Key Insights

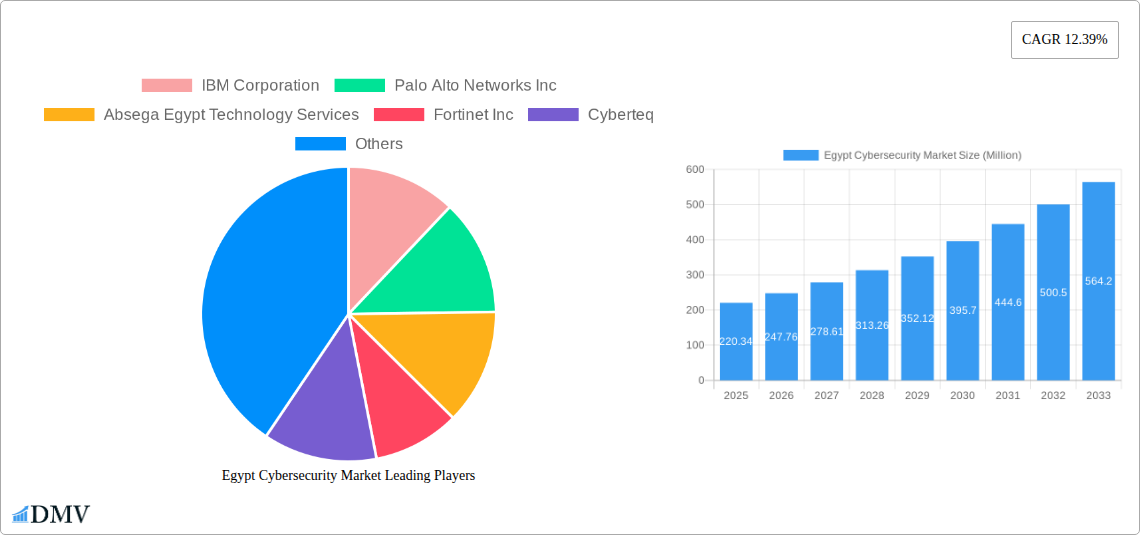

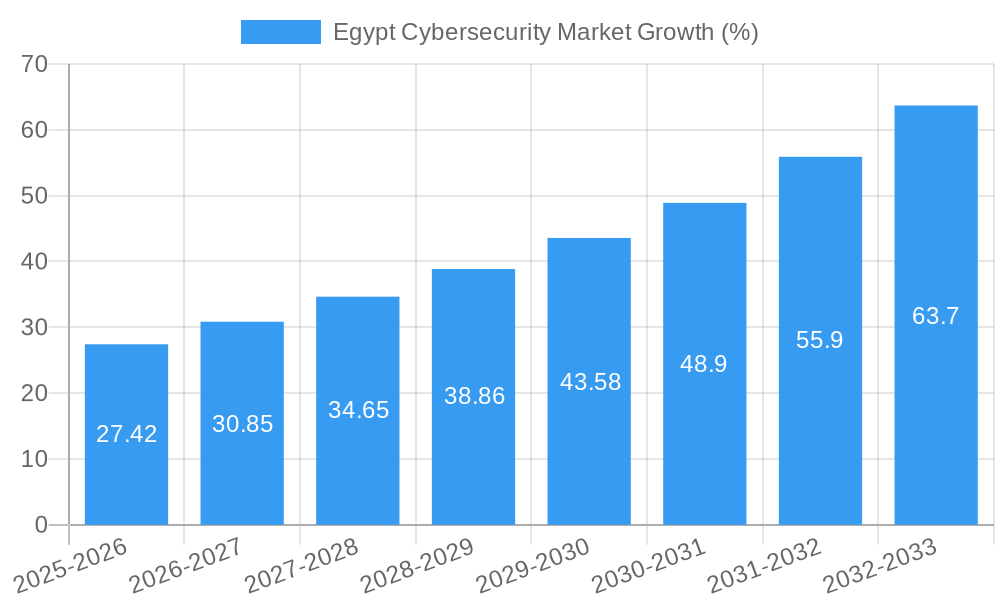

The Egypt cybersecurity market, valued at $220.34 million in 2025, is projected to experience robust growth, driven by increasing digitalization, rising cyber threats, and stringent government regulations. The compound annual growth rate (CAGR) of 12.39% from 2019 to 2033 indicates a significant expansion in market size, reaching an estimated $700 million by 2033. Key drivers include the proliferation of smartphones and internet usage, the expanding e-commerce sector, and the growing adoption of cloud computing and IoT technologies within businesses and government organizations. The market is segmented by solution type (e.g., endpoint security, network security, cloud security), service type (managed security services, consulting services), deployment mode (cloud, on-premises), and end-user industry (BFSI, government, healthcare, etc.). Leading players like IBM, Palo Alto Networks, Fortinet, and Microsoft are actively competing in this dynamic landscape, offering a diverse range of security solutions and services to cater to evolving customer needs. However, factors like a lack of cybersecurity awareness among individuals and businesses, limited skilled cybersecurity professionals, and budget constraints can pose challenges to market growth.

The market's future growth trajectory hinges on several factors. Continued investment in digital infrastructure, increased government initiatives to promote cybersecurity awareness and training, and the adoption of advanced security technologies like AI and machine learning for threat detection and prevention are expected to fuel market expansion. Further segmentation analysis focusing on specific sectors (e.g., the rapid growth of fintech in Egypt) would provide a more granular understanding of investment opportunities. Competitive dynamics will continue to shape the market, with players vying for market share through technological innovation, strategic partnerships, and mergers and acquisitions. The successful navigation of these factors will be crucial for continued market growth in Egypt's burgeoning digital ecosystem.

Egypt Cybersecurity Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Egypt cybersecurity market, encompassing historical data (2019-2024), current market dynamics (2025), and a comprehensive forecast (2025-2033). The report offers crucial insights for stakeholders seeking to understand market trends, identify investment opportunities, and navigate the evolving regulatory landscape within this rapidly growing sector. The market is projected to reach xx Million by 2033, driven by factors detailed within.

Egypt Cybersecurity Market Composition & Trends

This section delves into the granular composition of the Egyptian cybersecurity market, examining market concentration, innovation drivers, regulatory changes, substitute products, and end-user profiles. The analysis incorporates data on mergers and acquisitions (M&A) activities, providing a holistic view of market dynamics. The market exhibits a moderately concentrated structure, with a few major players holding significant market share, while numerous smaller companies focus on niche segments. Major players like IBM Corporation, Palo Alto Networks Inc, and Microsoft Corporation hold substantial shares, estimated to be around xx% cumulatively in 2025. However, smaller, agile companies like Absega Egypt Technology Services, Cyberteq and Secure Misr are carving out significant niches.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Government initiatives promoting digital transformation and increasing cyber threats.

- Regulatory Landscape: Evolving regulations focused on data protection and cybersecurity compliance are driving demand.

- Substitute Products: Limited viable substitutes exist, leading to higher market dependence on specialized solutions.

- End-User Profiles: Government agencies, financial institutions, telecom operators, and large enterprises are key consumers.

- M&A Activities: A moderate level of M&A activity has been observed in recent years, with deal values averaging approximately xx Million in the past five years. These activities often reflect a focus on expanding capabilities and market reach.

Egypt Cybersecurity Market Industry Evolution

This section analyzes the evolutionary trajectory of the Egyptian cybersecurity market, encompassing growth rates, technological advancements, and changing consumer demands from 2019 to 2033. The market has experienced significant growth, driven by increased digitization and rising cyber threats. The adoption of cloud-based security solutions and advanced threat detection technologies is accelerating. The average annual growth rate (CAGR) during the historical period (2019-2024) was approximately xx%, projected to reach xx% during the forecast period (2025-2033). This growth is fueled by expanding internet penetration, increasing mobile device usage, and the government's push for digital transformation. The market shows significant potential for further expansion as more organizations adopt advanced security solutions and regulatory compliance requirements tighten.

Specifically, the adoption of AI-powered security solutions is increasing rapidly, with an expected adoption rate of xx% by 2033. The demand for managed security services is also high as organizations seek expertise in protecting their increasingly complex IT infrastructure.

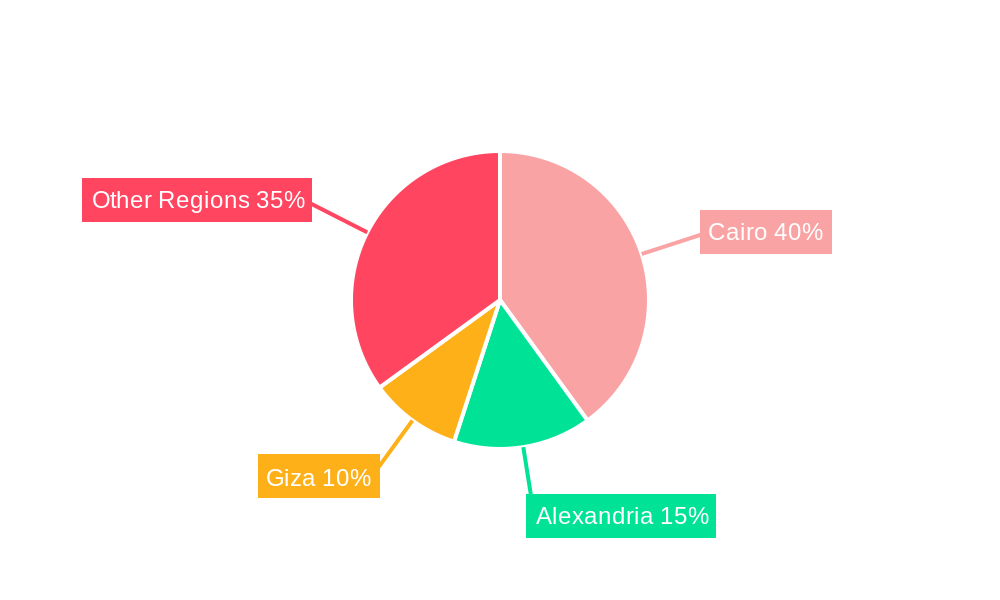

Leading Regions, Countries, or Segments in Egypt Cybersecurity Market

The Greater Cairo region dominates the Egyptian cybersecurity market, accounting for xx% of total revenue in 2025. This dominance is driven by a high concentration of businesses and government agencies, along with a more advanced digital infrastructure compared to other regions.

- Key Drivers for Cairo's Dominance:

- High concentration of businesses and government institutions.

- Advanced digital infrastructure.

- Significant investments in cybersecurity infrastructure.

- Strong regulatory support.

The financial services and government sectors are leading segments in terms of cybersecurity spending. Financial institutions invest heavily in security solutions to protect sensitive customer data and prevent financial fraud. Government agencies face numerous cyber threats and require robust security infrastructure to safeguard critical national assets and information.

Egypt Cybersecurity Market Product Innovations

The market is witnessing significant product innovations, primarily focusing on AI-powered threat detection, advanced endpoint protection, and cloud security solutions. These innovations offer improved threat detection accuracy, faster response times, and better protection against increasingly sophisticated cyberattacks. Unique selling propositions often center on advanced threat intelligence, automated incident response capabilities, and seamless integration with existing IT infrastructures. These advancements result in increased efficiency, reduced security breaches, and improved overall security posture.

Propelling Factors for Egypt Cybersecurity Market Growth

The growth of the Egypt cybersecurity market is propelled by several factors. Firstly, the rising adoption of cloud computing and the expansion of internet and mobile penetration create vulnerabilities that need to be addressed. Secondly, increased government initiatives promoting digitalization inadvertently expand the attack surface. Lastly, stringent data protection regulations necessitate proactive security measures. The government's commitment to fostering a digital economy and its investments in infrastructure projects are further driving market growth.

Obstacles in the Egypt Cybersecurity Market

The market faces challenges, including the shortage of skilled cybersecurity professionals, hindering effective implementation of security solutions. Additionally, budget constraints for small and medium-sized enterprises (SMEs) limit their investment in advanced security technologies. These factors, coupled with a relatively nascent cybersecurity awareness among some businesses, constitute significant hurdles to market expansion.

Future Opportunities in Egypt Cybersecurity Market

Significant opportunities exist in the expansion of managed security services, the growing demand for cloud-based security solutions, and the increasing adoption of AI and machine learning for threat detection. The market will also benefit from government initiatives to promote digital literacy and cybersecurity training, which will help reduce the skills gap and encourage wider adoption of cybersecurity measures across different sectors.

Major Players in the Egypt Cybersecurity Market Ecosystem

- IBM Corporation

- Palo Alto Networks Inc

- Absega Egypt Technology Services

- Fortinet Inc

- Cyberteq

- Trellix

- Microsoft Corporation

- Cisco Systems Inc

- Secure Misr

- Quick Heal Technologies Ltd

- List Not Exhaustive

Key Developments in Egypt Cybersecurity Market Industry

- June 2024: GateLock partners with ESET and Safetica, strengthening its regional presence and product offerings. This collaboration signifies a significant move towards enhanced security solutions within Egypt and the Middle East.

- April 2024: The National Telecommunication Institute (NTI) partners with Arab Security Consultants (ASC) to train 1000 individuals annually in cybersecurity, bolstering the skilled workforce and improving network security. This initiative reflects a proactive approach to address the cybersecurity skills gap and strengthen national cybersecurity capabilities.

Strategic Egypt Cybersecurity Market Forecast

The Egypt cybersecurity market is poised for sustained growth, driven by increased digitalization, rising cyber threats, and government initiatives. The forecast period (2025-2033) anticipates robust growth, with increasing adoption of advanced security technologies and services. This growth will be fueled by the expanding adoption of cloud computing, the increasing need for data protection, and the rising sophistication of cyberattacks. The market presents significant opportunities for both established players and emerging companies.

Egypt Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Consumer Security Software

- 1.1.4. Data Security

- 1.1.5. Identity and Access Management

- 1.1.6. Infrastructure Protection

- 1.1.7. Integrated Risk Management

- 1.1.8. Network Security Equipment

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud

- 2.2. On-Premise

-

3. End-User Industry

-

3.1. IT and Telecom

- 3.1.1. Use Cases

- 3.2. BFSI

- 3.3. Retail and E-Commerce

- 3.4. Oil Gas and Energy

- 3.5. Manufacturing

- 3.6. Government and Defense

- 3.7. Other End-users

-

3.1. IT and Telecom

Egypt Cybersecurity Market Segmentation By Geography

- 1. Egypt

Egypt Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions

- 3.3. Market Restrains

- 3.3.1. Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions

- 3.4. Market Trends

- 3.4.1. Digital Transformation Technologies and Rise of Security Intelligence to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Consumer Security Software

- 5.1.1.4. Data Security

- 5.1.1.5. Identity and Access Management

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Integrated Risk Management

- 5.1.1.8. Network Security Equipment

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-Premise

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. IT and Telecom

- 5.3.1.1. Use Cases

- 5.3.2. BFSI

- 5.3.3. Retail and E-Commerce

- 5.3.4. Oil Gas and Energy

- 5.3.5. Manufacturing

- 5.3.6. Government and Defense

- 5.3.7. Other End-users

- 5.3.1. IT and Telecom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Palo Alto Networks Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Absega Egypt Technology Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fortinet Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cyberteq

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trellix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Secure Misr

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Quick Heal Technologies Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Egypt Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Egypt Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Egypt Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Egypt Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 6: Egypt Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 7: Egypt Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Egypt Cybersecurity Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Egypt Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Egypt Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Egypt Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Egypt Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Egypt Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Egypt Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 15: Egypt Cybersecurity Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Egypt Cybersecurity Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Egypt Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Egypt Cybersecurity Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Cybersecurity Market?

The projected CAGR is approximately 12.39%.

2. Which companies are prominent players in the Egypt Cybersecurity Market?

Key companies in the market include IBM Corporation, Palo Alto Networks Inc, Absega Egypt Technology Services, Fortinet Inc, Cyberteq, Trellix, Microsoft Corporation, Cisco Systems Inc, Secure Misr, Quick Heal Technologies Ltd *List Not Exhaustive.

3. What are the main segments of the Egypt Cybersecurity Market?

The market segments include Offering, Deployment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions.

6. What are the notable trends driving market growth?

Digital Transformation Technologies and Rise of Security Intelligence to Hold Significant Growth.

7. Are there any restraints impacting market growth?

Digital Transformation Technologies and Rise of Security Intelligence; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions.

8. Can you provide examples of recent developments in the market?

June 2024: GateLock, a cybersecurity solutions provider, entered into a strategic partnership with ESET and Safetica, two prominent players in the information security software arena. This move strengthens GateLock's reputation as a smart solutions provider not just in Egypt but across the broader Middle Eastern region. The alliance was unveiled at GateLock's client conference, where attendees were treated to a firsthand look at the company's latest security offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Egypt Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence