Key Insights

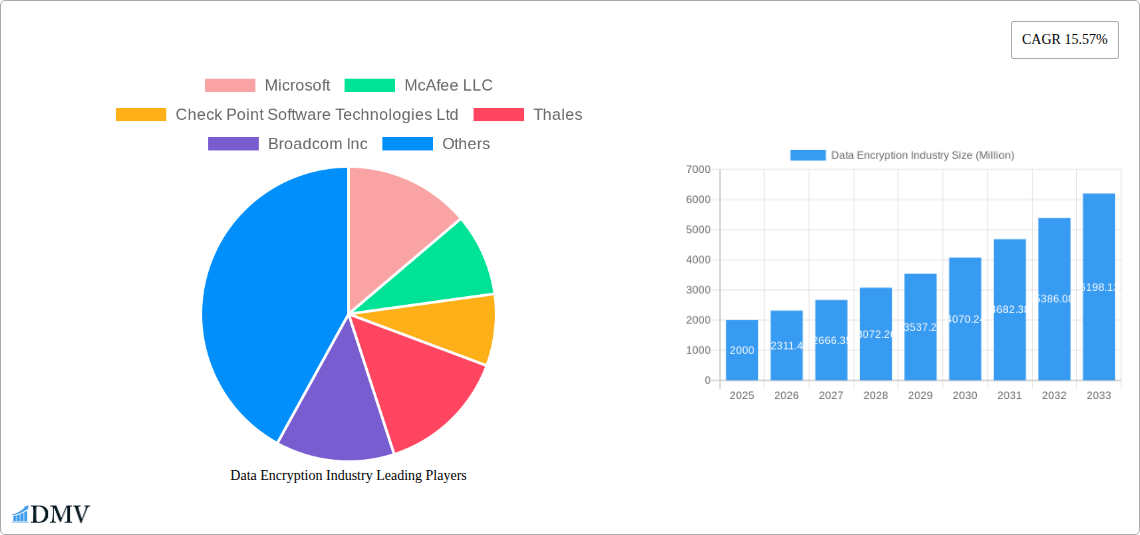

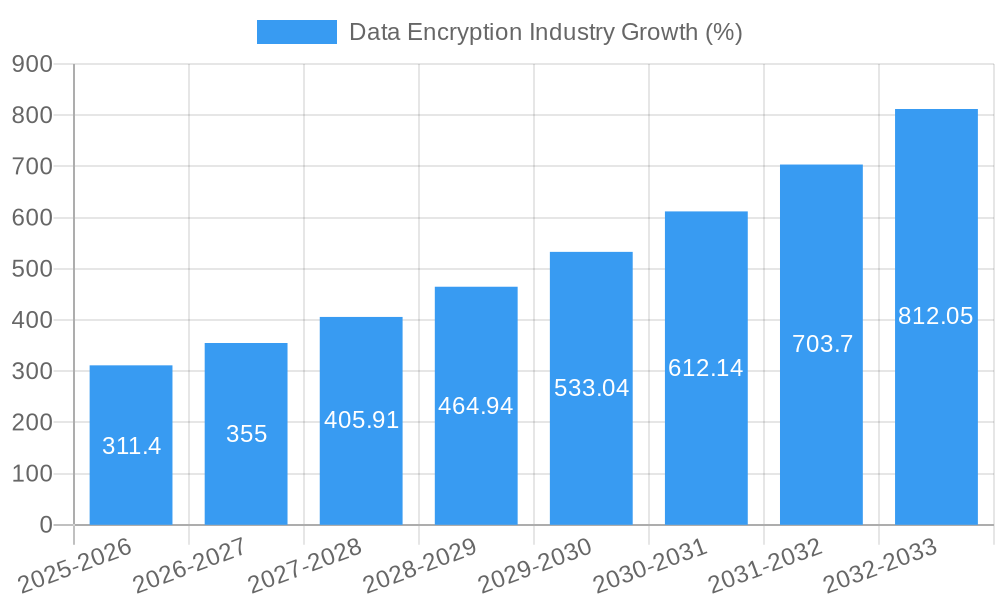

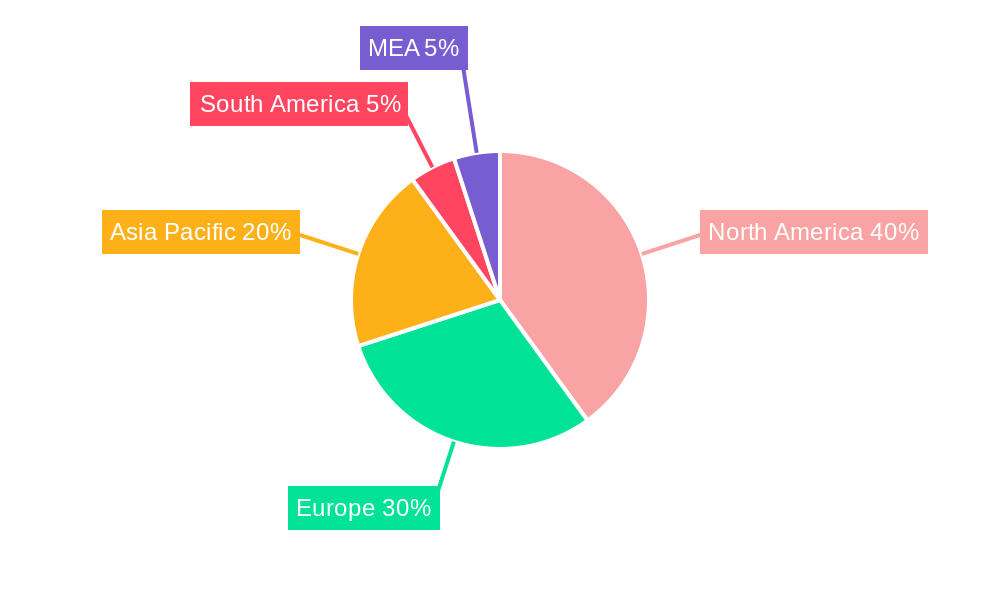

The data encryption market, valued at XX million in 2025, is experiencing robust growth, projected to expand at a 15.57% CAGR from 2025 to 2033. This surge is driven by escalating cyber threats, increasing regulatory compliance mandates (like GDPR and CCPA), and the proliferation of sensitive data across diverse industries. The cloud computing paradigm shift is a significant catalyst, fueling demand for cloud-based encryption solutions to safeguard data stored in and transmitted through cloud environments. Furthermore, the rising adoption of IoT devices and the expanding digitalization of various sectors, from healthcare and finance to government and retail, necessitates robust encryption measures to protect sensitive information. Strong growth is expected across all segments, with cloud deployment models and software solutions leading the charge due to their scalability, flexibility, and cost-effectiveness. Large enterprises are currently the major consumers, but the SME segment is poised for significant growth as awareness of cybersecurity risks increases and affordable solutions become widely available. Geographic expansion is also notable, with North America and Europe maintaining strong market share, while Asia-Pacific exhibits considerable growth potential due to rapid technological advancement and digital transformation initiatives.

However, several restraints impact market growth. These include the complexity of implementing and managing encryption solutions, the high initial investment costs associated with sophisticated encryption technologies, and the persistent challenge of keeping pace with constantly evolving cyber threats and attack vectors. The ongoing need for skilled cybersecurity professionals to manage and maintain encryption systems presents another hurdle. Nevertheless, the increasing severity and frequency of data breaches are outweighing these challenges, resulting in considerable investment in robust data encryption solutions. The market's segmentation reflects the diverse application needs across different industries and organizational sizes, indicating a thriving ecosystem of specialized encryption solutions to address unique security challenges. This diversification ensures ongoing market expansion and innovation in the years to come.

Data Encryption Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Data Encryption Industry, projecting a market valuation exceeding $XX Million by 2033. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Gain critical insights into market dynamics, technological advancements, and competitive landscapes, empowering strategic decision-making for stakeholders across the data security ecosystem.

Data Encryption Industry Market Composition & Trends

This section evaluates the market's competitive landscape, identifying key trends influencing growth. The global data encryption market is characterized by a moderately concentrated structure, with several major players vying for market share. Estimates suggest a market size of $XX Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Innovation is a key driver, fueled by increasing cyber threats and evolving data privacy regulations. M&A activity plays a significant role, with deals valued at $XX Million observed in recent years, leading to consolidation and increased market concentration.

- Market Share Distribution (2025): Microsoft (XX%), McAfee LLC (XX%), Check Point Software Technologies Ltd (XX%), Thales (XX%), Broadcom Inc (XX%), others (XX%). (Note: These percentages are estimated.)

- Key Innovation Catalysts: Rise of cloud computing, increasing adoption of IoT devices, and stringent data privacy regulations (GDPR, CCPA).

- Regulatory Landscape: The impact of GDPR, CCPA, and other data protection laws drives market growth through increased demand for robust encryption solutions.

- Substitute Products: Limited direct substitutes exist, but alternative security measures influence market adoption rates.

- End-User Profiles: Large enterprises, SMEs, government agencies, and BFSI institutions are primary consumers.

- M&A Activity: Recent years have seen numerous strategic acquisitions, primarily focused on expanding product portfolios and enhancing technological capabilities. Deal values have averaged $XX Million per transaction.

Data Encryption Industry Industry Evolution

The data encryption market has undergone significant evolution, driven by technological advancements and shifting consumer demands. The historical period (2019-2024) witnessed robust growth, with adoption rates rising steadily across various sectors. The market's trajectory reflects increasing concerns regarding data breaches and the growing importance of data security. Technological advancements, such as advancements in homomorphic encryption and quantum-resistant cryptography, are reshaping the landscape. The market is witnessing a paradigm shift towards cloud-based encryption solutions, propelled by cost optimization and scalability advantages. This trend is accelerating the demand for robust key management systems and multi-cloud encryption strategies. The increasing adoption of AI and machine learning in data security is further driving market growth. Specific data points are limited due to confidential information; however, the CAGR is projected at approximately XX% between 2025 and 2033.

Leading Regions, Countries, or Segments in Data Encryption Industry

The North American region currently dominates the data encryption market, followed by Europe. The high concentration of technology companies, robust IT infrastructure, and stringent data privacy regulations in these regions contribute significantly to this dominance. The Asia-Pacific region is exhibiting rapid growth potential, driven by increasing digitalization and government initiatives.

- By Component: Software solutions currently hold a larger market share compared to services, but the service segment is experiencing accelerated growth.

- By Deployment Model: Cloud-based deployment is gaining rapid traction, surpassing on-premise deployments.

- By Enterprise Size: Large enterprises are the primary consumers, but the SME segment is showing significant growth potential.

- By Function: Disk encryption holds a significant market share, closely followed by cloud and database encryption.

- By Industry Vertical: IT & Telecommunication, BFSI, and Healthcare are leading segments, exhibiting high demand for advanced encryption solutions.

Key Drivers:

- North America: High adoption rates, stringent regulatory environments, substantial investments in cybersecurity infrastructure.

- Europe: Stringent data privacy regulations (GDPR) and a mature IT landscape.

- Asia-Pacific: Rapid digitalization, rising cybersecurity concerns, and government support for cybersecurity initiatives.

Data Encryption Industry Product Innovations

Recent years have witnessed significant innovations in data encryption technology, focusing on enhanced security, improved performance, and increased usability. New solutions incorporate advanced encryption algorithms, robust key management systems, and advanced threat detection capabilities. Unique selling propositions include seamless integration with cloud platforms, simplified deployment procedures, and improved user interfaces. Technological advancements such as homomorphic encryption and post-quantum cryptography represent the next frontier of data encryption technology. These innovations aim to address emerging challenges, including increasing complexity of cyber threats and vulnerabilities to quantum computing.

Propelling Factors for Data Encryption Industry Growth

Several factors are driving the growth of the data encryption market. The ever-increasing frequency and sophistication of cyberattacks is a major catalyst, forcing organizations to invest heavily in robust security measures. The stringent regulatory environment, with regulations like GDPR and CCPA mandating strong data protection, significantly impacts growth. The rising adoption of cloud computing and the Internet of Things (IoT) also contributes to increased demand for data encryption solutions. Finally, economic factors, including growing investments in IT security, fuel the market's expansion.

Obstacles in the Data Encryption Industry Market

Despite substantial growth, the data encryption market faces significant challenges. The complexity of implementing and managing encryption solutions, coupled with skills shortages, represents a barrier to wider adoption. Supply chain disruptions can impact the availability of essential components, causing delays and cost increases. Intense competition among vendors leads to price pressures, affecting profitability. Furthermore, evolving regulatory landscapes require continuous adaptation, posing challenges for businesses. These challenges pose quantifiable impacts, influencing growth rates and margins for industry players. For instance, skills shortages could slow down market penetration by approximately XX% annually, according to a hypothetical analysis.

Future Opportunities in Data Encryption Industry

The future of the data encryption market is bright, with numerous growth opportunities. The expansion of cloud computing and the IoT generates substantial demand for robust security solutions. The increasing adoption of AI and machine learning in data security presents new opportunities for developing intelligent encryption technologies. The emergence of quantum-resistant cryptography offers solutions to potential future threats. Finally, untapped markets in developing economies provide significant potential for expansion.

Major Players in the Data Encryption Industry Ecosystem

- Microsoft

- McAfee LLC

- Check Point Software Technologies Ltd

- Thales

- Broadcom Inc

- Trend Micro Incorporated

- Dell Inc

- Sophos Ltd

- Micro Focus International plc

- IBM

Key Developments in Data Encryption Industry Industry

- March 2022: IBM Cloud Hyper Protect Crypto Services launched Unified Key Orchestrator, a multi-cloud key management solution based on the "Keep Your Own Key" concept. This development significantly enhanced cross-cloud key management capabilities.

- February 2022: Sophos announced plans for new data centers in Mumbai and Sao Paulo to improve compliance with data sovereignty regulations, expanding access to its encryption services in regions with stringent data localization rules.

Strategic Data Encryption Industry Market Forecast

The data encryption market is poised for continued growth, driven by increasing cyber threats, stringent regulations, and the expanding adoption of cloud computing and IoT. The forecast period (2025-2033) anticipates strong growth, with new technologies such as quantum-resistant cryptography and AI-driven security solutions driving market evolution. Emerging markets and evolving regulatory landscapes will present significant opportunities for industry players. The market's future hinges on innovation, adaptability, and the ability to address emerging cybersecurity threats effectively.

Data Encryption Industry Segmentation

-

1. Component

- 1.1. Software

- 1.2. Service

-

2. Deployment Model

- 2.1. On-premise

- 2.2. Cloud

-

3. Enterprise Size

- 3.1. Large Enterprises

- 3.2. Small & Medium Enterprises

-

4. Function

- 4.1. Disk Encryption

- 4.2. Communication Encryption

- 4.3. File/Folder Encryption

- 4.4. Cloud Encryption

- 4.5. Database Encryption

-

5. Industry Vertical

- 5.1. IT & Telecommunication

- 5.2. BFSI

- 5.3. Healthcare

- 5.4. Government

- 5.5. Retail

- 5.6. Education

- 5.7. Others

Data Encryption Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Data Encryption Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft

- 3.3. Market Restrains

- 3.3.1. Expensive Encryption Software Deployment and Maintenance costs; Utilization of Open-Source and Pirated Encryption Products

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 5.3.1. Large Enterprises

- 5.3.2. Small & Medium Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Disk Encryption

- 5.4.2. Communication Encryption

- 5.4.3. File/Folder Encryption

- 5.4.4. Cloud Encryption

- 5.4.5. Database Encryption

- 5.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.5.1. IT & Telecommunication

- 5.5.2. BFSI

- 5.5.3. Healthcare

- 5.5.4. Government

- 5.5.5. Retail

- 5.5.6. Education

- 5.5.7. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia

- 5.6.4. Australia and New Zealand

- 5.6.5. Middle East and Africa

- 5.6.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 6.3.1. Large Enterprises

- 6.3.2. Small & Medium Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Function

- 6.4.1. Disk Encryption

- 6.4.2. Communication Encryption

- 6.4.3. File/Folder Encryption

- 6.4.4. Cloud Encryption

- 6.4.5. Database Encryption

- 6.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.5.1. IT & Telecommunication

- 6.5.2. BFSI

- 6.5.3. Healthcare

- 6.5.4. Government

- 6.5.5. Retail

- 6.5.6. Education

- 6.5.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 7.3.1. Large Enterprises

- 7.3.2. Small & Medium Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Function

- 7.4.1. Disk Encryption

- 7.4.2. Communication Encryption

- 7.4.3. File/Folder Encryption

- 7.4.4. Cloud Encryption

- 7.4.5. Database Encryption

- 7.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.5.1. IT & Telecommunication

- 7.5.2. BFSI

- 7.5.3. Healthcare

- 7.5.4. Government

- 7.5.5. Retail

- 7.5.6. Education

- 7.5.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 8.3.1. Large Enterprises

- 8.3.2. Small & Medium Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Function

- 8.4.1. Disk Encryption

- 8.4.2. Communication Encryption

- 8.4.3. File/Folder Encryption

- 8.4.4. Cloud Encryption

- 8.4.5. Database Encryption

- 8.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.5.1. IT & Telecommunication

- 8.5.2. BFSI

- 8.5.3. Healthcare

- 8.5.4. Government

- 8.5.5. Retail

- 8.5.6. Education

- 8.5.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 9.3.1. Large Enterprises

- 9.3.2. Small & Medium Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Function

- 9.4.1. Disk Encryption

- 9.4.2. Communication Encryption

- 9.4.3. File/Folder Encryption

- 9.4.4. Cloud Encryption

- 9.4.5. Database Encryption

- 9.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.5.1. IT & Telecommunication

- 9.5.2. BFSI

- 9.5.3. Healthcare

- 9.5.4. Government

- 9.5.5. Retail

- 9.5.6. Education

- 9.5.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 10.3.1. Large Enterprises

- 10.3.2. Small & Medium Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Function

- 10.4.1. Disk Encryption

- 10.4.2. Communication Encryption

- 10.4.3. File/Folder Encryption

- 10.4.4. Cloud Encryption

- 10.4.5. Database Encryption

- 10.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.5.1. IT & Telecommunication

- 10.5.2. BFSI

- 10.5.3. Healthcare

- 10.5.4. Government

- 10.5.5. Retail

- 10.5.6. Education

- 10.5.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Latin America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Software

- 11.1.2. Service

- 11.2. Market Analysis, Insights and Forecast - by Deployment Model

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by Enterprise Size

- 11.3.1. Large Enterprises

- 11.3.2. Small & Medium Enterprises

- 11.4. Market Analysis, Insights and Forecast - by Function

- 11.4.1. Disk Encryption

- 11.4.2. Communication Encryption

- 11.4.3. File/Folder Encryption

- 11.4.4. Cloud Encryption

- 11.4.5. Database Encryption

- 11.5. Market Analysis, Insights and Forecast - by Industry Vertical

- 11.5.1. IT & Telecommunication

- 11.5.2. BFSI

- 11.5.3. Healthcare

- 11.5.4. Government

- 11.5.5. Retail

- 11.5.6. Education

- 11.5.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA Data Encryption Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Microsoft

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 McAfee LLC

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Check Point Software Technologies Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Thales

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Broadcom Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Trend Micro Incorporated

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Dell Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Sophos Ltd

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Micro Focus International plc*List Not Exhaustive

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 IBM

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Microsoft

List of Figures

- Figure 1: Global Data Encryption Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 17: North America Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 18: North America Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 19: North America Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 20: North America Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 21: North America Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 22: North America Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 23: North America Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 24: North America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: North America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 27: Europe Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 28: Europe Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 29: Europe Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 30: Europe Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 31: Europe Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 32: Europe Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 33: Europe Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 34: Europe Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 35: Europe Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 36: Europe Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 39: Asia Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 40: Asia Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 41: Asia Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 42: Asia Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 43: Asia Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 44: Asia Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 45: Asia Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 46: Asia Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 47: Asia Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 48: Asia Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 51: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 52: Australia and New Zealand Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 53: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 54: Australia and New Zealand Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 55: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 56: Australia and New Zealand Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 57: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 58: Australia and New Zealand Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 59: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 60: Australia and New Zealand Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Australia and New Zealand Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 63: Middle East and Africa Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 64: Middle East and Africa Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 65: Middle East and Africa Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 66: Middle East and Africa Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 67: Middle East and Africa Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 68: Middle East and Africa Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 69: Middle East and Africa Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 70: Middle East and Africa Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 71: Middle East and Africa Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 72: Middle East and Africa Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 73: Middle East and Africa Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Latin America Data Encryption Industry Revenue (Million), by Component 2024 & 2032

- Figure 75: Latin America Data Encryption Industry Revenue Share (%), by Component 2024 & 2032

- Figure 76: Latin America Data Encryption Industry Revenue (Million), by Deployment Model 2024 & 2032

- Figure 77: Latin America Data Encryption Industry Revenue Share (%), by Deployment Model 2024 & 2032

- Figure 78: Latin America Data Encryption Industry Revenue (Million), by Enterprise Size 2024 & 2032

- Figure 79: Latin America Data Encryption Industry Revenue Share (%), by Enterprise Size 2024 & 2032

- Figure 80: Latin America Data Encryption Industry Revenue (Million), by Function 2024 & 2032

- Figure 81: Latin America Data Encryption Industry Revenue Share (%), by Function 2024 & 2032

- Figure 82: Latin America Data Encryption Industry Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 83: Latin America Data Encryption Industry Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 84: Latin America Data Encryption Industry Revenue (Million), by Country 2024 & 2032

- Figure 85: Latin America Data Encryption Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Encryption Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 5: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 6: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 7: Global Data Encryption Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Belgium Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherland Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Nordics Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Japan Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Korea Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Southeast Asia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Australia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Indonesia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Phillipes Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Thailandc Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Asia Pacific Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Brazil Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Argentina Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Peru Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Chile Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Ecuador Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Venezuela Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United States Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Canada Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Mexico Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: United Arab Emirates Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Saudi Arabia Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Africa Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Middle East and Africa Data Encryption Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 54: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 55: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 56: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 57: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 58: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 60: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 61: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 62: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 63: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 64: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 66: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 67: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 68: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 69: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 70: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 72: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 73: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 74: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 75: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 76: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 77: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 78: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 79: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 80: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 81: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 82: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Global Data Encryption Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 84: Global Data Encryption Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 85: Global Data Encryption Industry Revenue Million Forecast, by Enterprise Size 2019 & 2032

- Table 86: Global Data Encryption Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 87: Global Data Encryption Industry Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 88: Global Data Encryption Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Encryption Industry?

The projected CAGR is approximately 15.57%.

2. Which companies are prominent players in the Data Encryption Industry?

Key companies in the market include Microsoft, McAfee LLC, Check Point Software Technologies Ltd, Thales, Broadcom Inc, Trend Micro Incorporated, Dell Inc, Sophos Ltd, Micro Focus International plc*List Not Exhaustive, IBM.

3. What are the main segments of the Data Encryption Industry?

The market segments include Component, Deployment Model, Enterprise Size, Function, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Regulatory Standards Related to Data Transfer and its Security; Growing Volume of Strength of Cyber Attacks and Mobile Theft.

6. What are the notable trends driving market growth?

IT & Telecommunication to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Expensive Encryption Software Deployment and Maintenance costs; Utilization of Open-Source and Pirated Encryption Products.

8. Can you provide examples of recent developments in the market?

March 2022 - Unified Key Orchestrator, a multi-cloud key management solution made available as a managed service by IBM Cloud Hyper Protect Crypto Services, was officially launched. Unified Key Orchestrator, based on the "Keep Your Own Key" concept, assists businesses in managing their data encryption keys across numerous key stores and cloud environments, including keys handled locally on IBM Cloud, AWS, and Microsoft Azure.\

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Encryption Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Encryption Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Encryption Industry?

To stay informed about further developments, trends, and reports in the Data Encryption Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence