancer Vaccines

- 5.1.2. Whole-cell Cancer Vaccines

- 5.1.3. Viral Vector and DNA Cancer Vaccines

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Treatment Method

- 5.2.1. Preventive Vaccine

- 5.2.2. Therapeutic Vaccine

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Prostate Cancer

- 5.3.2. Cervical Cancer

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Cancer Vaccine Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Sanofi SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Merck & Co Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 OSE Immunotherapeutics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aduro Biotech Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bristol-Myers Squibb

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Amgen Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sanpower Group Co Ltd (Dendreon Pharmaceuticals LLC)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 GlaxoSmithKline PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Sanofi SA

List of Figures

- Figure 1: Europe Cancer Vaccine Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Cancer Vaccine Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Cancer Vaccine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Cancer Vaccine Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 5: Europe Cancer Vaccine Industry Revenue Million Forecast, by Treatment Method 2019 & 2032

- Table 6: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Treatment Method 2019 & 2032

- Table 7: Europe Cancer Vaccine Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Europe Cancer Vaccine Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Cancer Vaccine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Cancer Vaccine Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 29: Europe Cancer Vaccine Industry Revenue Million Forecast, by Treatment Method 2019 & 2032

- Table 30: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Treatment Method 2019 & 2032

- Table 31: Europe Cancer Vaccine Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 33: Europe Cancer Vaccine Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Cancer Vaccine Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Germany Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Germany Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: France Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Italy Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Spain Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Europe Cancer Vaccine Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Europe Cancer Vaccine Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Cancer Vaccine Industry?

The projected CAGR is approximately 10.21%.

2. Which companies are prominent players in the Europe Cancer Vaccine Industry?

Key companies in the market include Sanofi SA, Merck & Co Inc, OSE Immunotherapeutics, Aduro Biotech Inc, Bristol-Myers Squibb, Amgen Inc , Sanpower Group Co Ltd (Dendreon Pharmaceuticals LLC), GlaxoSmithKline PLC.

3. What are the main segments of the Europe Cancer Vaccine Industry?

The market segments include Technology, Treatment Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of Cancer Cases; Technological Developments in Cancer Vaccines coupled with Huge Expenditure on Cancer Care.

6. What are the notable trends driving market growth?

Preventive Vaccines are Expected to a Hold Significant Market Share in the Treatment Method.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines; Presence of Alternative Therapies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Cancer Vaccine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Cancer Vaccine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Cancer Vaccine Industry?

To stay informed about further developments, trends, and reports in the Europe Cancer Vaccine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence