Key Insights

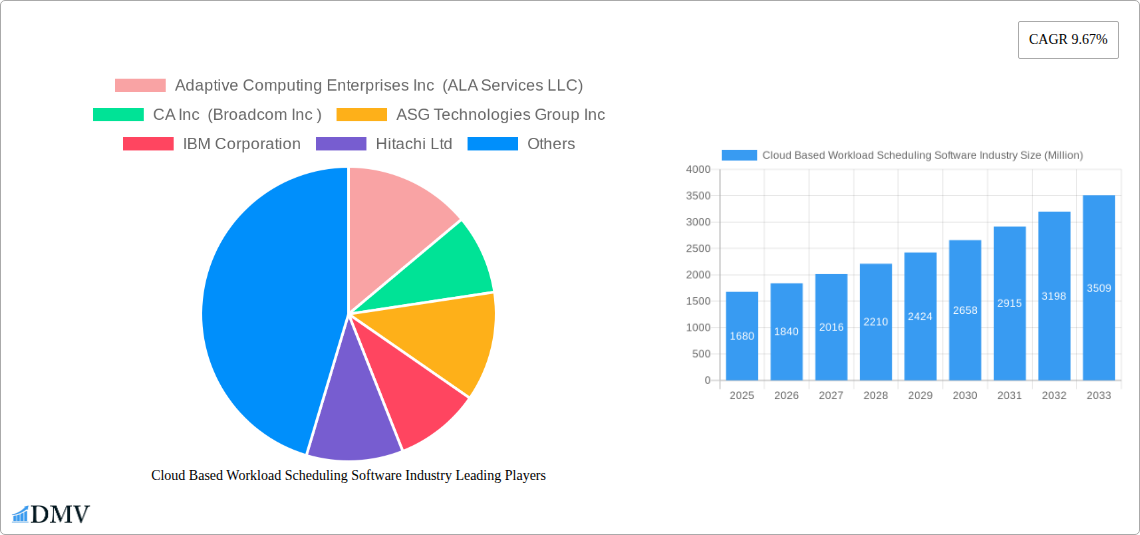

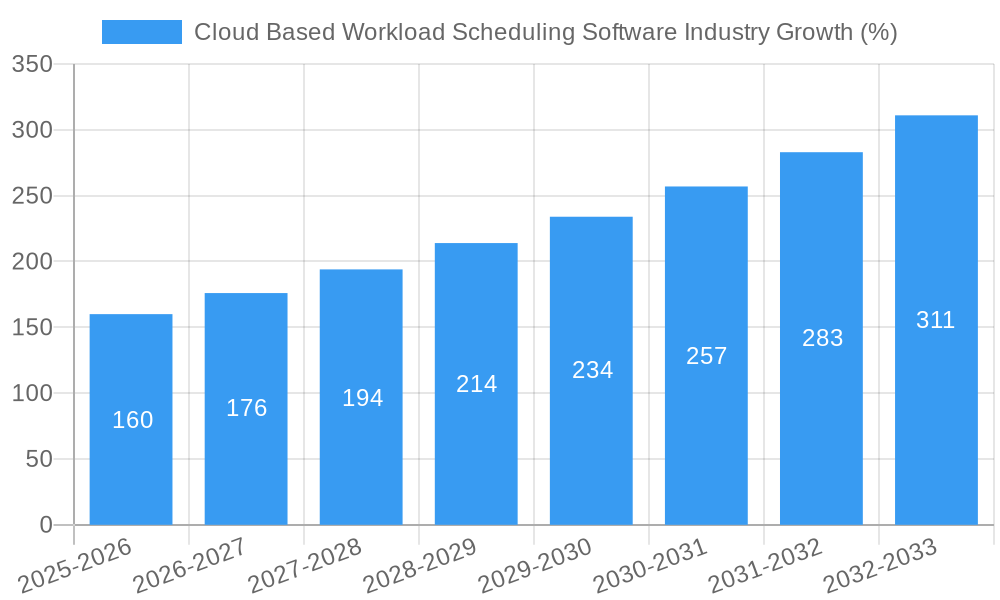

The Cloud-Based Workload Scheduling Software market is experiencing robust growth, projected to reach \$1.68 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.67% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud computing across diverse sectors – including corporate, government, and other end-users – necessitates efficient workload management. Businesses are increasingly seeking solutions to optimize resource utilization, reduce operational costs, and enhance application performance. The shift towards hybrid and multi-cloud environments further fuels demand for sophisticated scheduling software capable of seamlessly managing workloads across different platforms. Furthermore, the growing complexity of applications and the rise of big data analytics are driving the need for intelligent automation and optimization capabilities within workload scheduling, leading to increased adoption of advanced features offered by these software solutions. The market is segmented by deployment (public, private, hybrid cloud) and end-user (corporate, government, others), reflecting the diverse application and implementation strategies within different organizations. Key players like IBM, VMware, and Red Hat are shaping the market with their advanced offerings, fostering innovation and competition.

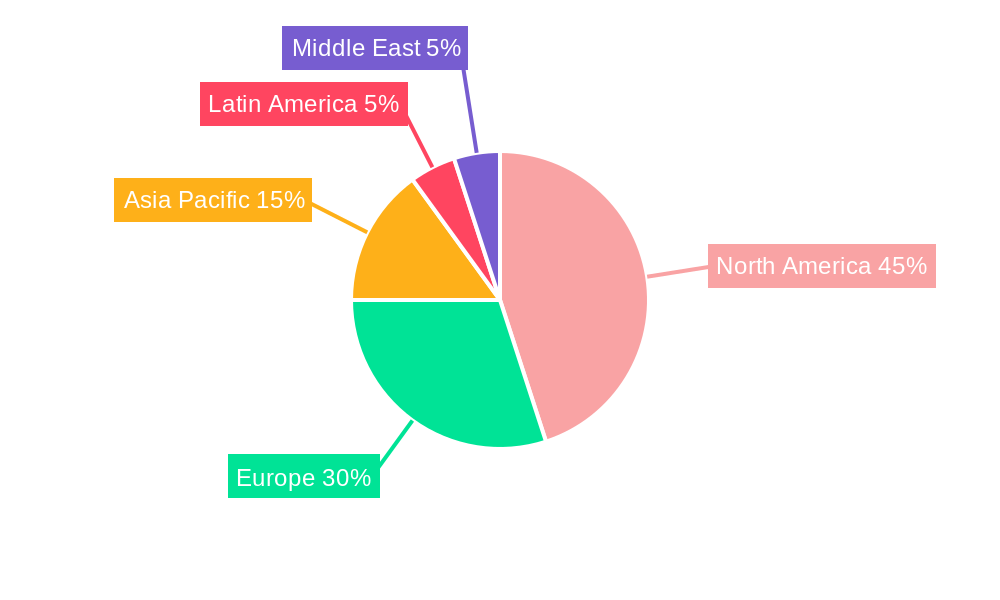

The continued growth trajectory is expected to be influenced by several trends. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in workload scheduling will enable more predictive and proactive resource allocation, enhancing efficiency. The expansion of edge computing will also necessitate specialized workload scheduling solutions optimized for distributed environments. However, potential restraints include security concerns surrounding cloud-based data and the integration complexities associated with migrating existing workloads to new platforms. Nevertheless, the overall market outlook remains positive, driven by the ongoing digital transformation across various industries and the growing need for optimized and automated workload management. North America is anticipated to hold a significant market share, followed by Europe and the Asia Pacific region, reflecting the level of cloud adoption and technological advancement in these areas.

Cloud Based Workload Scheduling Software Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Cloud Based Workload Scheduling Software industry, offering a comprehensive overview of market trends, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive market research to deliver actionable insights for stakeholders, covering crucial aspects like market size, competitive landscape, and emerging technologies. The global market value is projected to reach xx Million by 2033.

Cloud Based Workload Scheduling Software Industry Market Composition & Trends

This section delves into the intricate dynamics of the cloud-based workload scheduling software market. We analyze market concentration, identifying key players like Adaptive Computing Enterprises Inc (ALA Services LLC), CA Inc (Broadcom Inc), ASG Technologies Group Inc, IBM Corporation, Hitachi Ltd, Cisco Systems Inc, ManageIQ Inc (Red Hat Inc), VMware Inc, and BMC Software (Boxer Parent Company Inc). The report examines the distribution of market share amongst these companies, revealing the competitive intensity and potential for disruption. Further, we explore the influence of innovation catalysts such as AI and machine learning, alongside regulatory landscapes and the presence of substitute products impacting market growth. The impact of mergers and acquisitions (M&A) activities, including deal values (estimated at xx Million annually), is assessed to gauge its effect on market consolidation and competitive dynamics. End-user profiles are thoroughly examined, segmented into corporate, government, and other end users, with quantitative analysis of their respective market shares.

- Market Concentration: Highly fragmented with a few dominant players holding significant shares.

- Innovation Catalysts: AI, Machine Learning, automation technologies drive market growth.

- Regulatory Landscape: Compliance standards (e.g., GDPR, CCPA) shape market practices.

- Substitute Products: Traditional scheduling methods pose a competitive threat.

- M&A Activity: Significant consolidation is observed, with deal values exceeding xx Million annually in recent years.

Cloud Based Workload Scheduling Software Industry Industry Evolution

This section charts the evolution of the cloud-based workload scheduling software market, analyzing market growth trajectories from 2019 to 2033. We examine historical growth rates (xx% CAGR 2019-2024) and project future growth (xx% CAGR 2025-2033), driven by increasing cloud adoption, the rise of hybrid cloud environments, and the growing need for efficient resource management. The analysis incorporates the impact of technological advancements like serverless computing and containerization, which significantly influence workload scheduling strategies. Shifting consumer demands toward enhanced automation, scalability, and security are also explored. Adoption metrics, such as the percentage of enterprises using cloud-based scheduling solutions, are analyzed to illustrate market penetration. The influence of key market events like the Redwood Software acquisition of Tidal Software (January 2023) and ongoing technological advancements are meticulously investigated and their impact on the overall market growth are critically evaluated.

Leading Regions, Countries, or Segments in Cloud Based Workload Scheduling Software Industry

This section identifies the leading regions, countries, and segments within the cloud-based workload scheduling software market. The report dissects market dominance based on cloud deployment (public, private, hybrid) and end-user segments (corporate, government, other). We provide an in-depth analysis of the factors driving leadership in each segment.

By Cloud Deployment: The public cloud segment is expected to dominate due to scalability and cost-effectiveness, while hybrid cloud adoption shows significant growth, driven by the need for flexible workload management.

By End User: Corporate end-users constitute the largest segment, driven by the need for optimizing IT infrastructure and resources. Government adoption is also growing steadily, propelled by initiatives for digital transformation and enhanced security measures.

Key Drivers:

- Public Cloud: Cost efficiency, scalability, accessibility.

- Hybrid Cloud: Flexibility, security, compliance requirements.

- Corporate: Need for efficient resource allocation and automation.

- Government: Digital transformation initiatives, enhanced security.

Cloud Based Workload Scheduling Software Industry Product Innovations

The cloud-based workload scheduling software market showcases continuous innovation. Recent advancements include AI-powered optimization algorithms that dynamically adjust resource allocation based on real-time demand. Self-service portals are also gaining traction, empowering end-users to manage their workloads independently. Improved security features, such as multi-factor authentication and encryption, are becoming standard. Unique selling propositions often center around ease of use, integration capabilities, and sophisticated analytics dashboards for performance monitoring and optimization.

Propelling Factors for Cloud Based Workload Scheduling Software Industry Growth

Several factors contribute to the growth of the cloud-based workload scheduling software market. The increasing adoption of cloud computing, especially public and hybrid cloud models, creates significant demand. Technological advancements like serverless computing and containerization optimize workload management, driving market expansion. Favorable regulatory environments in certain regions incentivize cloud adoption. Finally, economic drivers, such as the need to reduce IT operational costs, are also key factors.

Obstacles in the Cloud Based Workload Scheduling Software Industry Market

Despite the positive growth outlook, certain challenges exist. Integration complexities with existing IT infrastructure can hinder adoption. Security concerns, especially regarding data breaches, are a major concern. Competitive pressures from established players and emerging startups exert downward pressure on pricing. Supply chain disruptions could also potentially affect the availability of software and hardware components, impacting overall market growth.

Future Opportunities in Cloud Based Workload Scheduling Software Industry

The future holds significant opportunities. Expansion into emerging markets, especially in developing economies, presents substantial growth potential. Integration with advanced technologies like edge computing and IoT devices creates new applications for workload scheduling software. The increasing demand for AI-powered solutions for improved workload optimization creates a significant demand.

Major Players in the Cloud Based Workload Scheduling Software Industry Ecosystem

- Adaptive Computing Enterprises Inc (ALA Services LLC)

- CA Inc (Broadcom Inc)

- ASG Technologies Group Inc

- IBM Corporation

- Hitachi Ltd

- Cisco Systems Inc

- ManageIQ Inc (Red Hat Inc)

- VMware Inc

- BMC Software (Boxer Parent Company Inc)

Key Developments in Cloud Based Workload Scheduling Software Industry Industry

November 2023: IBM announced a strategic partnership with Amazon Web Services (AWS) on Amazon RDS for Db2, enhancing AI workload management in hybrid cloud environments. This partnership significantly expands IBM's reach in the cloud-based workload scheduling market and strengthens AWS's database service offerings.

January 2023: Redwood Software's acquisition of Tidal Software broadened its automation capabilities, increasing competition and influencing the market landscape. This acquisition expands Redwood Software's market share and product offerings, posing a stronger competitive challenge to other market players.

Strategic Cloud Based Workload Scheduling Software Industry Market Forecast

The cloud-based workload scheduling software market is poised for robust growth driven by increasing cloud adoption, technological advancements, and the growing need for efficient resource management. The market is expected to experience significant expansion over the forecast period (2025-2033), fueled by the ongoing demand for enhanced automation, scalability, and security in both public and hybrid cloud environments. The continued development and integration of AI and machine learning capabilities will further drive market growth, opening new avenues for innovation and optimization.

Cloud Based Workload Scheduling Software Industry Segmentation

-

1. Cloud

- 1.1. Public

- 1.2. Private

- 1.3. Hybrid

-

2. End User

- 2.1. Corporate

- 2.2. Government

- 2.3. Other End Users

Cloud Based Workload Scheduling Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Based Workload Scheduling Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enterprises Shifting Towards Cloud-Based Services; Availability of Analytical tools in Cloud based Workload Scheduling Software

- 3.3. Market Restrains

- 3.3.1. Opensource-Free Software Hampering the Growth of Market

- 3.4. Market Trends

- 3.4.1. Public Cloud-Based Services is set to hold the largest market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cloud

- 5.1.1. Public

- 5.1.2. Private

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Corporate

- 5.2.2. Government

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Cloud

- 6. North America Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Cloud

- 6.1.1. Public

- 6.1.2. Private

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Corporate

- 6.2.2. Government

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Cloud

- 7. Europe Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Cloud

- 7.1.1. Public

- 7.1.2. Private

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Corporate

- 7.2.2. Government

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Cloud

- 8. Asia Pacific Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Cloud

- 8.1.1. Public

- 8.1.2. Private

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Corporate

- 8.2.2. Government

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Cloud

- 9. Latin America Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Cloud

- 9.1.1. Public

- 9.1.2. Private

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Corporate

- 9.2.2. Government

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Cloud

- 10. Middle East Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Cloud

- 10.1.1. Public

- 10.1.2. Private

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Corporate

- 10.2.2. Government

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Cloud

- 11. North America Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Cloud Based Workload Scheduling Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Adaptive Computing Enterprises Inc (ALA Services LLC)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 CA Inc (Broadcom Inc )

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ASG Technologies Group Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 IBM Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hitachi Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cisco Systems Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ManageIQ Inc (Red Hat Inc )*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 VMware Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 BMC Software (Boxer Parent Company Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Adaptive Computing Enterprises Inc (ALA Services LLC)

List of Figures

- Figure 1: Global Cloud Based Workload Scheduling Software Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Cloud 2024 & 2032

- Figure 13: North America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Cloud 2024 & 2032

- Figure 14: North America Cloud Based Workload Scheduling Software Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Cloud Based Workload Scheduling Software Industry Revenue (Million), by Cloud 2024 & 2032

- Figure 19: Europe Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Cloud 2024 & 2032

- Figure 20: Europe Cloud Based Workload Scheduling Software Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Cloud Based Workload Scheduling Software Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue (Million), by Cloud 2024 & 2032

- Figure 25: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Cloud 2024 & 2032

- Figure 26: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Cloud 2024 & 2032

- Figure 31: Latin America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Cloud 2024 & 2032

- Figure 32: Latin America Cloud Based Workload Scheduling Software Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Latin America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Latin America Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Cloud Based Workload Scheduling Software Industry Revenue (Million), by Cloud 2024 & 2032

- Figure 37: Middle East Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Cloud 2024 & 2032

- Figure 38: Middle East Cloud Based Workload Scheduling Software Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East Cloud Based Workload Scheduling Software Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East Cloud Based Workload Scheduling Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Cloud Based Workload Scheduling Software Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 3: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cloud Based Workload Scheduling Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cloud Based Workload Scheduling Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cloud Based Workload Scheduling Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cloud Based Workload Scheduling Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Cloud Based Workload Scheduling Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 16: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 17: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 19: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 22: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 25: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Cloud 2019 & 2032

- Table 28: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 29: Global Cloud Based Workload Scheduling Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Based Workload Scheduling Software Industry?

The projected CAGR is approximately 9.67%.

2. Which companies are prominent players in the Cloud Based Workload Scheduling Software Industry?

Key companies in the market include Adaptive Computing Enterprises Inc (ALA Services LLC), CA Inc (Broadcom Inc ), ASG Technologies Group Inc, IBM Corporation, Hitachi Ltd, Cisco Systems Inc, ManageIQ Inc (Red Hat Inc )*List Not Exhaustive, VMware Inc, BMC Software (Boxer Parent Company Inc ).

3. What are the main segments of the Cloud Based Workload Scheduling Software Industry?

The market segments include Cloud, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Enterprises Shifting Towards Cloud-Based Services; Availability of Analytical tools in Cloud based Workload Scheduling Software.

6. What are the notable trends driving market growth?

Public Cloud-Based Services is set to hold the largest market share.

7. Are there any restraints impacting market growth?

Opensource-Free Software Hampering the Growth of Market.

8. Can you provide examples of recent developments in the market?

November 2023: IBM announced a strategic partnership with Amazon Web Services (AWS) on Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to make it easier for database customers to manage data for artificial intelligence (AI) workloads across hybrid cloud environments. Amazon RDS for Db2 combines the operational expertise and ease of use of Amazon RDS to automate database administration with IBM Db2's decades of experience running mission-critical workloads for some of the world's significant banks, supply chain operations, and retail/e-commerce businesses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Based Workload Scheduling Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Based Workload Scheduling Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Based Workload Scheduling Software Industry?

To stay informed about further developments, trends, and reports in the Cloud Based Workload Scheduling Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence